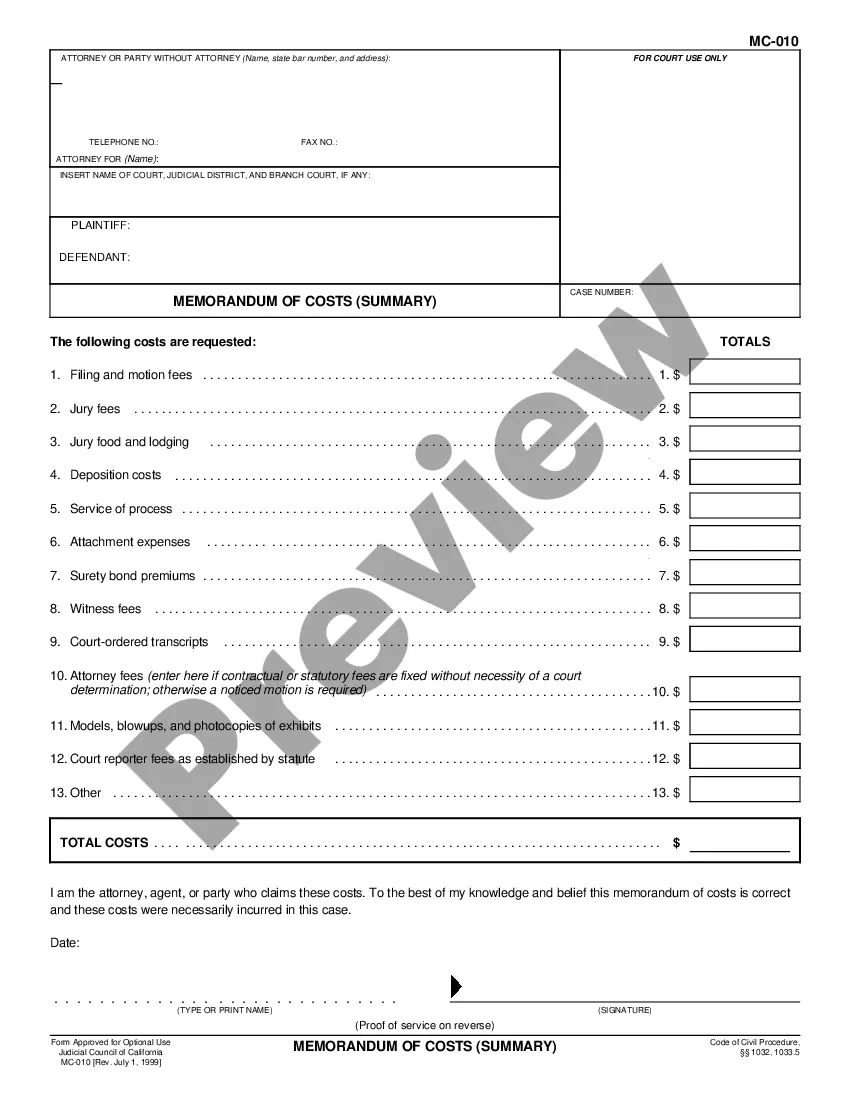

Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest: This Memorandum is simply a list of costs associated with litigation, after the judgment has been rendered. The Declarant signs this Memorandum, stating that he/she declares these costs, including accured interest on the outstanding balance, to be accurate, under penalty of law.

San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest

Description

How to fill out California Memorandum Of Costs After Judgment, Acknowledgment Of Credit, And Declaration Of Accrued Interest?

Are you in search of a dependable and affordable provider of legal forms to obtain the San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest? US Legal Forms is your prime solution.

Whether you need a simple agreement to outline rules for living with your partner or a collection of forms to process your divorce through the legal system, we have you taken care of. Our platform offers over 85,000 current legal document templates for personal and business purposes. All templates we provide are not generic and are structured according to the stipulations of individual states and locales.

To download the form, you must Log In to your account, find the necessary template, and click the Download button adjacent to it. Please keep in mind that you can download your previously acquired form templates at any time from the My documents section.

Is this your first visit to our site? No problem. You can easily create an account, but first, make sure to do the following.

Now you can proceed to register your account. Then select a subscription plan and continue to payment. Once the payment is completed, download the San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest in any format that is available. You can visit the site again whenever to redownload the form at no additional cost.

Obtaining up-to-date legal forms has never been simpler. Try US Legal Forms today, and stop wasting your valuable time searching for legal documents online permanently.

- Verify if the San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest complies with the laws of your state and locality.

- Review the form’s description (if available) to understand its purpose and intended audience.

- Restart your search if the template does not fit your legal needs.

Form popularity

FAQ

You should file the MC 012, Acknowledgment of Credit, when you have received payment on a judgment and need to record this payment formally. This form helps clarify the remaining balance and protects your rights as a creditor. Timing is essential; make sure to file promptly after receiving the payment to avoid confusion later. US Legal Forms offers the MC 012 template to simplify this task and ensure compliance with San Diego regulations.

The timeline for filing a San Diego California Memorandum of Costs After Judgment is generally within 15 days after the judgment is entered. This is crucial for ensuring that you preserve your right to collect costs. If you miss this deadline, you may lose the opportunity to recover costs associated with your case. To simplify this process, consider using the US Legal Forms platform for easy access to necessary forms and guidelines.

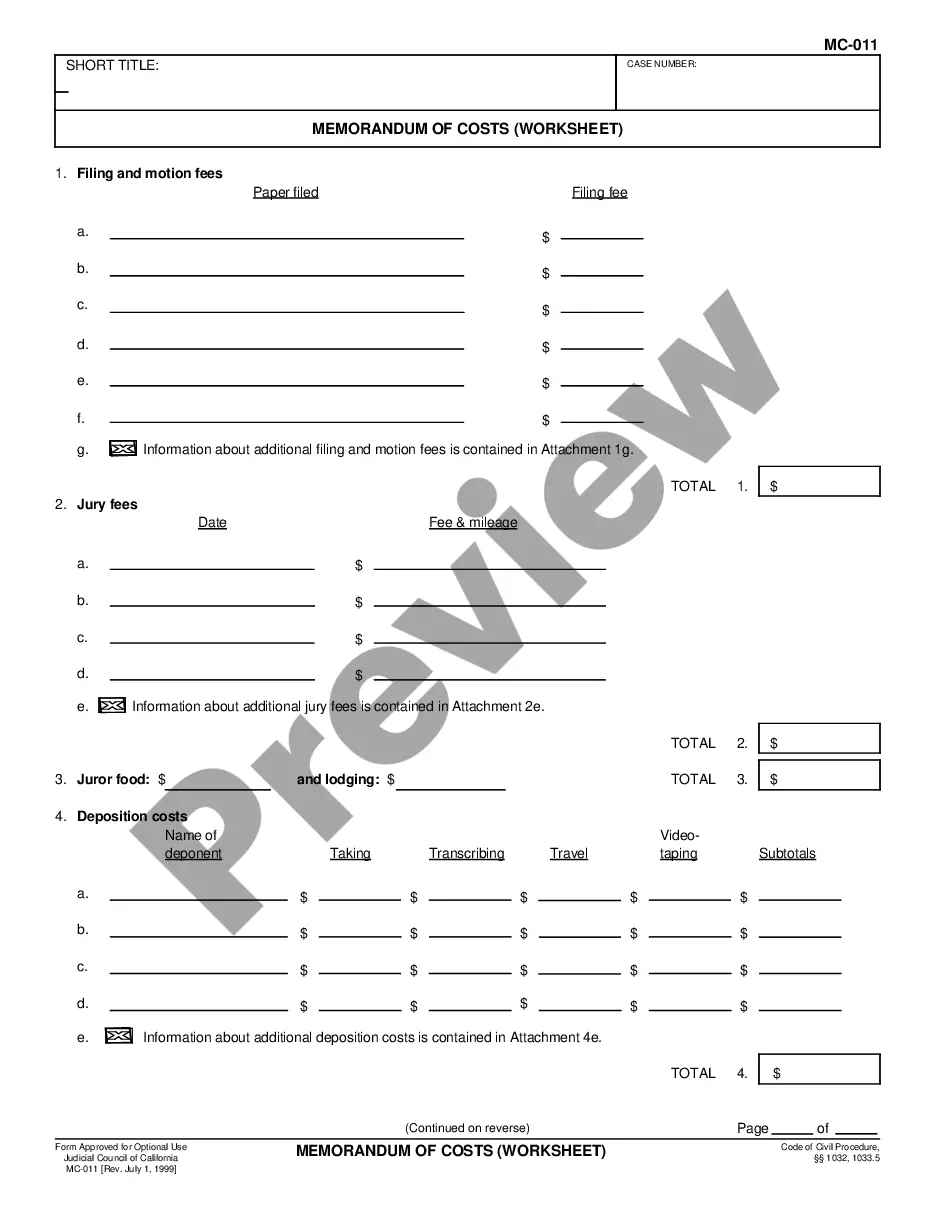

The MC 012 form, known as the 'Memorandum of Costs After Judgment,' is a critical document used in California courts. This form allows a prevailing party to itemize and request recovery of costs incurred after a judgment. By filling out the MC 012 form, you streamline the process of recovering your expenses, making it beneficial in situations involving a San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest. Utilizing platforms like USLegalForms can simplify the completion of this form, ensuring accuracy and compliance.

Filling out a Memorandum of Costs After Judgment involves writing down all costs you wish to recover. Start by listing your court fees and other expenses related to the judgment. Be sure to provide specific details and attach any necessary documentation as evidence. Consider using resources like USLegalForms to guide you through this process, ensuring that you correctly complete the San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest.

In San Diego, the maximum amount for small claims court is typically $10,000 for individual claimants. If you are a business, the limit is usually $5,000. It is important to note that these amounts can change, so check the latest guidelines or consult a legal advisor. Utilizing the San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest can help you manage future claims efficiently.

To add costs to a judgment in California, file a San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest with the court. Make sure to include an itemized list of all expenses incurred after the judgment. This process will ensure that the additional costs are legally recognized and enforceable against the debtor.

A Memorandum of Costs on Appeal in California serves a similar purpose as other memorandums but specifically addresses costs associated with an appeal. This document lists expenses incurred while pursuing or defending against an appeal decision. Incorporating this into your legal strategy will help ensure that all costs are accounted for in your San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest.

In California, you typically have 15 days from the entry of judgment to file your San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest. Failure to file within this period may limit your ability to recover your post-judgment costs. Thus, be proactive and organized to ensure you meet this important deadline.

The San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest is a legal document that lists all costs owed post-judgment. It formally informs the debtor of the total financial obligation, including any interest accrued. This memorandum is crucial in ensuring all parties are aware of accurate financial responsibilities after a legal decision.

A San Diego California Memorandum of Costs After Judgment, Acknowledgment of Credit, and Declaration of Accrued Interest outlines the expenses incurred after a judgment has been issued. This document accounts for costs such as attorney fees, filing fees, and accrued interest. It serves as an official record for the court and helps you claim reimbursement from the losing party.