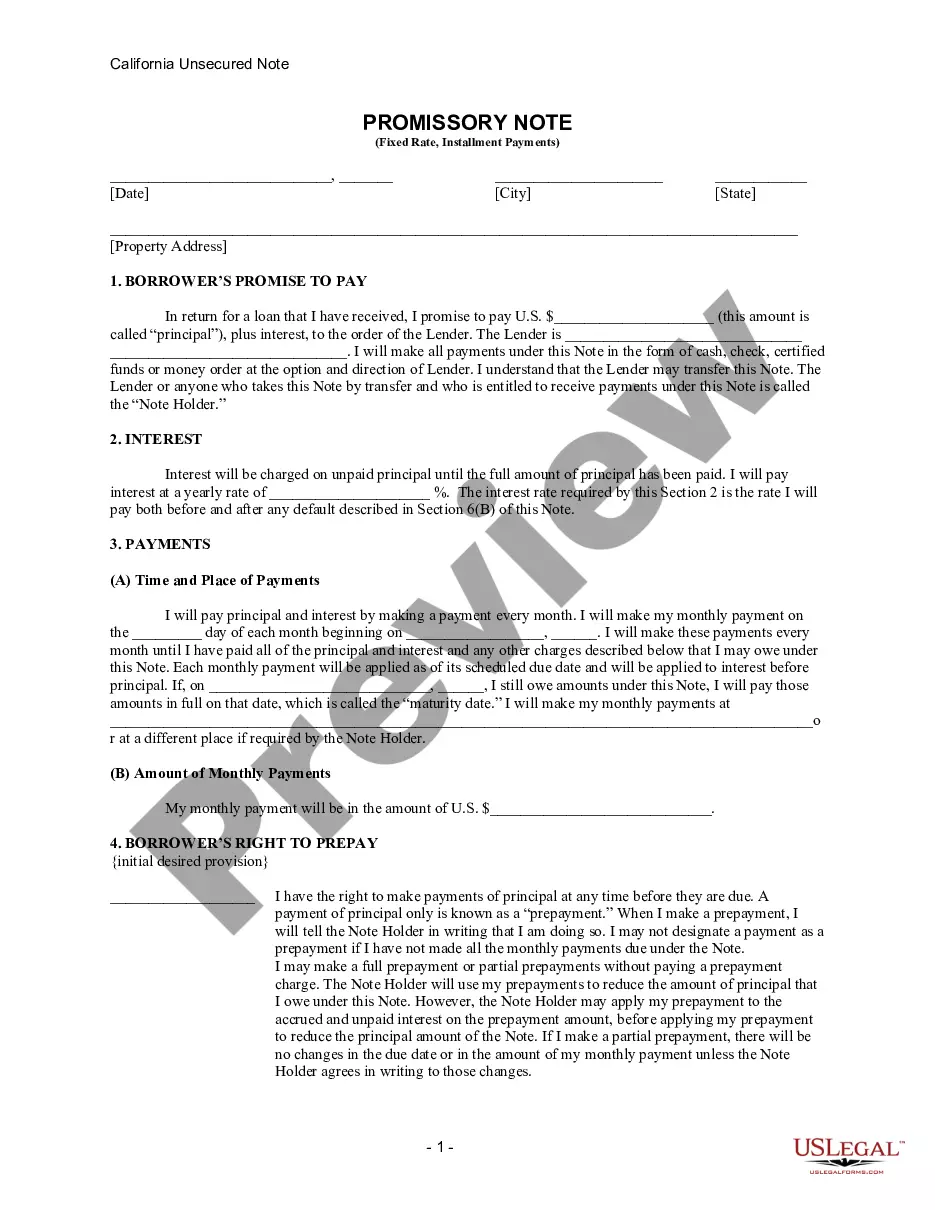

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

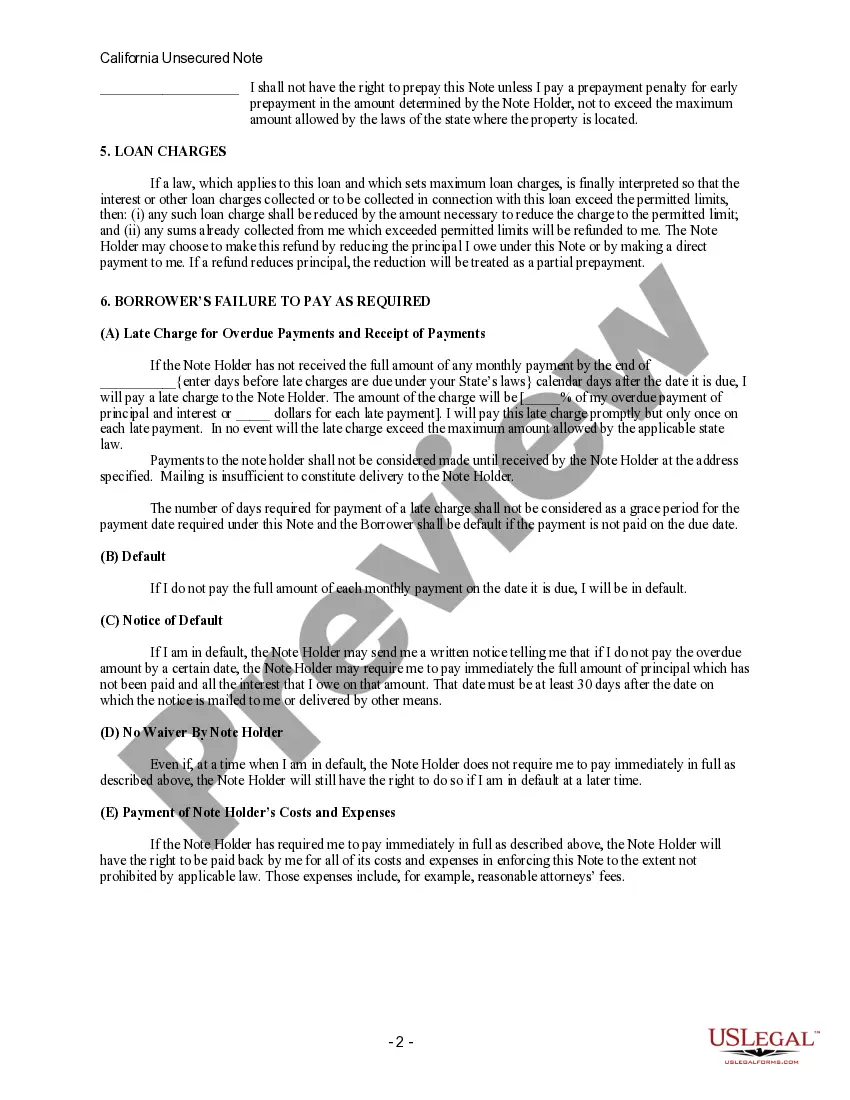

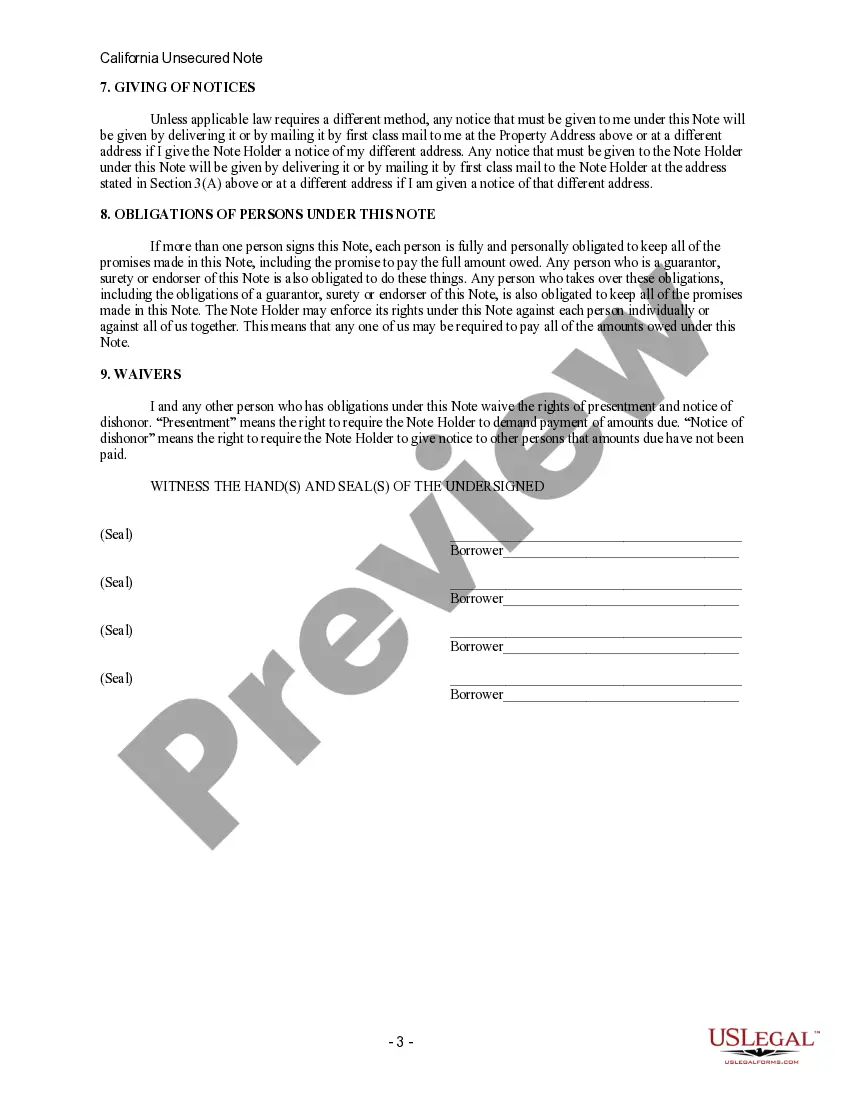

Elk Grove California Unsecured Installment Payment Promissory Note for Fixed Rate: A Comprehensive Description Elk Grove, located in Sacramento County, California, offers individuals and businesses various financial options, including the Unsecured Installment Payment Promissory Note for Fixed Rate. This legal document serves as a binding agreement between a lender and a borrower, detailing the terms and conditions of a loan. The key characteristic distinguishing this promissory note is the fixed interest rate. In Elk Grove, lenders and borrowers can choose from different types of Unsecured Installment Payment Promissory Notes for Fixed Rate, each tailored to specific needs. These include: 1. Personal Promissory Note: This type of promissory note caters to individual borrowers who may require financial assistance for personal reasons. Whether it's funding a vacation, wedding expenditure, medical bills, or home repairs, the Elk Grove Personal Unsecured Installment Payment Promissory Note for Fixed Rate ensures transparent repayment terms for both parties involved. 2. Business Promissory Note: Ideal for small businesses or startups, the Elk Grove Business Unsecured Installment Payment Promissory Note for Fixed Rate offers a dependable avenue for borrowing funds to cover various operational expenses. Entrepreneurs can utilize this note to secure financing for business development, purchasing equipment, hiring employees, or expanding their commercial ventures. 3. Education Promissory Note: Elk Grove California provides residents with an Education Unsecured Installment Payment Promissory Note for Fixed Rate. This note aims to assist students and parents in financing academic pursuits like tuition fees, textbooks, and other educational expenses. It sets forth detailed terms of repayment, easing the financial burden on families and ensuring a predictable repayment plan. 4. Medical Promissory Note: For medical emergencies, the Elk Grove Medical Unsecured Installment Payment Promissory Note for Fixed Rate is an invaluable tool. It enables individuals to deal with unexpected medical costs, allowing immediate access to suitable healthcare without relying solely on insurance coverage. Such notes offer peace of mind during challenging times, as both lenders and borrowers are protected by a well-defined agreement. Elk Grove California's Unsecured Installment Payment Promissory Notes for Fixed Rate provide numerous benefits. Key features include a predetermined interest rate, assuring borrowers of consistent monthly payments throughout the loan term. This stability allows borrowers to plan their finances effectively while providing lenders with a reliable and transparent means of collecting their investment. Moreover, these promissory notes emphasize flexibility by allowing lenders and borrowers to negotiate repayment terms based on mutually agreed-upon conditions. The fixed-rate feature assures that changes in the market interest rates will not affect the borrower's repayment plan, making it a secure enterprise for both parties involved. It is essential for lenders and borrowers to consult legal professionals or financial advisors before entering into such agreements. They can provide expert guidance, ensuring all necessary legalities are met while addressing individual concerns and interests. In conclusion, the Elk Grove California Unsecured Installment Payment Promissory Note for Fixed Rate offers a dependable financial solution for individuals, businesses, students, and medical emergencies. By providing transparent and stable repayment terms, this legal document safeguards the interests of both lenders and borrowers, fostering a secure financial environment within the Elk Grove community.Elk Grove California Unsecured Installment Payment Promissory Note for Fixed Rate: A Comprehensive Description Elk Grove, located in Sacramento County, California, offers individuals and businesses various financial options, including the Unsecured Installment Payment Promissory Note for Fixed Rate. This legal document serves as a binding agreement between a lender and a borrower, detailing the terms and conditions of a loan. The key characteristic distinguishing this promissory note is the fixed interest rate. In Elk Grove, lenders and borrowers can choose from different types of Unsecured Installment Payment Promissory Notes for Fixed Rate, each tailored to specific needs. These include: 1. Personal Promissory Note: This type of promissory note caters to individual borrowers who may require financial assistance for personal reasons. Whether it's funding a vacation, wedding expenditure, medical bills, or home repairs, the Elk Grove Personal Unsecured Installment Payment Promissory Note for Fixed Rate ensures transparent repayment terms for both parties involved. 2. Business Promissory Note: Ideal for small businesses or startups, the Elk Grove Business Unsecured Installment Payment Promissory Note for Fixed Rate offers a dependable avenue for borrowing funds to cover various operational expenses. Entrepreneurs can utilize this note to secure financing for business development, purchasing equipment, hiring employees, or expanding their commercial ventures. 3. Education Promissory Note: Elk Grove California provides residents with an Education Unsecured Installment Payment Promissory Note for Fixed Rate. This note aims to assist students and parents in financing academic pursuits like tuition fees, textbooks, and other educational expenses. It sets forth detailed terms of repayment, easing the financial burden on families and ensuring a predictable repayment plan. 4. Medical Promissory Note: For medical emergencies, the Elk Grove Medical Unsecured Installment Payment Promissory Note for Fixed Rate is an invaluable tool. It enables individuals to deal with unexpected medical costs, allowing immediate access to suitable healthcare without relying solely on insurance coverage. Such notes offer peace of mind during challenging times, as both lenders and borrowers are protected by a well-defined agreement. Elk Grove California's Unsecured Installment Payment Promissory Notes for Fixed Rate provide numerous benefits. Key features include a predetermined interest rate, assuring borrowers of consistent monthly payments throughout the loan term. This stability allows borrowers to plan their finances effectively while providing lenders with a reliable and transparent means of collecting their investment. Moreover, these promissory notes emphasize flexibility by allowing lenders and borrowers to negotiate repayment terms based on mutually agreed-upon conditions. The fixed-rate feature assures that changes in the market interest rates will not affect the borrower's repayment plan, making it a secure enterprise for both parties involved. It is essential for lenders and borrowers to consult legal professionals or financial advisors before entering into such agreements. They can provide expert guidance, ensuring all necessary legalities are met while addressing individual concerns and interests. In conclusion, the Elk Grove California Unsecured Installment Payment Promissory Note for Fixed Rate offers a dependable financial solution for individuals, businesses, students, and medical emergencies. By providing transparent and stable repayment terms, this legal document safeguards the interests of both lenders and borrowers, fostering a secure financial environment within the Elk Grove community.