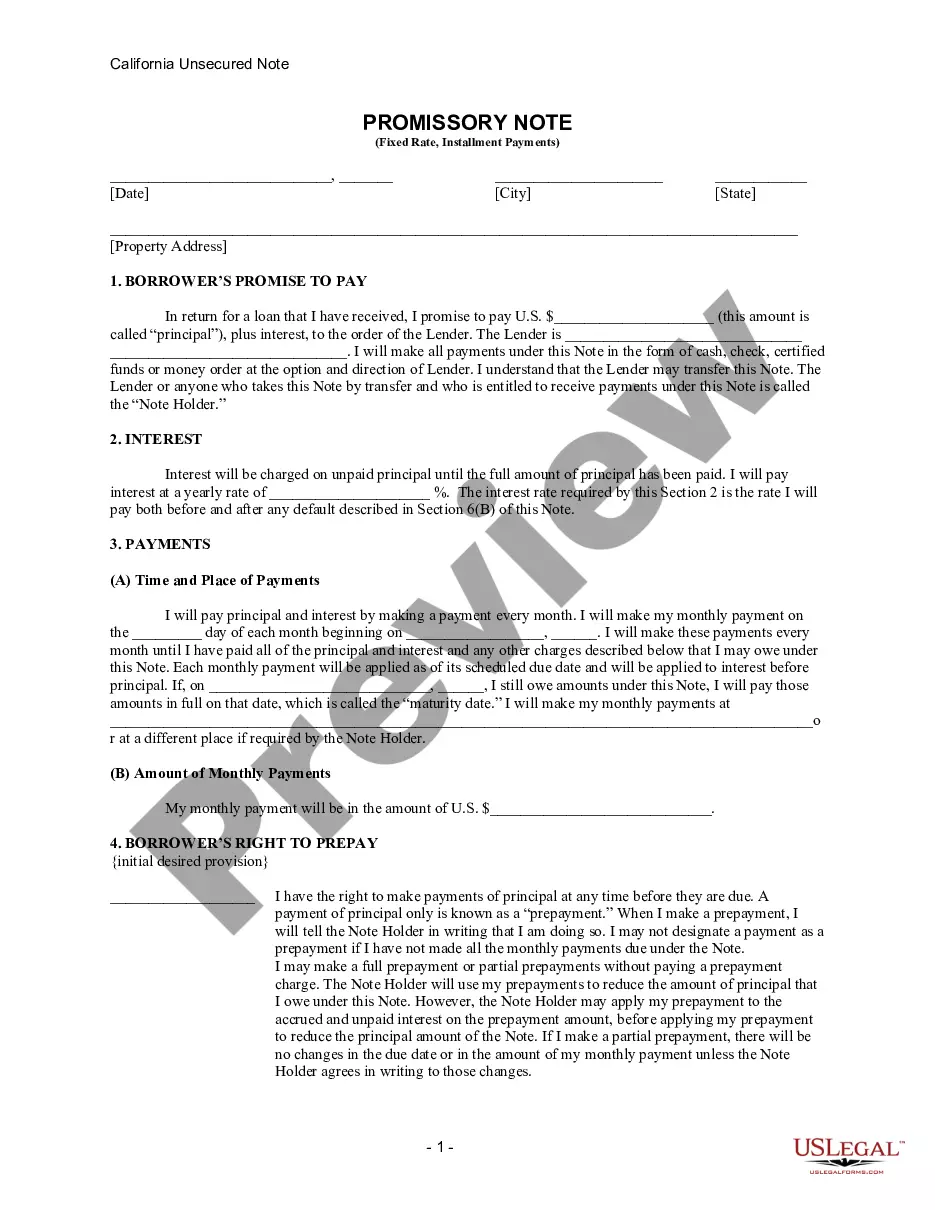

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

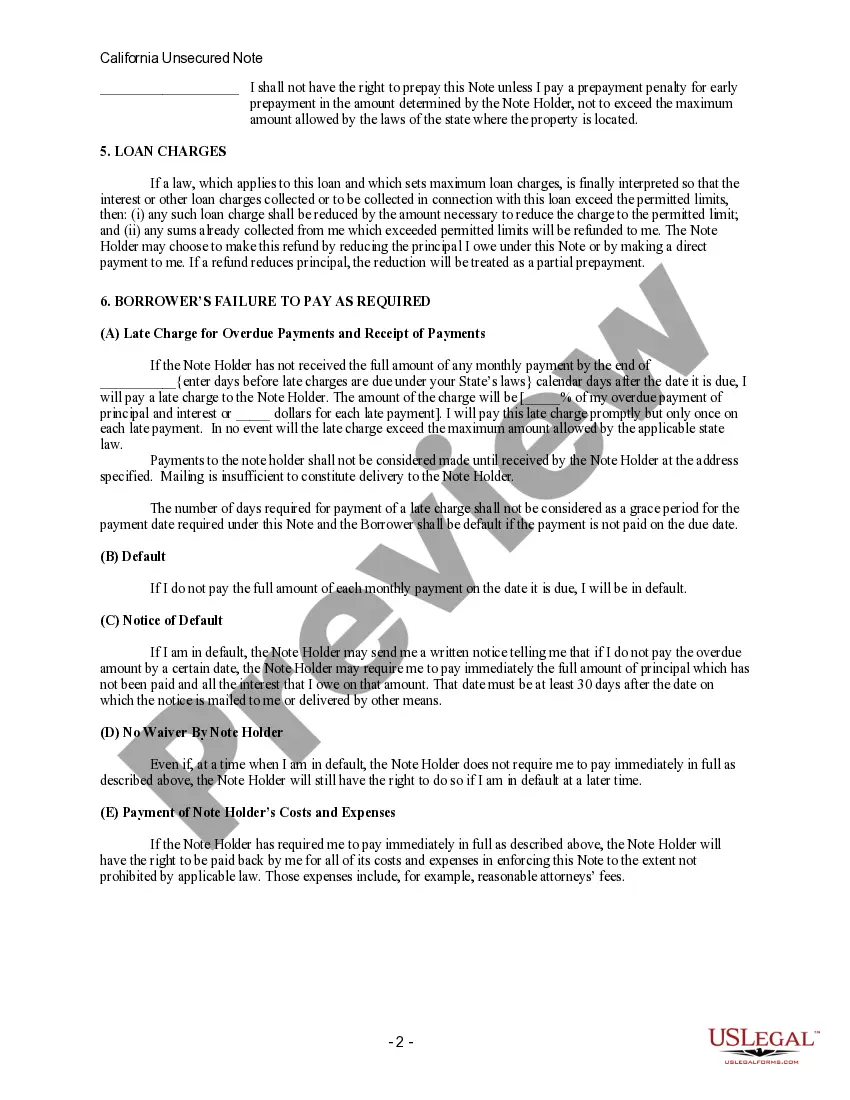

Title: Understanding the El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate Keywords: El Monte California, Unsecured Promissory Note, Installment Payment, Fixed Rate, Types Introduction: The El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note specifically caters to borrowers residing in El Monte, California, and offers the convenience of making installment payments with a fixed interest rate. This detailed description will delve into the various aspects of the note, its significance, and potential types available. Definition: An unsecured promissory note refers to a loan agreement where the borrower does not pledge any specific asset as collateral. Rather, it relies on the borrower's creditworthiness and reputation to ensure loan repayment. The terms of the loan, including repayment schedule and interest rate, are outlined in the promissory note. Features and Terms: 1. Installment Payments: The El Monte California Unsecured Installment Payment Promissory Note allows borrowers to repay the loan in equal installments over a predetermined period, easing the financial burden. 2. Fixed Interest Rate: This note offers a fixed interest rate, which remains unchanged throughout the loan term. This ensures predictable monthly payments, allowing borrowers to budget effectively. 3. Loan Amount and Duration: The promissory note will specify the principal loan amount and the agreed-upon duration for repayment, which both parties must adhere to. 4. Late Payment Penalties: Failure to repay the loan as per the defined schedule may result in penalties, as stipulated in the promissory note. 5. Default Clause: The note should include a clause concerning what constitutes a default, including events like non-payment, bankruptcy, or violation of any terms outlined in the agreement. Types: 1. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Personal Loan: This type is designed for borrowers seeking funds for personal reasons, such as debt consolidation, medical expenses, or home renovations. 2. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Education Loan: This specific note is suitable for borrowers seeking financial assistance for educational purposes, ensuring affordable installment payments. 3. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Small Business Loan: Catering to aspiring entrepreneurs or established businesses, this note helps manage expenses related to business operations, expansion, or equipment purchases. Conclusion: The El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate is a versatile financial instrument designed to facilitate borrowing needs in El Monte, California. Borrowers can enjoy the convenience of predictable monthly payments and a fixed interest rate, ensuring manageable debt repayments. Whether you require funds for personal use, education expenses, or for your small business, understanding the terms and types of this promissory note is essential to make informed financial decisions.Title: Understanding the El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate Keywords: El Monte California, Unsecured Promissory Note, Installment Payment, Fixed Rate, Types Introduction: The El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note specifically caters to borrowers residing in El Monte, California, and offers the convenience of making installment payments with a fixed interest rate. This detailed description will delve into the various aspects of the note, its significance, and potential types available. Definition: An unsecured promissory note refers to a loan agreement where the borrower does not pledge any specific asset as collateral. Rather, it relies on the borrower's creditworthiness and reputation to ensure loan repayment. The terms of the loan, including repayment schedule and interest rate, are outlined in the promissory note. Features and Terms: 1. Installment Payments: The El Monte California Unsecured Installment Payment Promissory Note allows borrowers to repay the loan in equal installments over a predetermined period, easing the financial burden. 2. Fixed Interest Rate: This note offers a fixed interest rate, which remains unchanged throughout the loan term. This ensures predictable monthly payments, allowing borrowers to budget effectively. 3. Loan Amount and Duration: The promissory note will specify the principal loan amount and the agreed-upon duration for repayment, which both parties must adhere to. 4. Late Payment Penalties: Failure to repay the loan as per the defined schedule may result in penalties, as stipulated in the promissory note. 5. Default Clause: The note should include a clause concerning what constitutes a default, including events like non-payment, bankruptcy, or violation of any terms outlined in the agreement. Types: 1. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Personal Loan: This type is designed for borrowers seeking funds for personal reasons, such as debt consolidation, medical expenses, or home renovations. 2. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Education Loan: This specific note is suitable for borrowers seeking financial assistance for educational purposes, ensuring affordable installment payments. 3. El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate — Small Business Loan: Catering to aspiring entrepreneurs or established businesses, this note helps manage expenses related to business operations, expansion, or equipment purchases. Conclusion: The El Monte California Unsecured Installment Payment Promissory Note for Fixed Rate is a versatile financial instrument designed to facilitate borrowing needs in El Monte, California. Borrowers can enjoy the convenience of predictable monthly payments and a fixed interest rate, ensuring manageable debt repayments. Whether you require funds for personal use, education expenses, or for your small business, understanding the terms and types of this promissory note is essential to make informed financial decisions.