This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out California Unsecured Installment Payment Promissory Note For Fixed Rate?

Finding authenticated templates tailored to your local regulations can be challenging unless you utilize the US Legal Forms library.

It’s a digital repository of over 85,000 legal documents catering to both personal and professional requirements and various real-world circumstances.

All the files are accurately classified by usage area and jurisdiction, making it as straightforward and simple as ABC to find the Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate.

Maintain your paperwork organized and compliant with legal standards is of utmost importance. Take advantage of the US Legal Forms library to always have vital document templates ready for any requirements right at your fingertips!

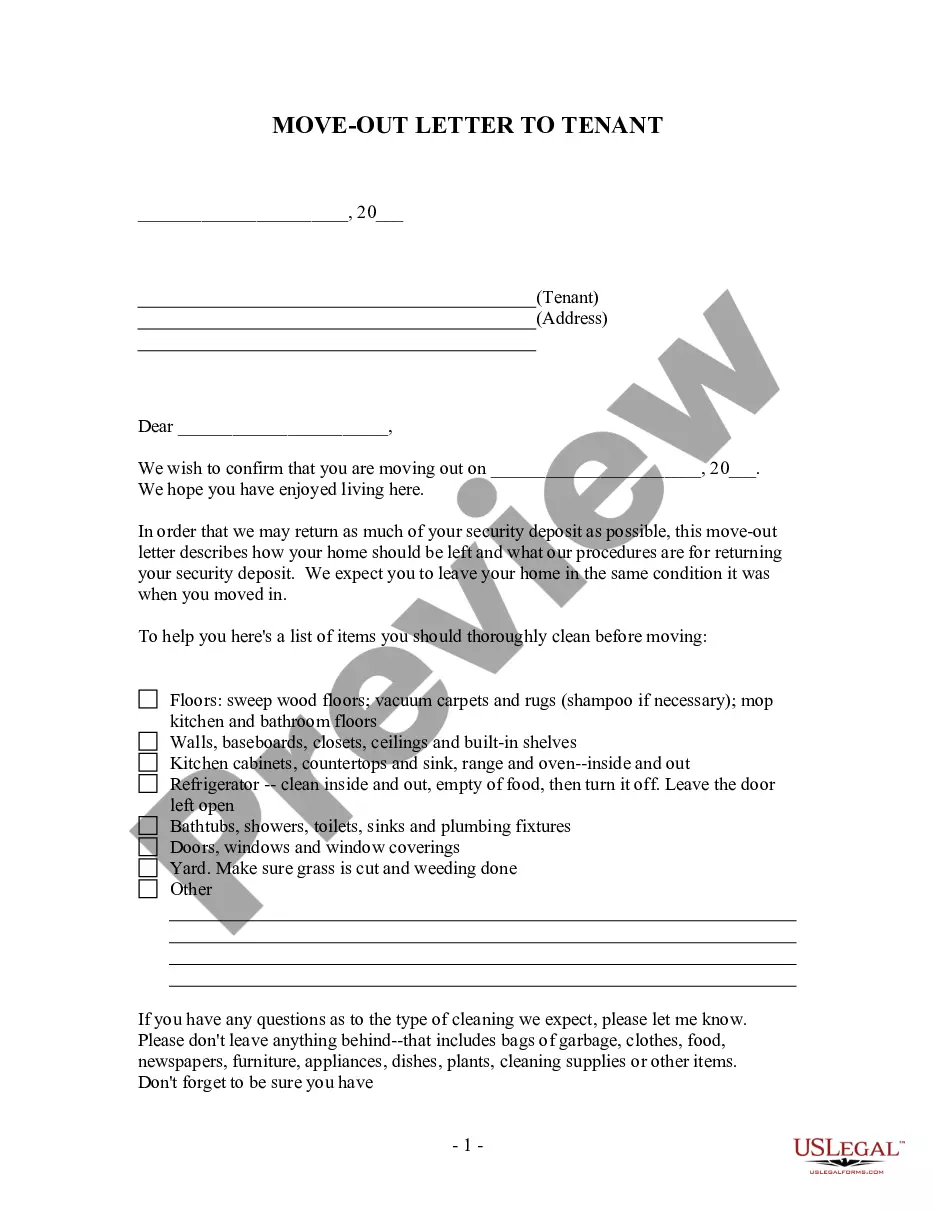

- Check the Preview mode and form description.

- Ensure you have selected the correct one that fulfills your needs and completely aligns with your local jurisdiction criteria.

- Search for an alternative template, if necessary.

- If you discover any discrepancies, use the Search tab above to locate the appropriate one. If it meets your needs, advance to the next step.

- Purchase the document.

Form popularity

FAQ

To file a Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate, you typically need to record it with the county recorder's office where the property is located. Filing provides a public record of the note, enhancing its legal standing. Moreover, this process helps protect your interests in the event of disputes or defaults. If you require assistance with the filing process, consider using the USLegalForms platform to streamline all necessary steps and ensure compliance with local regulations.

A promissory note is valid in California when it meets specific criteria, including a written format, clear payment terms, and the signatures of involved parties. For a Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate, ensuring all relevant information, such as repayment schedule and penalties for late payments, is included is vital. This level of detail helps protect both the lender and borrower.

You can obtain a promissory note through various methods, including online legal platforms like US Legal Forms. They offer ready-made templates that align with Riverside California regulations for Unsecured Installment Payment Promissory Notes for Fixed Rate. Using a reputable source simplifies the process, ensuring you have a legally compliant document.

In California, a promissory note must be in writing and include essential details such as the amount owed and the interest rate. When creating a Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate, consider including repayment dates and any late fees. Following state laws ensures that the note remains enforceable in court.

A promissory note can be deemed invalid in California if it lacks essential elements, such as a written agreement, signatures, or clear repayment terms. For a Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate, failing to meet these criteria could lead to its invalidation. To avoid potential issues, consider consulting uslegalforms, where you can find templates that help ensure your document is valid and enforceable.

A promissory note can hold up in court if it is properly executed and includes all necessary terms. In the case of a Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate, clear documentation of the repayment terms strengthens its validity. Should any disputes arise, this document can serve as crucial evidence in legal proceedings.

Absolutely, promissory notes are enforceable in California, provided they comply with relevant legal standards. A Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate can be enforced in court if it includes essential elements like the amount borrowed, interest rate, and payment schedule. By using platforms like uslegalforms, you can ensure that your promissory note meets all necessary guidelines for enforceability.

Yes, promissory notes are legally binding in California when they meet certain requirements. A Riverside California Unsecured Installment Payment Promissory Note for Fixed Rate must be in writing, signed by the borrower, and must clearly state the terms of repayment. If properly executed, this document can serve as a legally enforceable agreement, protecting both parties involved.