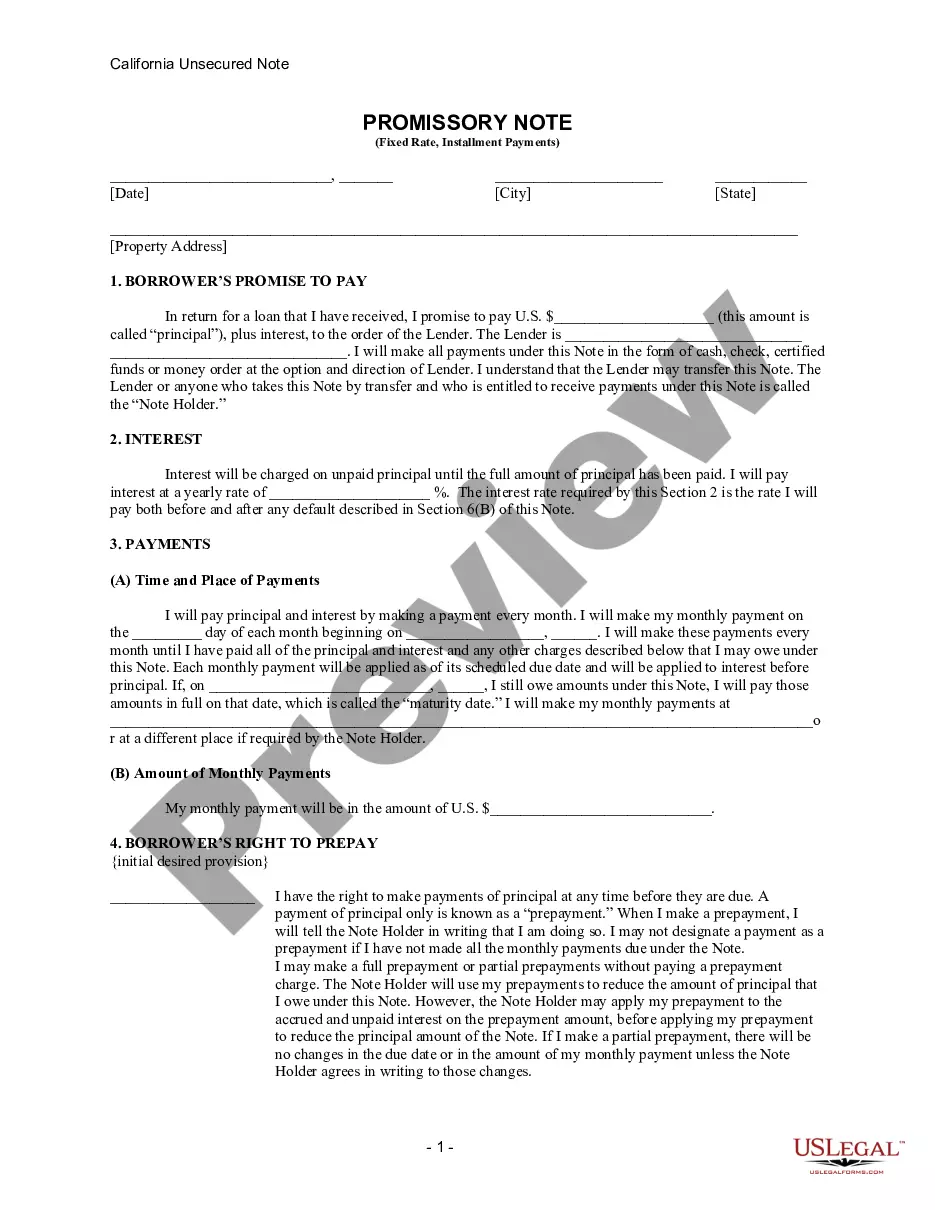

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

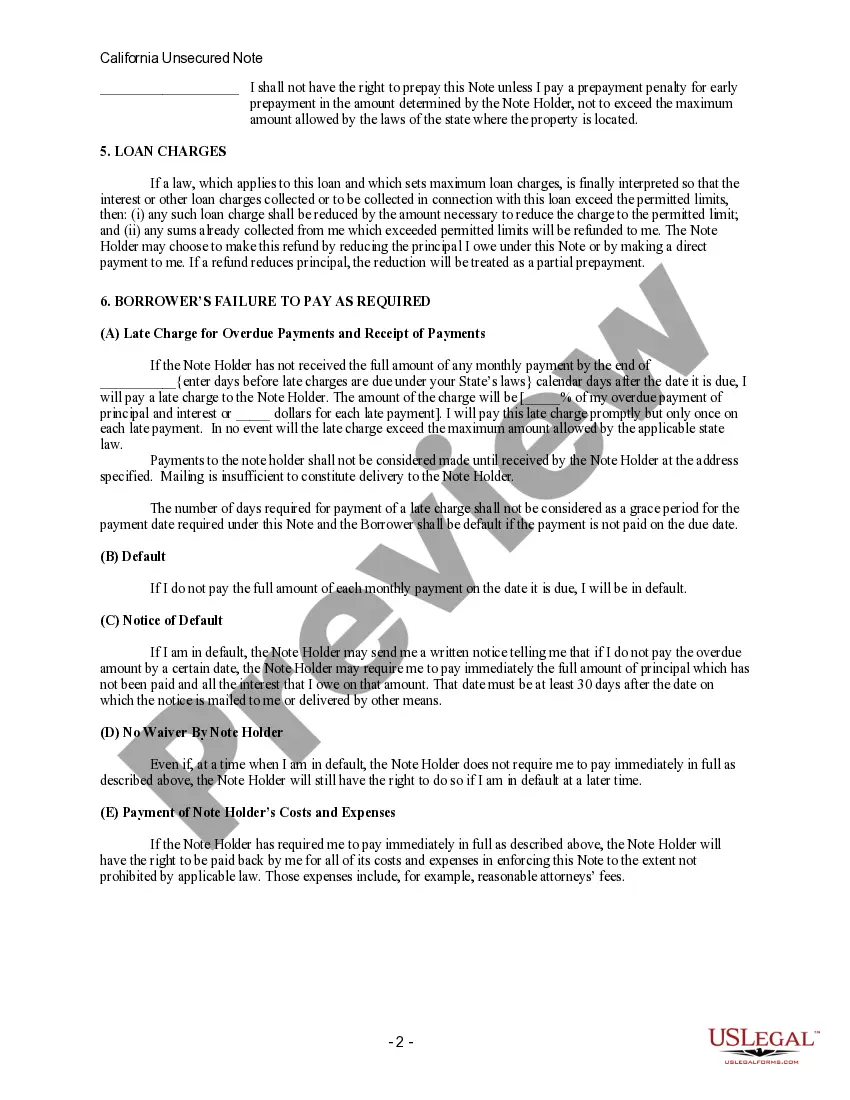

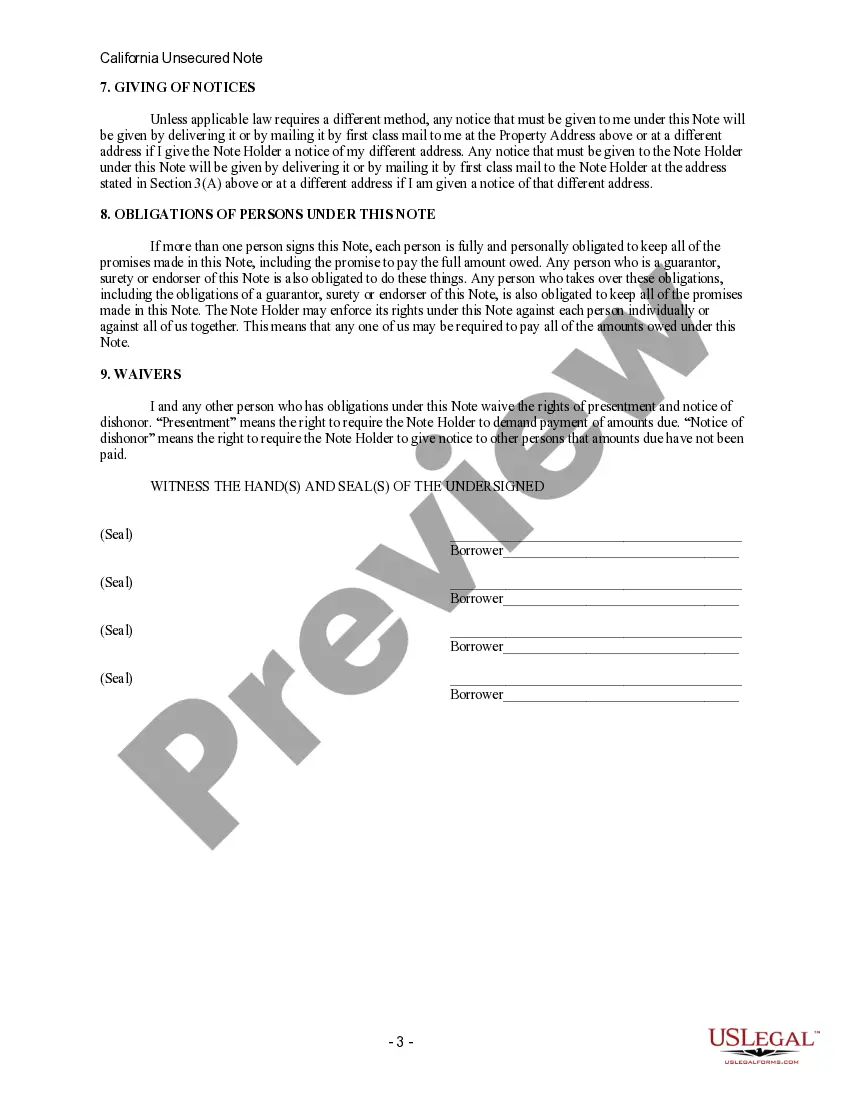

The San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is specifically designed for installment payment loans and provides the framework for repayment of the loan amount over a fixed period of time. The keyword "unsecured" refers to the fact that this promissory note does not require any collateral or asset to secure the loan. Instead, the borrower's promise to repay the loan is typically the only security provided. This type of arrangement is often used for smaller loan amounts or when the borrower does not have significant assets to offer as collateral. The keyword "installment" signifies that the loan amount will be repaid in multiple payments, rather than a lump sum. The promissory note specifies the payment schedule, including the amount of each installment, the due dates, and any applicable late fees or penalties. The keyword "fixed rate" indicates that the interest rate on the loan is predetermined and will not change throughout the repayment period. This provides stability and predictability for both the lender and the borrower, as they can accurately calculate the total cost of the loan and plan their finances accordingly. It is worth noting that there may be different variations or versions of the San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate, depending on specific circumstances or legal requirements. Variations may include slight variations in wording or additional clauses to address specific needs or circumstances. Some possible variations or types of San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate could include but are not limited to: 1. San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate with Balloon Payment: This type of promissory note includes a larger, final payment known as a "balloon payment" at the end of the term, in addition to regular installment payments. 2. San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate with Acceleration Clause: This promissory note may include an acceleration clause, which allows the lender to declare the entire loan amount due and payable if the borrower fails to meet certain conditions or defaults on the loan. It is always advisable to consult with legal professionals or financial experts to ensure complete compliance and understanding of the specific promissory note being used.The San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate is a legally binding document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This promissory note is specifically designed for installment payment loans and provides the framework for repayment of the loan amount over a fixed period of time. The keyword "unsecured" refers to the fact that this promissory note does not require any collateral or asset to secure the loan. Instead, the borrower's promise to repay the loan is typically the only security provided. This type of arrangement is often used for smaller loan amounts or when the borrower does not have significant assets to offer as collateral. The keyword "installment" signifies that the loan amount will be repaid in multiple payments, rather than a lump sum. The promissory note specifies the payment schedule, including the amount of each installment, the due dates, and any applicable late fees or penalties. The keyword "fixed rate" indicates that the interest rate on the loan is predetermined and will not change throughout the repayment period. This provides stability and predictability for both the lender and the borrower, as they can accurately calculate the total cost of the loan and plan their finances accordingly. It is worth noting that there may be different variations or versions of the San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate, depending on specific circumstances or legal requirements. Variations may include slight variations in wording or additional clauses to address specific needs or circumstances. Some possible variations or types of San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate could include but are not limited to: 1. San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate with Balloon Payment: This type of promissory note includes a larger, final payment known as a "balloon payment" at the end of the term, in addition to regular installment payments. 2. San Jose, California Unsecured Installment Payment Promissory Note for Fixed Rate with Acceleration Clause: This promissory note may include an acceleration clause, which allows the lender to declare the entire loan amount due and payable if the borrower fails to meet certain conditions or defaults on the loan. It is always advisable to consult with legal professionals or financial experts to ensure complete compliance and understanding of the specific promissory note being used.