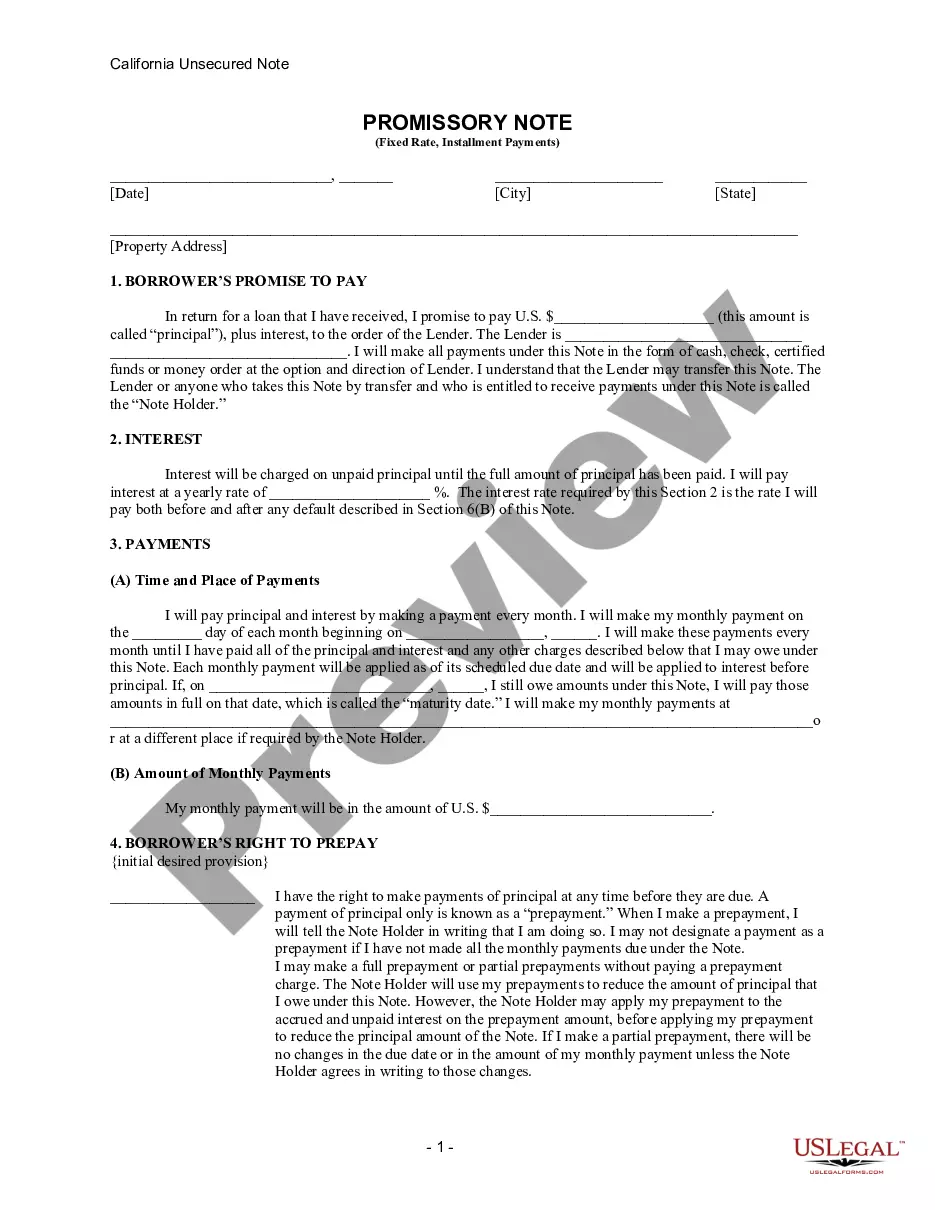

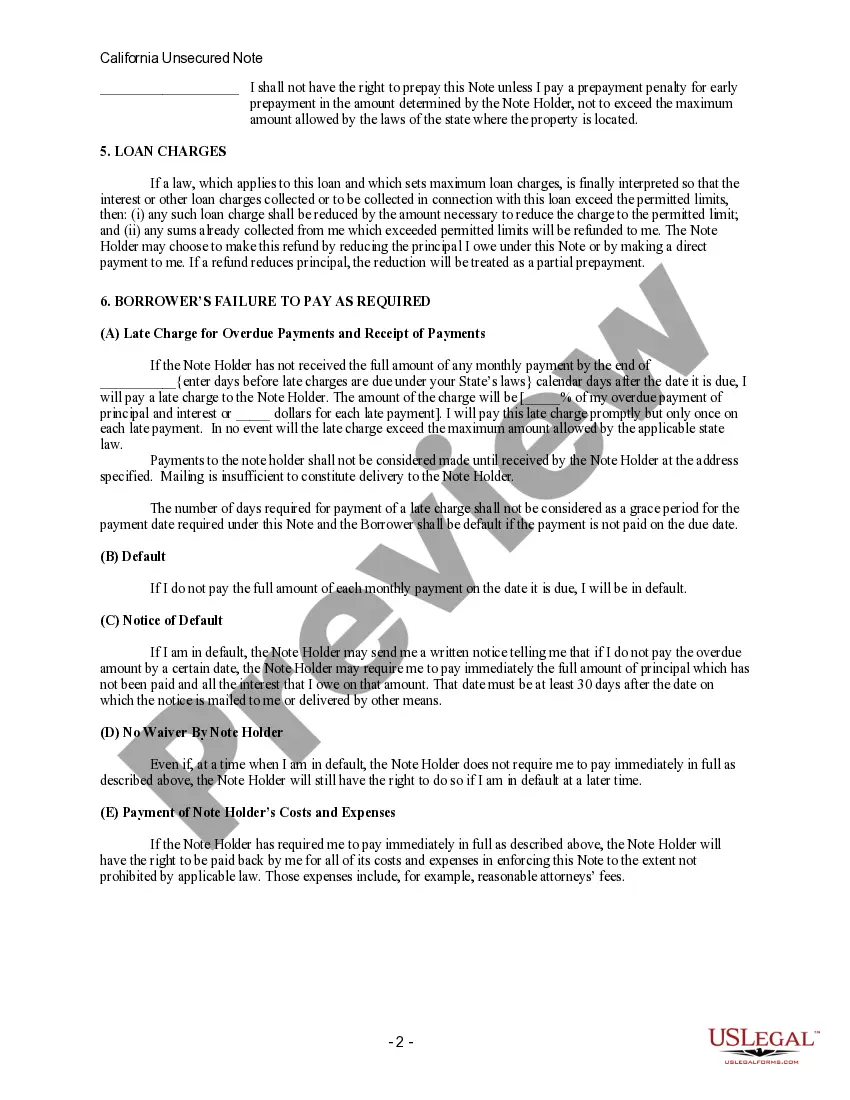

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Santa Clara, California. The promissory note serves as evidence of the debt and the borrower's promise to repay the loan in regular installments, with a fixed interest rate. The Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate is specifically designed for situations where the borrower does not provide any collateral to secure the loan. This means that the lender relies solely on the borrower's promise to repay the loan and does not have any specific property or asset as security. This type of promissory note is particularly common in personal loans, where friends, family members, or acquaintances provide financial support to each other. However, it can also be used in business transactions, such as small business loans or personal loans from private lenders. The Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate includes various essential details such as the names and contact information of both the lender and the borrower, the loan amount, interest rate, repayment schedule, and any late payment penalties or additional fees. Additionally, there might be different types or variations of the Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate depending on specific situations or requirements. These could include: 1. Individual to Individual Promissory Note: This type of promissory note is used when an individual lends money to another individual for personal reasons. 2. Business to Individual Promissory Note: In this case, a business entity lends money to an individual for personal or business-related purposes. 3. Business to Business Promissory Note: This type of promissory note is used when one business entity lends money to another business entity for various business purposes, such as expansion or investment. It is important to note that regardless of these variations, the Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate must comply with all legal requirements and regulations in Santa Clara, California. It is highly recommended consulting with a legal professional to ensure adherence to local laws and to customize the promissory note according to specific needs and circumstances.Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in Santa Clara, California. The promissory note serves as evidence of the debt and the borrower's promise to repay the loan in regular installments, with a fixed interest rate. The Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate is specifically designed for situations where the borrower does not provide any collateral to secure the loan. This means that the lender relies solely on the borrower's promise to repay the loan and does not have any specific property or asset as security. This type of promissory note is particularly common in personal loans, where friends, family members, or acquaintances provide financial support to each other. However, it can also be used in business transactions, such as small business loans or personal loans from private lenders. The Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate includes various essential details such as the names and contact information of both the lender and the borrower, the loan amount, interest rate, repayment schedule, and any late payment penalties or additional fees. Additionally, there might be different types or variations of the Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate depending on specific situations or requirements. These could include: 1. Individual to Individual Promissory Note: This type of promissory note is used when an individual lends money to another individual for personal reasons. 2. Business to Individual Promissory Note: In this case, a business entity lends money to an individual for personal or business-related purposes. 3. Business to Business Promissory Note: This type of promissory note is used when one business entity lends money to another business entity for various business purposes, such as expansion or investment. It is important to note that regardless of these variations, the Santa Clara, California Unsecured Installment Payment Promissory Note for Fixed Rate must comply with all legal requirements and regulations in Santa Clara, California. It is highly recommended consulting with a legal professional to ensure adherence to local laws and to customize the promissory note according to specific needs and circumstances.