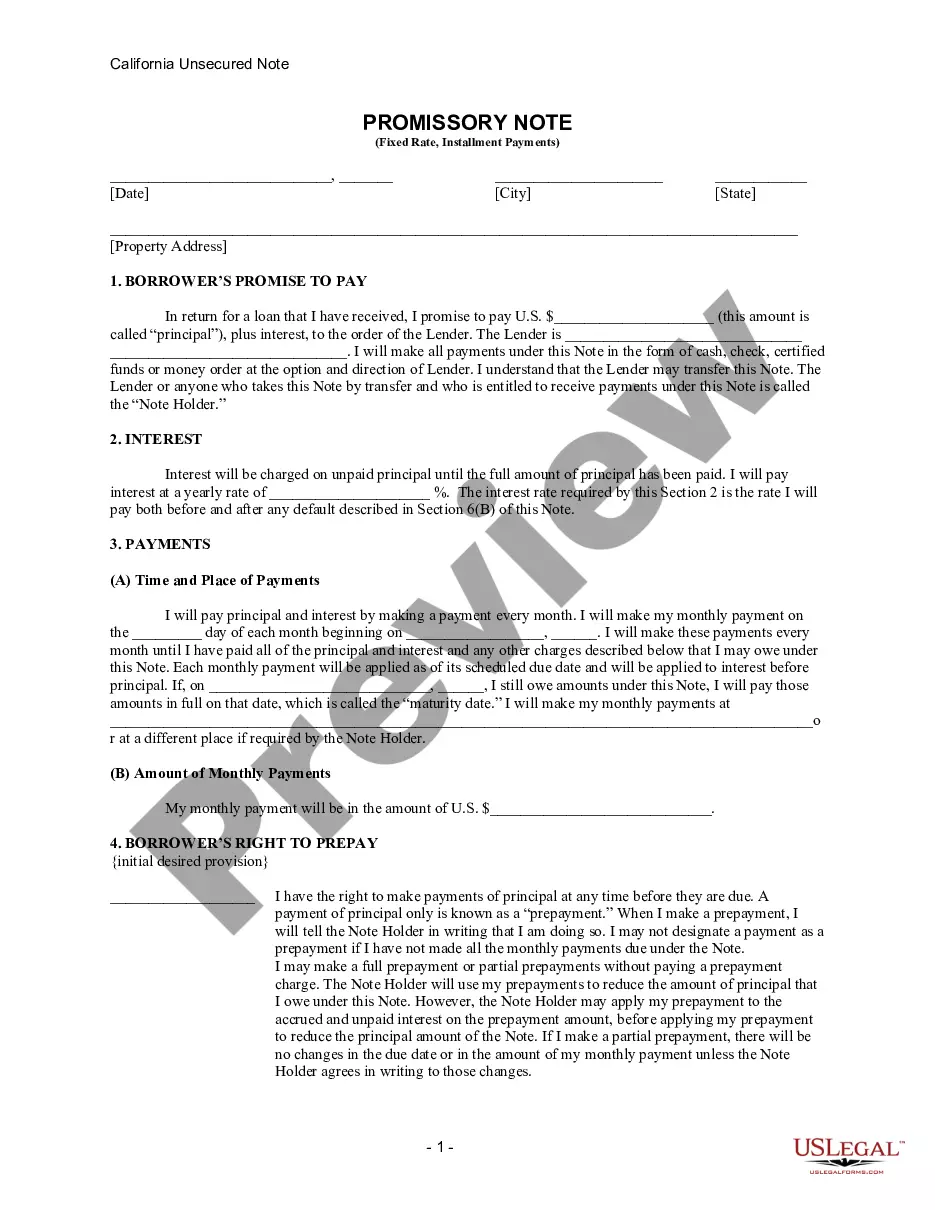

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

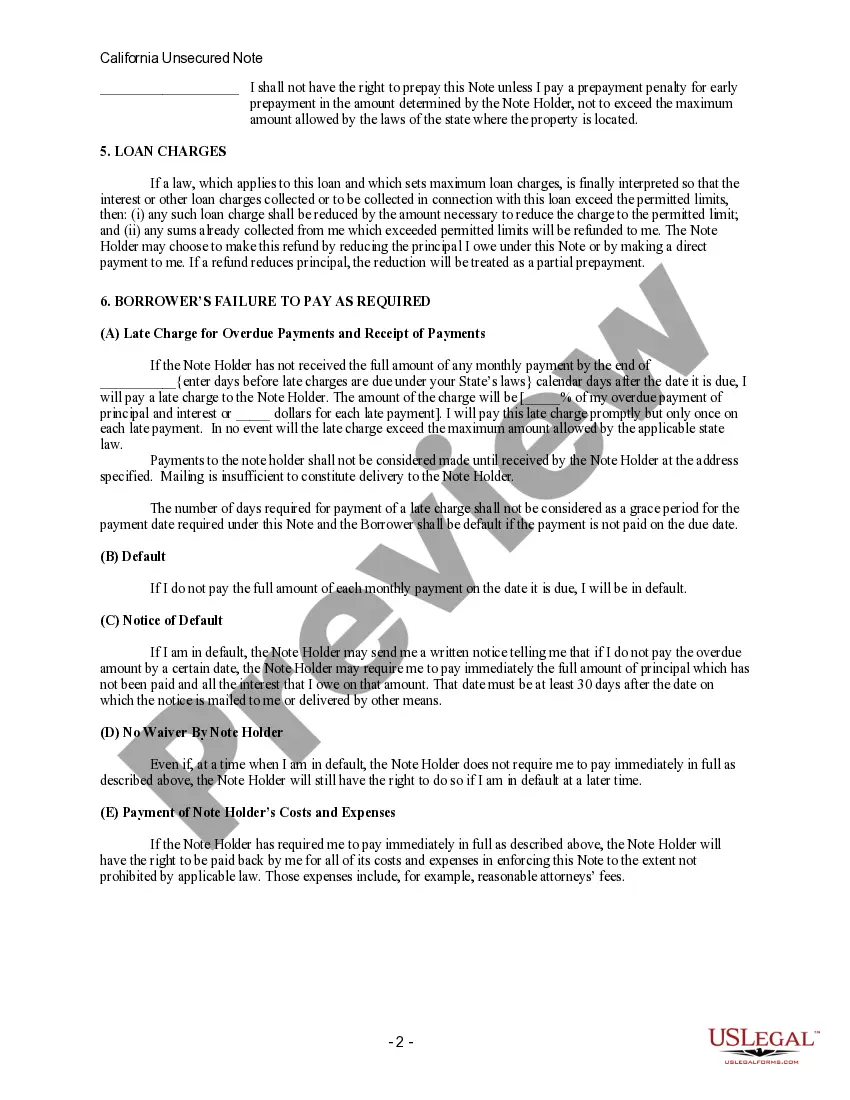

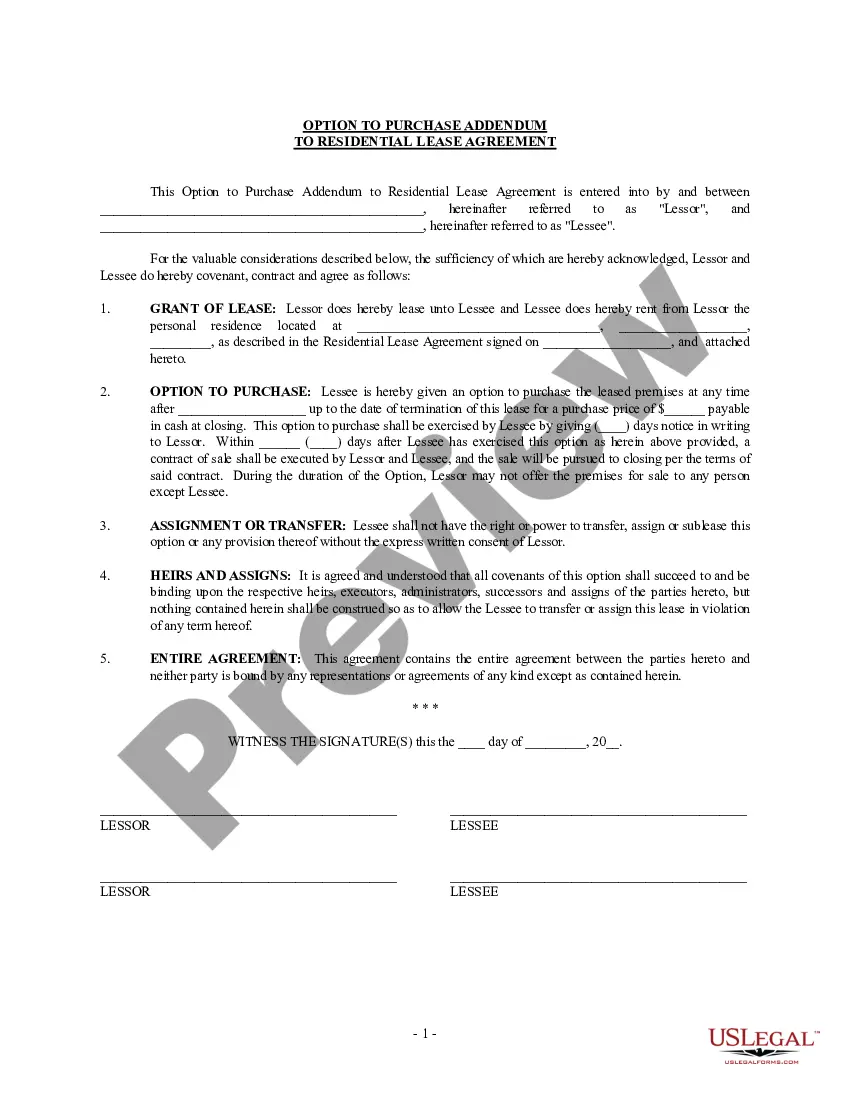

Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate applies to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This comprehensive document ensures that both parties are protected and aware of their rights and obligations. The Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate is utilized when a borrower seeks financial assistance without offering collateral or security against the loan. This type of promissory note ensures that the borrower agrees to make a series of installment payments over a designated period, with a fixed interest rate applied throughout the loan term. Key terms present in the Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate include: 1. Lender and Borrower Information: The promissory note starts by stating the full names, addresses, and contact details of both the lender and borrower, ensuring their identities are established. 2. Loan Amount: The note specifies the principal loan amount agreed upon for which the borrower is responsible to repay in full. 3. Payment Installments: The note outlines the number of installment payments, their due dates, and the amount to be paid at each interval. This arrangement enables the borrower to repay the loan over time rather than in a lump sum. 4. Interest Rate: The promissory note states the fixed interest rate agreed upon, ensuring transparency for the borrower regarding the additional cost of borrowing. 5. Late Payment Terms: The note may detail the consequences of late payments, including the application of late fees and the impact on the borrower's credit history. 6. Default and Acceleration: This section outlines the consequences should the borrower default on the loan. It specifies the lender's rights to accelerate the repayment schedule, potentially calling for the immediate balance to be repaid. 7. Governing Law: The Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate states that the agreement is subject to the laws and regulations of the state of California and the jurisdiction of the local courts. Types of Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Personal Loan Promissory Note: This type of promissory note is used for personal loans between family members, friends, or acquaintances, ensuring that the borrower understands their repayment obligations. 2. Business Loan Promissory Note: This promissory note is designed for loans granted to support business operations, growth, or investments. It outlines specific terms and conditions relevant to the business context. 3. Student Loan Promissory Note: This type of note is utilized for educational loans provided to students to fund their academic pursuits. It includes special provisions catering to the unique circumstances of student loans. In conclusion, the Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legally binding document that protects both the lender and borrower throughout the loan period. By clearly defining the terms, payment schedule, and consequences of default, this promissory note establishes a transparent and secure lending agreement.Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate applies to a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower. This comprehensive document ensures that both parties are protected and aware of their rights and obligations. The Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate is utilized when a borrower seeks financial assistance without offering collateral or security against the loan. This type of promissory note ensures that the borrower agrees to make a series of installment payments over a designated period, with a fixed interest rate applied throughout the loan term. Key terms present in the Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate include: 1. Lender and Borrower Information: The promissory note starts by stating the full names, addresses, and contact details of both the lender and borrower, ensuring their identities are established. 2. Loan Amount: The note specifies the principal loan amount agreed upon for which the borrower is responsible to repay in full. 3. Payment Installments: The note outlines the number of installment payments, their due dates, and the amount to be paid at each interval. This arrangement enables the borrower to repay the loan over time rather than in a lump sum. 4. Interest Rate: The promissory note states the fixed interest rate agreed upon, ensuring transparency for the borrower regarding the additional cost of borrowing. 5. Late Payment Terms: The note may detail the consequences of late payments, including the application of late fees and the impact on the borrower's credit history. 6. Default and Acceleration: This section outlines the consequences should the borrower default on the loan. It specifies the lender's rights to accelerate the repayment schedule, potentially calling for the immediate balance to be repaid. 7. Governing Law: The Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate states that the agreement is subject to the laws and regulations of the state of California and the jurisdiction of the local courts. Types of Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate may include: 1. Personal Loan Promissory Note: This type of promissory note is used for personal loans between family members, friends, or acquaintances, ensuring that the borrower understands their repayment obligations. 2. Business Loan Promissory Note: This promissory note is designed for loans granted to support business operations, growth, or investments. It outlines specific terms and conditions relevant to the business context. 3. Student Loan Promissory Note: This type of note is utilized for educational loans provided to students to fund their academic pursuits. It includes special provisions catering to the unique circumstances of student loans. In conclusion, the Stockton, California Unsecured Installment Payment Promissory Note for Fixed Rate serves as a legally binding document that protects both the lender and borrower throughout the loan period. By clearly defining the terms, payment schedule, and consequences of default, this promissory note establishes a transparent and secure lending agreement.