This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate

Description

How to fill out California Unsecured Installment Payment Promissory Note For Fixed Rate?

If you have previously made use of our service, Log In to your account and download the Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it as per your payment plan.

If this is your first interaction with our service, adhere to these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to access it again. Utilize the US Legal Forms service to quickly locate and save any template for your personal or professional requirements!

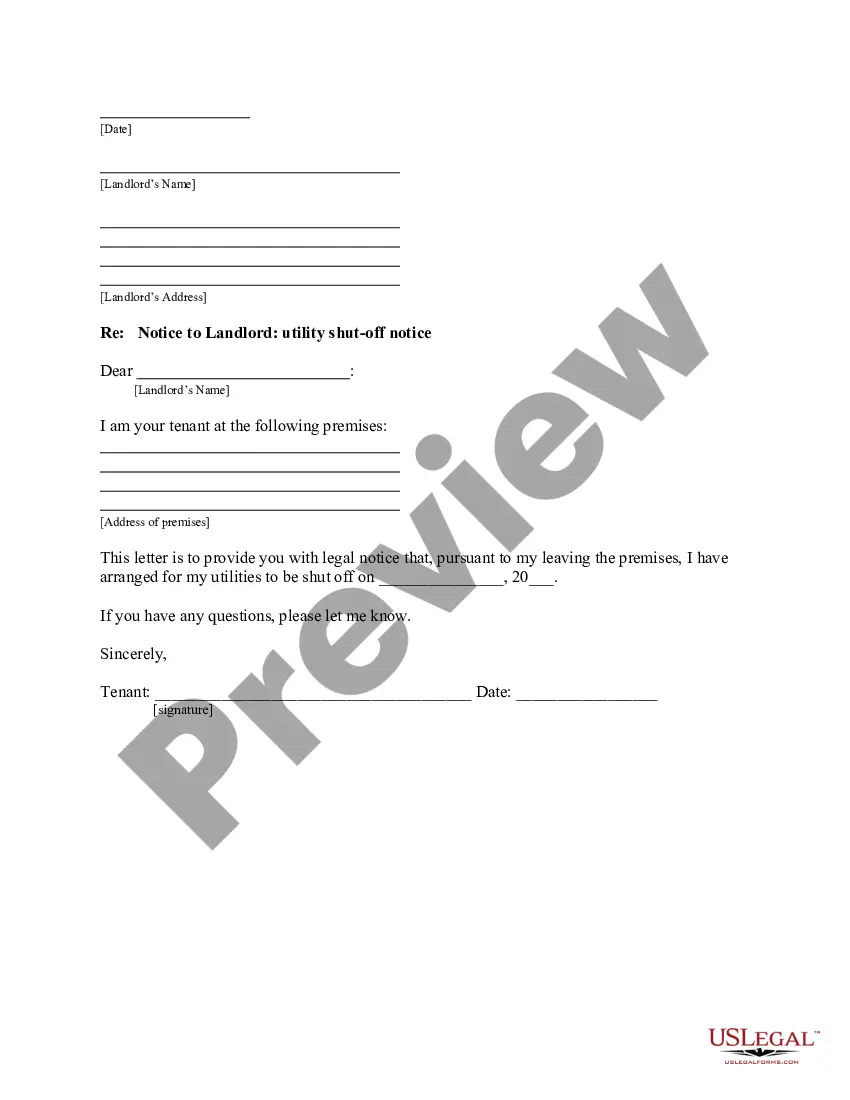

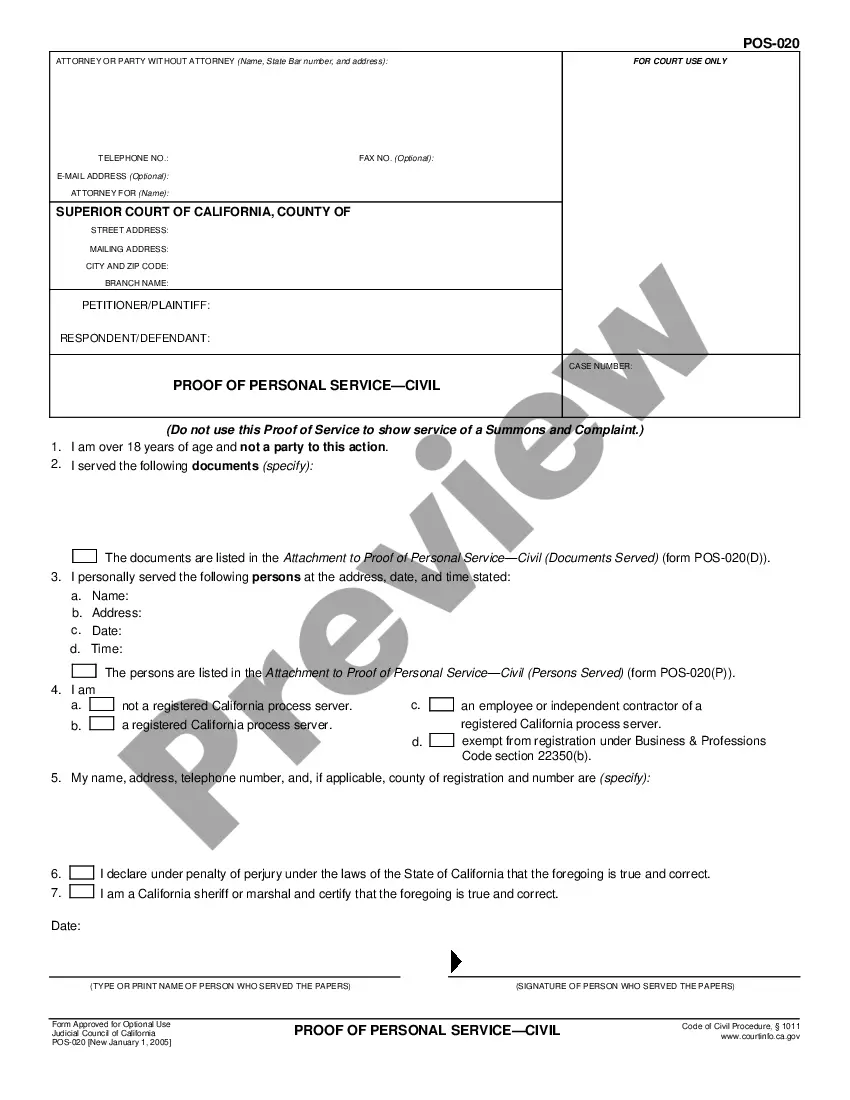

- Ensure you have located a suitable document. Browse the description and utilize the Preview option, if offered, to verify if it satisfies your requirements. If it does not suit you, employ the Search tab above to find the correct one.

- Acquire the template. Click the Buy Now button and select a monthly or yearly subscription package.

- Establish an account and process a payment. Input your credit card information or choose the PayPal option to finalize the transaction.

- Receive your Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate. Select the file format for your document and save it to your device.

- Complete your template. Print it out or utilize professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

An installment note is a type of promissory note that requires payments to be made in regular intervals over time. In essence, while all installment notes fall under the broader category of promissory notes, not all promissory notes require installments. If you're considering a Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate, you’re looking at a structured repayment plan that can help manage your finances effectively while avoiding the risks associated with unsecured borrowing.

A promissory note can be provided by individuals, businesses, or trusted online platforms like USLegalForms. When you seek a Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate, you will often find that experienced professionals can assist in drafting this document. This guidance helps ensure the note adheres to legal standards and covers your specific terms clearly. Additionally, using a well-defined service provides peace of mind and clarity in your transaction.

You can obtain a Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate from various sources. Many online platforms, like USLegalForms, offer customizable templates to meet your specific needs. These documents are accessible, easy to fill out, and can often be downloaded instantly. Choosing a reliable service ensures that you receive a legally sound promissory note.

While not all promissory notes require notarization, having one notarized can add an extra layer of security. Notarization serves to verify the identities of the parties involved, which can help prevent disputes. For your Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate, consider notarizing it to strengthen its enforceability. You can find comprehensive resources on US Legal Forms to assist you in this process.

To make a promissory note legal, you need to ensure it includes essential elements such as date, amount, and terms of repayment. Both parties should sign the note to demonstrate mutual agreement. Additionally, employing a witness or using legal forms can enhance its credibility. For a Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate, US Legal Forms provides templates that help ensure compliance.

Recording a promissory note involves documenting it in a public registry. In Sunnyvale, California, you typically file the note with the county recorder's office, which ensures it becomes part of the public record. This process protects your interests and provides proof of the agreement. You can simplify this by using the US Legal Forms platform to access templates and guidance for Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate.

A simple promissory note typically contains basic elements without intricate terms. For example, a Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate may state that the borrower agrees to repay $5,000 at a 5% interest rate over three years in monthly installments. Such simplicity ensures that both parties understand their commitments.

Promissory notes are generally enforceable in California, including the Sunnyvale California Unsecured Installment Payment Promissory Note for Fixed Rate. California law recognizes such agreements as binding as long as they meet specific legal requirements. It is essential to ensure clarity in the terms to avoid disputes down the line.