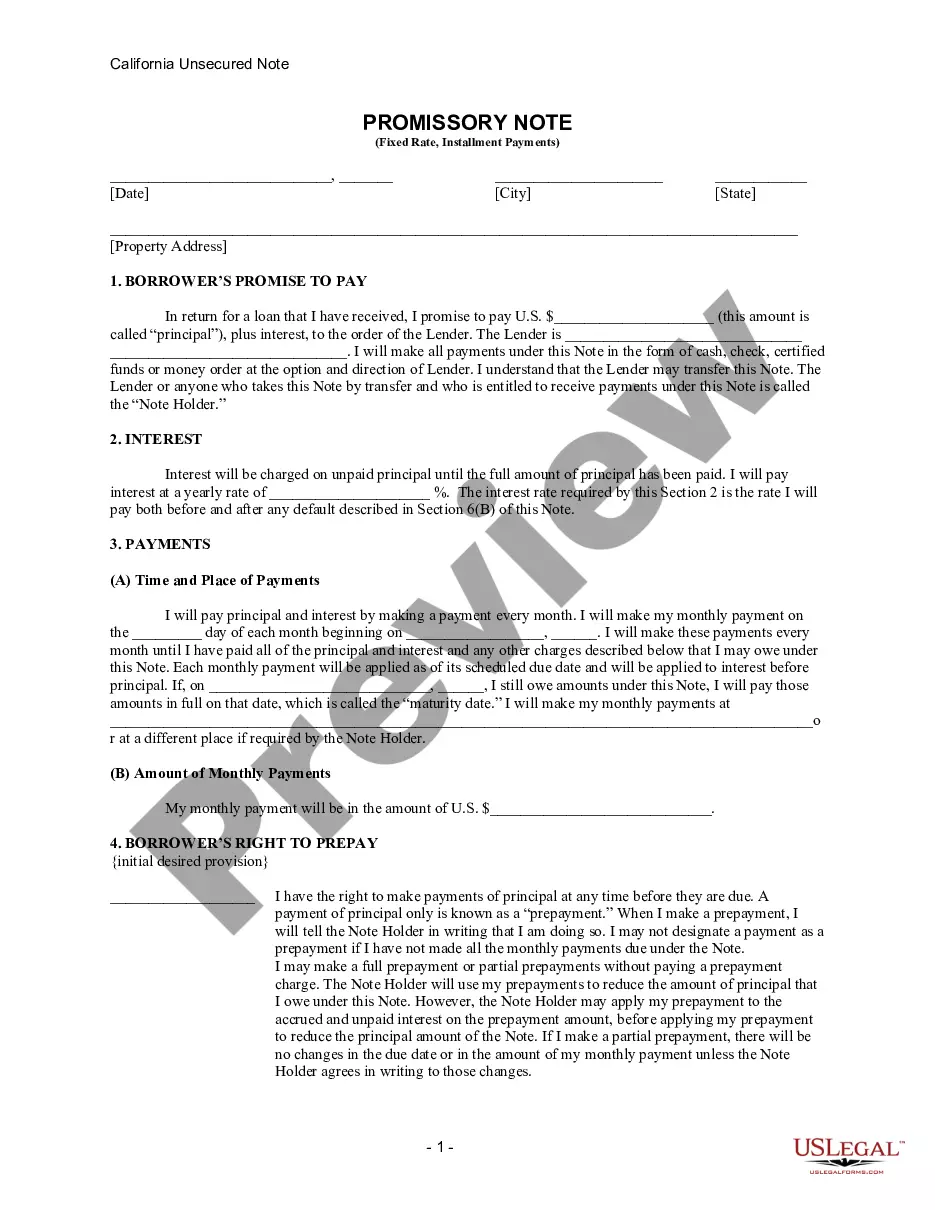

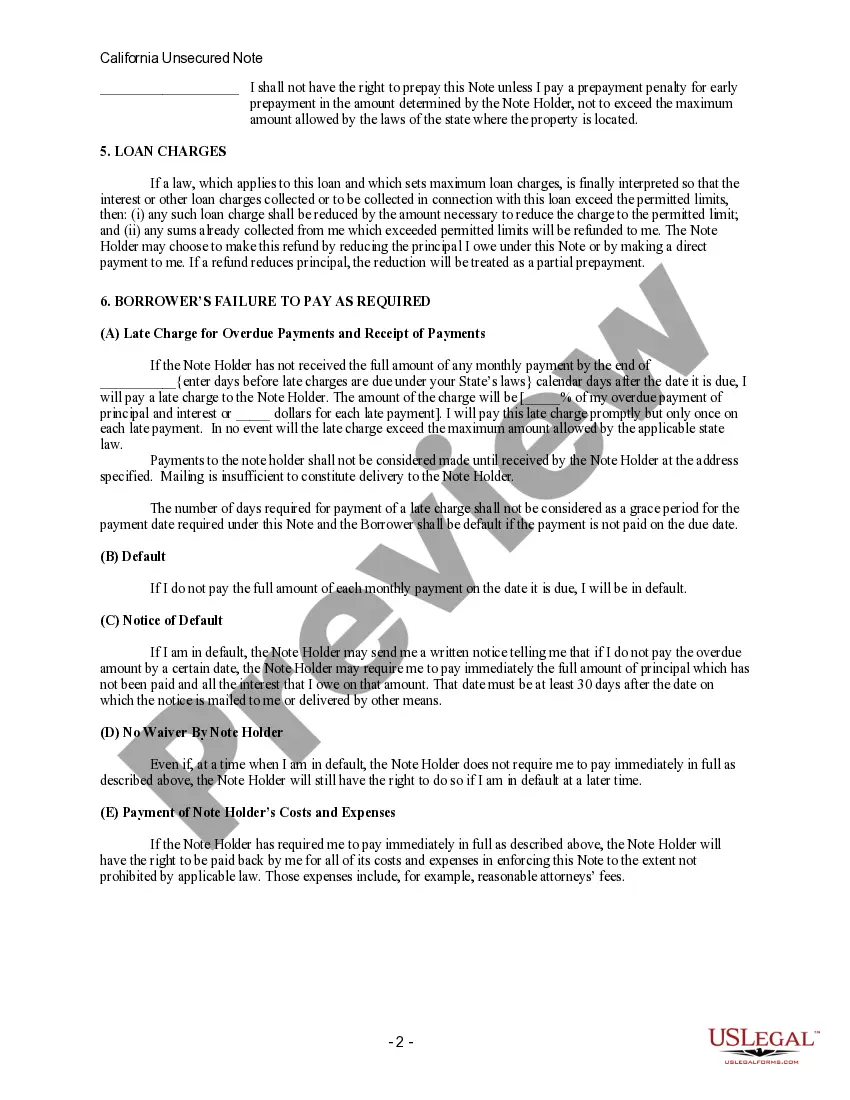

This is a Promissory Note for your state. The promissory note is unsecured, with a fixed interest rate, and contains a provision for installment payments.

Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Victorville, California. It is designed for unsecured loans where the borrower agrees to repay the borrowed amount in regular installments over a defined period of time. Keywords: Victorville California, unsecured loan, installment payment, promissory note, fixed rate. The Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate is a binding contract that ensures both parties understand their rights and responsibilities regarding the loan. It provides protection to lenders by establishing the borrower's obligation to repay the loan and the consequences of defaulting on the loan agreement. This promissory note specifies important details such as the borrowed amount, interest rate, repayment schedule, and any late payment penalties. The fixed interest rate ensures that the borrower will pay a predetermined interest percentage throughout the loan term, providing stability to both parties involved. In Victorville, California, there might be different types of Unsecured Installment Payment Promissory Notes for Fixed Rate, such as: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for small personal loans between family members, friends, or acquaintances. It details the terms of the loan, including repayment installments and interest rate. 2. Business Loan Promissory Note: This type of promissory note applies to loans taken by businesses or entrepreneurs for various purposes, such as expanding operations, purchasing equipment, or financing projects. The note includes specific terms and conditions tailored to business loan requirements. 3. Student Loan Promissory Note: This type of promissory note is designed specifically for educational purposes. It outlines the repayment schedule and interest rate associated with student loans, helping both lenders and borrowers understand their obligations. In any case, it is crucial for borrowers to thoroughly read and understand the terms and conditions of the Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate before signing. Seeking legal advice is highly recommended ensuring compliance with local laws and regulations.Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate is a legal document that outlines the terms and conditions of a loan agreement between a lender and borrower in Victorville, California. It is designed for unsecured loans where the borrower agrees to repay the borrowed amount in regular installments over a defined period of time. Keywords: Victorville California, unsecured loan, installment payment, promissory note, fixed rate. The Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate is a binding contract that ensures both parties understand their rights and responsibilities regarding the loan. It provides protection to lenders by establishing the borrower's obligation to repay the loan and the consequences of defaulting on the loan agreement. This promissory note specifies important details such as the borrowed amount, interest rate, repayment schedule, and any late payment penalties. The fixed interest rate ensures that the borrower will pay a predetermined interest percentage throughout the loan term, providing stability to both parties involved. In Victorville, California, there might be different types of Unsecured Installment Payment Promissory Notes for Fixed Rate, such as: 1. Personal Loan Promissory Note: This type of promissory note is commonly used for small personal loans between family members, friends, or acquaintances. It details the terms of the loan, including repayment installments and interest rate. 2. Business Loan Promissory Note: This type of promissory note applies to loans taken by businesses or entrepreneurs for various purposes, such as expanding operations, purchasing equipment, or financing projects. The note includes specific terms and conditions tailored to business loan requirements. 3. Student Loan Promissory Note: This type of promissory note is designed specifically for educational purposes. It outlines the repayment schedule and interest rate associated with student loans, helping both lenders and borrowers understand their obligations. In any case, it is crucial for borrowers to thoroughly read and understand the terms and conditions of the Victorville California Unsecured Installment Payment Promissory Note for Fixed Rate before signing. Seeking legal advice is highly recommended ensuring compliance with local laws and regulations.