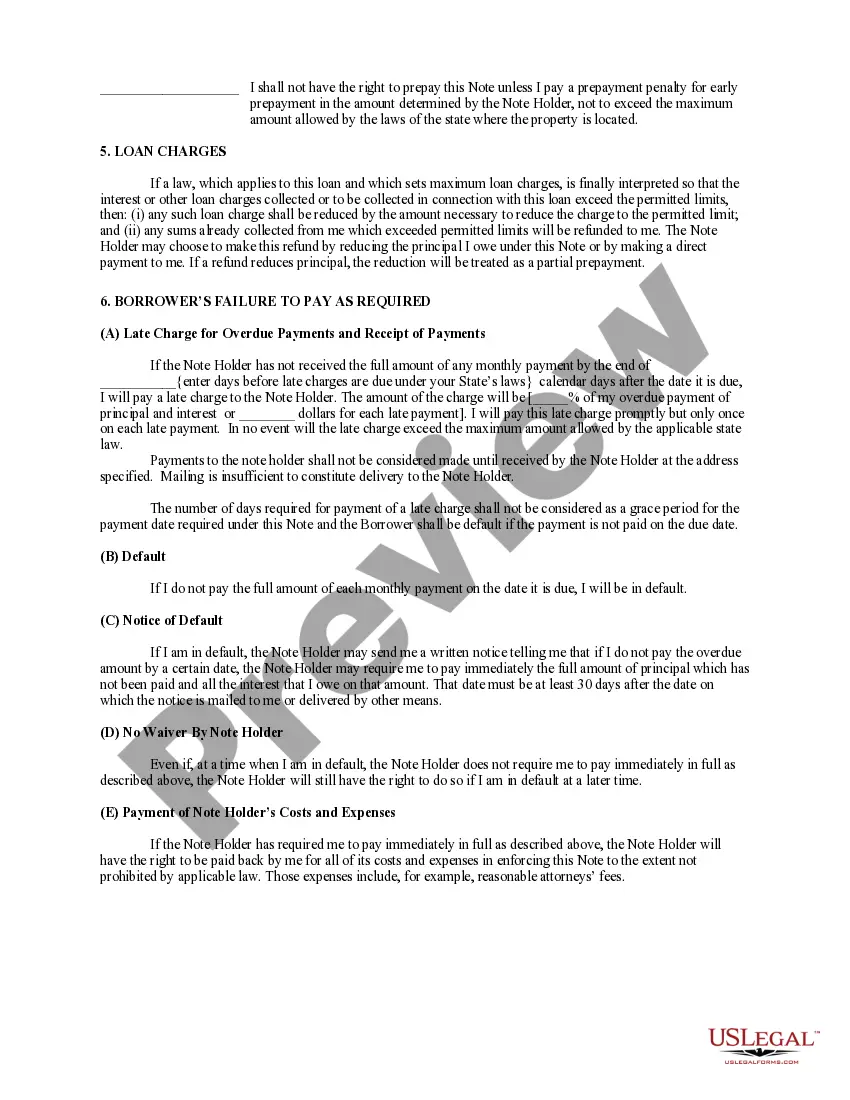

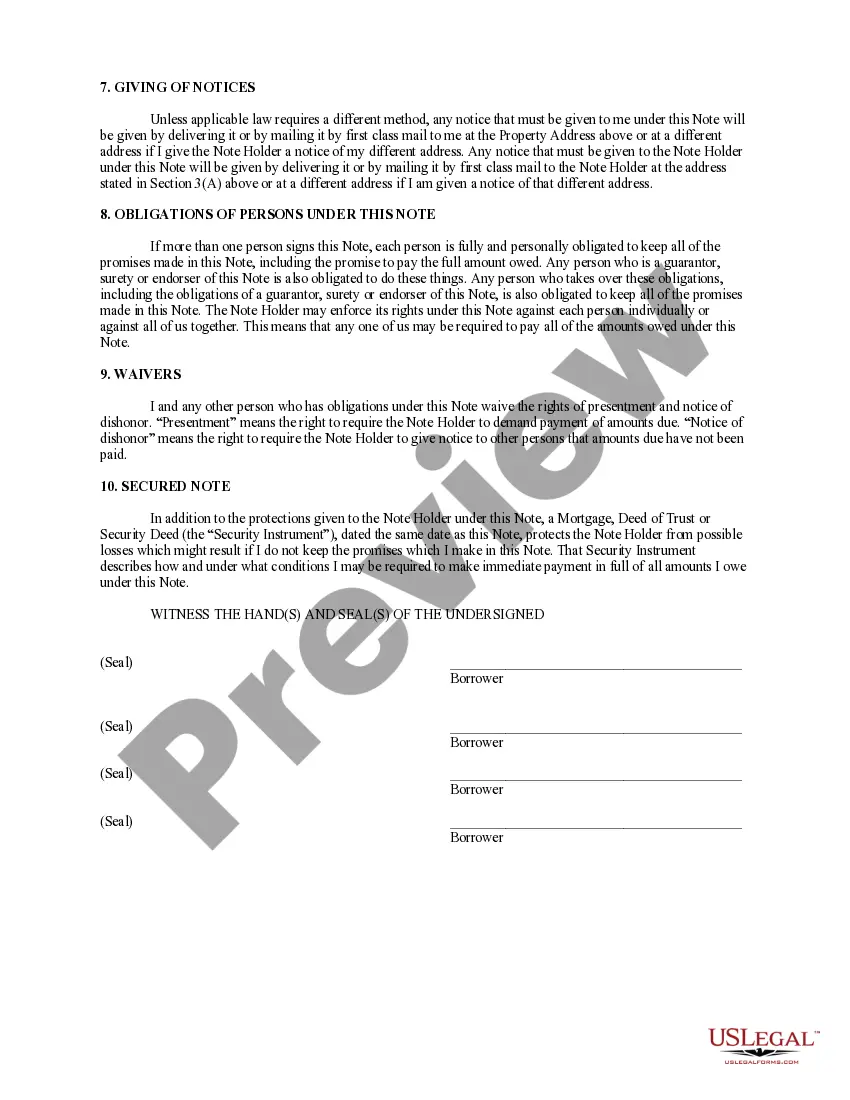

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate refers to a legal contract involving a borrower and a lender for a loan in Clovis, California. In this agreement, the borrower agrees to repay the loan through scheduled installments and secures the loan with residential real estate as collateral. This type of promissory note provides a fixed interest rate, meaning that the interest rate remains unchanged throughout the loan term. This offers stability and predictability to both the borrower and the lender, as they can accurately calculate and plan their payments and returns. The use of residential real estate as collateral provides security to the lender. In case the borrower defaults on the loan, the lender has the right to claim ownership of the residential property and sell it to recover the outstanding loan amount. There can be different variations or types of Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate based on specific terms and conditions agreed upon by the parties involved. Some of these variational types can be: 1. Short-term vs. long-term promissory notes: Depending on the loan term, the promissory note can be categorized as short-term (typically less than a year) or long-term (1 year or longer). Each type may have different interest rates and repayment plans. 2. Balloon payment option: This type of promissory note may provide the borrower with the option to make regular installments for a specified period, followed by a lump sum final payment, known as a balloon payment, at the end of the loan term. 3. Adjustable interest rate: While the fixed rate is the most common, an adjustable interest rate promissory note can also be an option. In this case, the interest rate can fluctuate based on market conditions or agreed-upon terms. 4. First lien vs. subordinate lien: A Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can vary based on its priority of repayment. A first lien note takes precedence over any other lenders or claims on the property, while a subordinate lien note comes after existing liens, possibly offering less security to the lender. 5. Refinancing option: Some promissory notes may include provisions that allow the borrower to refinance the loan at a later stage. This provides flexibility if the borrower wants to renegotiate the loan terms, potentially obtaining better rates or adjusting the loan amount. When entering into a Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is crucial for both parties to carefully review and understand the terms and conditions mentioned within the agreement to ensure compliance, avoid any disputes, and protect their respective interests.A Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate refers to a legal contract involving a borrower and a lender for a loan in Clovis, California. In this agreement, the borrower agrees to repay the loan through scheduled installments and secures the loan with residential real estate as collateral. This type of promissory note provides a fixed interest rate, meaning that the interest rate remains unchanged throughout the loan term. This offers stability and predictability to both the borrower and the lender, as they can accurately calculate and plan their payments and returns. The use of residential real estate as collateral provides security to the lender. In case the borrower defaults on the loan, the lender has the right to claim ownership of the residential property and sell it to recover the outstanding loan amount. There can be different variations or types of Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate based on specific terms and conditions agreed upon by the parties involved. Some of these variational types can be: 1. Short-term vs. long-term promissory notes: Depending on the loan term, the promissory note can be categorized as short-term (typically less than a year) or long-term (1 year or longer). Each type may have different interest rates and repayment plans. 2. Balloon payment option: This type of promissory note may provide the borrower with the option to make regular installments for a specified period, followed by a lump sum final payment, known as a balloon payment, at the end of the loan term. 3. Adjustable interest rate: While the fixed rate is the most common, an adjustable interest rate promissory note can also be an option. In this case, the interest rate can fluctuate based on market conditions or agreed-upon terms. 4. First lien vs. subordinate lien: A Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can vary based on its priority of repayment. A first lien note takes precedence over any other lenders or claims on the property, while a subordinate lien note comes after existing liens, possibly offering less security to the lender. 5. Refinancing option: Some promissory notes may include provisions that allow the borrower to refinance the loan at a later stage. This provides flexibility if the borrower wants to renegotiate the loan terms, potentially obtaining better rates or adjusting the loan amount. When entering into a Clovis California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, it is crucial for both parties to carefully review and understand the terms and conditions mentioned within the agreement to ensure compliance, avoid any disputes, and protect their respective interests.