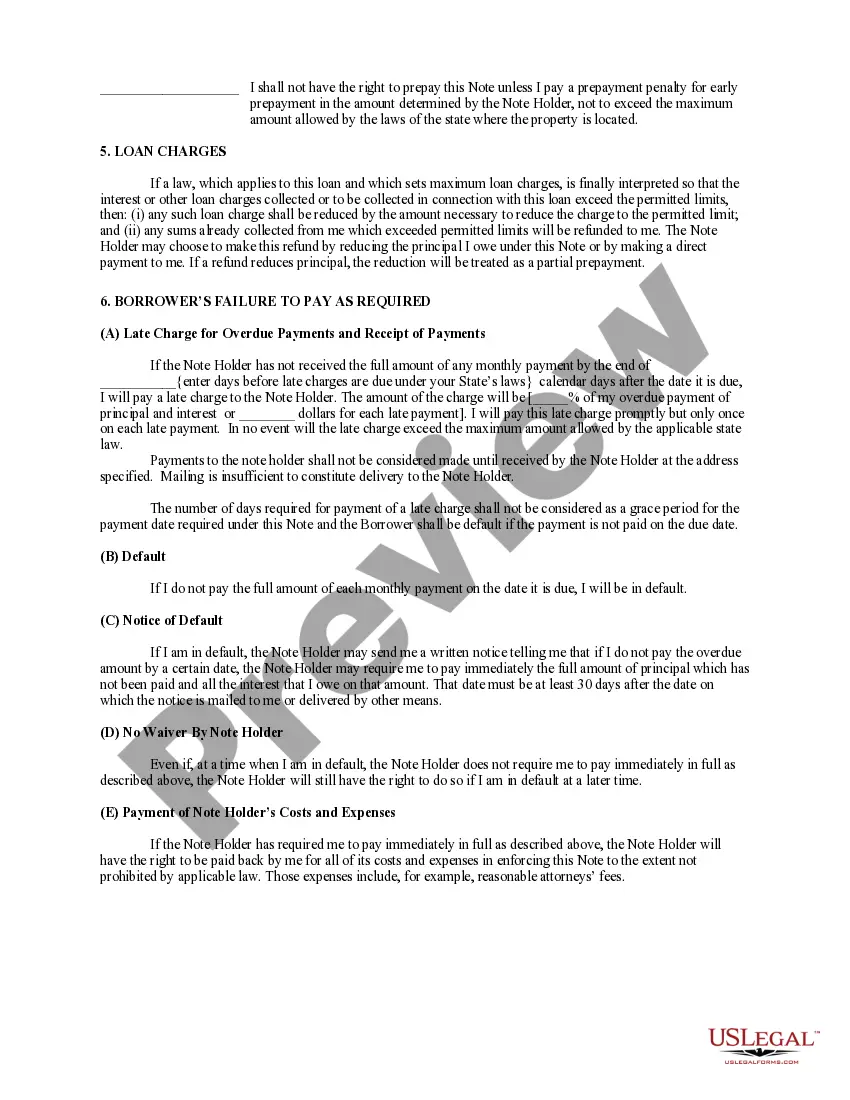

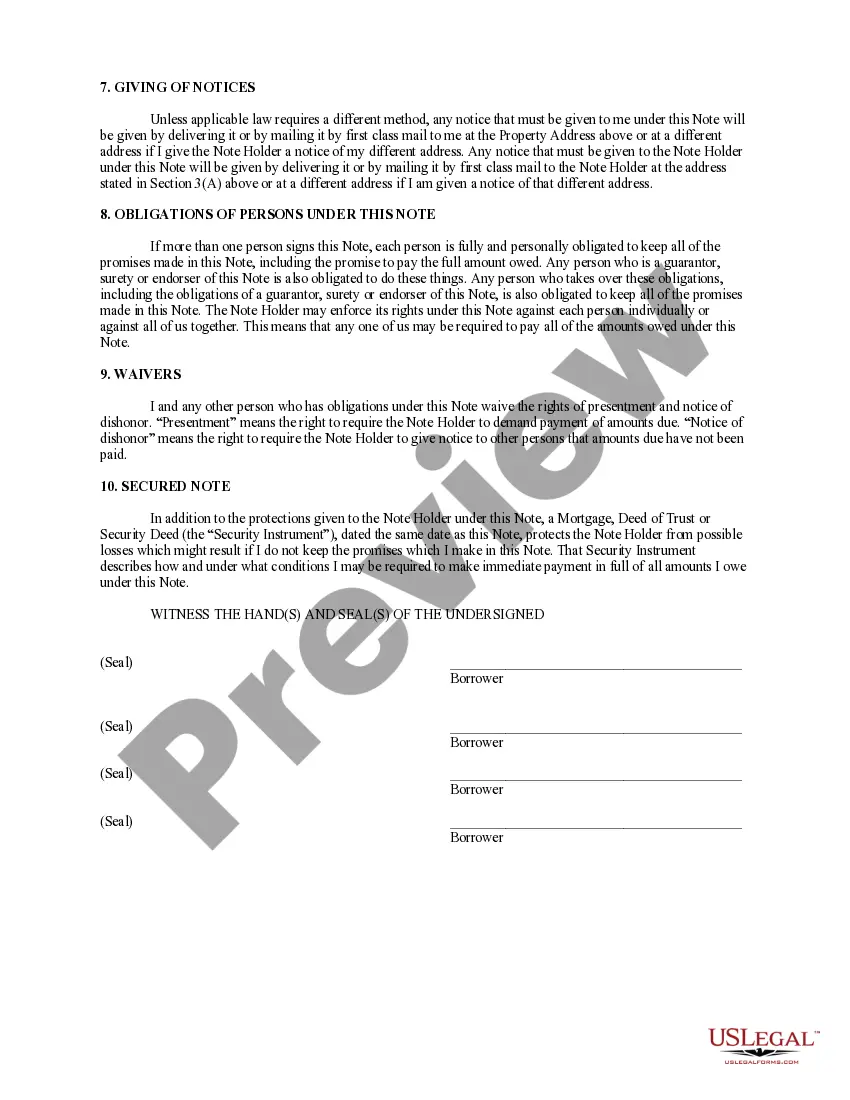

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

A Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document used when an individual borrows money from a lender to purchase a residential property or use their property as collateral. This promissory note outlines the terms and conditions of the loan, including the repayment schedule, interest rates, and the consequences of default. Here are the different types of Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Traditional Fixed Rate Promissory Note: This type of promissory note offers a stable interest rate throughout the loan's term, ensuring consistent monthly payments for the borrower. 2. Adjustable Rate Promissory Note: Unlike the traditional fixed rate, an adjustable rate promissory note features an interest rate that can change over time based on market fluctuations. This type of note may be suitable for borrowers expecting interest rates to decrease in the future. 3. Balloon Payment Promissory Note: With a balloon payment promissory note, borrowers make smaller monthly payments initially, followed by a significantly larger payment at the end of the loan term. This type of note is ideal for borrowers who anticipate obtaining a significant sum of money in the future. 4. Interest-Only Promissory Note: This promissory note requires the borrower to only pay interest for a specified period, usually the first few years of the loan term, before beginning to repay the principal. Interest-only notes are commonly used in situations where the borrower expects a higher income in the future. 5. Zero Down Payment Promissory Note: This type of note eliminates the requirement for a down payment, allowing borrowers to finance 100% of the residential property's value. Zero down payment notes may appeal to borrowers who lack liquid assets but possess a reliable income source. 6. Reverse Mortgage Promissory Note: Designed for older homeowners, a reverse mortgage promissory note allows borrowers to convert a portion of their home equity into loan proceeds. The loan is repaid, usually after the borrower's death, using the sale proceeds from the property. Regardless of the type, a Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides legal protection and clearly defines the obligations and responsibilities of both the borrower and the lender. It is essential to consult with a qualified attorney or real estate professional when drafting or signing such a promissory note to ensure compliance with local regulations and to protect both parties' interests.A Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is a legally binding document used when an individual borrows money from a lender to purchase a residential property or use their property as collateral. This promissory note outlines the terms and conditions of the loan, including the repayment schedule, interest rates, and the consequences of default. Here are the different types of Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate: 1. Traditional Fixed Rate Promissory Note: This type of promissory note offers a stable interest rate throughout the loan's term, ensuring consistent monthly payments for the borrower. 2. Adjustable Rate Promissory Note: Unlike the traditional fixed rate, an adjustable rate promissory note features an interest rate that can change over time based on market fluctuations. This type of note may be suitable for borrowers expecting interest rates to decrease in the future. 3. Balloon Payment Promissory Note: With a balloon payment promissory note, borrowers make smaller monthly payments initially, followed by a significantly larger payment at the end of the loan term. This type of note is ideal for borrowers who anticipate obtaining a significant sum of money in the future. 4. Interest-Only Promissory Note: This promissory note requires the borrower to only pay interest for a specified period, usually the first few years of the loan term, before beginning to repay the principal. Interest-only notes are commonly used in situations where the borrower expects a higher income in the future. 5. Zero Down Payment Promissory Note: This type of note eliminates the requirement for a down payment, allowing borrowers to finance 100% of the residential property's value. Zero down payment notes may appeal to borrowers who lack liquid assets but possess a reliable income source. 6. Reverse Mortgage Promissory Note: Designed for older homeowners, a reverse mortgage promissory note allows borrowers to convert a portion of their home equity into loan proceeds. The loan is repaid, usually after the borrower's death, using the sale proceeds from the property. Regardless of the type, a Salinas California Installments Fixed Rate Promissory Note Secured by Residential Real Estate provides legal protection and clearly defines the obligations and responsibilities of both the borrower and the lender. It is essential to consult with a qualified attorney or real estate professional when drafting or signing such a promissory note to ensure compliance with local regulations and to protect both parties' interests.