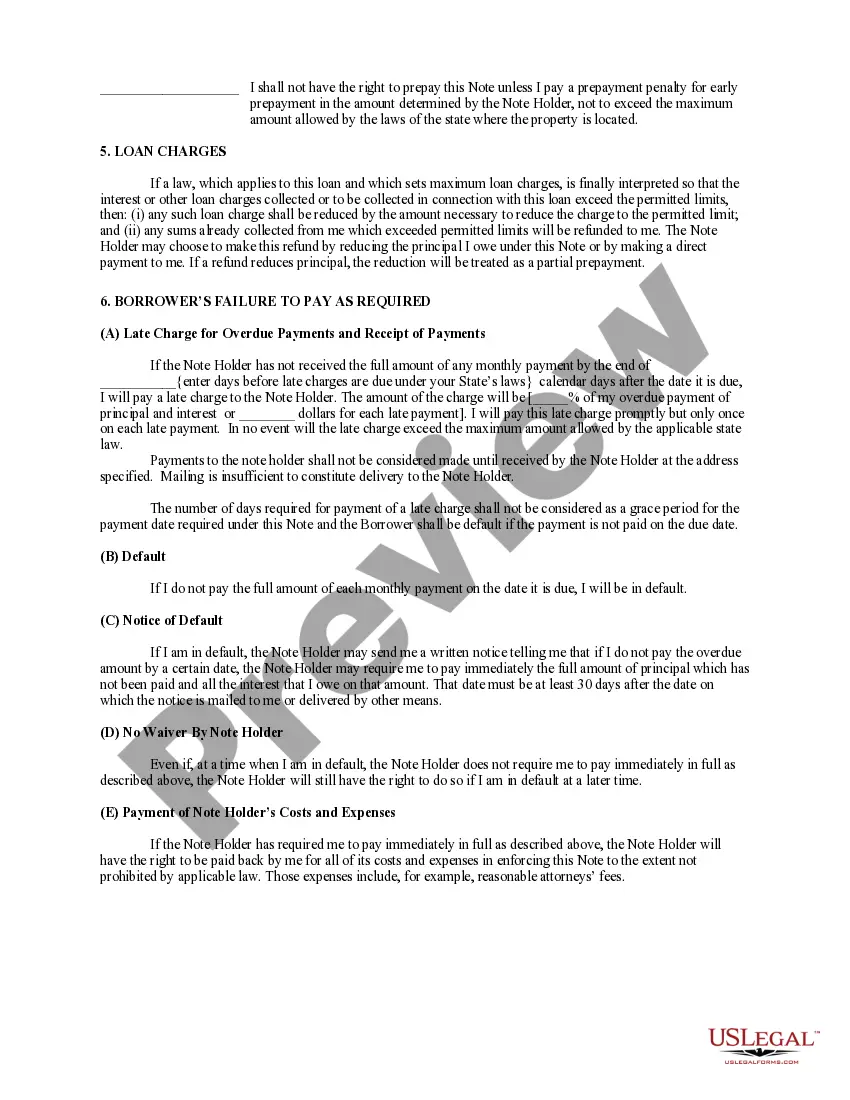

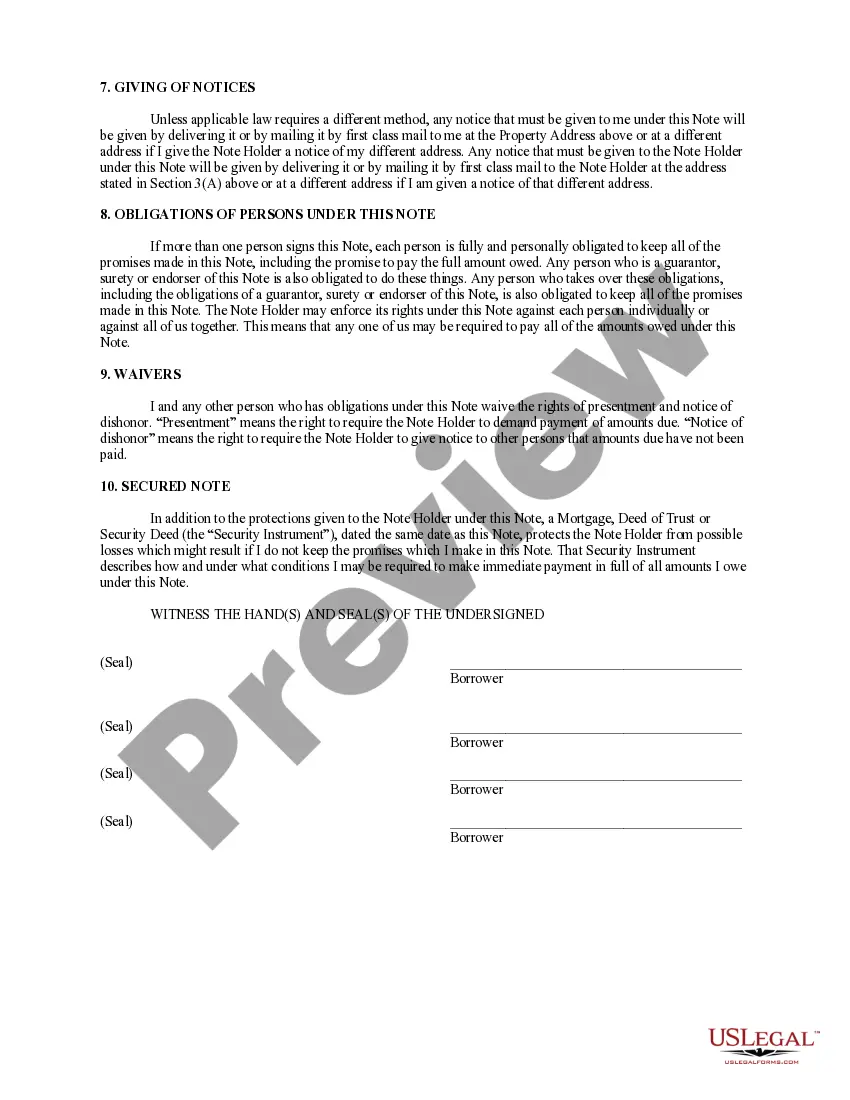

This is a form of Promissory Note for use where residential property is security for the loan. A promissory note is a written promise to pay a debt. An unconditional promise to pay on demand or at a fixed or determined future time a particular sum of money to or to the order of a specified person or to the bearer. A separate deed of trust or mortgage is also required.

West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description

How to fill out California Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

If you are in search of a legitimate form template, it’s challenging to discover a superior platform than the US Legal Forms website – one of the most comprehensive libraries on the web.

Here you can locate an extensive array of form samples for business and personal uses by categories and locations, or keywords.

Utilizing our advanced search feature, finding the latest West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is as simple as 1-2-3.

Complete the transaction. Use your credit card or PayPal account to finalize the registration process.

Obtain the form. Choose the format and save it to your device.

- Moreover, the accuracy of each document is confirmed by a team of experienced attorneys who consistently review the templates on our platform and update them in line with the latest state and county regulations.

- If you are already familiar with our system and hold a registered account, simply Log In to your user profile and select the Download option to obtain the West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate.

- If you are using US Legal Forms for the first time, just follow the instructions below.

- Ensure you have located the sample you require. Review its details and utilize the Preview feature (if available) to examine its content. If it does not fulfill your requirements, use the Search option at the top of the page to find the appropriate document.

- Validate your choice. Click the Buy now button. Then, select the desired pricing plan and provide information to register for an account.

Form popularity

FAQ

You typically do not file a promissory note with a government office; instead, you keep it in a safe place for record-keeping. However, a deed of trust or mortgage related to the note needs to be filed with the county recorder’s office. For a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, proper documentation ensures that your interests are safeguarded and legally enforceable.

Yes, a secured promissory note should be recorded to protect the lender's rights in the property. Recording the note ensures that it becomes public record, providing notice to other potential creditors. For a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, this step is crucial for establishing priority in the event of any disputes.

The document that secures the promissory note to the real property is known as a deed of trust. This legal instrument creates a lien on the property, ensuring that the lender can reclaim the asset if the borrower defaults. In the context of a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, the deed of trust acts as a vital protection for the lender's interests.

Securing a promissory note with real property involves including a mortgage or deed of trust within the agreement. This acts as collateral, giving the lender rights to the property if the borrower defaults. Explicitly mention that the note is a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate to reinforce its legitimacy. For further assistance, consider the resources available on the US Legal Forms platform.

An example of a promissory note could be an agreement where the borrower promises to repay a specified amount with interest over time. For instance, a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate would outline the principal, interest, and collateral involved. Such a framework helps ensure that both parties are aware of their obligations. Utilizing US Legal Forms can help you find samples to suit your needs.

Filling out a promissory note sample requires attention to detail. Begin with the names of both parties and the principal amount. Clearly outline the repayment terms, including how and when the borrower will make payments. Incorporating specific references to the West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can enhance clarity and enforceability.

A secured promissory note, such as a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate, is backed by collateral, usually property. In contrast, a standard promissory note does not have collateral and relies solely on the borrower's promise to repay. The secured option offers greater security for lenders, as they have a claim on the collateral if the borrower defaults.

If you are looking for a promissory note, consider exploring options like legal websites, banks, and specialized legal services. A West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate can be easily accessed through platforms like US Legal Forms, which provide reliable resources. This allows you to customize the note to fit your unique requirements, ensuring that all necessary details are covered.

You can obtain a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate from various sources, including financial institutions, attorneys, and legal document service providers. US Legal Forms offers a variety of customizable templates that can efficiently meet your needs. By using these templates, you can ensure that your note is compliant with local laws and regulations.

Yes, a West Covina California Installments Fixed Rate Promissory Note Secured by Residential Real Estate is typically secured by collateral. This means that the note is backed by residential property, providing added security for the lender. In the event of non-payment, the lender can take possession of the collateral. This level of security makes this option more attractive for both lenders and borrowers.