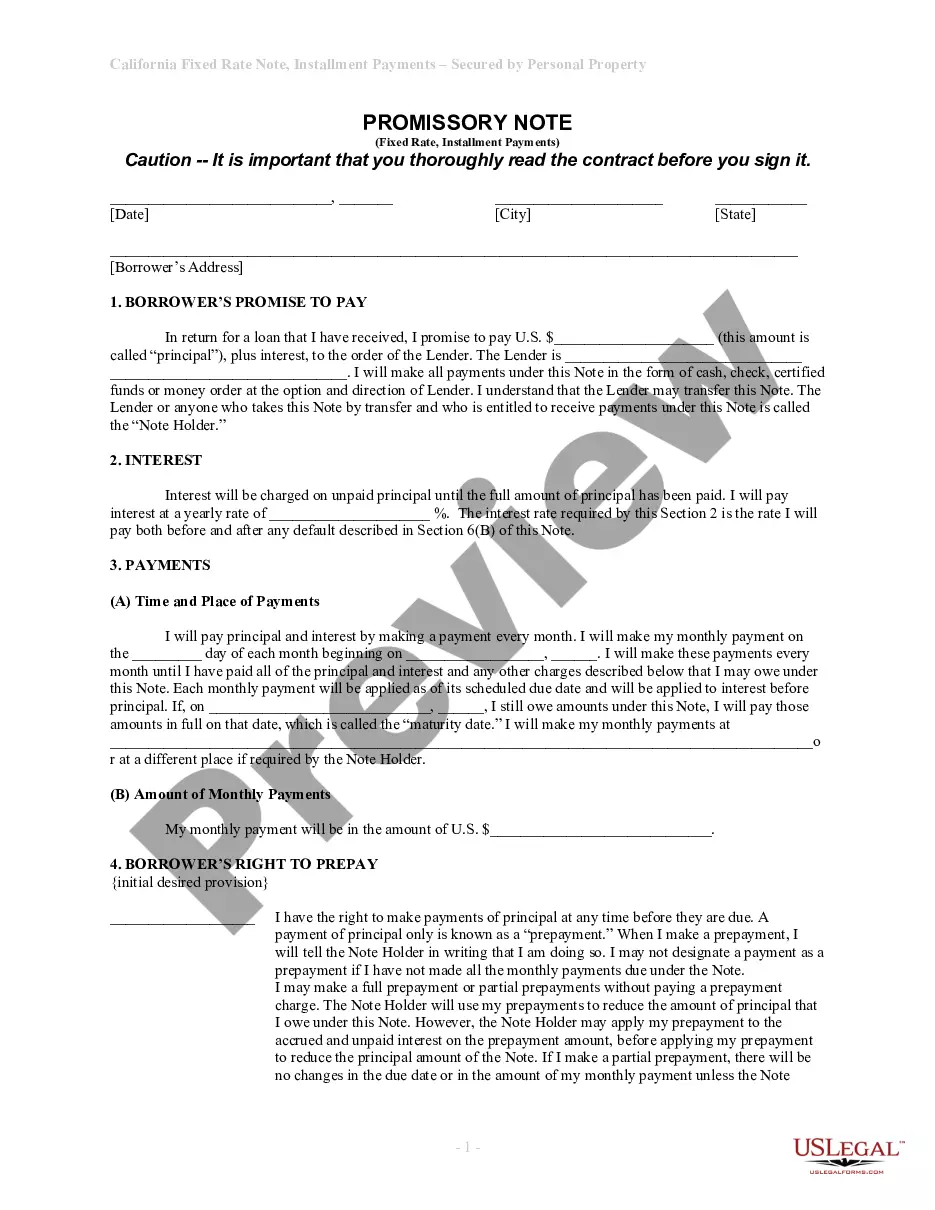

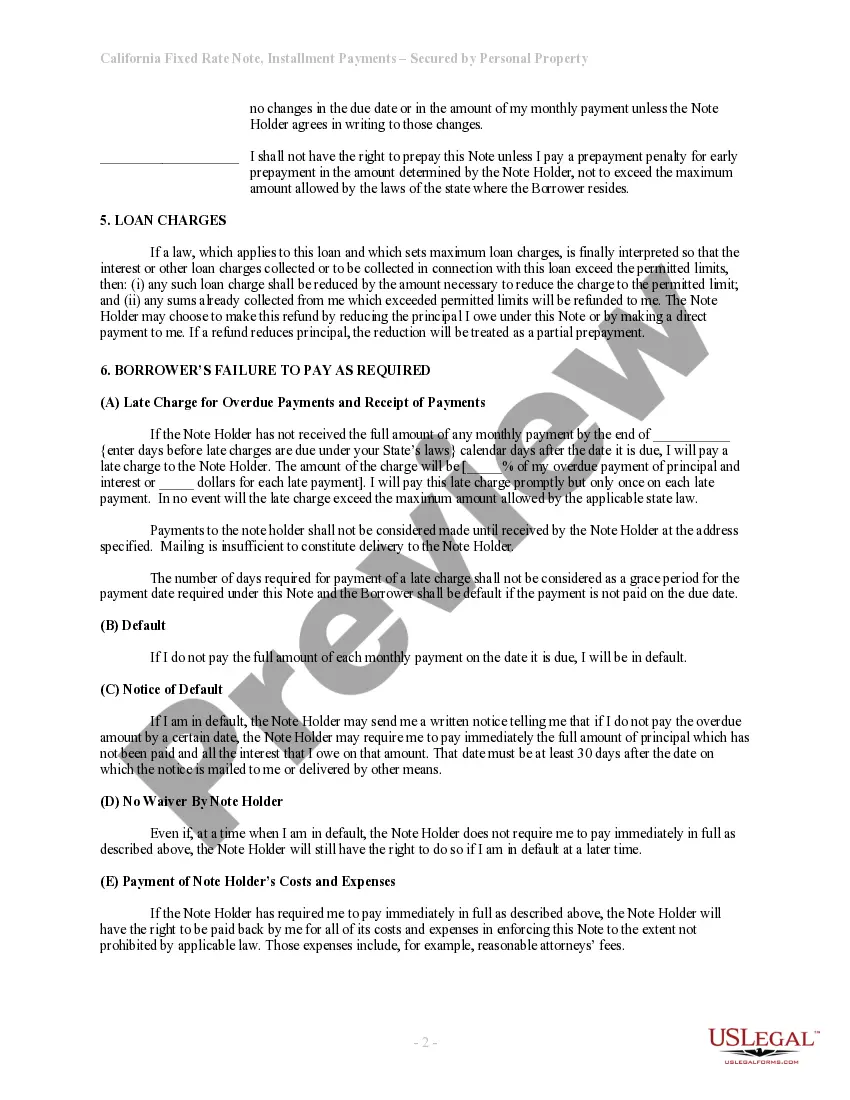

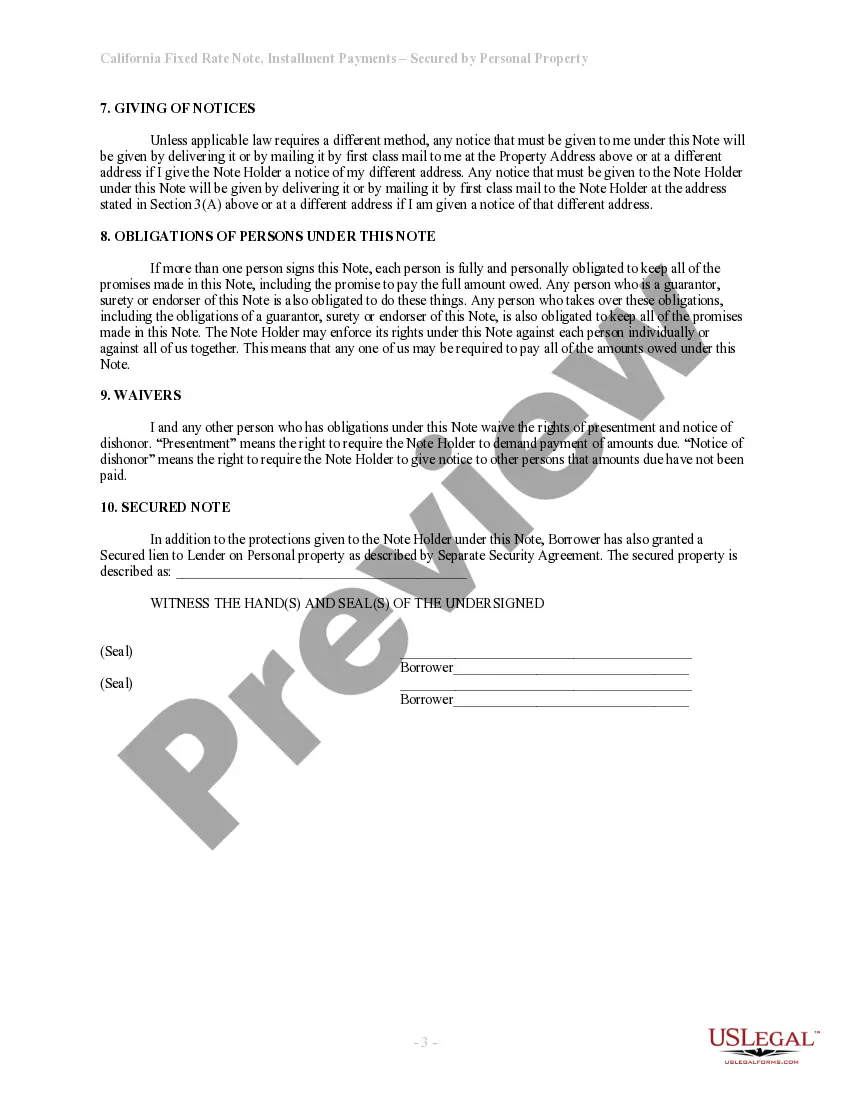

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Chico California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document used in Chico, California, to establish a written agreement between a borrower and a lender regarding the repayment terms of a loan that is secured by personal property. This promissory note is designed to provide clear and enforceable terms to protect the rights of both parties involved in the transaction. Key Features: 1. Chico California: This promissory note adheres to the laws and regulations specific to Chico, California, ensuring compliance with local legal standards. 2. Installments: The loan amount is repaid in regular installments over a defined period, typically monthly or quarterly. This allows borrowers to manage their finances effectively. 3. Fixed Rate: The interest rate on the loan remains constant throughout the repayment term. This offers borrowers stability and predictability in their loan obligations. 4. Promissory Note: This legal document clearly outlines the terms and conditions of the loan, including the repayment schedule, interest rate, late payment penalties, and any other relevant provisions. 5. Secured by Personal Property: The borrower pledges personal property as collateral to secure the loan. In the event of default, the lender has the right to seize and sell the pledged property to recover the outstanding balance. Types of Chico California Installments Fixed Rate Promissory Note Secured by Personal Property: 1. Vehicle Loan Promissory Note: This type of promissory note is specifically used for loans secured by personal vehicles, such as cars, motorcycles, or recreational vehicles. 2. Equipment Loan Promissory Note: Businesses or individuals seeking financing for equipment can use this type of promissory note to secure the loan using the equipment itself as collateral. 3. Personal Asset Loan Promissory Note: Borrowers can secure personal loans by pledging valuable assets such as jewelry, art, or collectibles, with the personal property serving as collateral. 4. Real Estate-Backed Promissory Note: This type of promissory note is utilized when a loan is secured using real estate property. However, it is important to note that this may involve additional legal processes beyond the scope of a Chico California Installments Fixed Rate Promissory Note. By utilizing a Chico California Installments Fixed Rate Promissory Note Secured by Personal Property, borrowers and lenders can establish a legally binding agreement that provides clarity and protection for both parties involved in the loan transaction.Chico California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document used in Chico, California, to establish a written agreement between a borrower and a lender regarding the repayment terms of a loan that is secured by personal property. This promissory note is designed to provide clear and enforceable terms to protect the rights of both parties involved in the transaction. Key Features: 1. Chico California: This promissory note adheres to the laws and regulations specific to Chico, California, ensuring compliance with local legal standards. 2. Installments: The loan amount is repaid in regular installments over a defined period, typically monthly or quarterly. This allows borrowers to manage their finances effectively. 3. Fixed Rate: The interest rate on the loan remains constant throughout the repayment term. This offers borrowers stability and predictability in their loan obligations. 4. Promissory Note: This legal document clearly outlines the terms and conditions of the loan, including the repayment schedule, interest rate, late payment penalties, and any other relevant provisions. 5. Secured by Personal Property: The borrower pledges personal property as collateral to secure the loan. In the event of default, the lender has the right to seize and sell the pledged property to recover the outstanding balance. Types of Chico California Installments Fixed Rate Promissory Note Secured by Personal Property: 1. Vehicle Loan Promissory Note: This type of promissory note is specifically used for loans secured by personal vehicles, such as cars, motorcycles, or recreational vehicles. 2. Equipment Loan Promissory Note: Businesses or individuals seeking financing for equipment can use this type of promissory note to secure the loan using the equipment itself as collateral. 3. Personal Asset Loan Promissory Note: Borrowers can secure personal loans by pledging valuable assets such as jewelry, art, or collectibles, with the personal property serving as collateral. 4. Real Estate-Backed Promissory Note: This type of promissory note is utilized when a loan is secured using real estate property. However, it is important to note that this may involve additional legal processes beyond the scope of a Chico California Installments Fixed Rate Promissory Note. By utilizing a Chico California Installments Fixed Rate Promissory Note Secured by Personal Property, borrowers and lenders can establish a legally binding agreement that provides clarity and protection for both parties involved in the loan transaction.