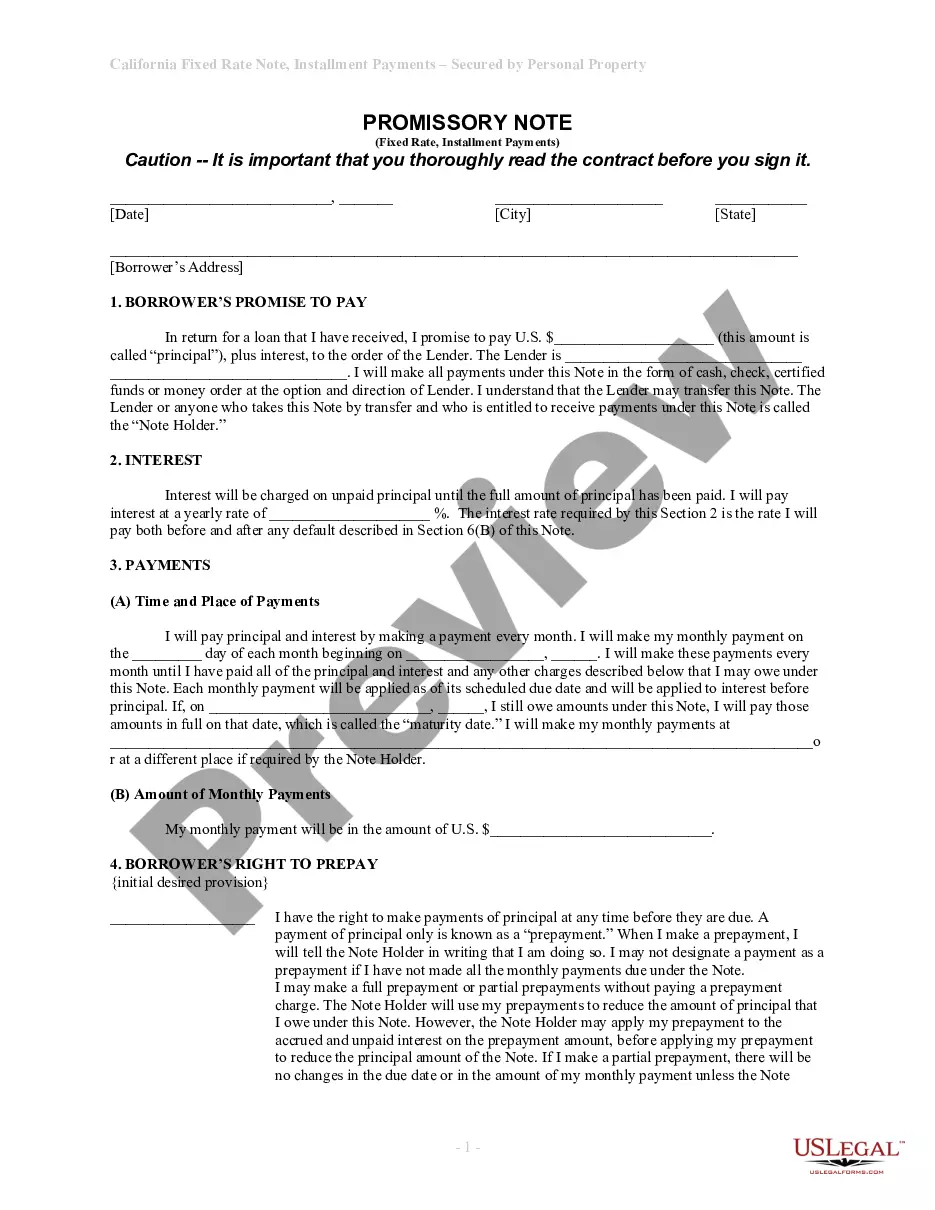

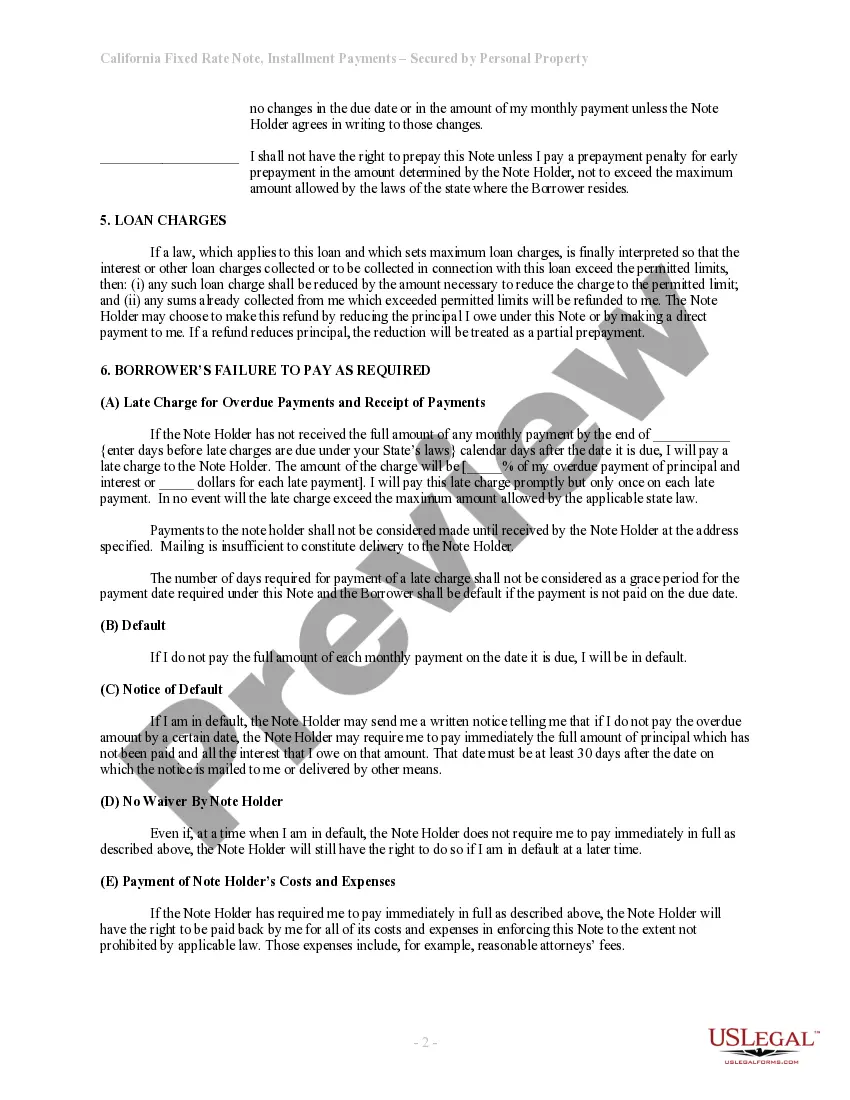

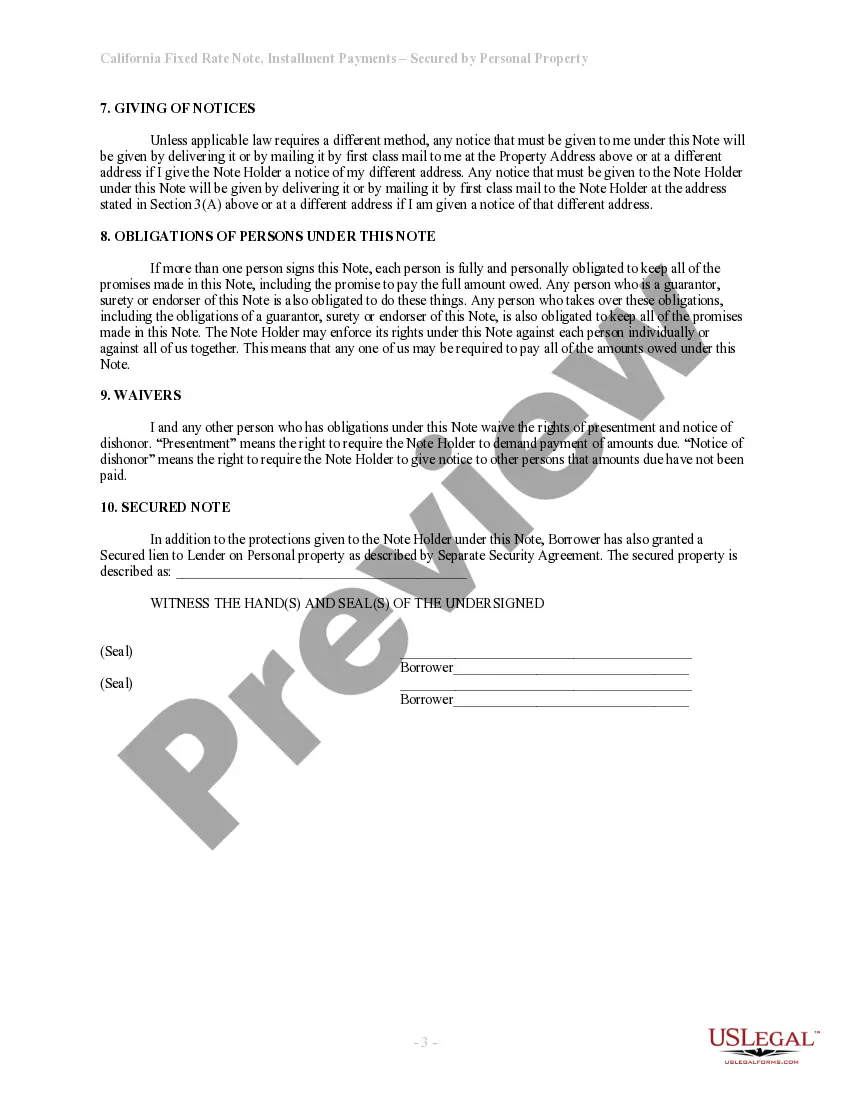

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

A Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Daly City, California. This type of promissory note is specifically secured by personal property, which serves as collateral for the loan. Here is a detailed description of this financial instrument: Overview: A Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a binding contract between a borrower, also known as the debtor or obliged, and a lender, also known as the creditor or obliged. The promissory note serves as evidence of the debt owed by the borrower to the lender and includes specific details about the loan. Key Elements: 1. Parties involved: The promissory note identifies the borrower and the lender. It includes their legal names, addresses, and contact information. 2. Loan Amount: The promissory note specifies the total amount borrowed by the borrower from the lender. 3. Interest Rate: The fixed interest rate charged on the loan is stated in the promissory note. This rate remains constant throughout the loan term. 4. Installment Payments: The note outlines the repayment plan, specifying the total number of installments, the frequency of payments (monthly, quarterly, annually, etc.), and the due date of each installment. 5. Maturity Date: This is the date by which the loan must be fully paid off, including both the principal amount and any interest accrued. 6. Collateral: The promissory note specifically states that personal property, chosen by the borrower, will be used as collateral to secure the loan. If the borrower fails to repay the loan as agreed, the lender has the right to seize and sell the personal property to recover the outstanding debt. Different Types: Although there may not be different types of Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property, specific variations can occur based on the nature of the personal property being used as collateral. For example, a borrower might use a vehicle, such as a car or a motorcycle, as collateral. Alternatively, they may choose to use other personal belongings, such as jewelry, valuable artwork, or electronic equipment, as security for the loan. The specific details regarding the personal property and its valuation would be included in the promissory note. In conclusion, a Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that establishes a loan agreement between a borrower and a lender. This type of promissory note provides detailed information about the loan terms, including the loan amount, interest rate, installment payments, maturity date, and the personal property used as collateral.A Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender in Daly City, California. This type of promissory note is specifically secured by personal property, which serves as collateral for the loan. Here is a detailed description of this financial instrument: Overview: A Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a binding contract between a borrower, also known as the debtor or obliged, and a lender, also known as the creditor or obliged. The promissory note serves as evidence of the debt owed by the borrower to the lender and includes specific details about the loan. Key Elements: 1. Parties involved: The promissory note identifies the borrower and the lender. It includes their legal names, addresses, and contact information. 2. Loan Amount: The promissory note specifies the total amount borrowed by the borrower from the lender. 3. Interest Rate: The fixed interest rate charged on the loan is stated in the promissory note. This rate remains constant throughout the loan term. 4. Installment Payments: The note outlines the repayment plan, specifying the total number of installments, the frequency of payments (monthly, quarterly, annually, etc.), and the due date of each installment. 5. Maturity Date: This is the date by which the loan must be fully paid off, including both the principal amount and any interest accrued. 6. Collateral: The promissory note specifically states that personal property, chosen by the borrower, will be used as collateral to secure the loan. If the borrower fails to repay the loan as agreed, the lender has the right to seize and sell the personal property to recover the outstanding debt. Different Types: Although there may not be different types of Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property, specific variations can occur based on the nature of the personal property being used as collateral. For example, a borrower might use a vehicle, such as a car or a motorcycle, as collateral. Alternatively, they may choose to use other personal belongings, such as jewelry, valuable artwork, or electronic equipment, as security for the loan. The specific details regarding the personal property and its valuation would be included in the promissory note. In conclusion, a Daly City California Installments Fixed Rate Promissory Note Secured by Personal Property is a legally binding document that establishes a loan agreement between a borrower and a lender. This type of promissory note provides detailed information about the loan terms, including the loan amount, interest rate, installment payments, maturity date, and the personal property used as collateral.