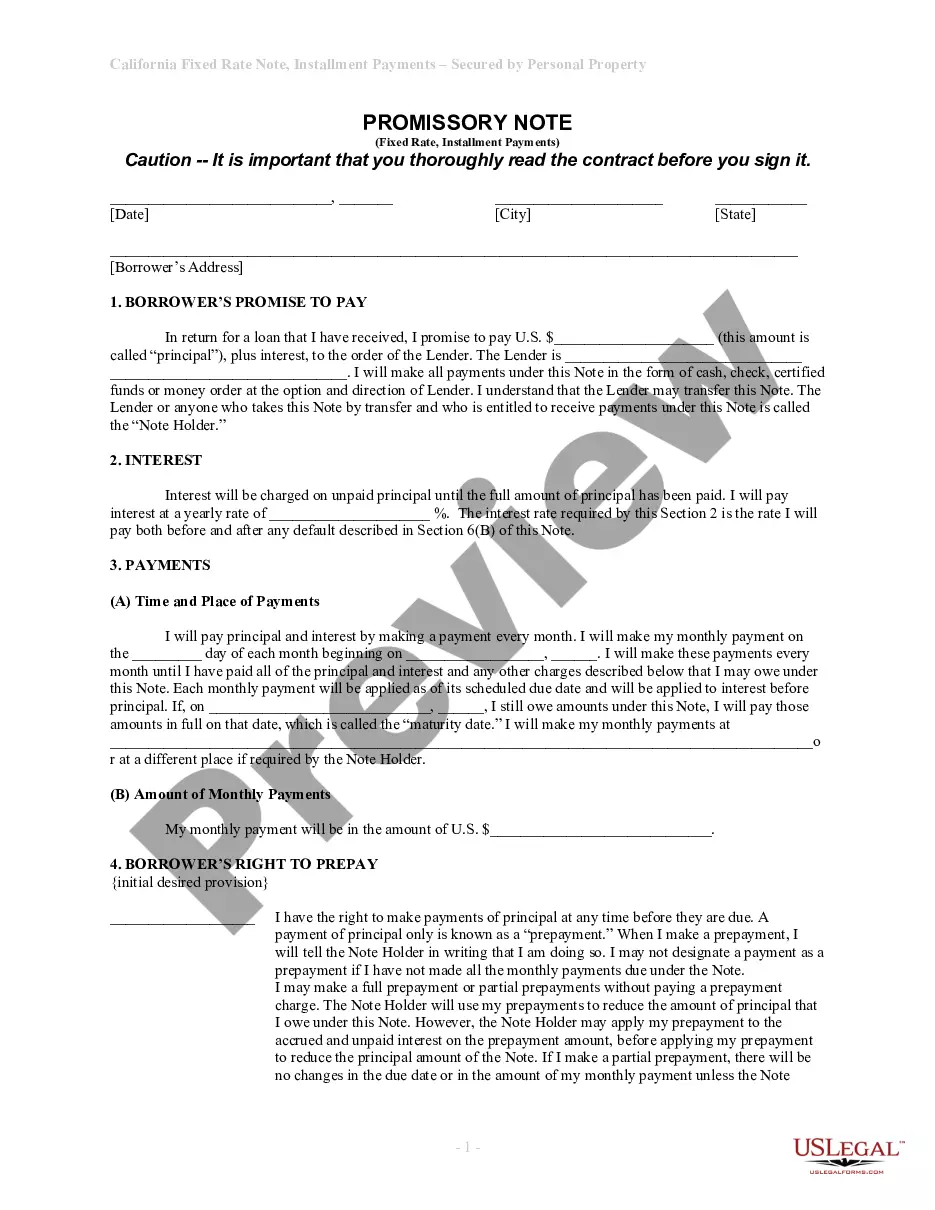

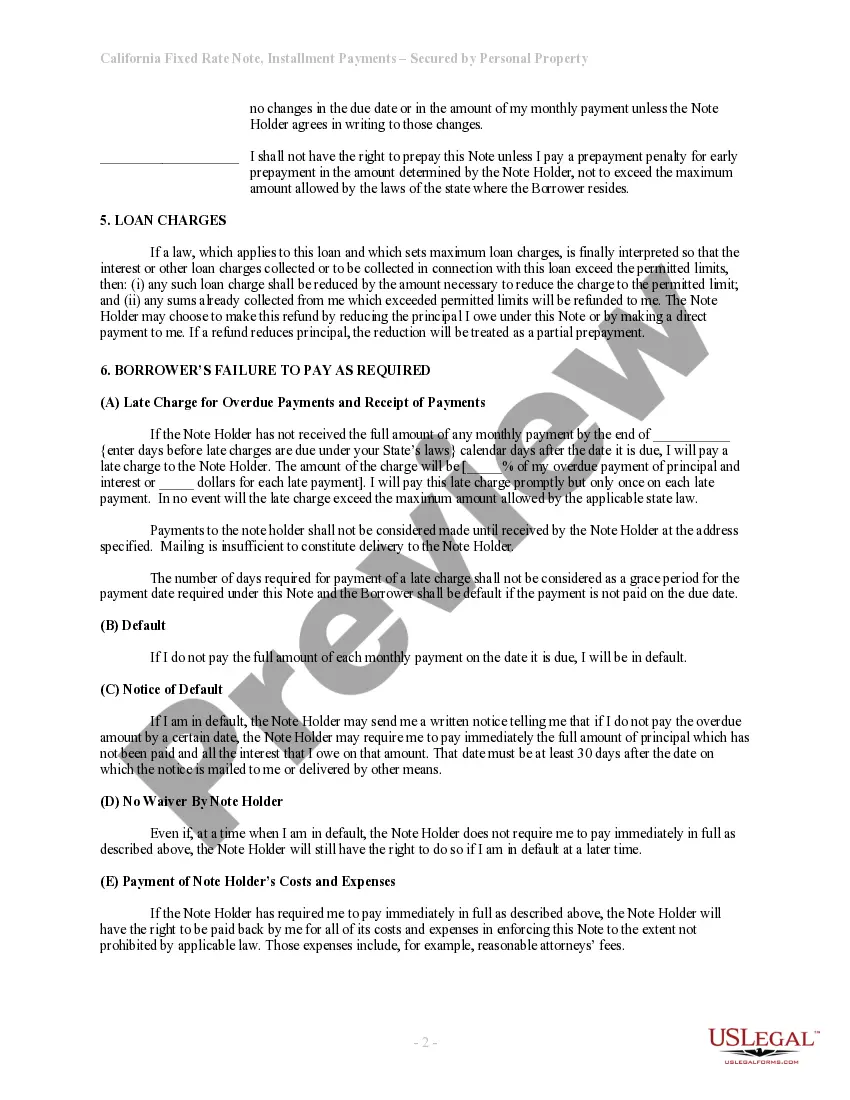

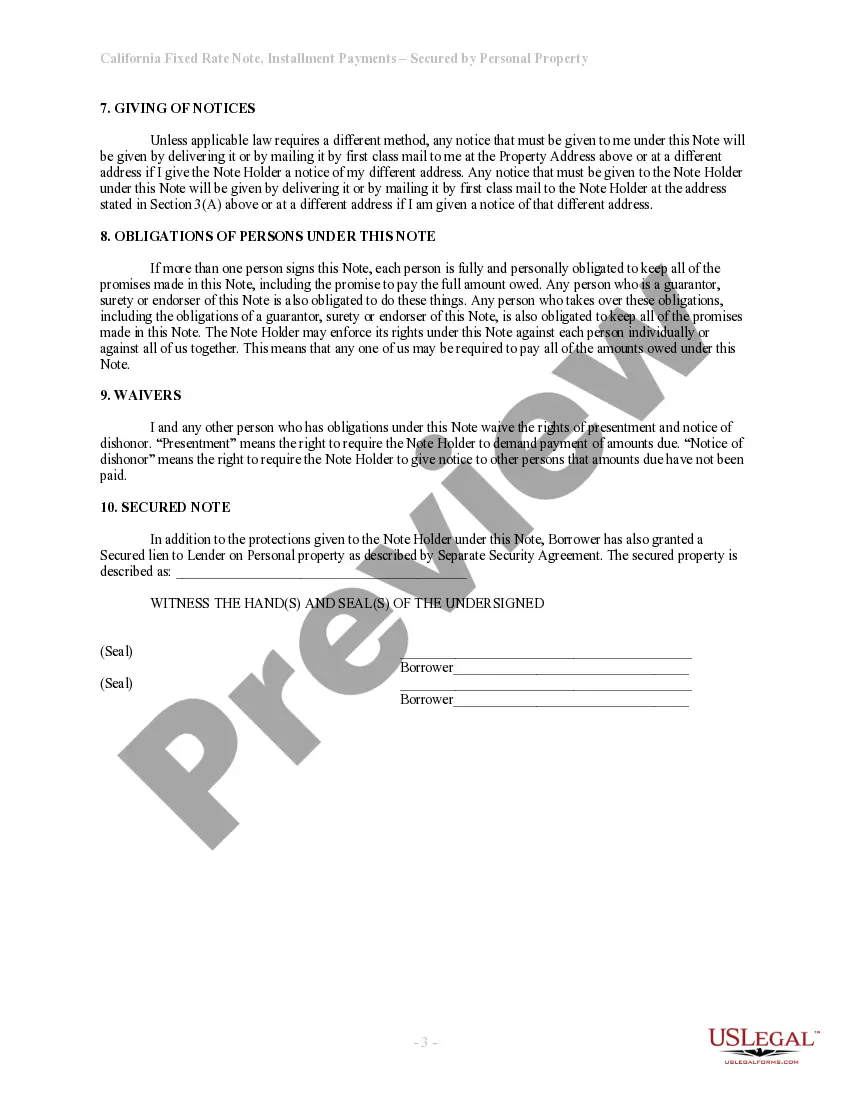

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In Norwalk, California, installment loans can be obtained by executing a Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property. This promissory note is specifically structured for borrowers in Norwalk, California, and allows them to borrow a specified amount of money from a lender and repay it in installments over a predetermined period of time. The fixed rate feature ensures that the interest rate remains constant throughout the loan term, providing borrowers with predictability and stability in their monthly payments. To secure the loan, the borrower pledges their personal property as collateral. This means that in the event of default or failure to repay the loan, the lender has the right to seize the pledged personal property to recover their investment. The personal property can include various assets, such as vehicles, real estate, or any valuable item that holds significant worth. In Norwalk, California, there may be different types of Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property, depending on the lender and borrower's specific requirements. These variations may include: 1. Auto Loan Promissory Note: This type of promissory note is secured by a borrower's vehicle. It allows individuals to obtain funds by pledging their car, truck, or motorcycle as collateral. 2. Real Estate Promissory Note: If a borrower owns a property in Norwalk, California, they may opt for a promissory note secured by real estate. This type of note allows borrowers to use their residential or commercial property as collateral to secure the loan. 3. Personal Asset Promissory Note: Sometimes, borrowers may have valuable personal assets like jewelry, artwork, or high-end electronics that can serve as collateral for the loan. This type of promissory note allows individuals to leverage their personal possessions to secure the loan. Regardless of the specific type of promissory note, it is crucial for borrowers in Norwalk, California, to carefully review and understand the terms and conditions of the loan agreement. They must ensure they can meet the repayment obligations and fully comprehend the consequences of defaulting on the loan, which may result in the loss of their personal property. Consulting a legal professional or financial advisor is always recommended navigating the intricacies of Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property.Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property A promissory note is a legal document that outlines the terms and conditions of a loan agreement between a borrower and a lender. In Norwalk, California, installment loans can be obtained by executing a Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property. This promissory note is specifically structured for borrowers in Norwalk, California, and allows them to borrow a specified amount of money from a lender and repay it in installments over a predetermined period of time. The fixed rate feature ensures that the interest rate remains constant throughout the loan term, providing borrowers with predictability and stability in their monthly payments. To secure the loan, the borrower pledges their personal property as collateral. This means that in the event of default or failure to repay the loan, the lender has the right to seize the pledged personal property to recover their investment. The personal property can include various assets, such as vehicles, real estate, or any valuable item that holds significant worth. In Norwalk, California, there may be different types of Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property, depending on the lender and borrower's specific requirements. These variations may include: 1. Auto Loan Promissory Note: This type of promissory note is secured by a borrower's vehicle. It allows individuals to obtain funds by pledging their car, truck, or motorcycle as collateral. 2. Real Estate Promissory Note: If a borrower owns a property in Norwalk, California, they may opt for a promissory note secured by real estate. This type of note allows borrowers to use their residential or commercial property as collateral to secure the loan. 3. Personal Asset Promissory Note: Sometimes, borrowers may have valuable personal assets like jewelry, artwork, or high-end electronics that can serve as collateral for the loan. This type of promissory note allows individuals to leverage their personal possessions to secure the loan. Regardless of the specific type of promissory note, it is crucial for borrowers in Norwalk, California, to carefully review and understand the terms and conditions of the loan agreement. They must ensure they can meet the repayment obligations and fully comprehend the consequences of defaulting on the loan, which may result in the loss of their personal property. Consulting a legal professional or financial advisor is always recommended navigating the intricacies of Norwalk California Installments Fixed Rate Promissory Note Secured by Personal Property.