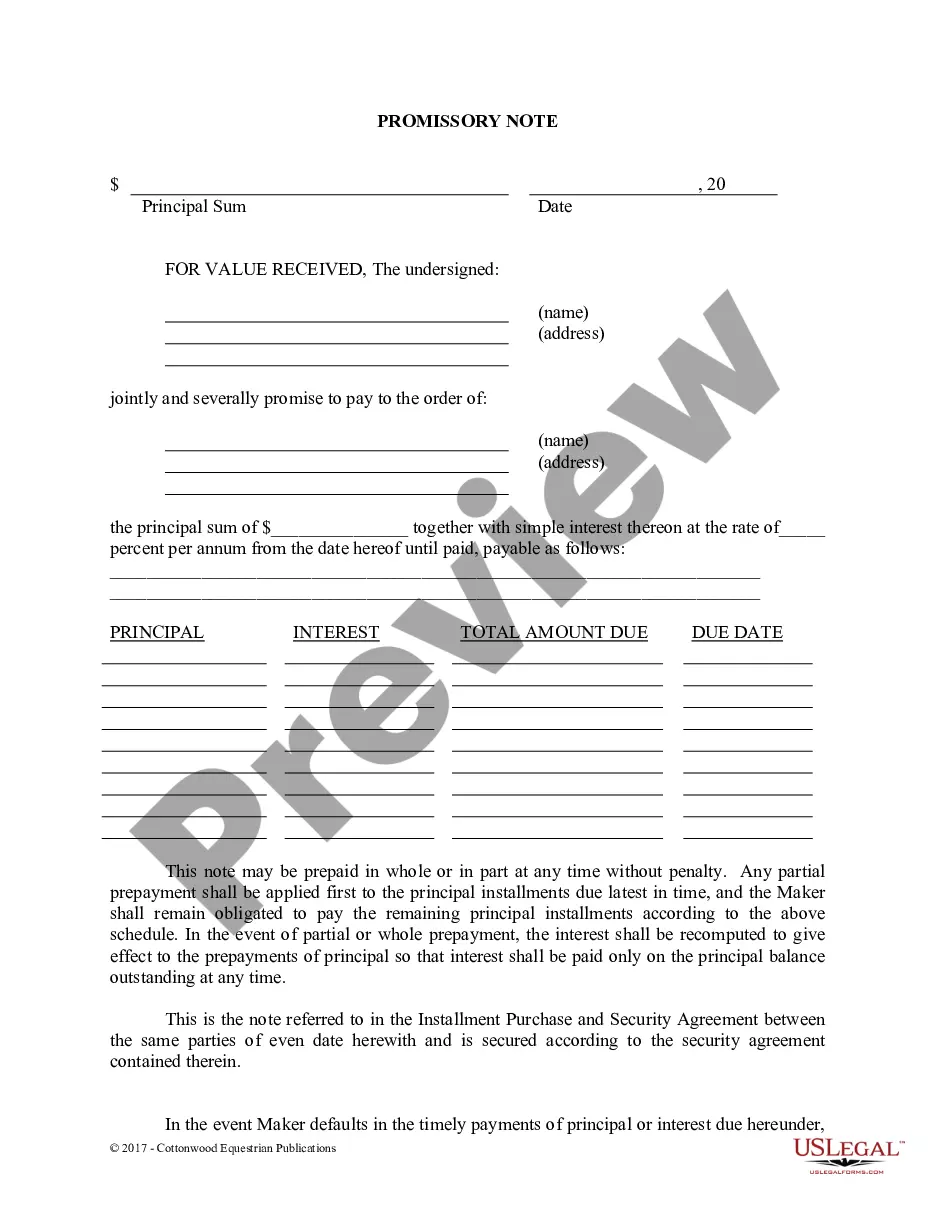

This is a form of Promissory Note for use where personal property is security for the loan. A separate security agreement is also required.

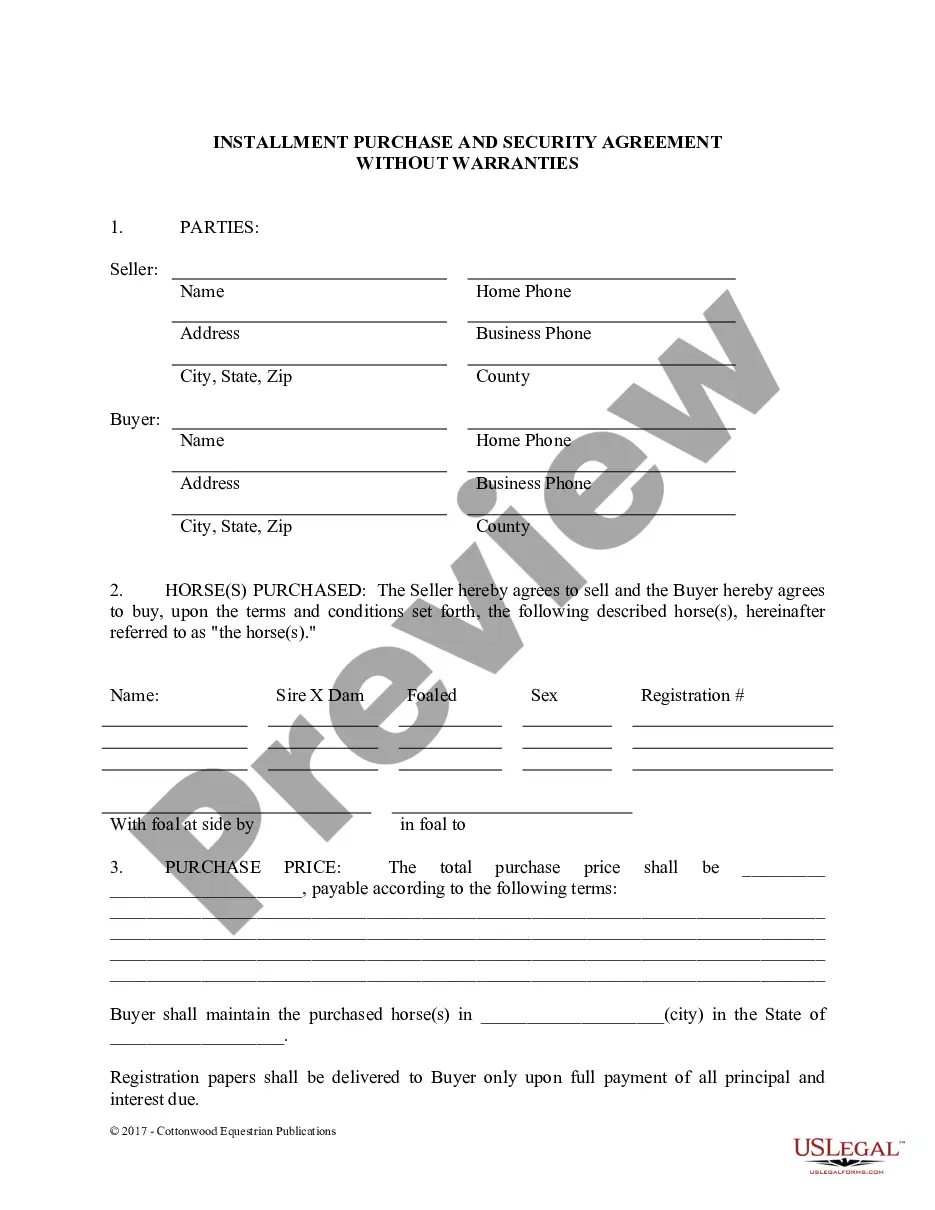

A Santa Maria California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document used in financial transactions that allows borrowers to obtain a loan while pledging personal property as collateral. This type of promissory note ensures that the lender has a secured interest in the borrower's personal property in case of default. The Santa Maria California Installments Fixed Rate Promissory Note offers specific terms and conditions, including a fixed interest rate, regular installment payments, and a predetermined repayment period. These aspects provide both the borrower and the lender with clarity and certainty throughout the loan term. The personal property securing the promissory note can vary depending on the borrower's assets and agreement with the lender. Common types of personal property that can be used as collateral include vehicles, jewelry, electronics, and other valuable possessions. The specific details regarding the pledged personal property should be clearly outlined in the promissory note to ensure both parties are in agreement. By utilizing a promissory note secured by personal property, lenders are provided with additional security and a higher chance of recouping their investment in case of default. Borrowers may find this type of loan more accessible, even if they have limited credit history or are unable to secure a traditional loan. It's crucial to note that Santa Maria California may have various types or variations of Installments Fixed Rate Promissory Note secured by personal property, including: 1. Santa Maria California Installments Fixed Rate Promissory Note Secured by Vehicle: This type of promissory note specifically uses a vehicle as collateral. It provides lenders with a legal claim to the vehicle in case of default by the borrower. 2. Santa Maria California Installments Fixed Rate Promissory Note Secured by Jewelry: In this variation, the borrower pledges jewelry as collateral for the loan. The lender has the right to claim the jewelry in case of non-payment as outlined in the promissory note. 3. Santa Maria California Installments Fixed Rate Promissory Note Secured by Electronics: This type of promissory note secures the loan with electronic devices owned by the borrower. The lender has the right to claim and sell the electronics if the borrower fails to meet their repayment obligations. It's essential for both borrowers and lenders to consult legal professionals to ensure the promissory note reflects their agreement accurately and adheres to Santa Maria California's specific regulations.A Santa Maria California Installments Fixed Rate Promissory Note Secured by Personal Property is a legal document used in financial transactions that allows borrowers to obtain a loan while pledging personal property as collateral. This type of promissory note ensures that the lender has a secured interest in the borrower's personal property in case of default. The Santa Maria California Installments Fixed Rate Promissory Note offers specific terms and conditions, including a fixed interest rate, regular installment payments, and a predetermined repayment period. These aspects provide both the borrower and the lender with clarity and certainty throughout the loan term. The personal property securing the promissory note can vary depending on the borrower's assets and agreement with the lender. Common types of personal property that can be used as collateral include vehicles, jewelry, electronics, and other valuable possessions. The specific details regarding the pledged personal property should be clearly outlined in the promissory note to ensure both parties are in agreement. By utilizing a promissory note secured by personal property, lenders are provided with additional security and a higher chance of recouping their investment in case of default. Borrowers may find this type of loan more accessible, even if they have limited credit history or are unable to secure a traditional loan. It's crucial to note that Santa Maria California may have various types or variations of Installments Fixed Rate Promissory Note secured by personal property, including: 1. Santa Maria California Installments Fixed Rate Promissory Note Secured by Vehicle: This type of promissory note specifically uses a vehicle as collateral. It provides lenders with a legal claim to the vehicle in case of default by the borrower. 2. Santa Maria California Installments Fixed Rate Promissory Note Secured by Jewelry: In this variation, the borrower pledges jewelry as collateral for the loan. The lender has the right to claim the jewelry in case of non-payment as outlined in the promissory note. 3. Santa Maria California Installments Fixed Rate Promissory Note Secured by Electronics: This type of promissory note secures the loan with electronic devices owned by the borrower. The lender has the right to claim and sell the electronics if the borrower fails to meet their repayment obligations. It's essential for both borrowers and lenders to consult legal professionals to ensure the promissory note reflects their agreement accurately and adheres to Santa Maria California's specific regulations.