This is a form of Promissory Note for use where commercial property is security for the loan. A separate deed of trust or mortgage is also required.

San Jose California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

Description

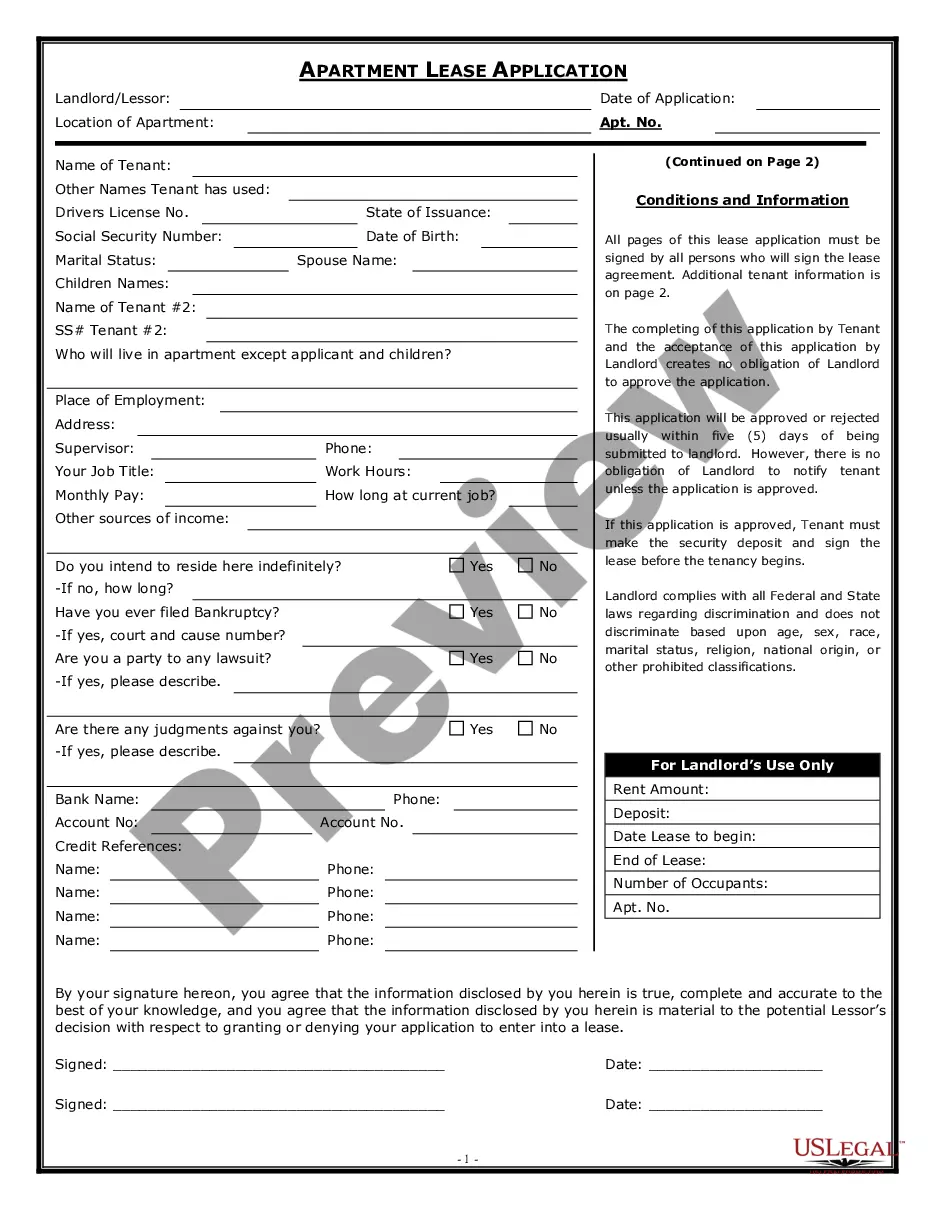

How to fill out California Installments Fixed Rate Promissory Note Secured By Commercial Real Estate?

Take advantage of the US Legal Forms and gain instant access to any form you need.

Our efficient platform with a vast array of documents permits you to locate and obtain nearly any document model you need.

You can save, complete, and sign the San Jose California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate within minutes rather than spending hours online seeking the correct template.

Utilizing our catalog is an excellent way to enhance the security of your document submission.

If you haven't created an account yet, follow the steps outlined below.

Locate the template you need. Verify that it is indeed the document you are searching for: review its title and description, and utilize the Preview feature if it is accessible. If not, use the Search bar to find the required document. Initiate the saving process. Click Buy Now and select your preferred pricing plan. Next, register for an account and complete your order using a credit card or PayPal. Download the document. Choose the format to obtain the San Jose California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate and modify, complete, or sign it to fit your needs. US Legal Forms is likely one of the largest and most reliable document repositories online. We are always available to help you with any legal matter, even if it is simply downloading the San Jose California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate. Make sure to leverage our platform and streamline your document experience!

- Our skilled attorneys frequently review all the documents to ensure that the forms are applicable for a specific region and adhere to new legislation and regulations.

- How can you obtain the San Jose California Installments Fixed Rate Promissory Note Secured by Commercial Real Estate.

- If you possess an account, simply Log In to your profile. The Download option will be available on all the templates you view. Additionally, you can retrieve all your previously saved documents in the My documents section.

Form popularity

FAQ

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

As part of the home loan mortgage process, you can expect to execute both a legally binding mortgage and mortgage promissory note, which work toward complementary purposes.

Promissory notes, also known as mortgage notes, are written agreements in which one party promises to pay another party a certain amount of money at a later date in time. Banks and borrowers typically agree to these notes during the mortgage process.

California Promissory Note Requirements A promissory note, although the name suggests is a promise, has the same legal consequences as a legally binding contract. In other words, a ?promissory note? is a type of contract.

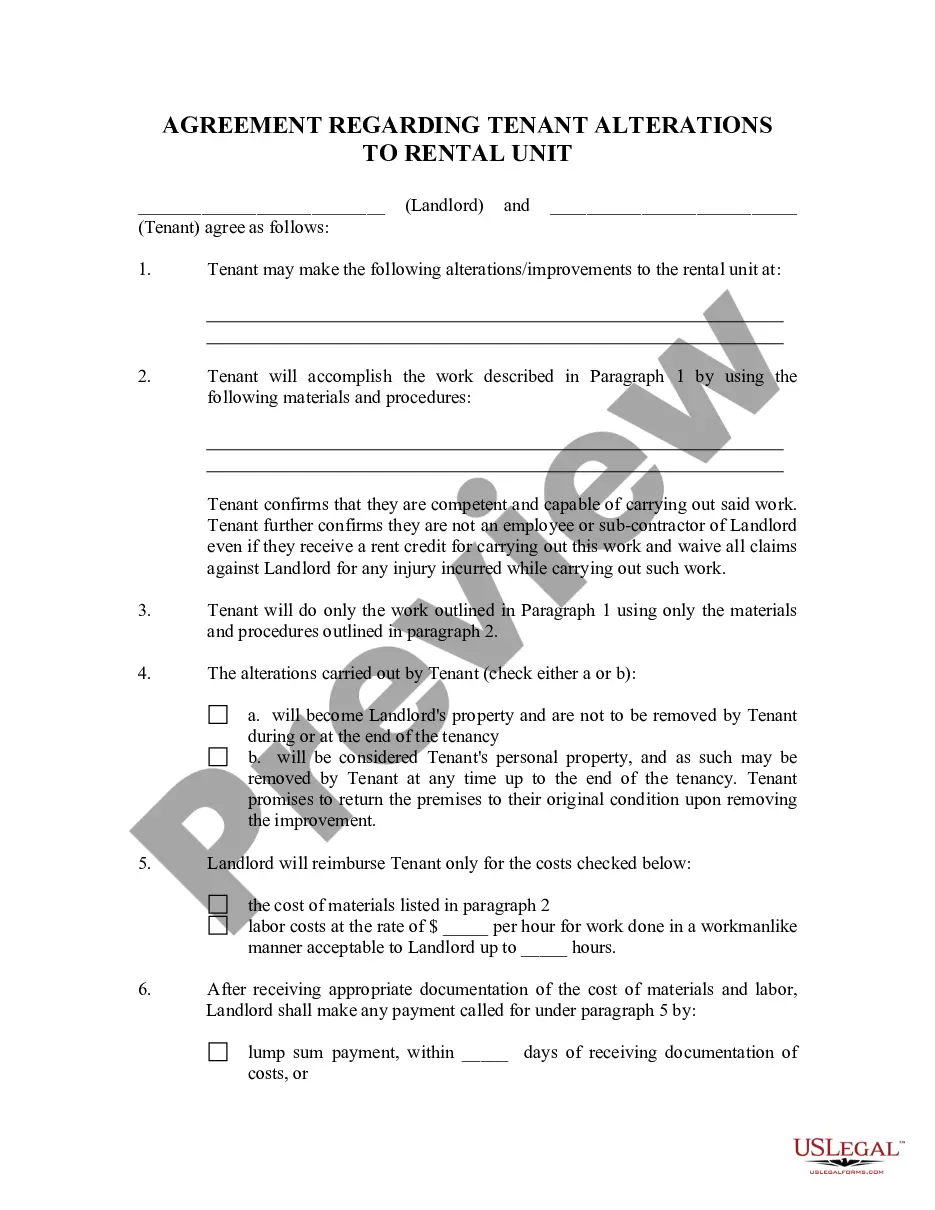

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

The major difference between a secured and unsecured Promissory Note is collateral. A secured promissory note, as the name partially implies, is secured by some form of property (i.e. collateral), while an unsecured promissory note does not involve collateral.

In California, loans can be secured by real property through a deed of trust. Accordingly, a deed of trust is a security instrument that functions like a mortgage.

A promissory note and deed of trust have one simple function to secure the repayment of a loan by placing a lien on the property as collateral. If the loan is not paid, then the lender has the right to sell the property. Both documents are used to make sure the seller secures the repayment of the loan.

A home mortgage effectively secures a promissory note with the title to the property in question in case the lender should need to foreclose and sell the property in event of nonpayment. Your lender will keep the original promissory note until your loan is paid off.