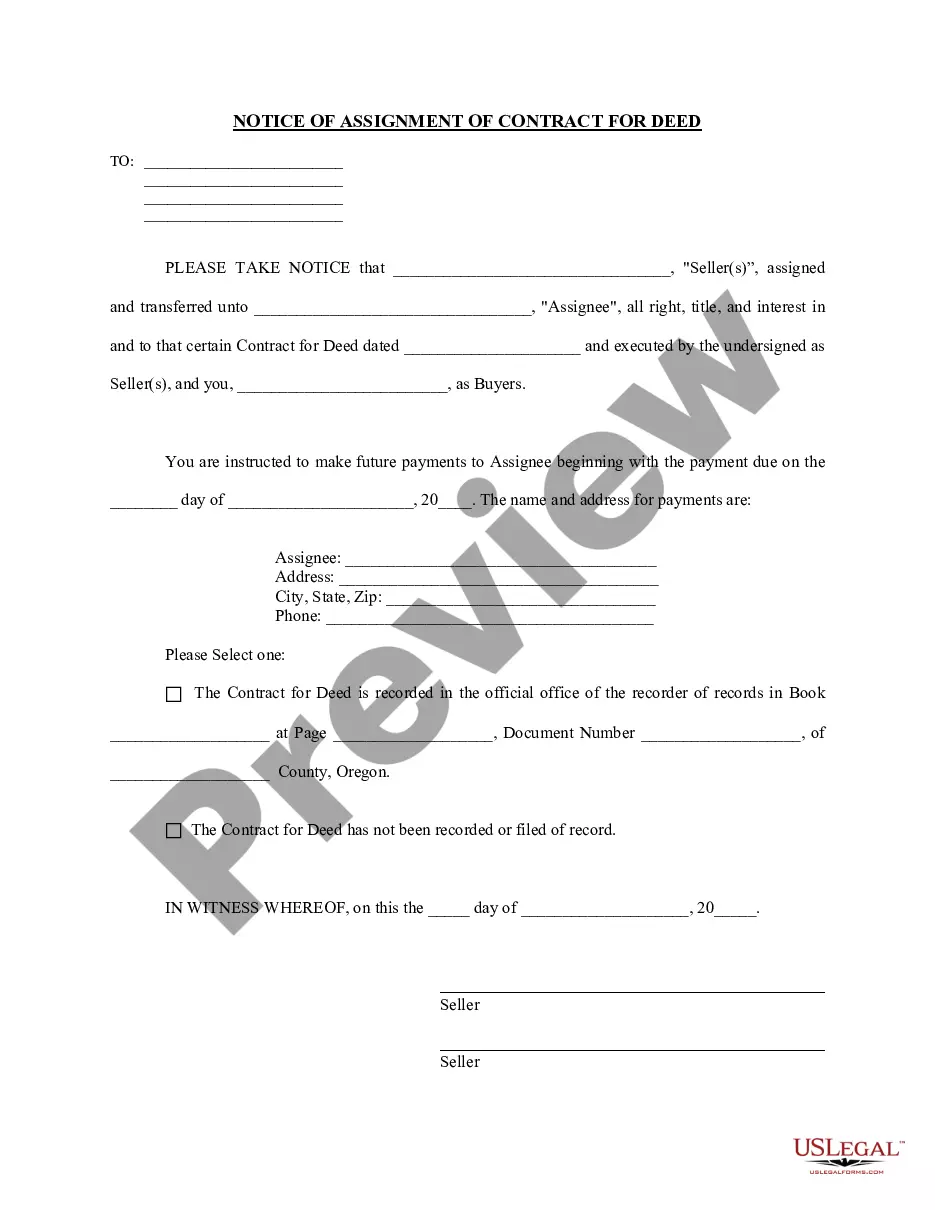

With this Assignment of Mortgage Package,you will find the forms and letters that are necessary for the owner of a deed of trust/mortgage to convey the owner's interest in the deed of trust/mortgage to a third party.

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;

Jurupa Valley California Assignment of Mortgage Package is a crucial legal document used in real estate transactions. This package consists of various forms and documents necessary for transferring the rights and obligations of a mortgage from one party to another. It is commonly used when a mortgage lender assigns the mortgage loan to a different financial institution or when a property is sold or transferred. The Jurupa Valley California Assignment of Mortgage Package includes: 1. Assignment of Mortgage Form: This is the primary document that outlines the transfer of the mortgage from the original lender to the new lender or assignee. It contains information about the original borrower, the property address, the original lender, and the assignee. 2. Promissory Note: This document is associated with the mortgage and represents the borrower's promise to repay the loan according to the agreed-upon terms and conditions. It states the loan amount, interest rate, repayment schedule, and other key details. 3. Mortgage Deed: This is a legal document that creates a lien on the property as security for the loan. It outlines the property's description, the lender's rights, and the borrower's obligations. The mortgage deed is typically signed by the borrower and recorded with the county or city records office to give public notice of the mortgage. 4. Loan Modification Agreement: In some cases, the assignment of a mortgage may involve modifying the existing loan terms. This agreement outlines the changes agreed upon by both parties, such as interest rate adjustments, repayment term extensions, or changes in payment amounts. 5. Assumption Agreement: When a property is sold or transferred, this agreement allows the new borrower to assume the existing mortgage and take over the responsibilities and obligations associated with it. It states the terms and conditions of the assumption, including any necessary qualifications or approvals from the lender. 6. Estoppel Certificate: This document is usually provided by the borrower and confirms the current status of the mortgage, including the outstanding balance, interest rate, payment history, and any other relevant details. It is often required by the new lender or assignee to verify the accuracy of the information provided by the original lender. These are the primary documents included in a standard Jurupa Valley California Assignment of Mortgage Package. However, it is essential to consult with legal professionals or real estate experts to ensure compliance with specific local laws and regulations. Each transaction may have unique requirements or additional documents based on the circumstances, such as refinancing, foreclosure, or loan assumptions.Jurupa Valley California Assignment of Mortgage Package is a crucial legal document used in real estate transactions. This package consists of various forms and documents necessary for transferring the rights and obligations of a mortgage from one party to another. It is commonly used when a mortgage lender assigns the mortgage loan to a different financial institution or when a property is sold or transferred. The Jurupa Valley California Assignment of Mortgage Package includes: 1. Assignment of Mortgage Form: This is the primary document that outlines the transfer of the mortgage from the original lender to the new lender or assignee. It contains information about the original borrower, the property address, the original lender, and the assignee. 2. Promissory Note: This document is associated with the mortgage and represents the borrower's promise to repay the loan according to the agreed-upon terms and conditions. It states the loan amount, interest rate, repayment schedule, and other key details. 3. Mortgage Deed: This is a legal document that creates a lien on the property as security for the loan. It outlines the property's description, the lender's rights, and the borrower's obligations. The mortgage deed is typically signed by the borrower and recorded with the county or city records office to give public notice of the mortgage. 4. Loan Modification Agreement: In some cases, the assignment of a mortgage may involve modifying the existing loan terms. This agreement outlines the changes agreed upon by both parties, such as interest rate adjustments, repayment term extensions, or changes in payment amounts. 5. Assumption Agreement: When a property is sold or transferred, this agreement allows the new borrower to assume the existing mortgage and take over the responsibilities and obligations associated with it. It states the terms and conditions of the assumption, including any necessary qualifications or approvals from the lender. 6. Estoppel Certificate: This document is usually provided by the borrower and confirms the current status of the mortgage, including the outstanding balance, interest rate, payment history, and any other relevant details. It is often required by the new lender or assignee to verify the accuracy of the information provided by the original lender. These are the primary documents included in a standard Jurupa Valley California Assignment of Mortgage Package. However, it is essential to consult with legal professionals or real estate experts to ensure compliance with specific local laws and regulations. Each transaction may have unique requirements or additional documents based on the circumstances, such as refinancing, foreclosure, or loan assumptions.