With this Assignment of Mortgage Package,you will find the forms and letters that are necessary for the owner of a deed of trust/mortgage to convey the owner's interest in the deed of trust/mortgage to a third party.

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;

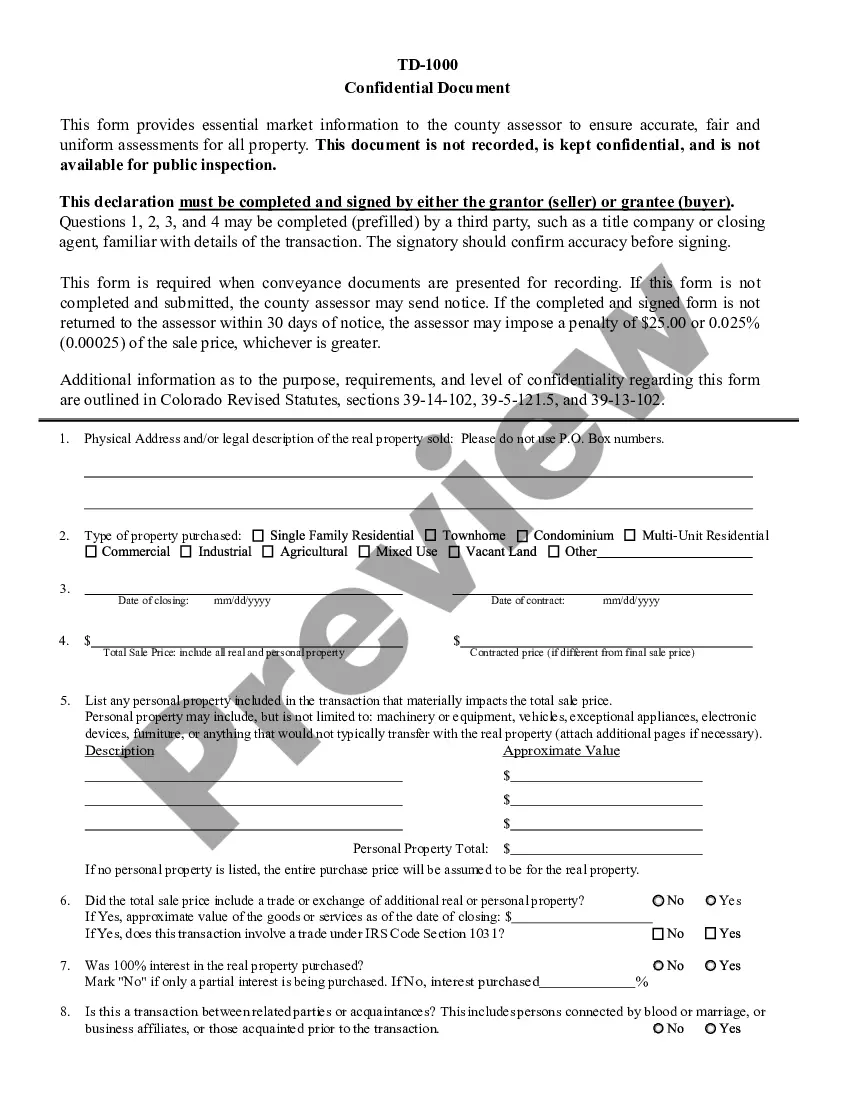

The Long Beach California Assignment of Mortgage Package is a comprehensive set of legal documents and forms required for the transfer of a mortgage from one party to another in the city of Long Beach, California. These packages are crucial in the real estate industry, facilitating smooth ownership transitions and ensuring the legal clarity of mortgage assignments. The Long Beach California Assignment of Mortgage Package may vary depending on specific circumstances, and it consists of several key components necessary for the assignment process. 1. Assignment of Mortgage Form: This is the core document that establishes the transfer of the mortgage from the current holder (assignor) to the new party (assignee). It includes essential details such as the names and addresses of the parties, property information, and the terms of the transfer. 2. Promissory Note: Often included in the package, the promissory note represents the underlying loan agreement between the borrower and the original lender. It outlines the payment terms, interest rates, and repayment schedule, among other crucial financial aspects. 3. Affidavit of Consideration: This document declares the consideration (monetary value) involved in the assignment transaction. It serves as proof of the assignment's legality and helps determine any potential tax liabilities. 4. Mortgage Modification Agreement: Sometimes, the assignment of a mortgage package may involve modifying the original terms of the mortgage. This agreement outlines the changes made to the loan agreement, such as interest rate adjustments, repayment extensions, or modification of payment terms. 5. Notice of Assignment: This document notifies the borrower that the mortgage has been assigned and provides information about the new mortgage holder. It ensures transparency and clarifies whom the borrower should contact regarding future mortgage-related matters. 6. Consent to Assignment: In some cases, the assignment of a mortgage package may require the consent of the borrower. This document serves as evidence that the borrower has given their consent to the transfer and acknowledges the new mortgage holder. It is important to note that the specific contents of the Long Beach California Assignment of Mortgage Package may vary depending on the requirements of lenders, local regulations, and the complexity of the transaction. Always consult legal professionals or mortgage experts for guidance in preparing and executing these documents to ensure compliance with relevant laws and regulations.The Long Beach California Assignment of Mortgage Package is a comprehensive set of legal documents and forms required for the transfer of a mortgage from one party to another in the city of Long Beach, California. These packages are crucial in the real estate industry, facilitating smooth ownership transitions and ensuring the legal clarity of mortgage assignments. The Long Beach California Assignment of Mortgage Package may vary depending on specific circumstances, and it consists of several key components necessary for the assignment process. 1. Assignment of Mortgage Form: This is the core document that establishes the transfer of the mortgage from the current holder (assignor) to the new party (assignee). It includes essential details such as the names and addresses of the parties, property information, and the terms of the transfer. 2. Promissory Note: Often included in the package, the promissory note represents the underlying loan agreement between the borrower and the original lender. It outlines the payment terms, interest rates, and repayment schedule, among other crucial financial aspects. 3. Affidavit of Consideration: This document declares the consideration (monetary value) involved in the assignment transaction. It serves as proof of the assignment's legality and helps determine any potential tax liabilities. 4. Mortgage Modification Agreement: Sometimes, the assignment of a mortgage package may involve modifying the original terms of the mortgage. This agreement outlines the changes made to the loan agreement, such as interest rate adjustments, repayment extensions, or modification of payment terms. 5. Notice of Assignment: This document notifies the borrower that the mortgage has been assigned and provides information about the new mortgage holder. It ensures transparency and clarifies whom the borrower should contact regarding future mortgage-related matters. 6. Consent to Assignment: In some cases, the assignment of a mortgage package may require the consent of the borrower. This document serves as evidence that the borrower has given their consent to the transfer and acknowledges the new mortgage holder. It is important to note that the specific contents of the Long Beach California Assignment of Mortgage Package may vary depending on the requirements of lenders, local regulations, and the complexity of the transaction. Always consult legal professionals or mortgage experts for guidance in preparing and executing these documents to ensure compliance with relevant laws and regulations.