With this Assignment of Mortgage Package,you will find the forms and letters that are necessary for the owner of a deed of trust/mortgage to convey the owner's interest in the deed of trust/mortgage to a third party.

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;

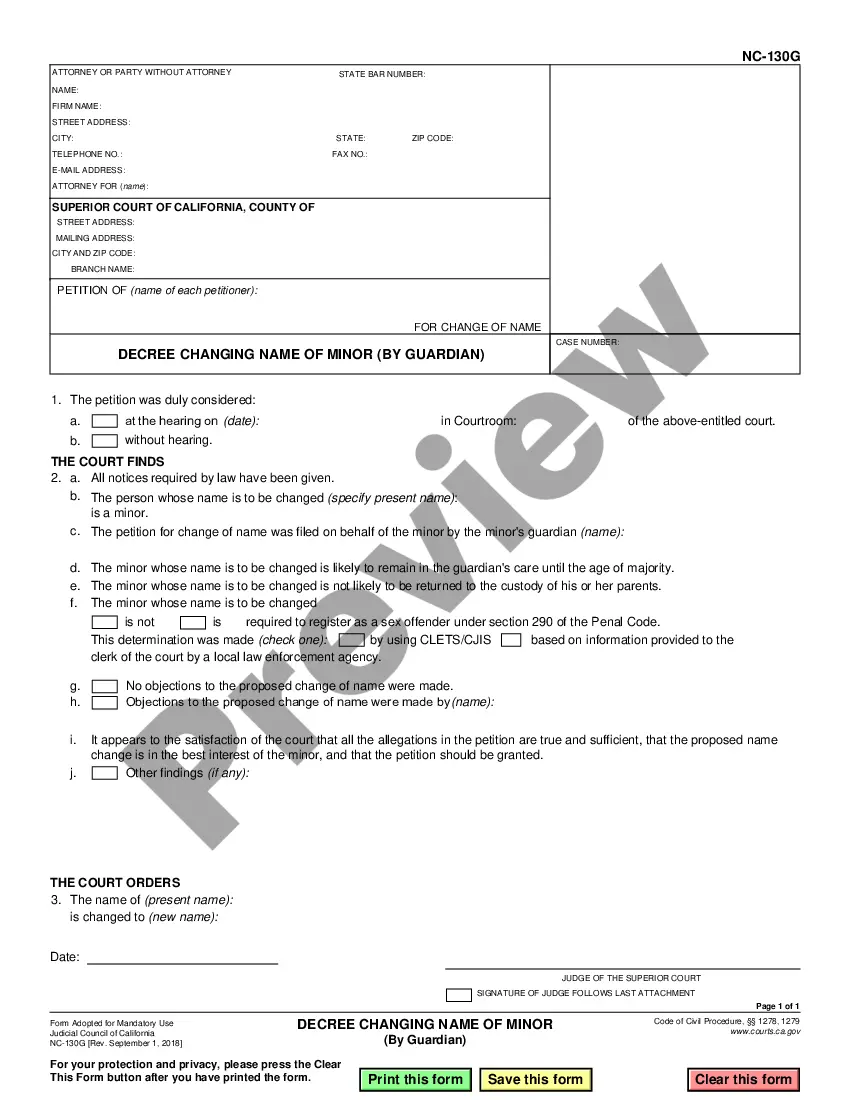

The Orange California Assignment of Mortgage Package is a collection of legal documents used in real estate transactions to transfer the rights and obligations of a mortgage from one party to another. It is a crucial process when a property owner decides to sell their home or transfer their mortgage to another individual or entity. The Assignment of Mortgage Package typically includes the following documents: 1. Assignment of Mortgage Form: This form is used to transfer the legal ownership of the mortgage from the original lender to the new lender or purchaser. It contains details such as the name of the original lender, the borrower's name, the property address, and the terms of the mortgage. 2. Mortgage Note: This document outlines the terms of the loan agreement, such as the interest rate, payment schedule, and other provisions. It includes essential information about the loan that the new lender or purchaser needs to understand before assuming the mortgage. 3. Title Deed: This is a legal document that proves ownership of the property. It is typically included in the Assignment of Mortgage Package to confirm that the new lender or purchaser will hold the mortgage lien on the property. 4. Power of Attorney: In some cases, the original borrower may appoint a power of attorney to execute the Assignment of Mortgage on their behalf. This document grants authority to a designated individual to act on behalf of the borrower during the transaction. It is important to note that while the basic components mentioned above are common to most Orange California Assignment of Mortgage Packages, the exact documents required may vary depending on the specific circumstances of the transaction. For example, if the mortgage is being assigned to a trust or an LLC, additional documents may be included to facilitate the transfer of ownership to these entities. In summary, the Orange California Assignment of Mortgage Package is a critical set of legal documents used to transfer the rights and obligations of a mortgage from one entity to another. It ensures that the transfer of the mortgage is properly documented and legally binding. By understanding the necessary documents in the package and their purpose, individuals involved in real estate transactions in Orange, California can navigate the assignment process with confidence and ensure a smooth transfer of mortgage ownership.