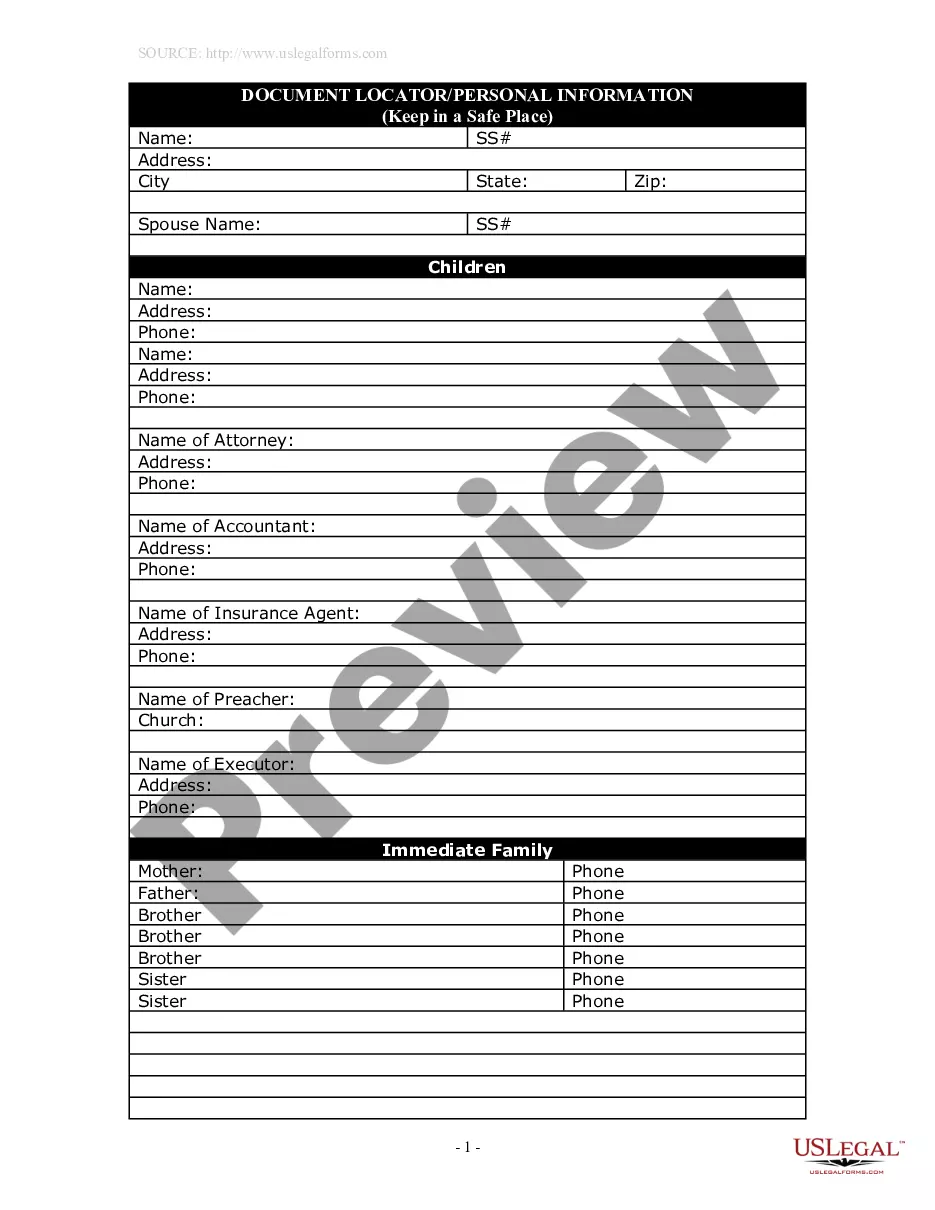

With this Assignment of Mortgage Package,you will find the forms and letters that are necessary for the owner of a deed of trust/mortgage to convey the owner's interest in the deed of trust/mortgage to a third party.

Included in your package are the following forms:

1. Assignment of Deed of Trust by Individual Mortgage Holder;

2. Assignment of Deed of Trust by Corporate Mortgage Holder;

3. Letter of Notice to Borrower of Assignment of Mortgage;

4. Letter to Recording Office for Recording Assignment of Mortgage;

The Temecula California Assignment of Mortgage Package refers to a set of legal documents that solidify the transfer of a mortgage from one party to another in the city of Temecula, California. This package typically includes various forms and agreements necessary to carry out this transaction successfully. The Assignment of Mortgage Package is crucial in real estate dealings as it ensures a smooth transfer of ownership and obligations between the original mortgage holder (assignor) and the new mortgage holder (assignee). This package is commonly used when a homeowner decides to sell their property or transfer their mortgage to a different lender. The primary document within the Assignment of Mortgage Package is the Assignment of Mortgage form itself. This form outlines the details of the transfer, including the parties involved, property information, mortgage details, and any agreed-upon terms and conditions. It serves as the official record of the assignment and is signed by both the assignor and the assignee. In addition to the Assignment of Mortgage, this package may also include supporting documents. These can vary depending on the specifics of the transaction and the requirements of the parties involved. Examples of such documents could include: 1. Promissory Note: This document outlines the terms of the loan, including the repayment schedule, interest rate, and any late payment penalties. 2. Mortgage Agreement: This agreement sets out the terms and conditions of the mortgage, such as the interest rate, payment frequency, and loan duration. 3. Title Documents: These records confirm the legal ownership and status of the property, ensuring there are no liens or encumbrances that may affect the assignment. 4. Mortgage Deed: This document officially transfers the property from the assignor to the assignee, providing evidence of the change in ownership. It is important to note that while the Assignment of Mortgage Package generally includes these typical documents, the specific contents may vary depending on the requirements of the parties involved, the complexity of the transaction, and any additional legal considerations. Overall, the Temecula California Assignment of Mortgage Package is a comprehensive collection of documents designed to facilitate the transfer of mortgages smoothly and legally in the city of Temecula. It ensures a clear record of the assignment is established, protecting the rights and interests of all parties involved in the real estate transaction.