This package contains the forms that are useful and necessary to help you annually review your financial status and maintain your financial records. With your Annual Financial Statement Check Up Package, you will find the essential forms to annually evaluate your finances and revise your financial documents based upon any changes in your personal circumstances. The documents in this package include the following:

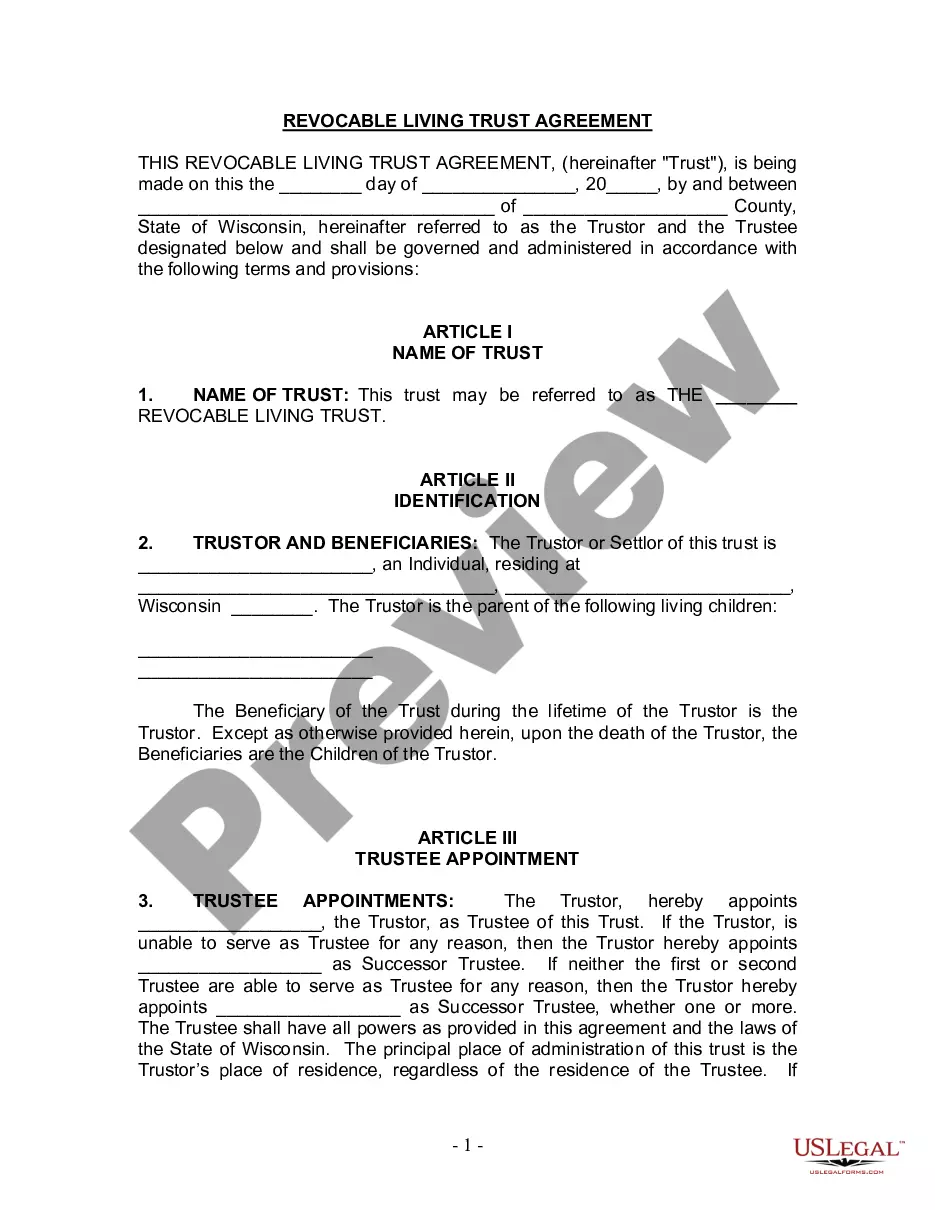

1) Last Will and Testament that suits your specific needs;

2) General Durable Power of Attorney for Property and Finances Effective Upon Disability;

3) Estate Planning Questionnaire and Worksheets;

4) Retirement Cash Flow;

5) Personal Monthly Budget Worksheet;

6) Cash Flow Statement;

7) Credit Report Request Form;

8) Financial Statement Form for Husband and Wife; and

9) Financial Statement Form for Individual.

Purchase this package and save up to 50% over purchasing the forms separately!

Norwalk California Annual Financial Checkup Package is a comprehensive financial assessment service offered to residents in Norwalk, California. This package is designed to provide individuals and businesses with a detailed evaluation of their financial health and offer expert advice on how to improve their financial situation. The Norwalk California Annual Financial Checkup Package includes a range of services and analysis tools to comprehensively review one's financial status. By conducting this checkup annually, individuals can stay on top of their finances, identify areas of improvement, and make informed decisions for their future financial goals. The main components of the Norwalk California Annual Financial Checkup Package are: 1. Income and Expense Analysis: A thorough review of one's income sources, along with an analysis of monthly expenses. This helps identify areas where money can be saved or allocated more efficiently. 2. Debt Management Assessment: Evaluation of existing debts, including mortgage, loans, credit cards, and other liabilities. This assessment provides an overview of debt-to-income ratios and offers strategies to effectively manage and reduce debt. 3. Investment Portfolio Review: Examination of an individual's investment portfolio, including stocks, bonds, real estate, and other assets. This analysis helps assess the performance of investments and suggests adjustments or diversification strategies. 4. Retirement Planning: A comprehensive review of retirement goals and current savings, including analysis of employer-sponsored retirement plans, individual retirement accounts (IRAs), and other investment vehicles. This assessment provides insights on whether one is on track to achieve desired retirement goals. 5. Insurance Review: Assessment of existing insurance coverage, including life, health, property, and casualty insurances. This analysis ensures individuals are adequately protected and identifies any gaps in coverage. 6. Tax Strategy Evaluation: An overview of tax planning strategies to maximize tax savings and minimize potential liabilities. This includes suggestions on tax-efficient investments, deductions, and credits. The Norwalk California Annual Financial Checkup Package aims to provide tailored financial advice based on an individual's unique financial circumstances. It helps individuals gain a deeper understanding of their financial situation and provides actionable recommendations for improving their financial well-being. In addition to the standard Annual Financial Checkup Package, there may be variations or additional packages available to cater to specific needs, such as business financial checkups or specialized services for individuals with complex financial situations. By leveraging the Norwalk California Annual Financial Checkup Package, individuals and businesses can gain peace of mind, make informed financial decisions, and work towards achieving their long-term financial goals effectively.