This package contains the forms that are useful and necessary to help you annually review your financial status and maintain your financial records. With your Annual Financial Statement Check Up Package, you will find the essential forms to annually evaluate your finances and revise your financial documents based upon any changes in your personal circumstances. The documents in this package include the following:

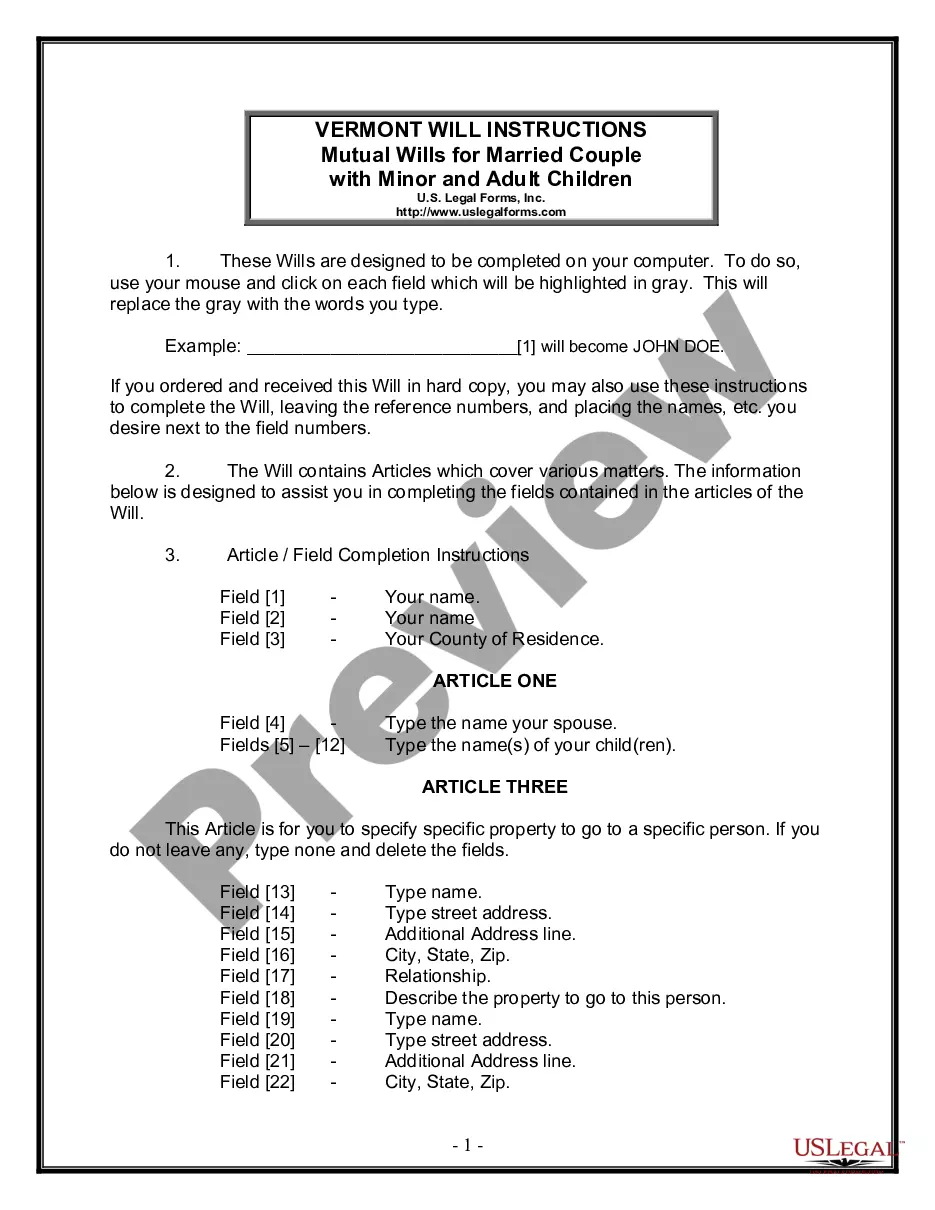

1) Last Will and Testament that suits your specific needs;

2) General Durable Power of Attorney for Property and Finances Effective Upon Disability;

3) Estate Planning Questionnaire and Worksheets;

4) Retirement Cash Flow;

5) Personal Monthly Budget Worksheet;

6) Cash Flow Statement;

7) Credit Report Request Form;

8) Financial Statement Form for Husband and Wife; and

9) Financial Statement Form for Individual.

Purchase this package and save up to 50% over purchasing the forms separately!

The San Diego California Annual Financial Checkup Package is a comprehensive financial assessment service designed to help individuals and businesses in San Diego evaluate and optimize their financial health. It offers a range of features that address various financial aspects and aims to provide a clear snapshot of one's financial situation. Designed and tailored to meet the diverse needs of individuals and businesses, the San Diego California Annual Financial Checkup Package encompasses different types depending on the specific requirements of the client: 1. Personal Financial Checkup: This package focuses on evaluating an individual's personal finances, including budgeting, saving, debt management, and retirement planning. It offers a detailed analysis of income, expenses, investments, and assets, providing valuable insights to help individuals achieve their financial goals. 2. Business Financial Checkup: Catering to the needs of small businesses, startups, and entrepreneurs in San Diego, this package assesses various financial aspects of a business. It includes an analysis of cash flow, profitability, growth potential, investment strategies, tax planning, and compliance with relevant regulations. The Business Financial Checkup Package serves as a reliable tool for business owners in making informed decisions and streamlining their financial operations. 3. Investment Portfolio Checkup: Targeting individuals and businesses with existing investment portfolios, this package focuses on evaluating the performance, diversification, and risk management of investments. It assesses the suitability of investment strategies in line with the client's financial goals, helping them optimize their portfolio to attain better returns. 4. Retirement Checkup: Aimed at individuals planning for retirement in San Diego, this package comprehensively examines their retirement savings, income sources, expected expenses, and potential risks. It offers a detailed analysis of retirement readiness, recommends adjustments to maximize retirement income, and provides strategies to manage longevity and healthcare costs effectively. With the San Diego California Annual Financial Checkup Package, clients can expect a detailed evaluation of their financial situation, personalized recommendations, and professional guidance to enhance their financial well-being. This service is conducted by experienced financial advisors, accountants, and planners who use advanced tools and methodologies to deliver accurate and insightful reports. Emphasizing confidentiality and transparency, the checkup package lays the foundation for financial stability and success in San Diego, setting clients on the path to achieve their short-term and long-term financial objectives.