This package contains the forms that are useful and necessary to help you annually review your financial status and maintain your financial records. With your Annual Financial Statement Check Up Package, you will find the essential forms to annually evaluate your finances and revise your financial documents based upon any changes in your personal circumstances. The documents in this package include the following:

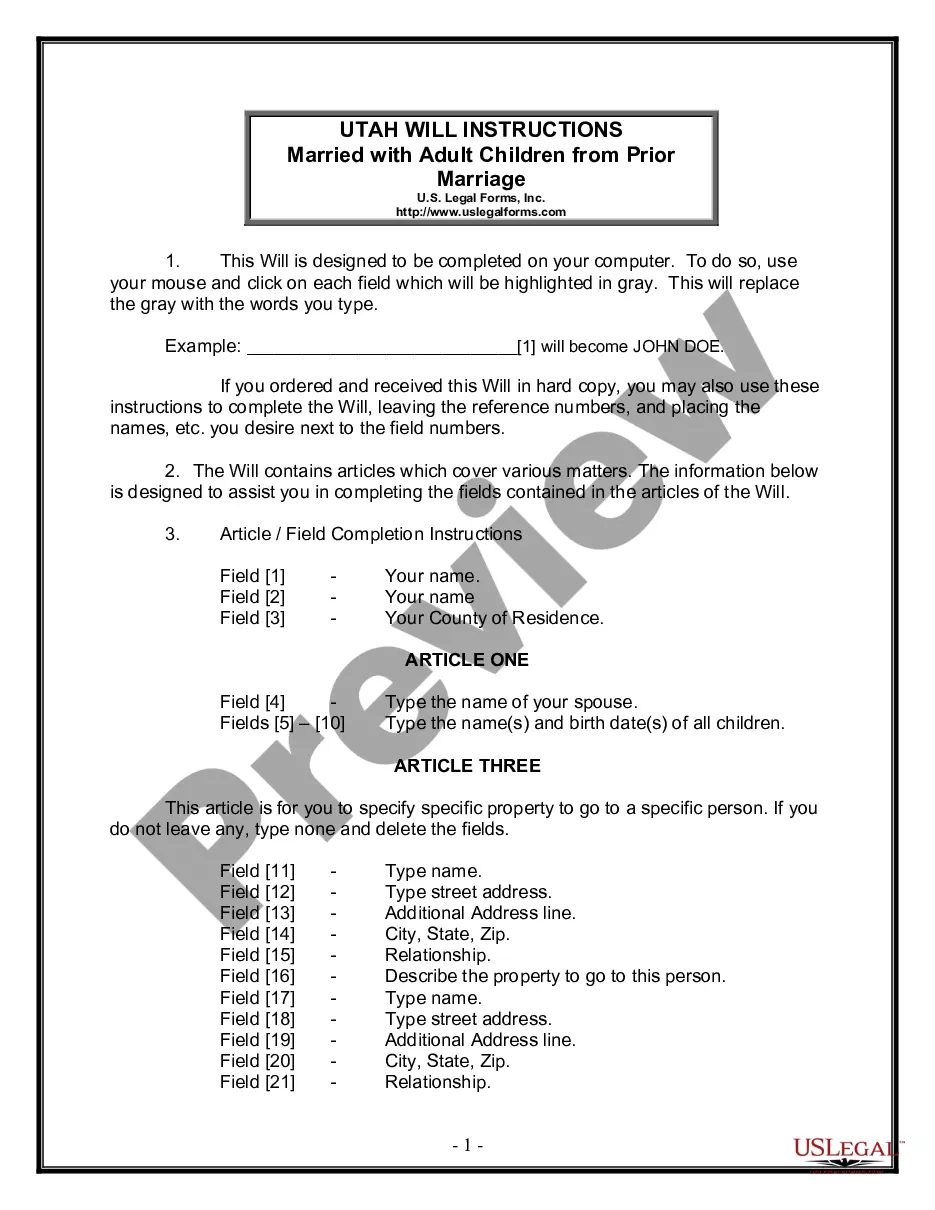

1) Last Will and Testament that suits your specific needs;

2) General Durable Power of Attorney for Property and Finances Effective Upon Disability;

3) Estate Planning Questionnaire and Worksheets;

4) Retirement Cash Flow;

5) Personal Monthly Budget Worksheet;

6) Cash Flow Statement;

7) Credit Report Request Form;

8) Financial Statement Form for Husband and Wife; and

9) Financial Statement Form for Individual.

Purchase this package and save up to 50% over purchasing the forms separately!

The San Jose California Annual Financial Checkup Package is a comprehensive financial assessment service offered to residents of San Jose, California. It is designed to provide individuals and families with a thorough evaluation of their overall financial health and help them make informed decisions about their future financial goals. This package encompasses a wide range of financial aspects, including budgeting, debt management, retirement planning, tax optimization, investment strategies, insurance coverage, and estate planning. It is tailored to address the unique financial goals and circumstances of each client, ensuring personalized recommendations and solutions. The Financial Checkup Package consists of multiple components, each focusing on a specific area of financial management. These may include: 1. Budget Analysis: This involves reviewing a client's income, expenses, and spending habits to identify potential areas for improvement, reduce unnecessary expenses, and establish a realistic budget. 2. Debt Assessment: This component evaluates any outstanding debts, such as mortgages, credit cards, student loans, and car loans, and offers strategies to reduce debt burden and enhance creditworthiness. 3. Retirement Planning: A comprehensive analysis of retirement goals, income sources, and growth potential is conducted to determine the required savings, investment plans, and retirement account strategies. 4. Tax Optimization: This element examines a client's tax situation and identifies opportunities for maximizing deductions, credits, and tax-efficient investments to minimize tax liabilities. 5. Investment Review: The financial advisor will assess the client's investment portfolio, analyzing its performance, risk level, diversification, and alignment with their financial objectives. Recommendations for potential adjustments or reallocation are provided. 6. Insurance Coverage Analysis: This component examines the sufficiency and cost-effectiveness of existing insurance policies (life, health, property, etc.) and recommends updates or adjustments to ensure adequate coverage. 7. Estate Planning Evaluation: This stage focuses on reviewing and optimizing a client's estate plan, including wills, trusts, and beneficiary designations, to ensure they align with their financial goals and provide for their heirs' future. By offering a comprehensive assessment of various financial aspects, the San Jose California Annual Financial Checkup Package aims to empower individuals and families to make informed financial decisions, prioritize their goals, and optimize their overall financial well-being.The San Jose California Annual Financial Checkup Package is a comprehensive financial assessment service offered to residents of San Jose, California. It is designed to provide individuals and families with a thorough evaluation of their overall financial health and help them make informed decisions about their future financial goals. This package encompasses a wide range of financial aspects, including budgeting, debt management, retirement planning, tax optimization, investment strategies, insurance coverage, and estate planning. It is tailored to address the unique financial goals and circumstances of each client, ensuring personalized recommendations and solutions. The Financial Checkup Package consists of multiple components, each focusing on a specific area of financial management. These may include: 1. Budget Analysis: This involves reviewing a client's income, expenses, and spending habits to identify potential areas for improvement, reduce unnecessary expenses, and establish a realistic budget. 2. Debt Assessment: This component evaluates any outstanding debts, such as mortgages, credit cards, student loans, and car loans, and offers strategies to reduce debt burden and enhance creditworthiness. 3. Retirement Planning: A comprehensive analysis of retirement goals, income sources, and growth potential is conducted to determine the required savings, investment plans, and retirement account strategies. 4. Tax Optimization: This element examines a client's tax situation and identifies opportunities for maximizing deductions, credits, and tax-efficient investments to minimize tax liabilities. 5. Investment Review: The financial advisor will assess the client's investment portfolio, analyzing its performance, risk level, diversification, and alignment with their financial objectives. Recommendations for potential adjustments or reallocation are provided. 6. Insurance Coverage Analysis: This component examines the sufficiency and cost-effectiveness of existing insurance policies (life, health, property, etc.) and recommends updates or adjustments to ensure adequate coverage. 7. Estate Planning Evaluation: This stage focuses on reviewing and optimizing a client's estate plan, including wills, trusts, and beneficiary designations, to ensure they align with their financial goals and provide for their heirs' future. By offering a comprehensive assessment of various financial aspects, the San Jose California Annual Financial Checkup Package aims to empower individuals and families to make informed financial decisions, prioritize their goals, and optimize their overall financial well-being.