This package contains the forms that are useful and necessary to help you annually review your financial status and maintain your financial records. With your Annual Financial Statement Check Up Package, you will find the essential forms to annually evaluate your finances and revise your financial documents based upon any changes in your personal circumstances. The documents in this package include the following:

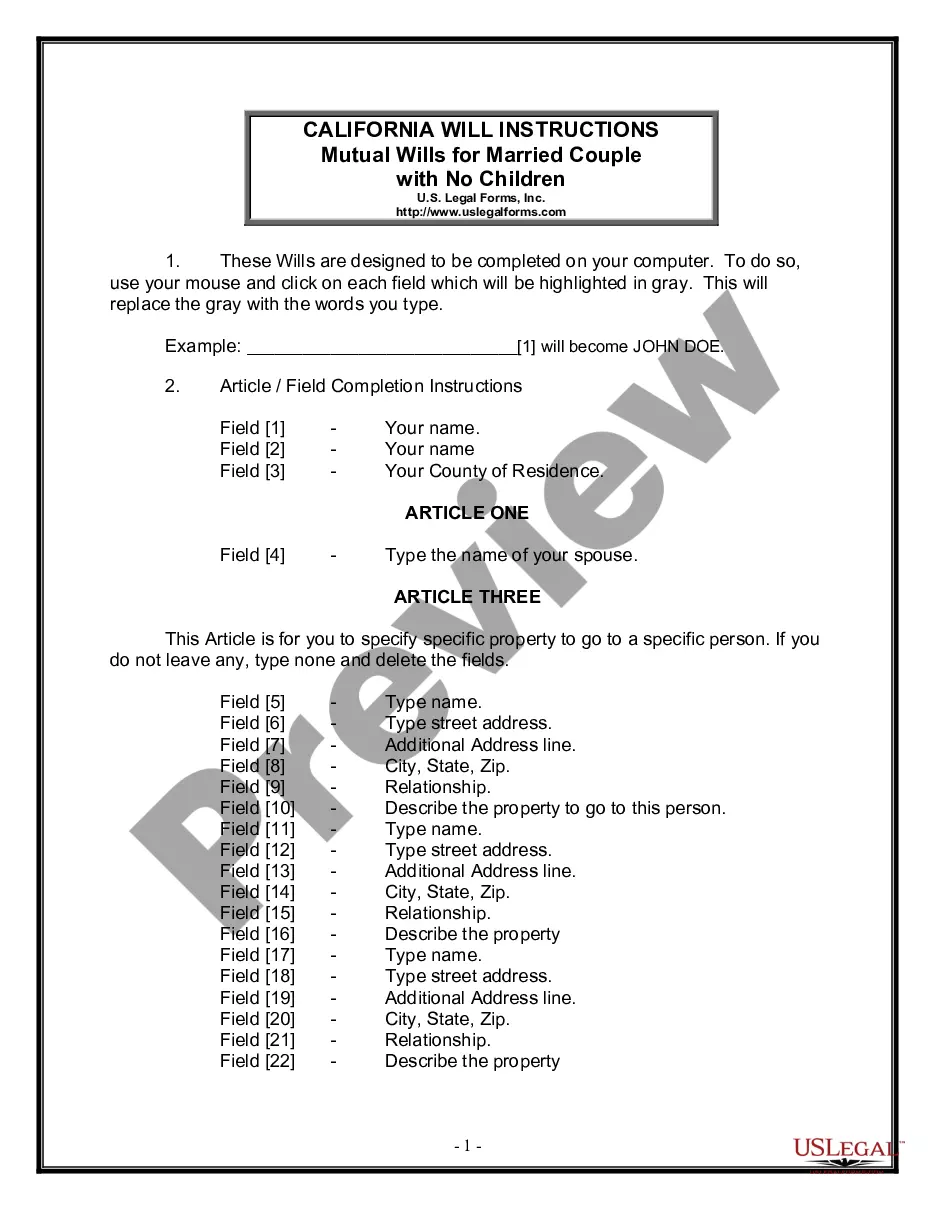

1) Last Will and Testament that suits your specific needs;

2) General Durable Power of Attorney for Property and Finances Effective Upon Disability;

3) Estate Planning Questionnaire and Worksheets;

4) Retirement Cash Flow;

5) Personal Monthly Budget Worksheet;

6) Cash Flow Statement;

7) Credit Report Request Form;

8) Financial Statement Form for Husband and Wife; and

9) Financial Statement Form for Individual.

Purchase this package and save up to 50% over purchasing the forms separately!

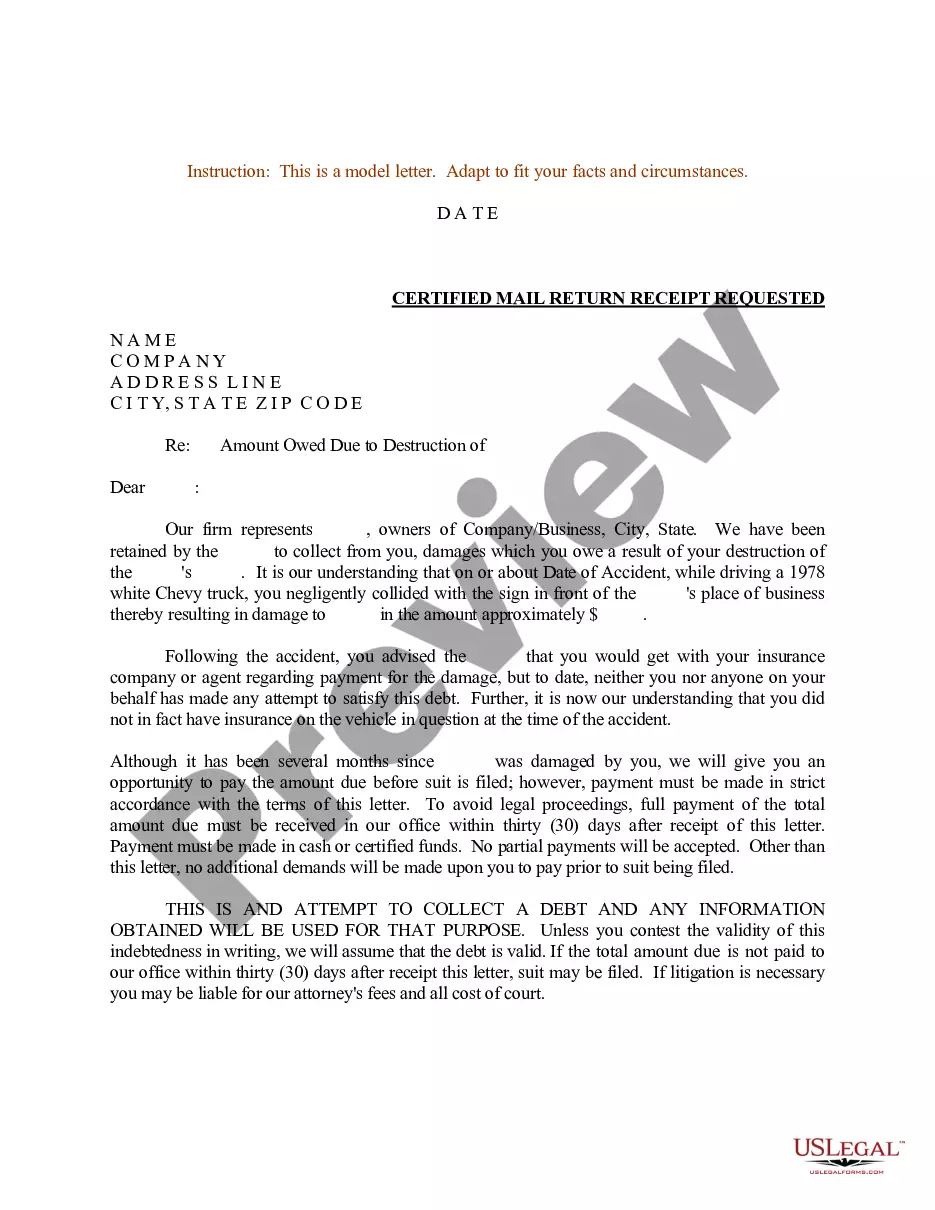

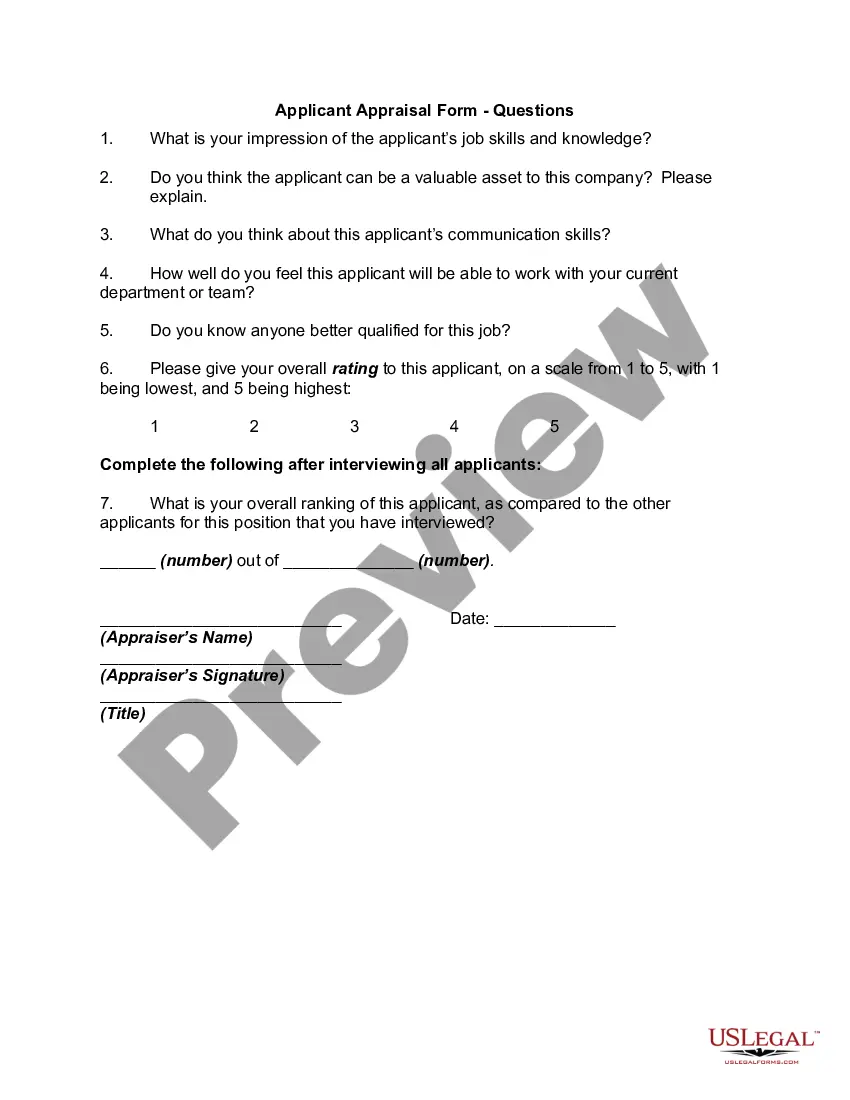

Santa Maria California Annual Financial Checkup Package is a comprehensive financial assessment service offered to individuals, families, and businesses in Santa Maria, California. This package aims to provide a detailed analysis of the financial health and stability of clients and offers tailored solutions to help them achieve their financial goals. The Santa Maria California Annual Financial Checkup Package includes a range of services and evaluation components that cover various aspects of personal and business finances. These services are designed to identify strengths, weaknesses, and areas of improvement in one's financial situation. Key aspects covered in the Santa Maria California Annual Financial Checkup Package may include: 1. Income and Expense Evaluation: A thorough assessment of the client's income sources, analyzing monthly cash flow, and identifying areas of overspending or potential savings opportunities. 2. Debt Analysis: Examination of existing debts, such as credit card balances, loans, and mortgages, to determine the impact on overall financial health. This analysis includes a review of interest rates, payment schedules, and potential strategies to reduce or restructure debt. 3. Asset and Investment Review: A comprehensive review of the client's assets, including stocks, bonds, real estate holdings, retirement accounts, and other investments. This evaluation aims to assess the performance and diversification of these assets and identify potential adjustments or opportunities for growth. 4. Retirement Planning: A personalized assessment of retirement goals and objectives, estimating future income needs, and designing a suitable savings plan. This may include recommendations for retirement account contributions, portfolio allocations, and retirement calculators to evaluate progress towards retirement goals. 5. Risk Management: An evaluation of insurance policies, such as life, health, property, and liability insurance, to ensure proper coverage and recommend adjustments if necessary. The analysis may also include identifying potential gaps in coverage and suggesting strategies for mitigating major risks. 6. Tax Planning: A review of personal or business tax returns to identify potential areas for tax reduction, utilization of tax benefits or incentives, and ensure compliance with tax regulations. This may include recommendations on tax-efficient investments or the use of tax-advantaged accounts. 7. Estate Planning: Analysis of the client's assets, wills, trusts, and beneficiaries to ensure efficient transfer of wealth, preservation of assets, and minimizing tax implications upon death. This may include guidance on updating or creating essential estate planning documents. The Santa Maria California Annual Financial Checkup Package aims to provide clients with a comprehensive view of their financial situation and identify areas that require attention or improvement. It offers customized recommendations, strategies, and ongoing support to help clients achieve financial stability, security, and long-term success. While there may not be different types of Santa Maria California Annual Financial Checkup Packages, clients can expect customized solutions and recommendations based on their specific financial goals, circumstances, and preferences. The package can be tailored to individuals, families, or businesses, ensuring that all clients receive the most relevant and beneficial financial guidance.Santa Maria California Annual Financial Checkup Package is a comprehensive financial assessment service offered to individuals, families, and businesses in Santa Maria, California. This package aims to provide a detailed analysis of the financial health and stability of clients and offers tailored solutions to help them achieve their financial goals. The Santa Maria California Annual Financial Checkup Package includes a range of services and evaluation components that cover various aspects of personal and business finances. These services are designed to identify strengths, weaknesses, and areas of improvement in one's financial situation. Key aspects covered in the Santa Maria California Annual Financial Checkup Package may include: 1. Income and Expense Evaluation: A thorough assessment of the client's income sources, analyzing monthly cash flow, and identifying areas of overspending or potential savings opportunities. 2. Debt Analysis: Examination of existing debts, such as credit card balances, loans, and mortgages, to determine the impact on overall financial health. This analysis includes a review of interest rates, payment schedules, and potential strategies to reduce or restructure debt. 3. Asset and Investment Review: A comprehensive review of the client's assets, including stocks, bonds, real estate holdings, retirement accounts, and other investments. This evaluation aims to assess the performance and diversification of these assets and identify potential adjustments or opportunities for growth. 4. Retirement Planning: A personalized assessment of retirement goals and objectives, estimating future income needs, and designing a suitable savings plan. This may include recommendations for retirement account contributions, portfolio allocations, and retirement calculators to evaluate progress towards retirement goals. 5. Risk Management: An evaluation of insurance policies, such as life, health, property, and liability insurance, to ensure proper coverage and recommend adjustments if necessary. The analysis may also include identifying potential gaps in coverage and suggesting strategies for mitigating major risks. 6. Tax Planning: A review of personal or business tax returns to identify potential areas for tax reduction, utilization of tax benefits or incentives, and ensure compliance with tax regulations. This may include recommendations on tax-efficient investments or the use of tax-advantaged accounts. 7. Estate Planning: Analysis of the client's assets, wills, trusts, and beneficiaries to ensure efficient transfer of wealth, preservation of assets, and minimizing tax implications upon death. This may include guidance on updating or creating essential estate planning documents. The Santa Maria California Annual Financial Checkup Package aims to provide clients with a comprehensive view of their financial situation and identify areas that require attention or improvement. It offers customized recommendations, strategies, and ongoing support to help clients achieve financial stability, security, and long-term success. While there may not be different types of Santa Maria California Annual Financial Checkup Packages, clients can expect customized solutions and recommendations based on their specific financial goals, circumstances, and preferences. The package can be tailored to individuals, families, or businesses, ensuring that all clients receive the most relevant and beneficial financial guidance.