This package contains the forms that are useful and necessary to help you annually review your financial status and maintain your financial records. With your Annual Financial Statement Check Up Package, you will find the essential forms to annually evaluate your finances and revise your financial documents based upon any changes in your personal circumstances. The documents in this package include the following:

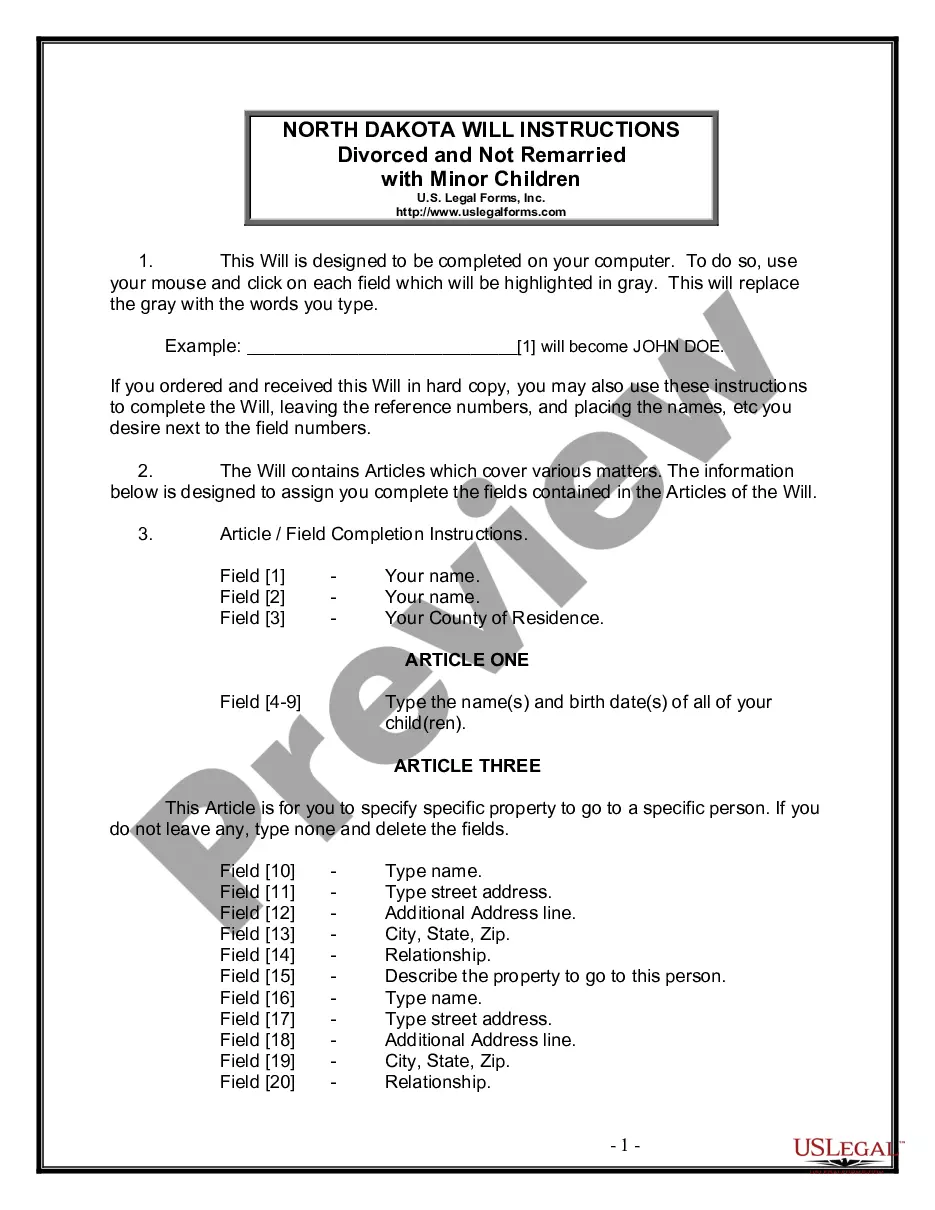

1) Last Will and Testament that suits your specific needs;

2) General Durable Power of Attorney for Property and Finances Effective Upon Disability;

3) Estate Planning Questionnaire and Worksheets;

4) Retirement Cash Flow;

5) Personal Monthly Budget Worksheet;

6) Cash Flow Statement;

7) Credit Report Request Form;

8) Financial Statement Form for Husband and Wife; and

9) Financial Statement Form for Individual.

Purchase this package and save up to 50% over purchasing the forms separately!

The West Covina California Annual Financial Checkup Package is a comprehensive and thorough financial assessment service designed to help residents of West Covina, California manage their finances effectively. This package aims to provide individuals with a detailed overview of their financial health, identify areas for improvement, and offer personalized recommendations for achieving financial goals. The Annual Financial Checkup Package in West Covina, California offers various types of assessments to cater to different financial needs. These types may include: 1. Personal Budget Analysis: This assessment reviews an individual's income, expenses, and spending habits to help create a personalized budget plan that optimizes savings and supports financial goals. 2. Retirement Planning Evaluation: This evaluation focuses on analyzing an individual's current retirement savings, assessing their retirement goals, and providing customized strategies to maximize savings and plan for a secure future. 3. Investment Portfolio Review: This analysis examines an individual's investment portfolio, assesses its performance, and offers recommendations to diversify investments or make informed adjustments for better returns. 4. Debt Management Assessment: This assessment aims to evaluate an individual's current debt, such as credit cards, loans, or mortgages, and provides strategies for debt reduction, consolidation, or refinancing. 5. Tax Planning Consultation: This consultation helps individuals optimize their tax return by identifying potential deductions, credits, and tax-saving strategies, ensuring compliance with relevant tax laws. 6. Insurance Coverage Evaluation: This evaluation reviews an individual's insurance policies, such as health, life, or property insurance, and offers advice on coverage adequacy and potential cost-saving opportunities. 7. Estate Planning Review: This review assesses an individual's estate plan, including wills, trusts, and beneficiary designations, to ensure it aligns with their wishes and addresses potential tax implications. Overall, the West Covina California Annual Financial Checkup Package provides a comprehensive range of assessments tailored to individuals' unique financial circumstances. It aims to support residents of West Covina in making informed financial decisions, achieving their financial goals, and gaining peace of mind in regard to their financial future.