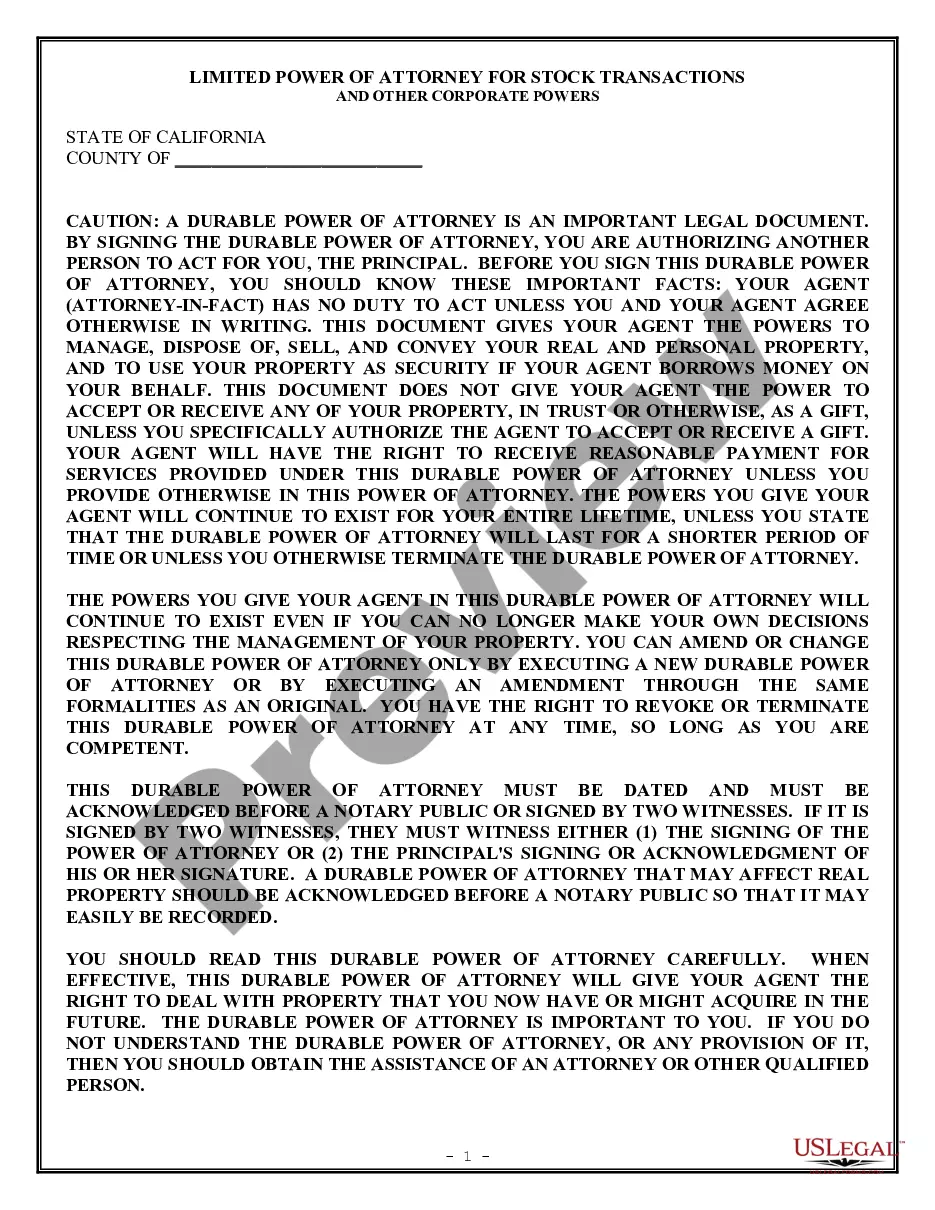

This Limited Power of Attorney form provides for a limited power of attorney for stock transactions only. It used by a shareholder to authorize another person to vote stock and to conduct other corporate powers. The document must be signed before two witnesses.

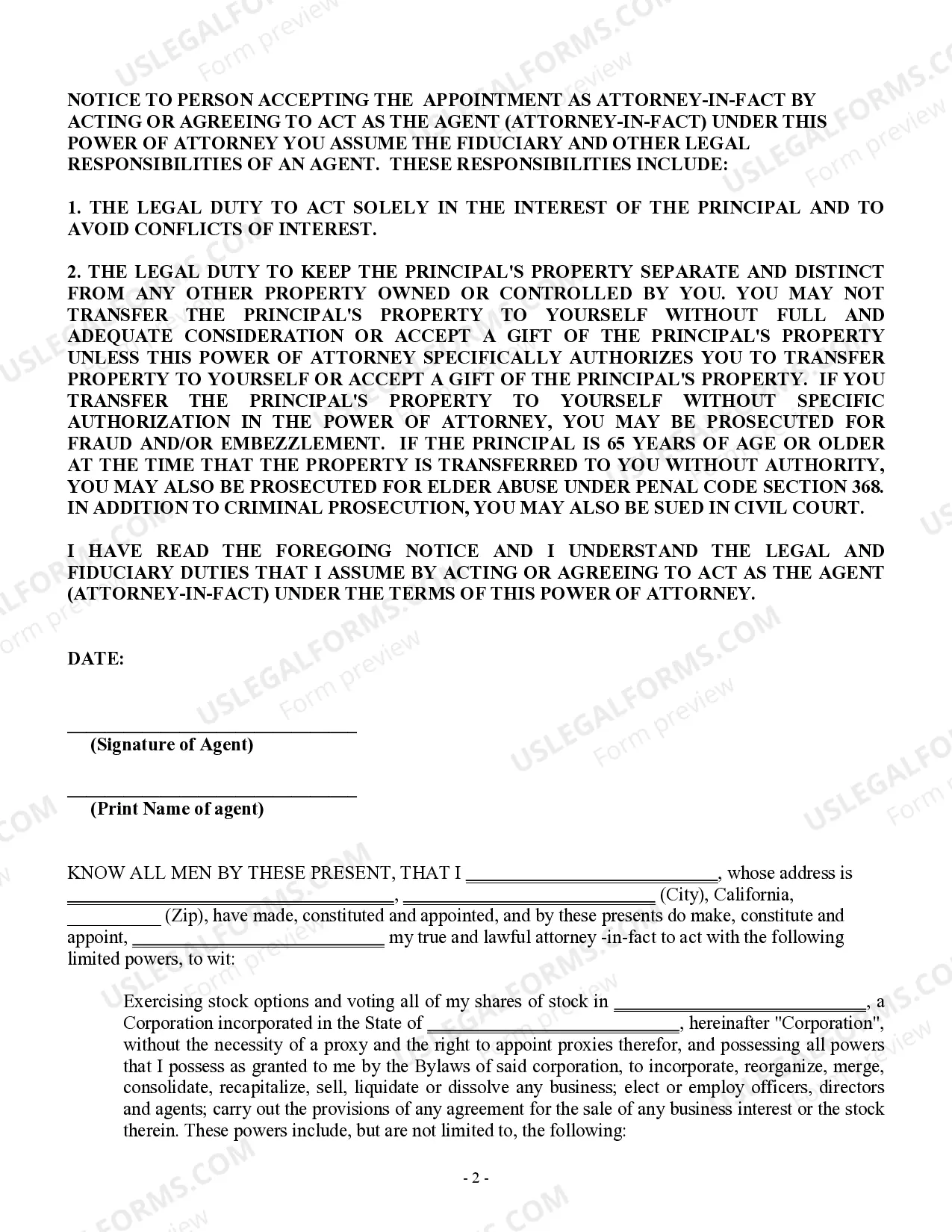

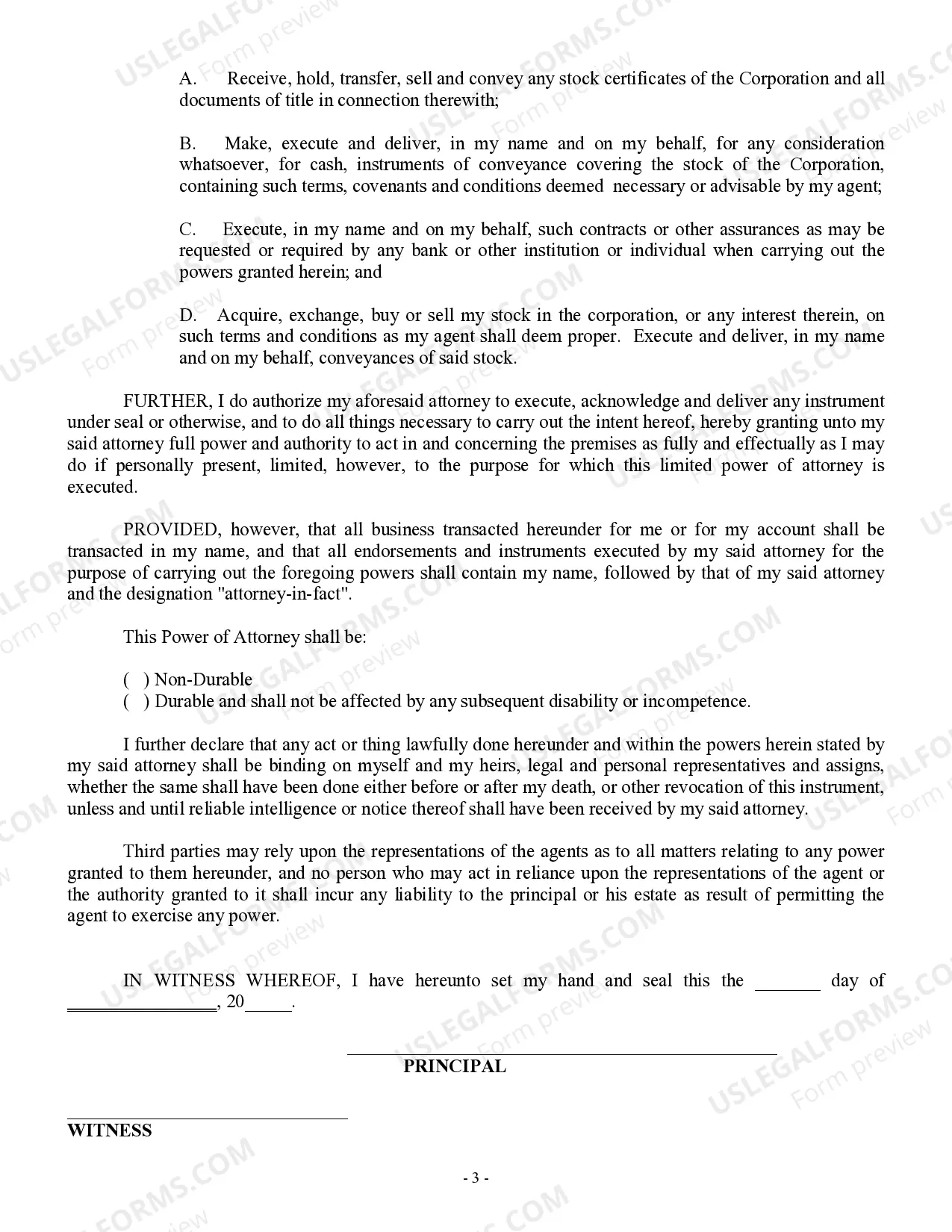

Title: Exploring the West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers: An In-Depth Overview Introduction: In West Covina, California, individuals engaging in stock transactions and other corporate activities may grant a Limited Power of Attorney (LPO) to authorize another party to act on their behalf. This legal document streamlines stock transactions and empowers chosen representatives to make specific decisions related to corporate matters. In this article, we will delve into the details of the West Covina California Limited Power of Attorney, its purpose, benefits, different types, and the process to obtain one. Keywords: West Covina California, Limited Power of Attorney, Stock Transactions, Corporate Powers, LPO, legal document. 1. Understanding the West Covina California Limited Power of Attorney: The West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal instrument that allows individuals to delegate their authority to a trusted representative for specific actions related to stocks and corporate activities within the jurisdiction. 2. Purpose and Benefits: By granting a Limited Power of Attorney, individuals provide their designated representatives with the authority and responsibility to conduct essential stock transactions and make decisions on their behalf. The limited nature of this power means that the representative can only act within the rights and limitations specified in the document, ensuring control and security over the individual's assets. 3. Types of West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers: a. Financial Power of Attorney for Stock Transactions: This type of LPO grants the representative the authority to buy, sell, or trade stocks on behalf of the individual. It enables the designated person to make decisions, execute trades, and manage the individual's investment portfolio. b. Corporate Power of Attorney: This variant of the Limited Power of Attorney focuses on granting authority to manage broader corporate matters. It allows the representative to act on behalf of the individual in making decisions related to corporate agreements, contracts, and negotiations. It may also provide powers to vote in shareholder meetings and engage in other corporate activities. 4. The Process of Obtaining a West Covina California Limited Power of Attorney: a. Determine the scope: It is crucial to identify the specific powers and limitations required for the representative before drafting the LPO document. b. Seek legal guidance: Consult an attorney experienced in power of attorney matters to ensure compliance with West Covina California's regulations and your personal requirements. c. Draft the document: Collaborate with your attorney to create a comprehensive document outlining the powers and limitations with clarity. d. Notarize the document: The West Covina California Limited Power of Attorney must be notarized to authenticate its legitimacy. e. Notify relevant parties: Inform your stockbroker, financial institutions, and other involved parties to acknowledge and accept the authority granted to your representative. Conclusion: The West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers is a powerful legal tool that allows individuals to delegate specific decision-making powers to trusted representatives concerning stock transactions and corporate activities. By understanding its purpose, benefits, and different types, individuals can ensure efficient management of their finances and corporate affairs while safeguarding their interests. Keywords: West Covina California, Limited Power of Attorney, Stock Transactions, Corporate Powers, LPO, legal document, financial power of attorney, corporate power of attorney.Title: Exploring the West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers: An In-Depth Overview Introduction: In West Covina, California, individuals engaging in stock transactions and other corporate activities may grant a Limited Power of Attorney (LPO) to authorize another party to act on their behalf. This legal document streamlines stock transactions and empowers chosen representatives to make specific decisions related to corporate matters. In this article, we will delve into the details of the West Covina California Limited Power of Attorney, its purpose, benefits, different types, and the process to obtain one. Keywords: West Covina California, Limited Power of Attorney, Stock Transactions, Corporate Powers, LPO, legal document. 1. Understanding the West Covina California Limited Power of Attorney: The West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers is a legal instrument that allows individuals to delegate their authority to a trusted representative for specific actions related to stocks and corporate activities within the jurisdiction. 2. Purpose and Benefits: By granting a Limited Power of Attorney, individuals provide their designated representatives with the authority and responsibility to conduct essential stock transactions and make decisions on their behalf. The limited nature of this power means that the representative can only act within the rights and limitations specified in the document, ensuring control and security over the individual's assets. 3. Types of West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers: a. Financial Power of Attorney for Stock Transactions: This type of LPO grants the representative the authority to buy, sell, or trade stocks on behalf of the individual. It enables the designated person to make decisions, execute trades, and manage the individual's investment portfolio. b. Corporate Power of Attorney: This variant of the Limited Power of Attorney focuses on granting authority to manage broader corporate matters. It allows the representative to act on behalf of the individual in making decisions related to corporate agreements, contracts, and negotiations. It may also provide powers to vote in shareholder meetings and engage in other corporate activities. 4. The Process of Obtaining a West Covina California Limited Power of Attorney: a. Determine the scope: It is crucial to identify the specific powers and limitations required for the representative before drafting the LPO document. b. Seek legal guidance: Consult an attorney experienced in power of attorney matters to ensure compliance with West Covina California's regulations and your personal requirements. c. Draft the document: Collaborate with your attorney to create a comprehensive document outlining the powers and limitations with clarity. d. Notarize the document: The West Covina California Limited Power of Attorney must be notarized to authenticate its legitimacy. e. Notify relevant parties: Inform your stockbroker, financial institutions, and other involved parties to acknowledge and accept the authority granted to your representative. Conclusion: The West Covina California Limited Power of Attorney for Stock Transactions and Corporate Powers is a powerful legal tool that allows individuals to delegate specific decision-making powers to trusted representatives concerning stock transactions and corporate activities. By understanding its purpose, benefits, and different types, individuals can ensure efficient management of their finances and corporate affairs while safeguarding their interests. Keywords: West Covina California, Limited Power of Attorney, Stock Transactions, Corporate Powers, LPO, legal document, financial power of attorney, corporate power of attorney.