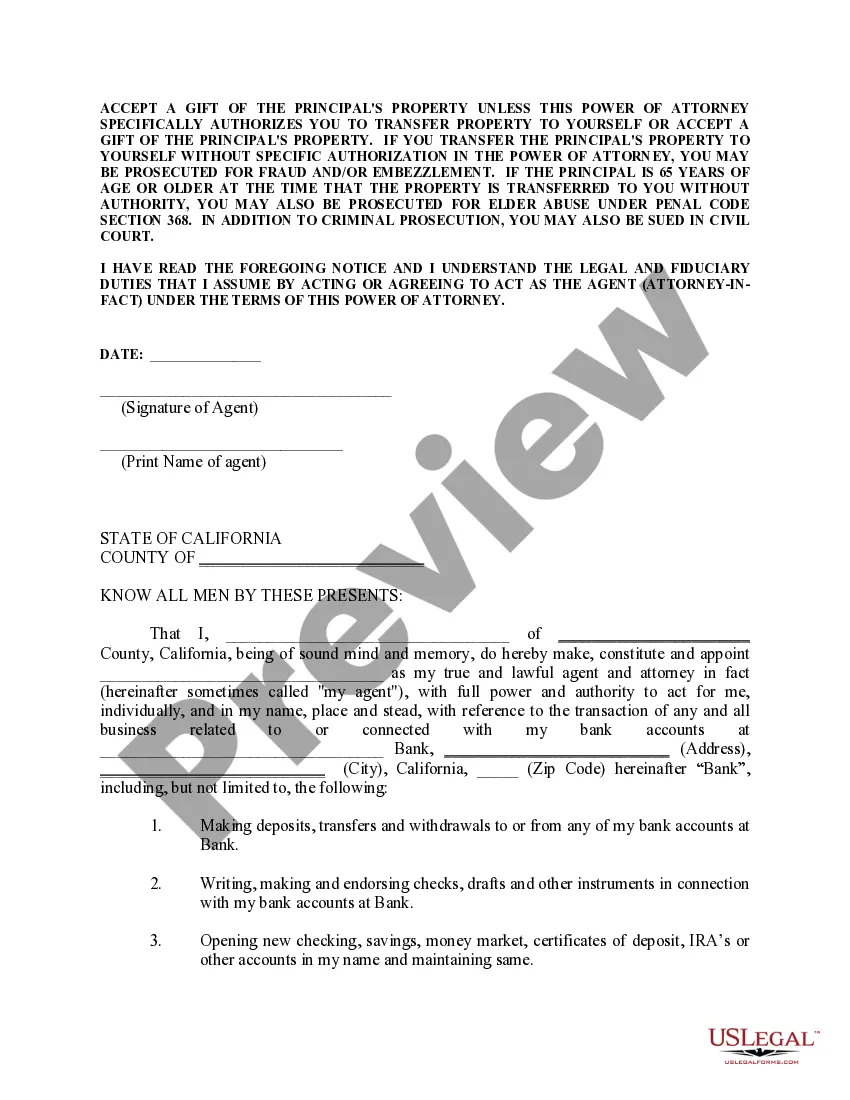

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

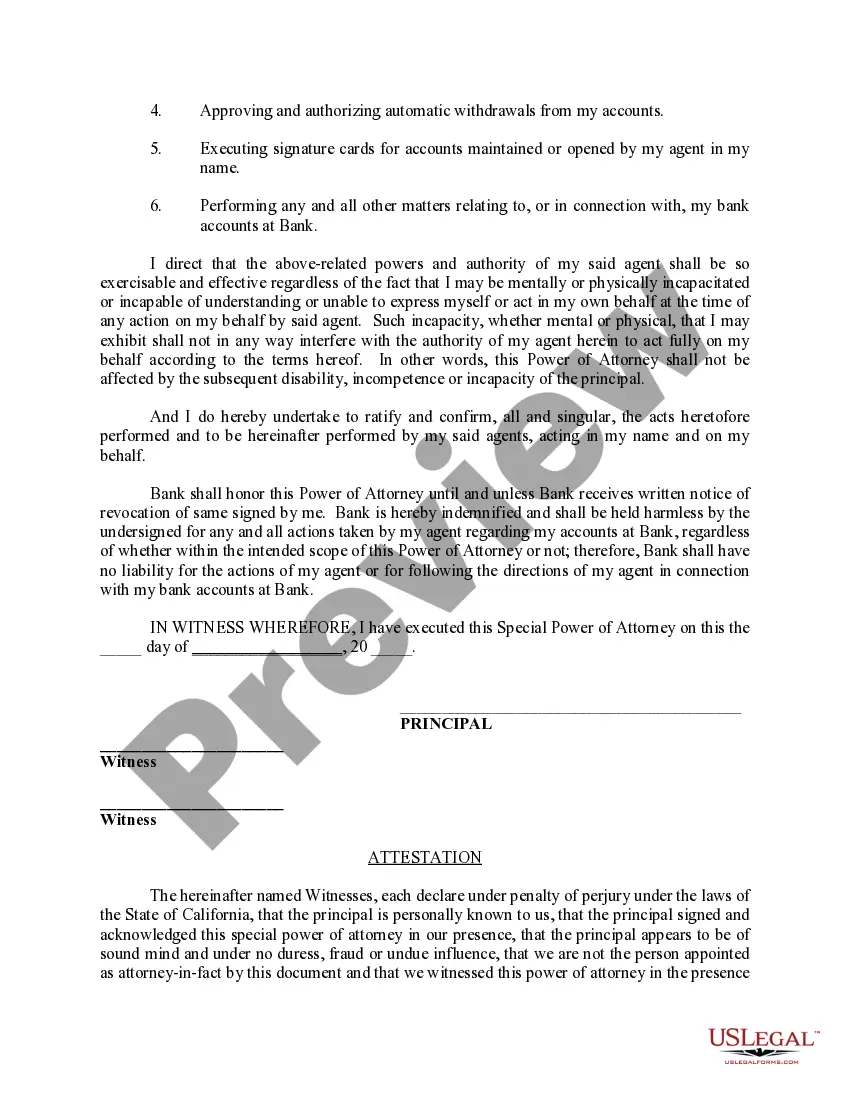

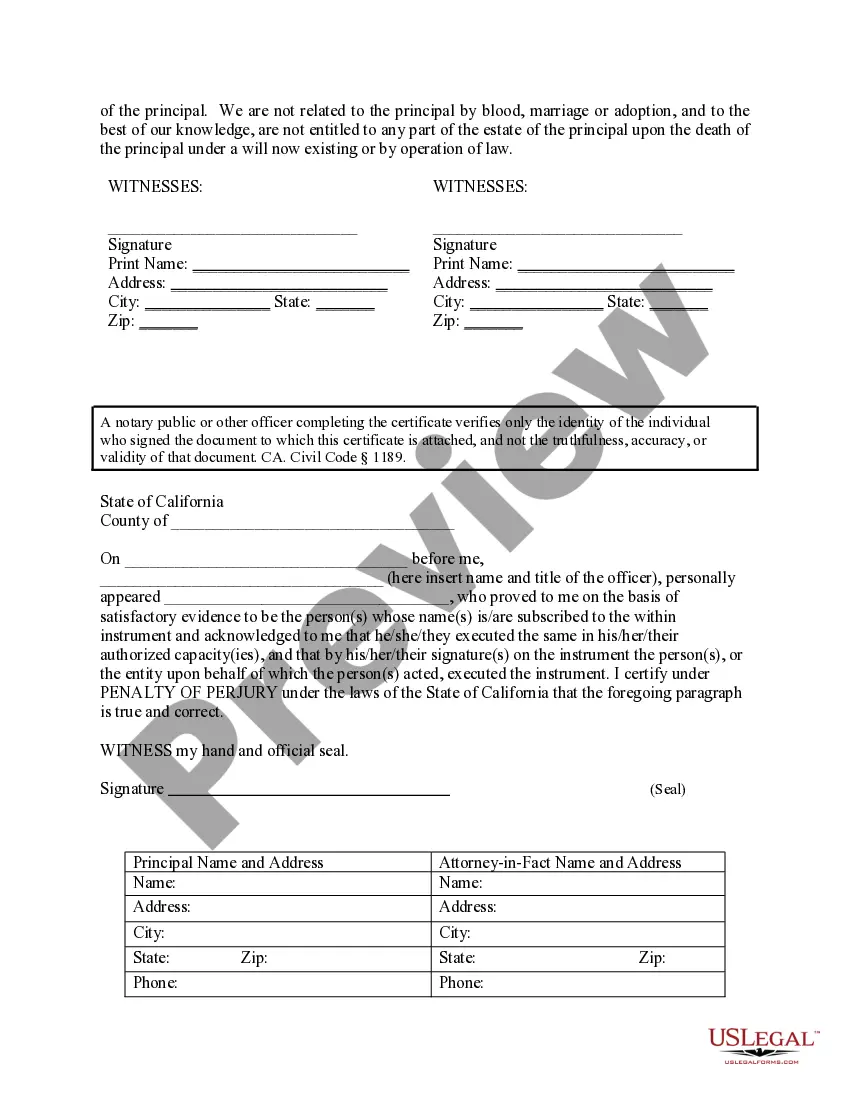

Title: Alameda California Special Durable Power of Attorney for Bank Account Matters: Explained Introduction: The Alameda California Special Durable Power of Attorney for Bank Account Matters is a legal document that allows an individual (the principal) in Alameda, California, to designate someone else (the attorney-in-fact) to make decisions and manage their bank accounts in specific financial matters. This specialized power of attorney grants authority to the designated person to act on behalf of the principal and ensure the smooth management of their bank accounts under certain circumstances. Types of Alameda California Special Durable Power of Attorney for Bank Account Matters: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of special durable power of attorney allows the attorney-in-fact to perform specific tasks related to the principal's bank accounts, such as depositing or withdrawing funds, paying bills, or transferring money between accounts. The authority granted is limited to the mentioned matters and may have a specific time frame or duration. 2. Comprehensive Special Durable Power of Attorney for Bank Account Matters: A comprehensive special durable power of attorney grants broader authority to the attorney-in-fact, allowing them to manage multiple aspects of the principal's bank accounts. The powers may include banking transactions, managing investments, opening or closing accounts, and even resolving disputes regarding the accounts. 3. Advance Directive Special Durable Power of Attorney for Bank Account Matters: This type of special durable power of attorney is often used in situations where the principal becomes incapacitated or unable to make decisions regarding their bank accounts. It allows the attorney-in-fact to make decisions on behalf of the principal according to the directives provided in advance, outlining their preferences for financial matters. Key Elements of an Alameda California Special Durable Power of Attorney for Bank Account Matters: When drafting a special durable power of attorney for bank account matters in Alameda, California, it is essential to include the following key elements and information: 1. Identification of the Parties: Clearly identify the principal and the attorney-in-fact by providing their full legal names, addresses, and contact details. 2. Granting Authority: Specify the scope of authority being granted, whether it is limited, comprehensive, or pursuant to an advance directive, and outline the specific powers that the attorney-in-fact will have over the principal's bank accounts. 3. Effective Dates and Duration: Indicate the effective dates for the power of attorney, its duration, and any conditions that may terminate or revoke it, such as the principal's recovery from incapacity or their passing. 4. Notarization and Witnesses: Ensure the power of attorney is notarized and signed by the principal. Some jurisdictions may require additional witnesses for the document to be legally valid. Conclusion: The Alameda California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that allows a designated person to act on behalf of a principal in managing their bank accounts. Understanding the different types available and incorporating the necessary elements ensures the document's validity and compliance with the specific requirements of Alameda, California. Don't hesitate to consult a legal professional for guidance and assistance in creating and executing this important document.Title: Alameda California Special Durable Power of Attorney for Bank Account Matters: Explained Introduction: The Alameda California Special Durable Power of Attorney for Bank Account Matters is a legal document that allows an individual (the principal) in Alameda, California, to designate someone else (the attorney-in-fact) to make decisions and manage their bank accounts in specific financial matters. This specialized power of attorney grants authority to the designated person to act on behalf of the principal and ensure the smooth management of their bank accounts under certain circumstances. Types of Alameda California Special Durable Power of Attorney for Bank Account Matters: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of special durable power of attorney allows the attorney-in-fact to perform specific tasks related to the principal's bank accounts, such as depositing or withdrawing funds, paying bills, or transferring money between accounts. The authority granted is limited to the mentioned matters and may have a specific time frame or duration. 2. Comprehensive Special Durable Power of Attorney for Bank Account Matters: A comprehensive special durable power of attorney grants broader authority to the attorney-in-fact, allowing them to manage multiple aspects of the principal's bank accounts. The powers may include banking transactions, managing investments, opening or closing accounts, and even resolving disputes regarding the accounts. 3. Advance Directive Special Durable Power of Attorney for Bank Account Matters: This type of special durable power of attorney is often used in situations where the principal becomes incapacitated or unable to make decisions regarding their bank accounts. It allows the attorney-in-fact to make decisions on behalf of the principal according to the directives provided in advance, outlining their preferences for financial matters. Key Elements of an Alameda California Special Durable Power of Attorney for Bank Account Matters: When drafting a special durable power of attorney for bank account matters in Alameda, California, it is essential to include the following key elements and information: 1. Identification of the Parties: Clearly identify the principal and the attorney-in-fact by providing their full legal names, addresses, and contact details. 2. Granting Authority: Specify the scope of authority being granted, whether it is limited, comprehensive, or pursuant to an advance directive, and outline the specific powers that the attorney-in-fact will have over the principal's bank accounts. 3. Effective Dates and Duration: Indicate the effective dates for the power of attorney, its duration, and any conditions that may terminate or revoke it, such as the principal's recovery from incapacity or their passing. 4. Notarization and Witnesses: Ensure the power of attorney is notarized and signed by the principal. Some jurisdictions may require additional witnesses for the document to be legally valid. Conclusion: The Alameda California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that allows a designated person to act on behalf of a principal in managing their bank accounts. Understanding the different types available and incorporating the necessary elements ensures the document's validity and compliance with the specific requirements of Alameda, California. Don't hesitate to consult a legal professional for guidance and assistance in creating and executing this important document.