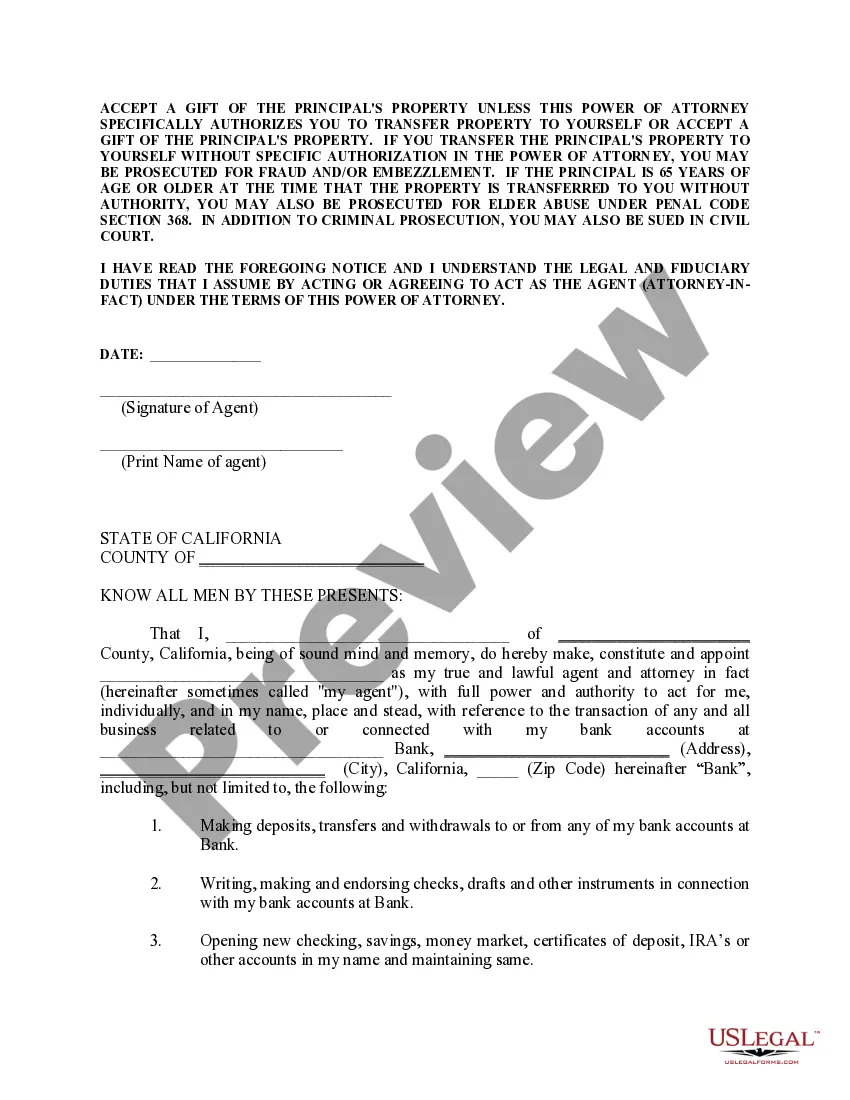

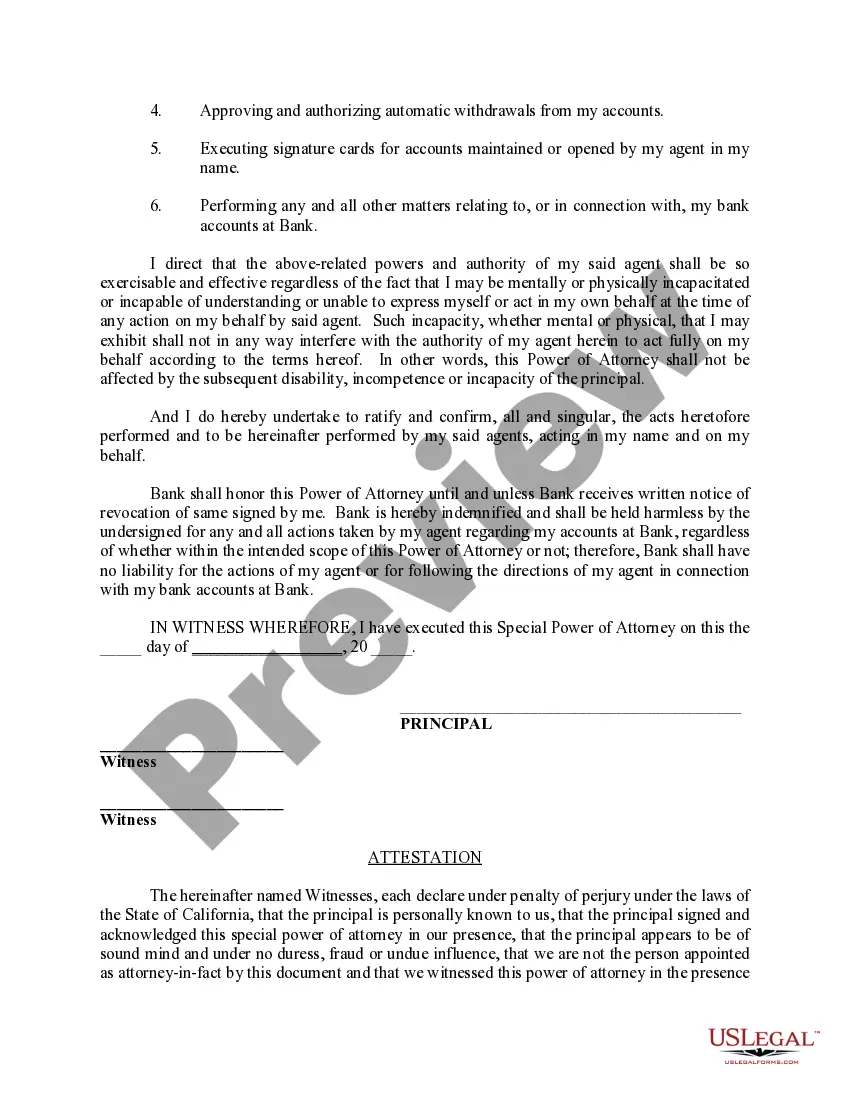

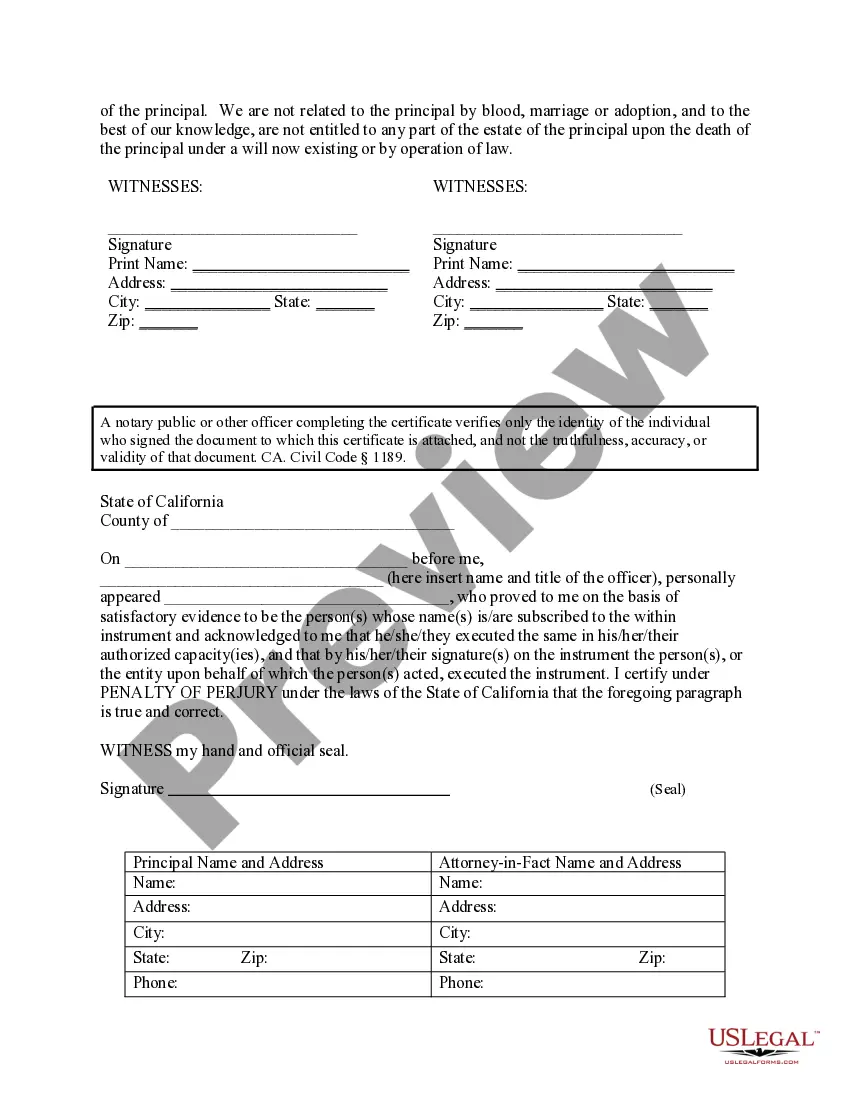

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Bakersfield California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual the authority to manage specific banking matters on behalf of the principal. This type of power of attorney is designed to be durable, meaning it remains in effect even if the principal becomes incapacitated or mentally incompetent. The Bakersfield California Special Durable Power of Attorney for Bank Account Matters allows the appointed agent to perform a variety of tasks pertaining to the principal's bank accounts, such as depositing and withdrawing funds, writing checks, making electronic transfers, managing investments, and accessing account statements. The agent is entrusted with the responsibility to handle all financial matters diligently and solely in the best interest of the principal. There are several types of Bakersfield California Special Durable Power of Attorney for Bank Account Matters, which include: 1. Limited Scope Special Durable Power of Attorney: This type of power of attorney grants the agent authority over specific bank accounts or transactions only. It is often used when the principal requires assistance with specific banking matters, but does not want to give the agent full control over all financial affairs. 2. General Special Durable Power of Attorney: This form of power of attorney provides the agent with broader authority, allowing them to manage the principal's entire bank account portfolio. The agent can handle a wider range of financial transactions and make decisions on behalf of the principal. 3. Springing Special Durable Power of Attorney: Unlike the traditional durable power of attorney, this type only becomes effective once a specific condition or event occurs, usually the incapacity of the principal. It provides a safeguard for the principal and ensures that the agent's powers are invoked only when necessary. 4. Co-Agents Special Durable Power of Attorney: This form of power of attorney allows the principal to appoint multiple individuals as agents, who can either act together (jointly) or separately (severally). This option is typically chosen when the principal desires the expertise and input of multiple trusted individuals. Bakersfield California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that enables individuals to effectively manage their banking affairs, even when they are unable to do so themselves. It is essential to consult with a qualified attorney to understand the specific requirements and considerations when crafting such a power of attorney to ensure its legality and relevance to individual circumstances.Bakersfield California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants a designated individual the authority to manage specific banking matters on behalf of the principal. This type of power of attorney is designed to be durable, meaning it remains in effect even if the principal becomes incapacitated or mentally incompetent. The Bakersfield California Special Durable Power of Attorney for Bank Account Matters allows the appointed agent to perform a variety of tasks pertaining to the principal's bank accounts, such as depositing and withdrawing funds, writing checks, making electronic transfers, managing investments, and accessing account statements. The agent is entrusted with the responsibility to handle all financial matters diligently and solely in the best interest of the principal. There are several types of Bakersfield California Special Durable Power of Attorney for Bank Account Matters, which include: 1. Limited Scope Special Durable Power of Attorney: This type of power of attorney grants the agent authority over specific bank accounts or transactions only. It is often used when the principal requires assistance with specific banking matters, but does not want to give the agent full control over all financial affairs. 2. General Special Durable Power of Attorney: This form of power of attorney provides the agent with broader authority, allowing them to manage the principal's entire bank account portfolio. The agent can handle a wider range of financial transactions and make decisions on behalf of the principal. 3. Springing Special Durable Power of Attorney: Unlike the traditional durable power of attorney, this type only becomes effective once a specific condition or event occurs, usually the incapacity of the principal. It provides a safeguard for the principal and ensures that the agent's powers are invoked only when necessary. 4. Co-Agents Special Durable Power of Attorney: This form of power of attorney allows the principal to appoint multiple individuals as agents, who can either act together (jointly) or separately (severally). This option is typically chosen when the principal desires the expertise and input of multiple trusted individuals. Bakersfield California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that enables individuals to effectively manage their banking affairs, even when they are unable to do so themselves. It is essential to consult with a qualified attorney to understand the specific requirements and considerations when crafting such a power of attorney to ensure its legality and relevance to individual circumstances.