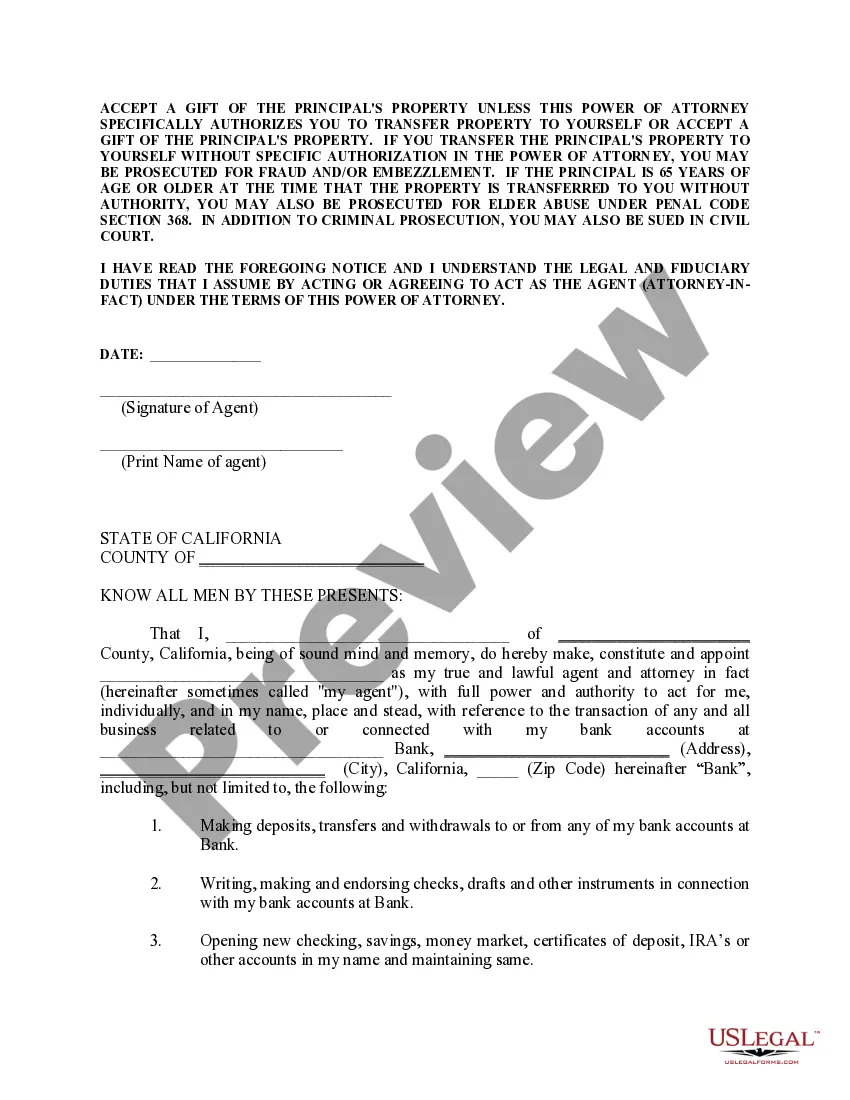

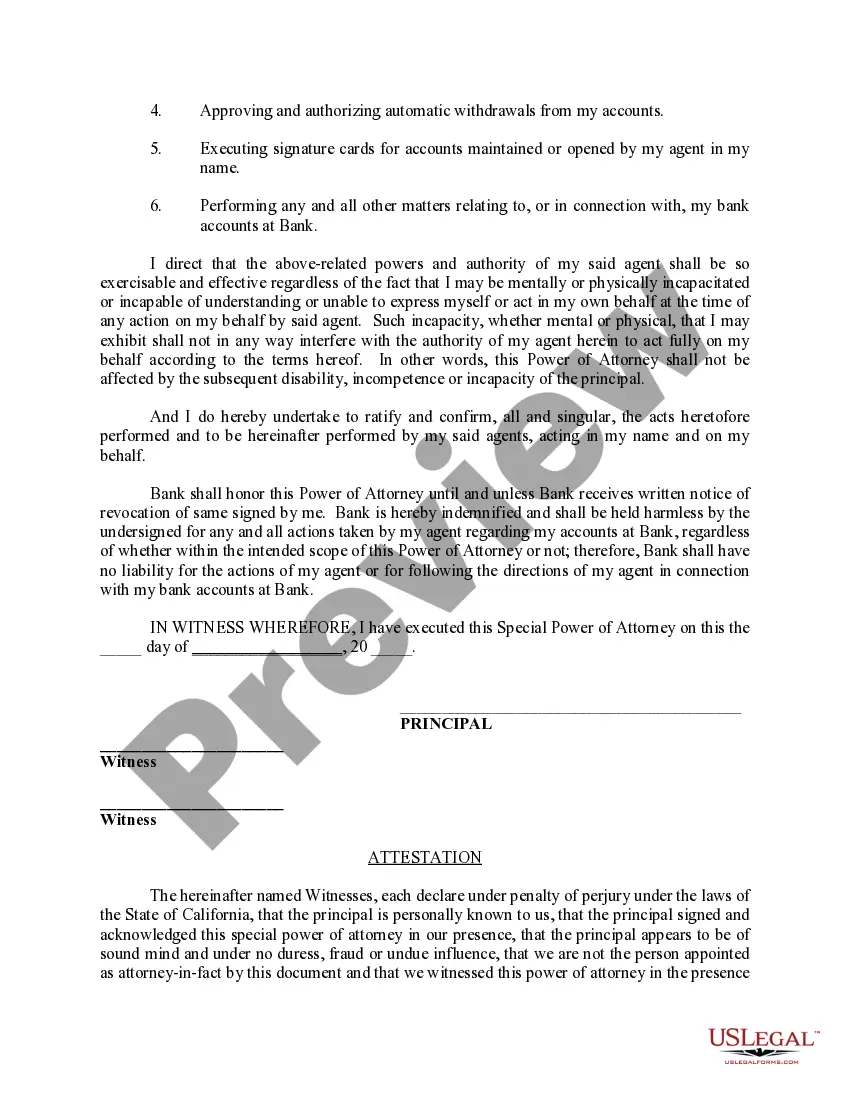

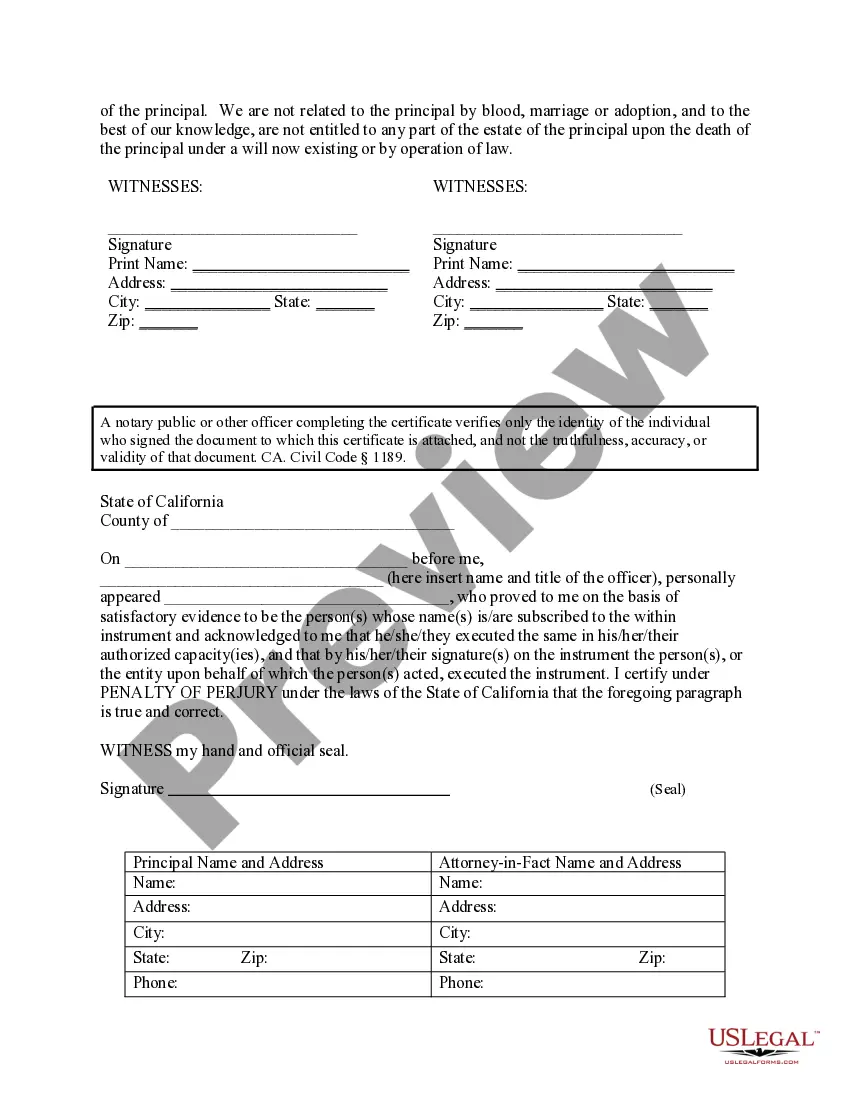

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

A Special Durable Power of Attorney for Bank Account Matters in Santa Ana, California is a legal document that grants a designated individual the authority to make financial decisions and transactions specifically pertaining to the bank accounts of the principal. This type of power of attorney can be particularly useful in situations where the principal is unable to manage their bank accounts due to illness, injury, or absence. The Santa Ana California Special Durable Power of Attorney for Bank Account Matters allows the appointed agent, also known as an attorney-in-fact, to access the principal's bank accounts, deposit or withdraw funds, transfer money between accounts, and perform other necessary transactions. The designated agent has a fiduciary duty to act in the best interest of the principal and must adhere to any specific instructions or limitations outlined in the power of attorney document. Different types of Santa Ana California Special Durable Power of Attorney for Bank Account Matters may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific and limited authority over the principal's bank accounts. The agent may only be allowed to perform certain transactions or handle specific accounts as specified in the document. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, a general special durable power of attorney provides the agent with broader powers and authority over all the principal's bank accounts. The agent can manage and conduct various financial transactions on behalf of the principal. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only when a specific event or condition occurs, such as the incapacity of the principal. In the case of a Springing Special Durable Power of Attorney for Bank Account Matters, the agent's authority is activated once the principal is deemed unable to manage their bank accounts. It is important to note that the specific terminology and requirements of a Special Durable Power of Attorney for Bank Account Matters can vary based on the laws and regulations of Santa Ana, California. It is advised to seek legal advice or utilize a reputable template to ensure the accurate creation and execution of this document.A Special Durable Power of Attorney for Bank Account Matters in Santa Ana, California is a legal document that grants a designated individual the authority to make financial decisions and transactions specifically pertaining to the bank accounts of the principal. This type of power of attorney can be particularly useful in situations where the principal is unable to manage their bank accounts due to illness, injury, or absence. The Santa Ana California Special Durable Power of Attorney for Bank Account Matters allows the appointed agent, also known as an attorney-in-fact, to access the principal's bank accounts, deposit or withdraw funds, transfer money between accounts, and perform other necessary transactions. The designated agent has a fiduciary duty to act in the best interest of the principal and must adhere to any specific instructions or limitations outlined in the power of attorney document. Different types of Santa Ana California Special Durable Power of Attorney for Bank Account Matters may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific and limited authority over the principal's bank accounts. The agent may only be allowed to perform certain transactions or handle specific accounts as specified in the document. 2. General Special Durable Power of Attorney for Bank Account Matters: In contrast to the limited power of attorney, a general special durable power of attorney provides the agent with broader powers and authority over all the principal's bank accounts. The agent can manage and conduct various financial transactions on behalf of the principal. 3. Springing Special Durable Power of Attorney for Bank Account Matters: A springing power of attorney becomes effective only when a specific event or condition occurs, such as the incapacity of the principal. In the case of a Springing Special Durable Power of Attorney for Bank Account Matters, the agent's authority is activated once the principal is deemed unable to manage their bank accounts. It is important to note that the specific terminology and requirements of a Special Durable Power of Attorney for Bank Account Matters can vary based on the laws and regulations of Santa Ana, California. It is advised to seek legal advice or utilize a reputable template to ensure the accurate creation and execution of this document.