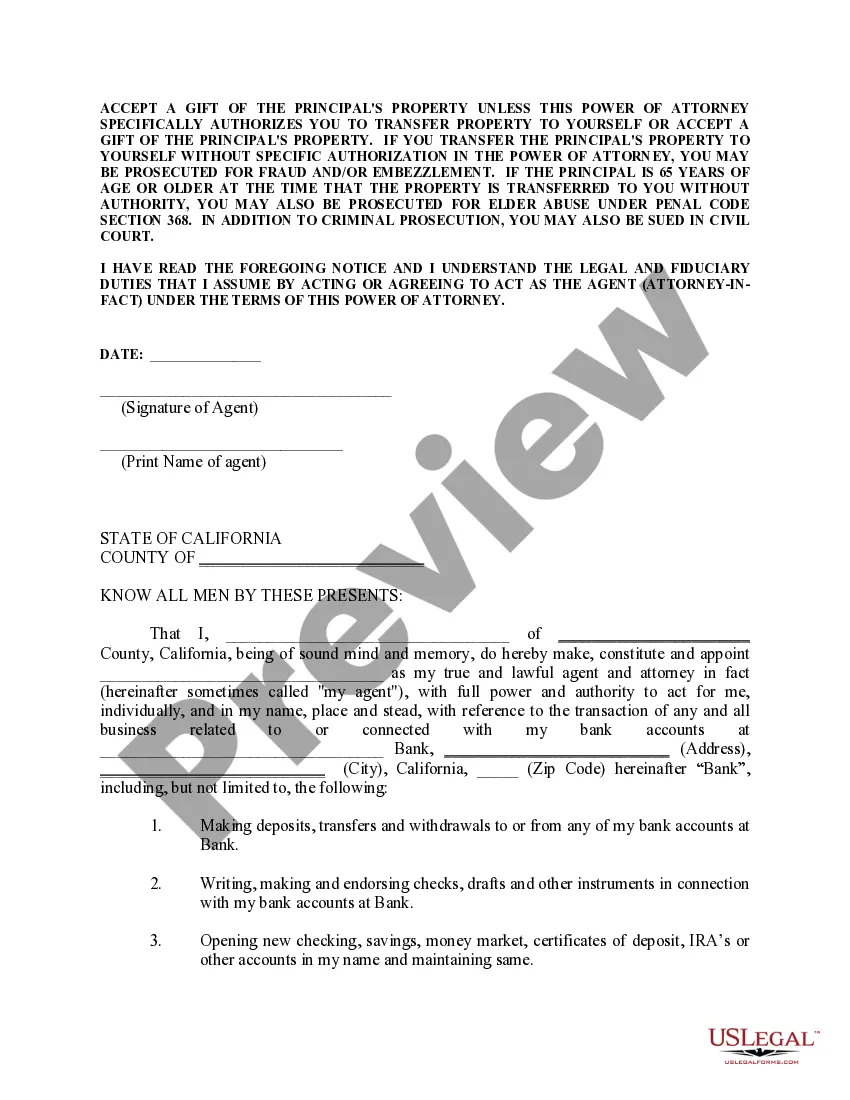

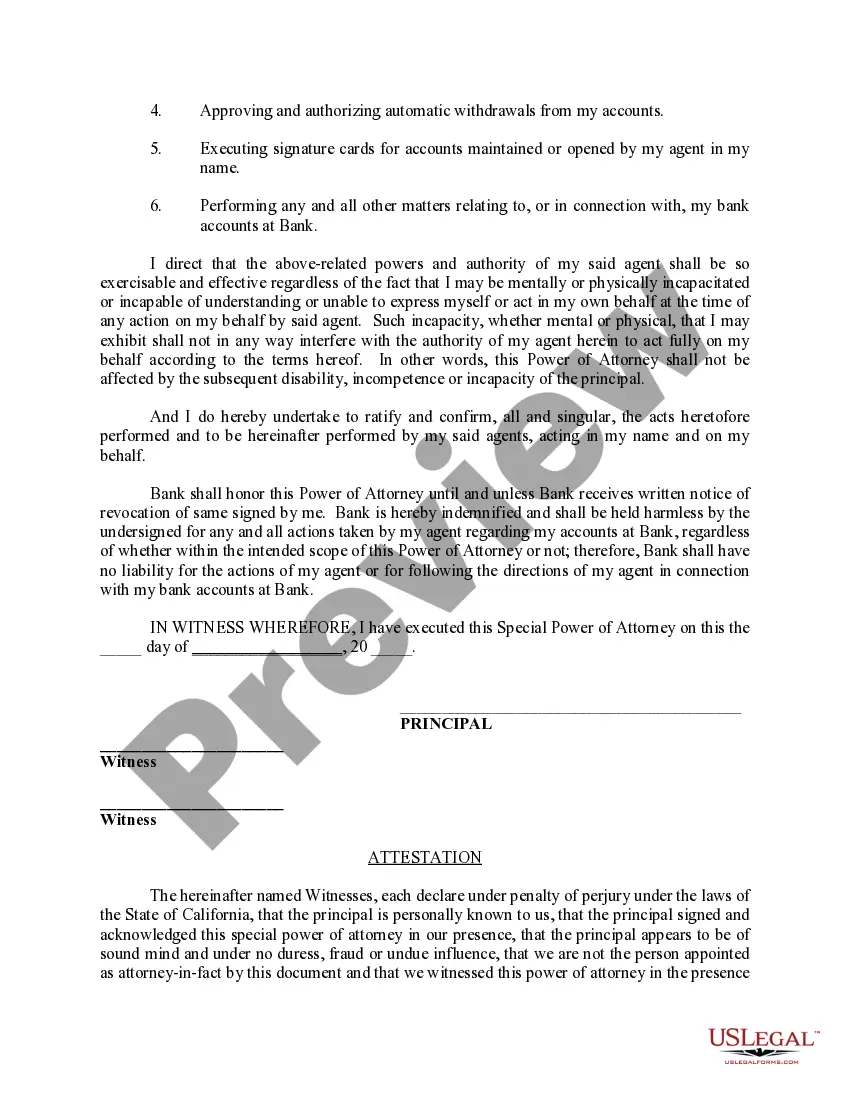

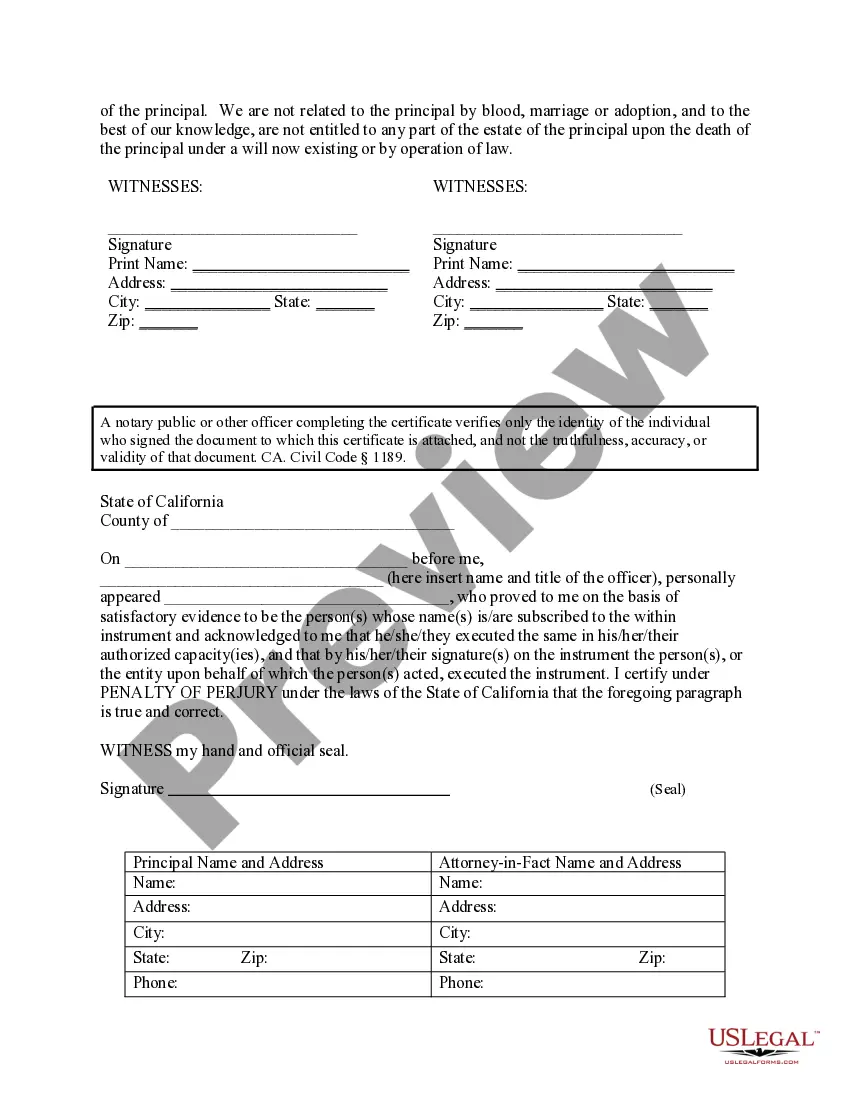

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

A Santa Maria California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual (known as the "attorney-in-fact" or "agent") the authority to make important banking decisions on behalf of another person (known as the "principal"). This type of power of attorney specifically focuses on matters related to bank accounts and provides the agent with the ability to carry out various actions. The Santa Maria California Special Durable Power of Attorney for Bank Account Matters enables the agent to handle the principal's financial affairs, including but not limited to: managing bank accounts, depositing and withdrawing funds, paying bills, transferring funds between accounts, accessing safe deposit boxes, authorizing wire transfers, and signing checks. The agent is responsible for acting in the best interest of the principal when making these financial decisions. There are multiple variations of the Santa Maria California Special Durable Power of Attorney for Bank Account Matters, each addressing specific circumstances and granting different levels of authority. These variations may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific powers for a limited period or specific transactions related to bank account matters. It provides focused authority for a specific purpose without granting broad control over all financial matters. 2. General Special Durable Power of Attorney for Bank Account Matters: This version provides the agent with broad authority to handle all bank account matters on behalf of the principal. It allows the agent to manage the principal's financial affairs comprehensively and without limitations. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only if a specific event or condition occurs, for example, the principal becoming incapacitated or unable to make financial decisions. It ensures that the agent's authority is activated under specific circumstances. When drafting a Santa Maria California Special Durable Power of Attorney for Bank Account Matters, it is crucial to include relevant details such as the names and addresses of both the principal and the chosen agent. Additionally, the document should specify the specific powers granted to the agent, any limitations on their authority, and any conditions necessary for the activation of the power of attorney, if applicable. Creating a Santa Maria California Special Durable Power of Attorney for Bank Account Matters is a significant legal step that should be thoroughly understood by all parties involved. Consulting with an experienced attorney is highly recommended ensuring the document accurately reflects the principal's intentions and complies with applicable laws.A Santa Maria California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an individual (known as the "attorney-in-fact" or "agent") the authority to make important banking decisions on behalf of another person (known as the "principal"). This type of power of attorney specifically focuses on matters related to bank accounts and provides the agent with the ability to carry out various actions. The Santa Maria California Special Durable Power of Attorney for Bank Account Matters enables the agent to handle the principal's financial affairs, including but not limited to: managing bank accounts, depositing and withdrawing funds, paying bills, transferring funds between accounts, accessing safe deposit boxes, authorizing wire transfers, and signing checks. The agent is responsible for acting in the best interest of the principal when making these financial decisions. There are multiple variations of the Santa Maria California Special Durable Power of Attorney for Bank Account Matters, each addressing specific circumstances and granting different levels of authority. These variations may include: 1. Limited Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney grants the agent specific powers for a limited period or specific transactions related to bank account matters. It provides focused authority for a specific purpose without granting broad control over all financial matters. 2. General Special Durable Power of Attorney for Bank Account Matters: This version provides the agent with broad authority to handle all bank account matters on behalf of the principal. It allows the agent to manage the principal's financial affairs comprehensively and without limitations. 3. Springing Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only if a specific event or condition occurs, for example, the principal becoming incapacitated or unable to make financial decisions. It ensures that the agent's authority is activated under specific circumstances. When drafting a Santa Maria California Special Durable Power of Attorney for Bank Account Matters, it is crucial to include relevant details such as the names and addresses of both the principal and the chosen agent. Additionally, the document should specify the specific powers granted to the agent, any limitations on their authority, and any conditions necessary for the activation of the power of attorney, if applicable. Creating a Santa Maria California Special Durable Power of Attorney for Bank Account Matters is a significant legal step that should be thoroughly understood by all parties involved. Consulting with an experienced attorney is highly recommended ensuring the document accurately reflects the principal's intentions and complies with applicable laws.