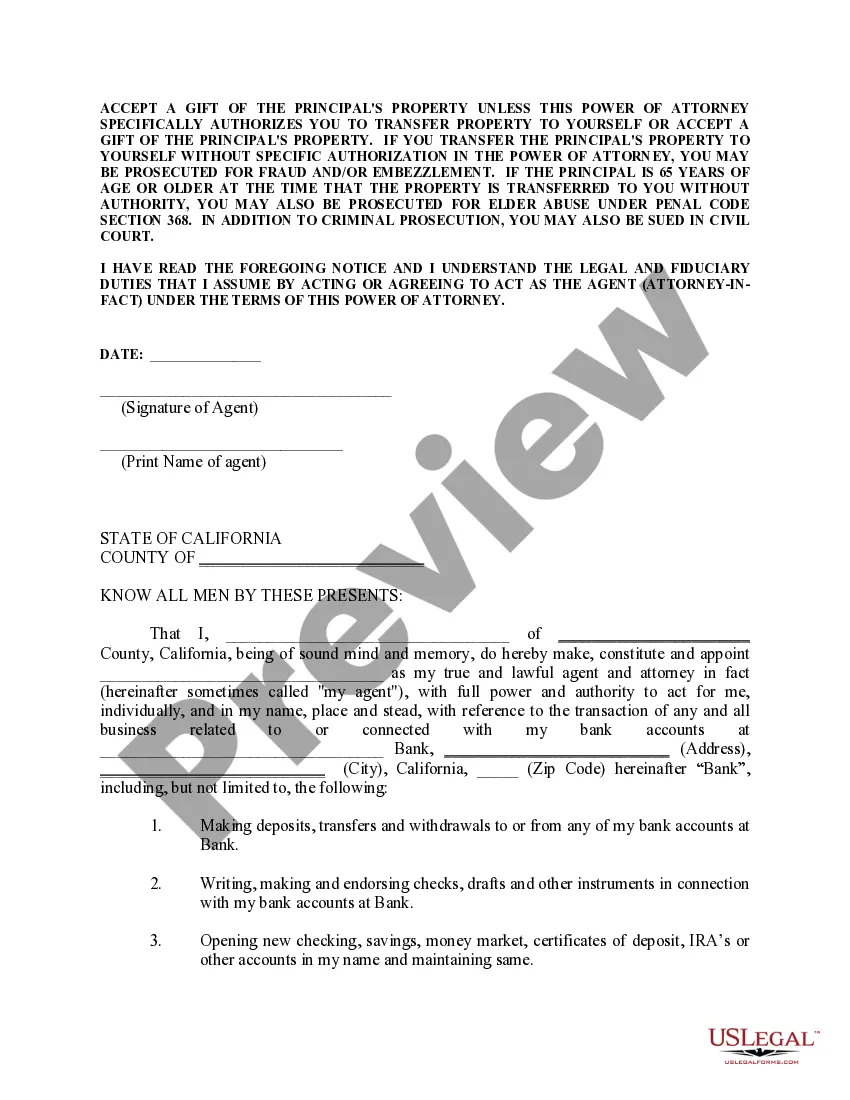

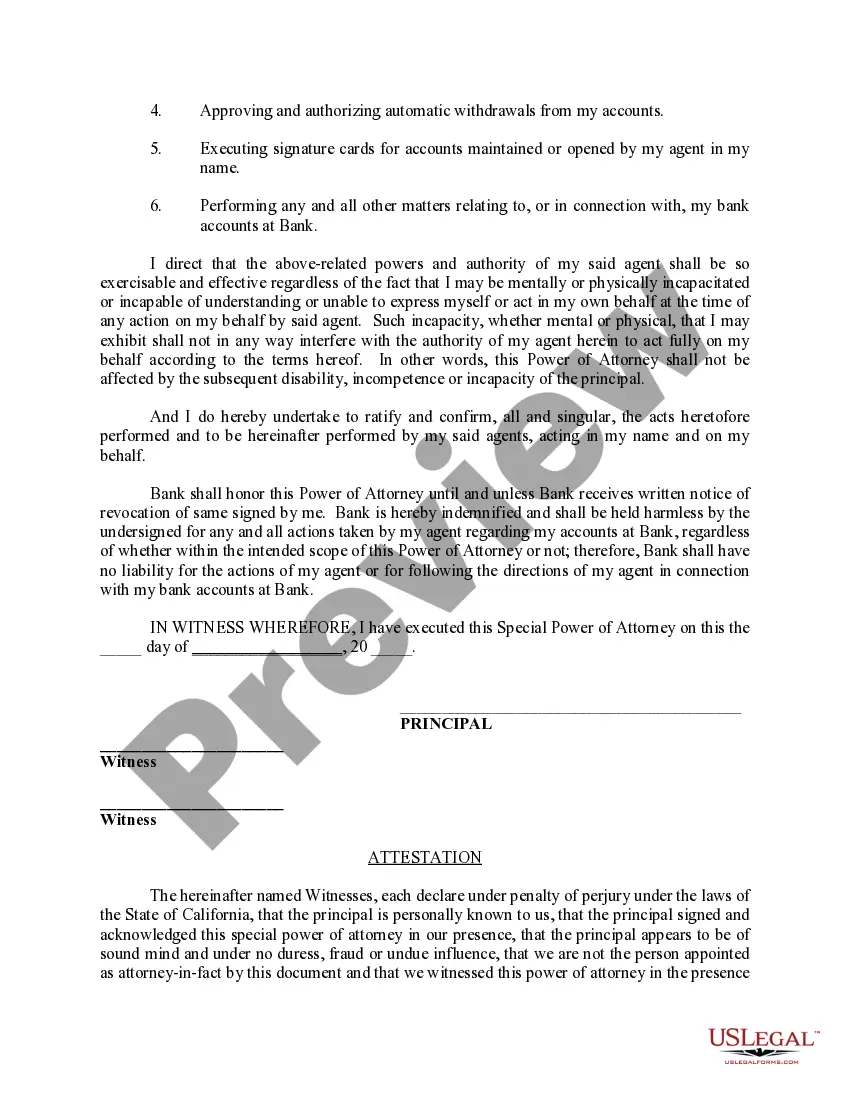

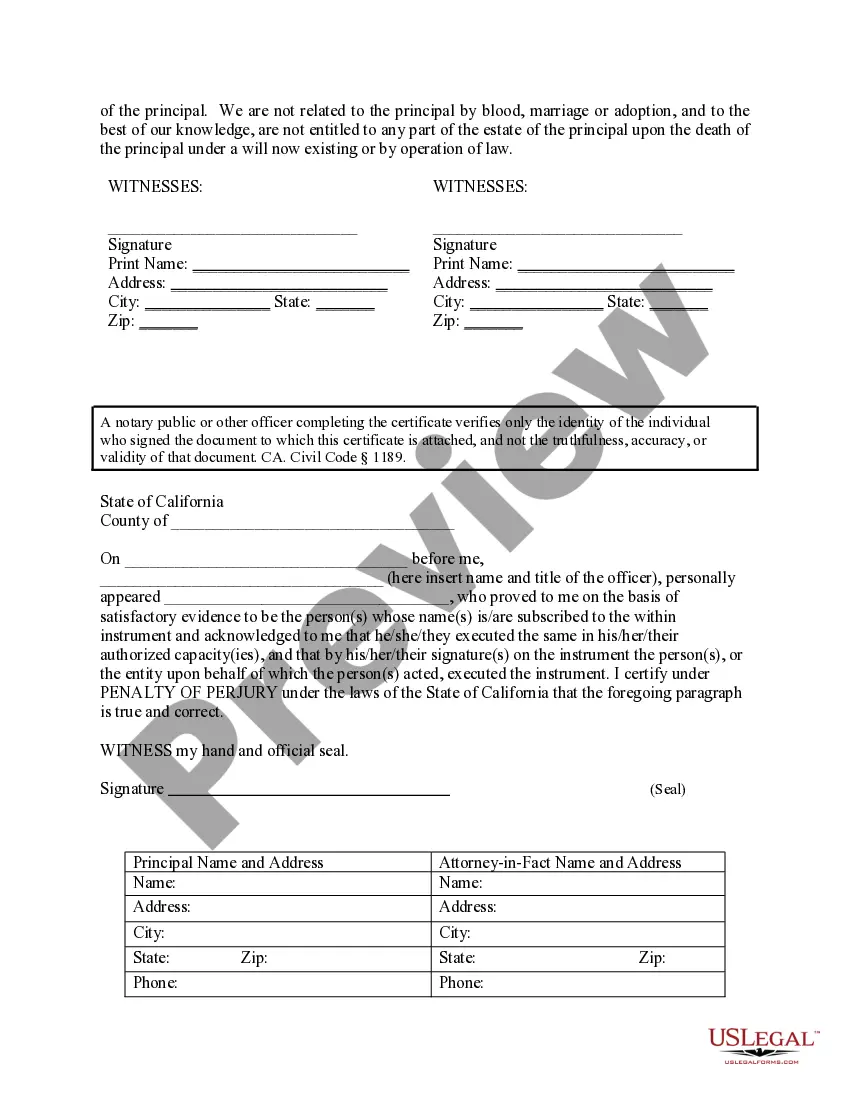

This special or limited power of attorney is for your agent to handle bank account matters for you, including, making deposits, writing checks, opening accounts, etc. A limited power of attorney allows the principal to give only specific powers to the agent. The limited power of attorney is used to allow the agent to handle specific matters when the principal is unavailable or unable to do so.

Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an appointed individual the authority to handle specific bank account matters on behalf of another person. This specialized power of attorney ensures that the designated person, known as the agent or attorney-in-fact, can make decisions and perform actions related to the principal's bank accounts, even if the principal becomes incapacitated. Keywords: Thousand Oaks California, special durable power of attorney, bank account matters, legal document, appointed individual, authority, handle, specific, decisions, actions, incapacitated. Different Types of Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters include: 1. General Special Durable Power of Attorney for Bank Account Matters: This grants the agent broad powers to manage all aspects of the principal's bank accounts, including making deposits, withdrawals, transfers, and handling other financial transactions. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This narrows down the authority of the agent to specific bank account matters. It may only allow the agent to perform certain actions, such as paying bills, managing investments, or handling loan payments. 3. Specific Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney focuses on a single bank account or a group of accounts held by the principal. It grants the agent authority solely for those accounts, whether it's monitoring balances, reconciling statements, or executing transactions. 4. Temporal Special Durable Power of Attorney for Bank Account Matters: This specifies a defined time period during which the agent's authority is valid. It could be useful if the principal needs assistance with bank account matters for a temporary period, such as during an extended vacation or in case of hospitalization. 5. Contingent Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only if certain conditions or events occur. For example, it may come into effect if the principal becomes incapacitated or is unable to manage their bank accounts. 6. Springing Special Durable Power of Attorney for Bank Account Matters: Similar to the contingent power of attorney, this also becomes effective under specific circumstances. However, this type requires a triggering event, such as a physician's declaration of the principal's incapacity, before the agent can exercise their authority. In conclusion, Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that allows a designated individual to handle various bank account matters on behalf of another person. Different types of this power of attorney provide varying levels and scopes of authority, ensuring the principal's financial affairs are appropriately managed.Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters is a legal document that grants an appointed individual the authority to handle specific bank account matters on behalf of another person. This specialized power of attorney ensures that the designated person, known as the agent or attorney-in-fact, can make decisions and perform actions related to the principal's bank accounts, even if the principal becomes incapacitated. Keywords: Thousand Oaks California, special durable power of attorney, bank account matters, legal document, appointed individual, authority, handle, specific, decisions, actions, incapacitated. Different Types of Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters include: 1. General Special Durable Power of Attorney for Bank Account Matters: This grants the agent broad powers to manage all aspects of the principal's bank accounts, including making deposits, withdrawals, transfers, and handling other financial transactions. 2. Limited Special Durable Power of Attorney for Bank Account Matters: This narrows down the authority of the agent to specific bank account matters. It may only allow the agent to perform certain actions, such as paying bills, managing investments, or handling loan payments. 3. Specific Special Durable Power of Attorney for Bank Account Matters: This type of power of attorney focuses on a single bank account or a group of accounts held by the principal. It grants the agent authority solely for those accounts, whether it's monitoring balances, reconciling statements, or executing transactions. 4. Temporal Special Durable Power of Attorney for Bank Account Matters: This specifies a defined time period during which the agent's authority is valid. It could be useful if the principal needs assistance with bank account matters for a temporary period, such as during an extended vacation or in case of hospitalization. 5. Contingent Special Durable Power of Attorney for Bank Account Matters: This power of attorney becomes effective only if certain conditions or events occur. For example, it may come into effect if the principal becomes incapacitated or is unable to manage their bank accounts. 6. Springing Special Durable Power of Attorney for Bank Account Matters: Similar to the contingent power of attorney, this also becomes effective under specific circumstances. However, this type requires a triggering event, such as a physician's declaration of the principal's incapacity, before the agent can exercise their authority. In conclusion, Thousand Oaks California Special Durable Power of Attorney for Bank Account Matters is a crucial legal tool that allows a designated individual to handle various bank account matters on behalf of another person. Different types of this power of attorney provide varying levels and scopes of authority, ensuring the principal's financial affairs are appropriately managed.