Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

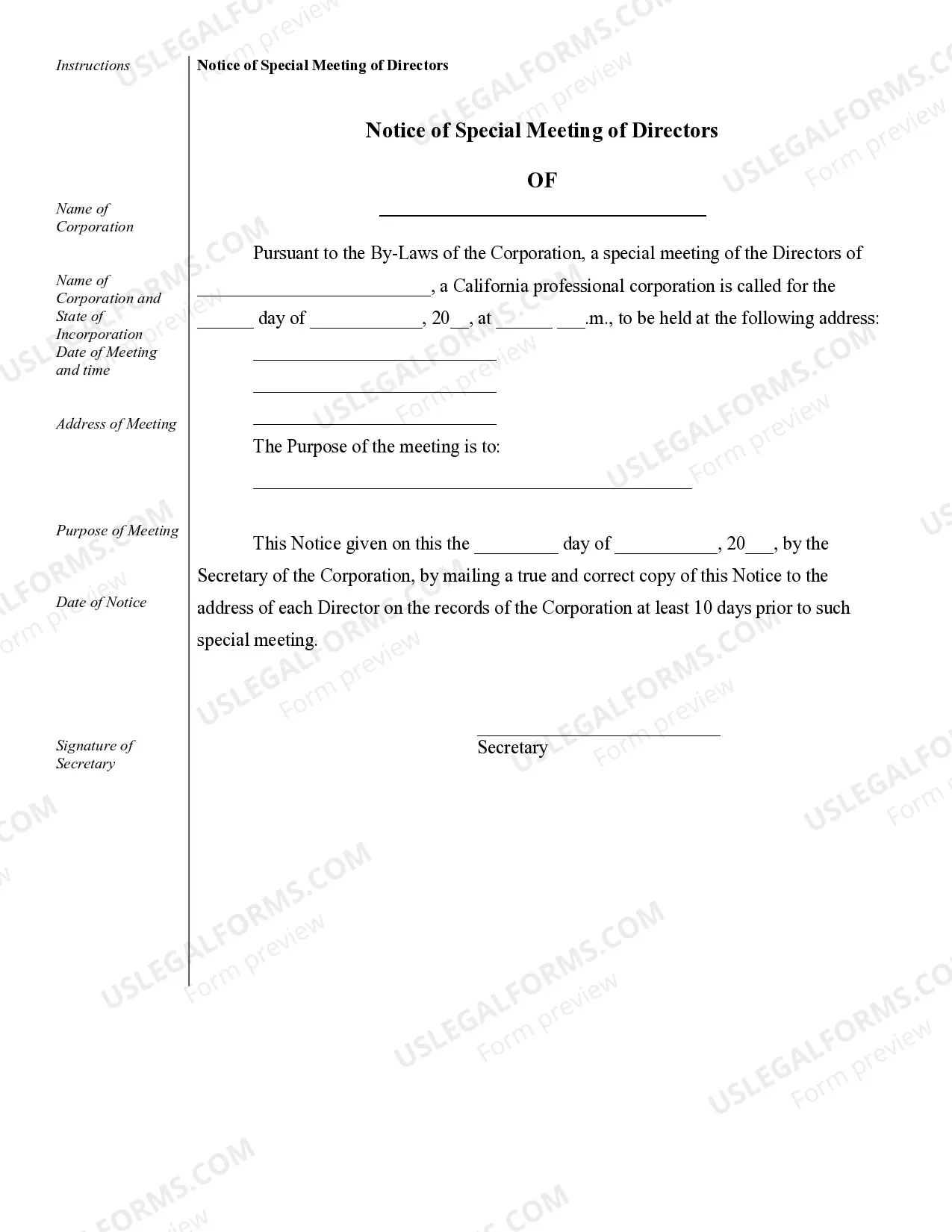

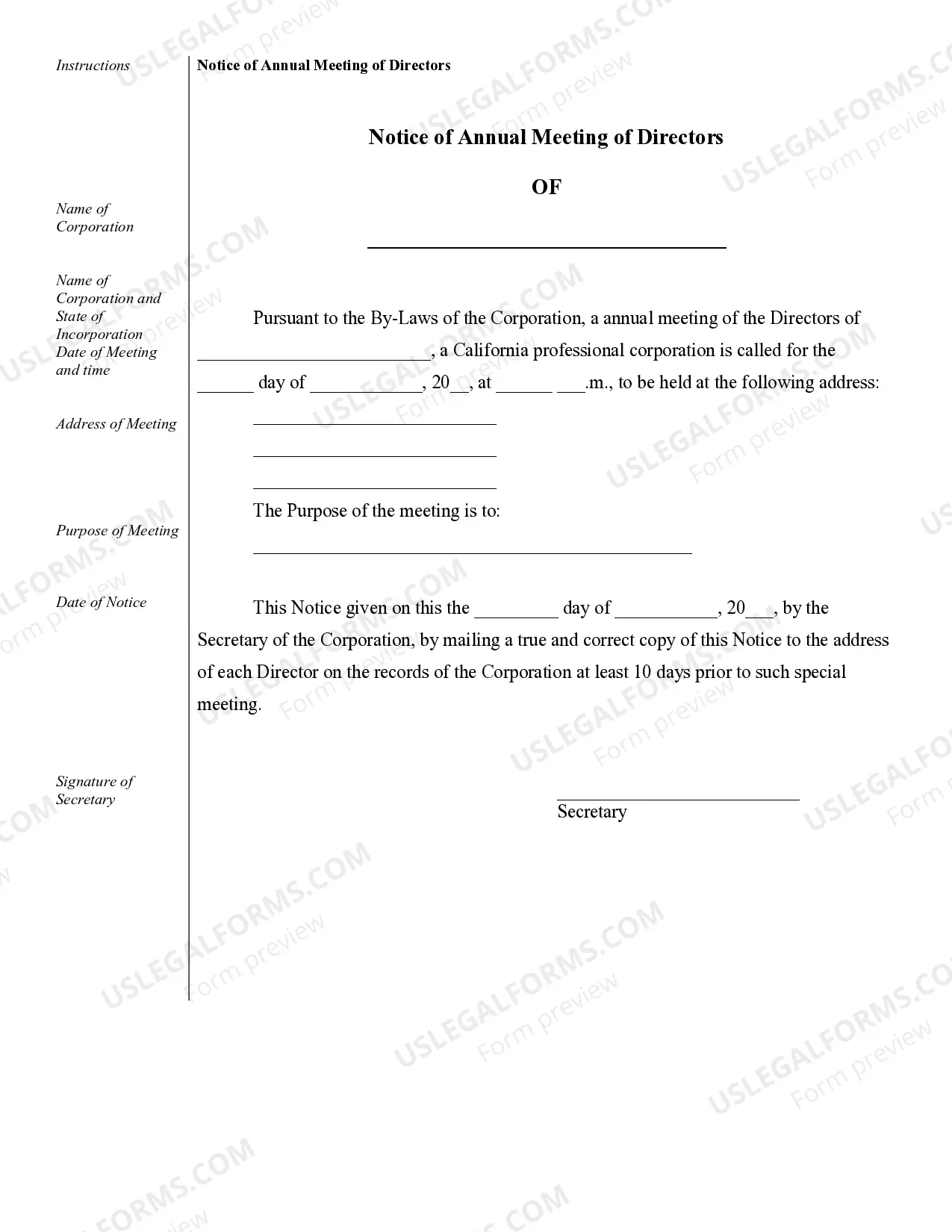

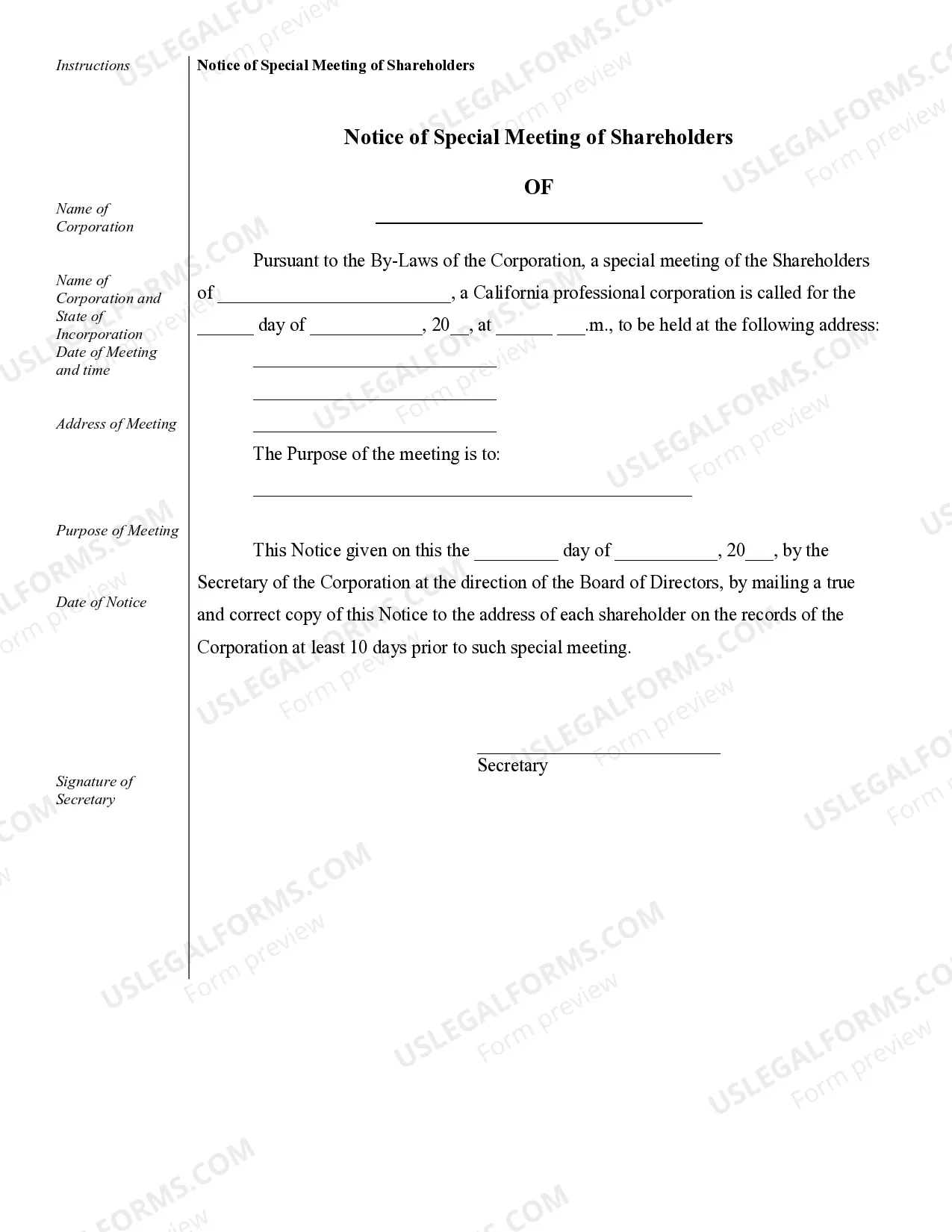

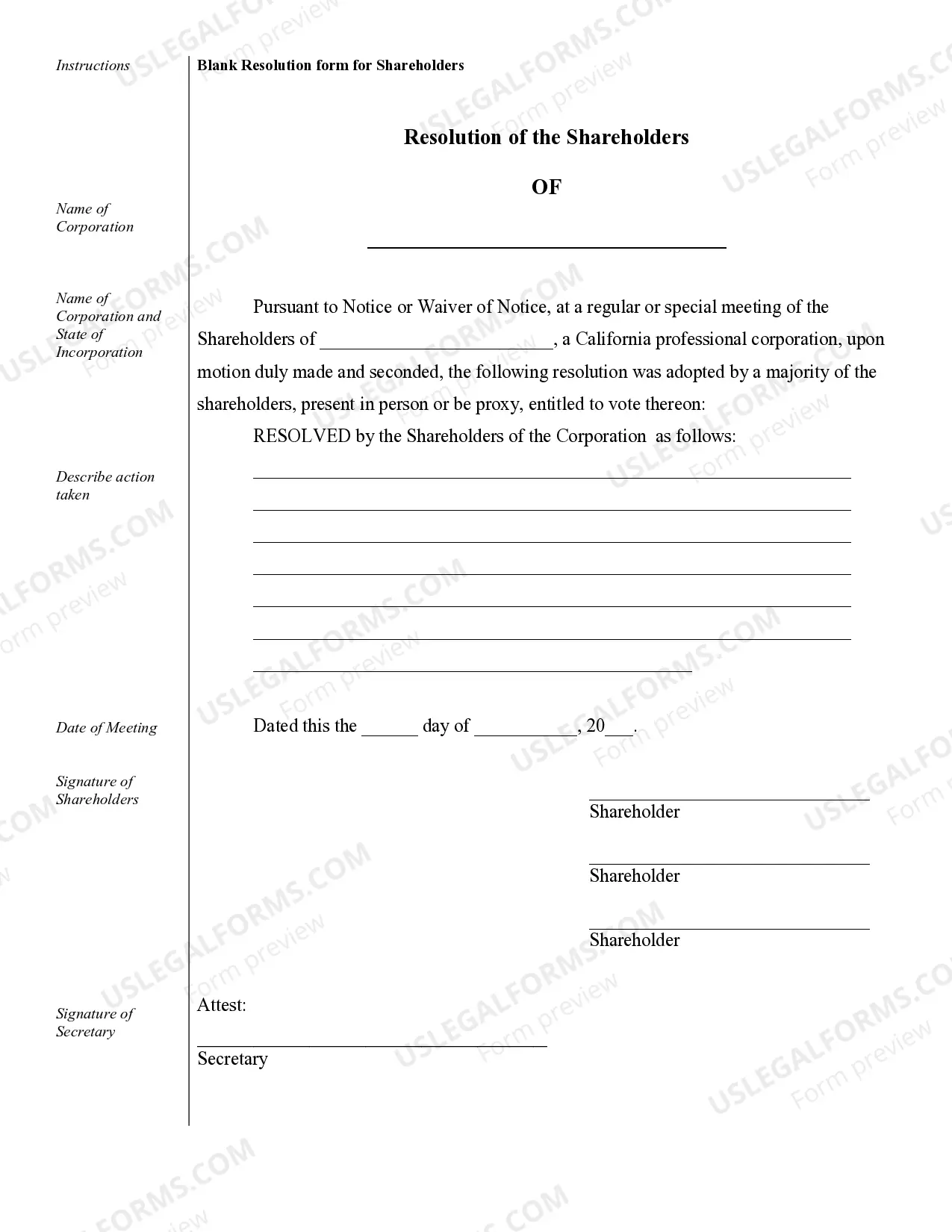

Antioch Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive record of the activities, decisions, and transactions of a professional corporation. These records serve as vital evidence of the corporation's compliance with legal requirements and its adherence to corporate governance principles. They are crucial for maintaining transparency and ensuring accountability within the organization. Here, we discuss various types of Antioch Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation is a foundational document that establishes the professional corporation as a legal entity. It includes crucial information such as the company's name, purpose, duration, principal place of business, and the names and addresses of the initial directors and officers. 2. Bylaws: Bylaws outline the operational framework and rules that govern the corporation's internal affairs. They define the corporation's board structure, officer positions, meeting procedures, voting rights, and other essential governance provisions. 3. Meeting Minutes: Meeting minutes provide a detailed account of discussions, decisions, and actions taken during board of directors and shareholder meetings. These records include information about attendees, topics discussed, votes taken, and resolutions adopted. 4. Shareholder Agreements: Shareholder agreements set out the rights, responsibilities, and obligations of the corporation's shareholders. They define issues related to ownership, transfer of shares, dispute resolution, and the role of shareholders in decision-making processes. 5. Director Resolutions: Director resolutions document significant decisions made by the board of directors outside regular meetings. These resolutions may cover matters such as the appointment or removal of officers, approval of contracts, amendments to bylaws, or changes in the corporation's capital structure. 6. Stock Ledger: The stock ledger provides a detailed record of all shares issued by the corporation, including information about shareholders' names, addresses, and share ownership. It ensures proper record-keeping of ownership interests and facilitates the transfer or sale of shares. 7. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, present the financial performance and position of the professional corporation. These records help stakeholders assess the corporation's profitability, liquidity, and overall financial health. 8. Annual Reports: Professional corporations in California are required to file annual reports with the Secretary of State. These reports disclose key information about the corporation's directors, officers, and registered agent, ensuring transparency and compliance with state regulations. Maintaining accurate, up-to-date, and complete corporate records is crucial for a California Professional Corporation. These records assist in audits, legal disputes, mergers and acquisitions, and provide evidence of corporate compliance and good governance practices.Antioch Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive record of the activities, decisions, and transactions of a professional corporation. These records serve as vital evidence of the corporation's compliance with legal requirements and its adherence to corporate governance principles. They are crucial for maintaining transparency and ensuring accountability within the organization. Here, we discuss various types of Antioch Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation is a foundational document that establishes the professional corporation as a legal entity. It includes crucial information such as the company's name, purpose, duration, principal place of business, and the names and addresses of the initial directors and officers. 2. Bylaws: Bylaws outline the operational framework and rules that govern the corporation's internal affairs. They define the corporation's board structure, officer positions, meeting procedures, voting rights, and other essential governance provisions. 3. Meeting Minutes: Meeting minutes provide a detailed account of discussions, decisions, and actions taken during board of directors and shareholder meetings. These records include information about attendees, topics discussed, votes taken, and resolutions adopted. 4. Shareholder Agreements: Shareholder agreements set out the rights, responsibilities, and obligations of the corporation's shareholders. They define issues related to ownership, transfer of shares, dispute resolution, and the role of shareholders in decision-making processes. 5. Director Resolutions: Director resolutions document significant decisions made by the board of directors outside regular meetings. These resolutions may cover matters such as the appointment or removal of officers, approval of contracts, amendments to bylaws, or changes in the corporation's capital structure. 6. Stock Ledger: The stock ledger provides a detailed record of all shares issued by the corporation, including information about shareholders' names, addresses, and share ownership. It ensures proper record-keeping of ownership interests and facilitates the transfer or sale of shares. 7. Financial Statements: Financial statements, including balance sheets, income statements, and cash flow statements, present the financial performance and position of the professional corporation. These records help stakeholders assess the corporation's profitability, liquidity, and overall financial health. 8. Annual Reports: Professional corporations in California are required to file annual reports with the Secretary of State. These reports disclose key information about the corporation's directors, officers, and registered agent, ensuring transparency and compliance with state regulations. Maintaining accurate, up-to-date, and complete corporate records is crucial for a California Professional Corporation. These records assist in audits, legal disputes, mergers and acquisitions, and provide evidence of corporate compliance and good governance practices.