Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

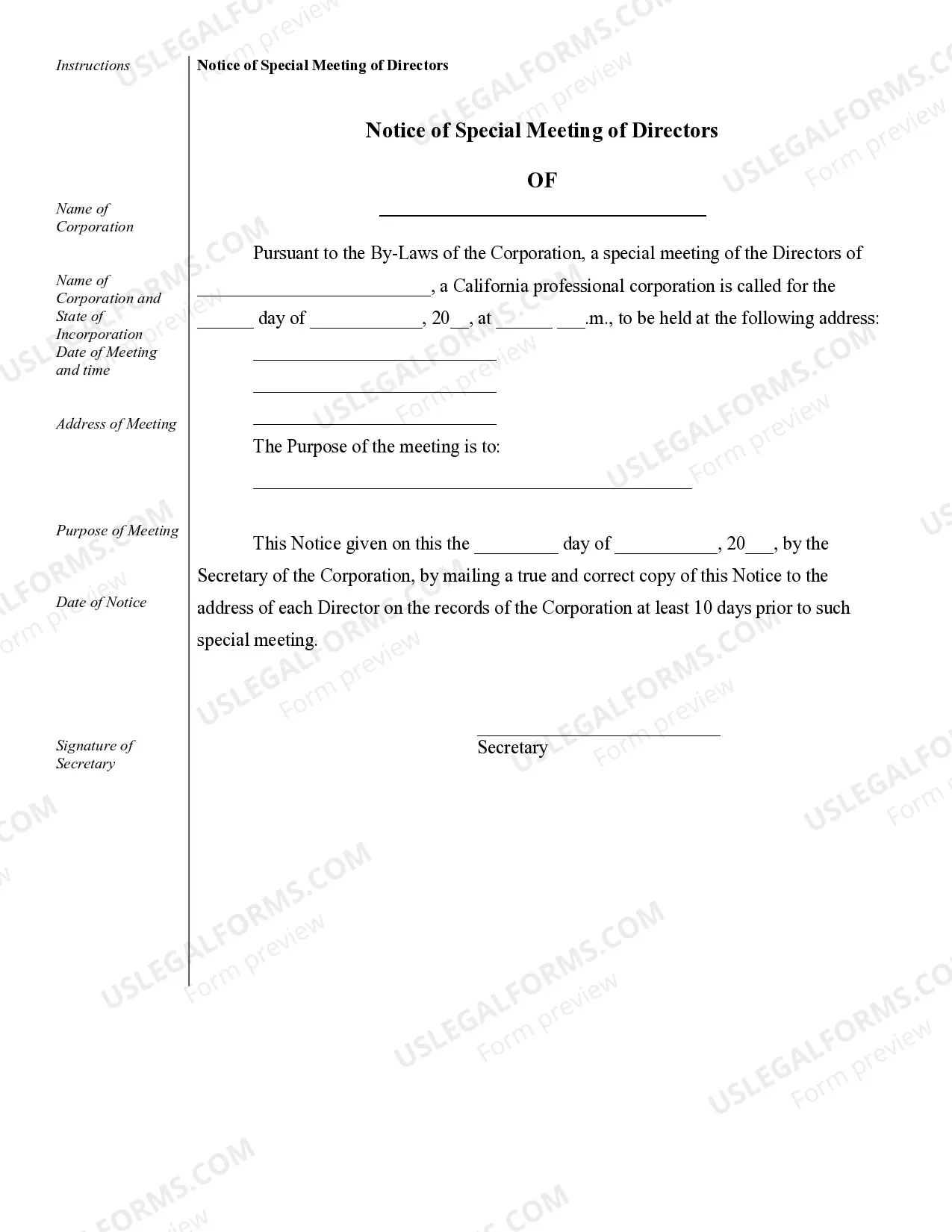

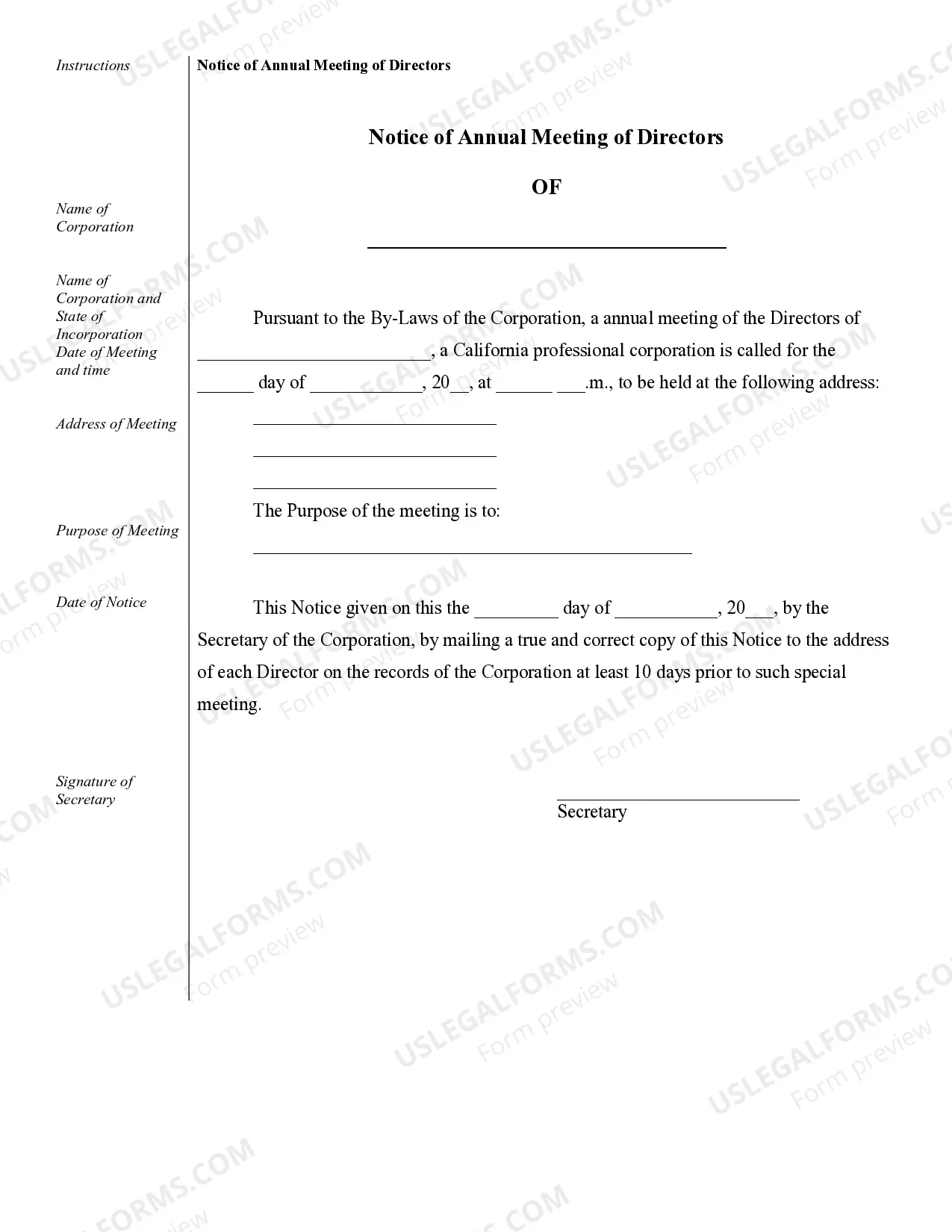

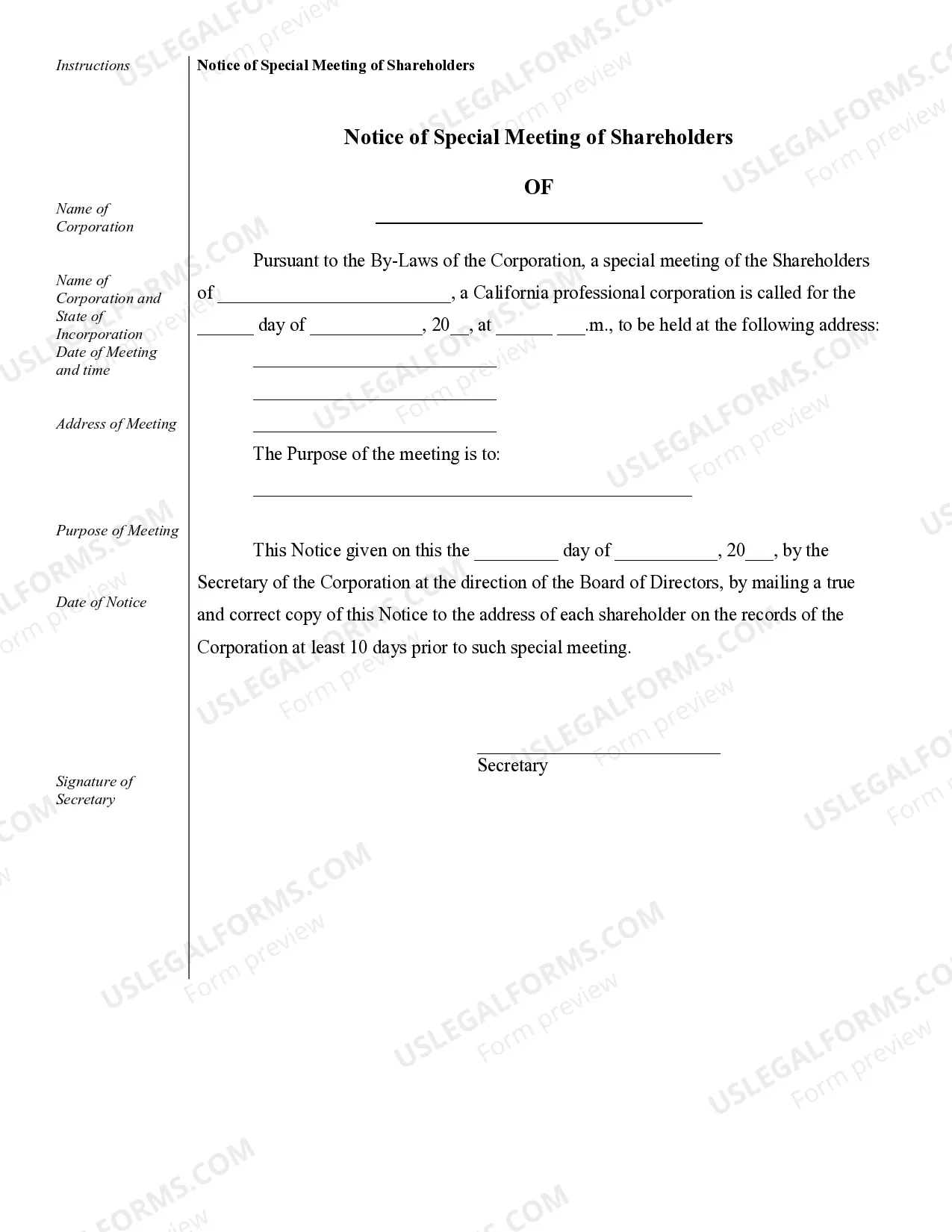

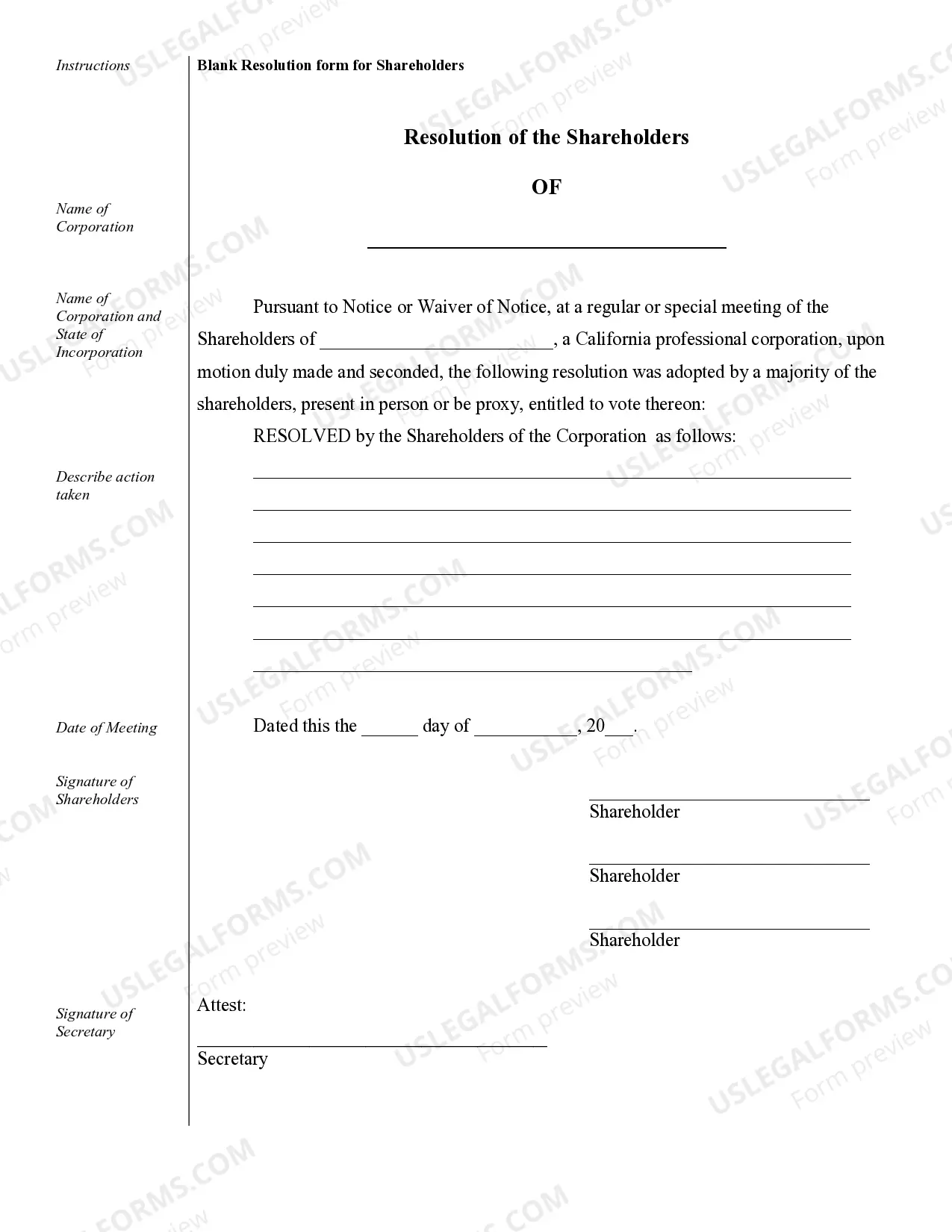

Concord Sample Corporate Records for a California Professional Corporation are essential documents that help maintain accurate and up-to-date records of a professional corporation's activities, decisions, and legal obligations in the state of California. These records serve as a crucial resource for the corporation's shareholders, directors, and officers, ensuring compliance with legal requirements and facilitating smooth operations. Here are some key types of Concord Sample Corporate Records commonly used for California Professional Corporations: 1. Articles of Incorporation: This is a foundational document that establishes the existence of the professional corporation and contains vital information such as the corporation's name, purpose, shares, registered agent, and the names of the initial directors. 2. Bylaws: These are the internal rules and regulations that govern the corporation's day-to-day operations, including procedures for holding meetings, electing directors and officers, voting rights, and other corporate governance matters. 3. Shareholder Agreements: These agreements outline the rights, responsibilities, and obligations of the corporation's shareholders, including restrictions on share transfers, buy-sell provisions, and dispute resolution mechanisms. 4. Minutes of Meetings: Detailed records of meetings held by the directors, shareholders, and committees of the corporation. These minutes document the discussions, decisions, and resolutions made during the meetings, and are crucial for legal compliance and transparency. 5. Stock Certificates and Ledgers: Stock certificates serve as evidence of ownership for shareholders, while stock ledgers record the issuance, transfer, and cancellation of shares. These records provide an accurate record of the corporation's share ownership. 6. Annual Reports: California Professional Corporations are required to file annual reports with the California Secretary of State, disclosing specific information about the corporation's status, business activities, and registered agent. 7. Resolutions and Consents: Written resolutions and consents document the corporation's authorized actions and decisions taken without convening a formal meeting. These records establish the legality of corporate actions and help minimize the need for unnecessary meetings. 8. Financial Records: Financial statements, tax returns, and accounting records should be maintained to ensure accurate financial reporting and compliance with tax regulations. It is important to note that the specific types of Corporate Records may vary depending on the nature of the professional corporation and its activities. Consulting with legal professionals specializing in corporate law is advisable to ensure compliance with all applicable laws and regulations in California.Concord Sample Corporate Records for a California Professional Corporation are essential documents that help maintain accurate and up-to-date records of a professional corporation's activities, decisions, and legal obligations in the state of California. These records serve as a crucial resource for the corporation's shareholders, directors, and officers, ensuring compliance with legal requirements and facilitating smooth operations. Here are some key types of Concord Sample Corporate Records commonly used for California Professional Corporations: 1. Articles of Incorporation: This is a foundational document that establishes the existence of the professional corporation and contains vital information such as the corporation's name, purpose, shares, registered agent, and the names of the initial directors. 2. Bylaws: These are the internal rules and regulations that govern the corporation's day-to-day operations, including procedures for holding meetings, electing directors and officers, voting rights, and other corporate governance matters. 3. Shareholder Agreements: These agreements outline the rights, responsibilities, and obligations of the corporation's shareholders, including restrictions on share transfers, buy-sell provisions, and dispute resolution mechanisms. 4. Minutes of Meetings: Detailed records of meetings held by the directors, shareholders, and committees of the corporation. These minutes document the discussions, decisions, and resolutions made during the meetings, and are crucial for legal compliance and transparency. 5. Stock Certificates and Ledgers: Stock certificates serve as evidence of ownership for shareholders, while stock ledgers record the issuance, transfer, and cancellation of shares. These records provide an accurate record of the corporation's share ownership. 6. Annual Reports: California Professional Corporations are required to file annual reports with the California Secretary of State, disclosing specific information about the corporation's status, business activities, and registered agent. 7. Resolutions and Consents: Written resolutions and consents document the corporation's authorized actions and decisions taken without convening a formal meeting. These records establish the legality of corporate actions and help minimize the need for unnecessary meetings. 8. Financial Records: Financial statements, tax returns, and accounting records should be maintained to ensure accurate financial reporting and compliance with tax regulations. It is important to note that the specific types of Corporate Records may vary depending on the nature of the professional corporation and its activities. Consulting with legal professionals specializing in corporate law is advisable to ensure compliance with all applicable laws and regulations in California.