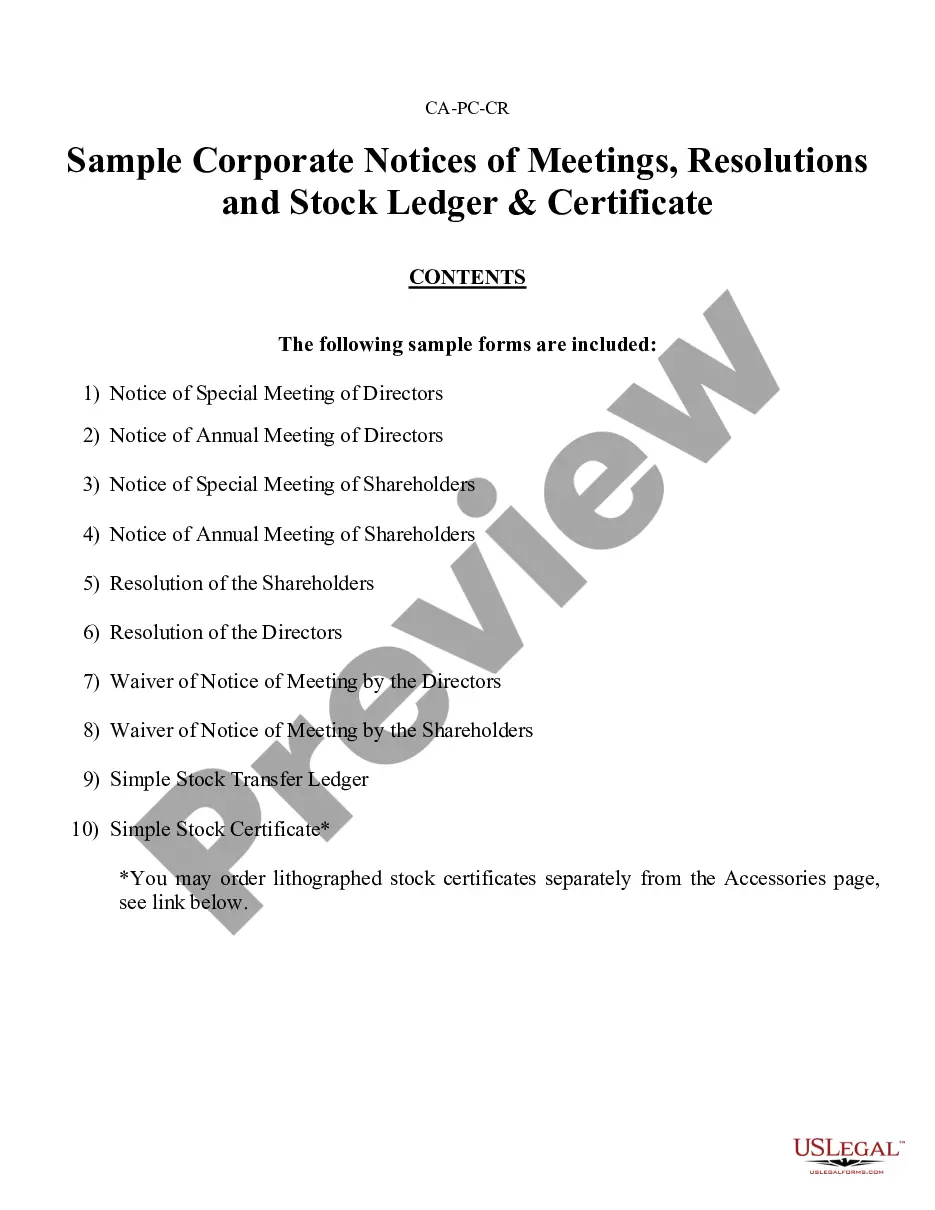

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

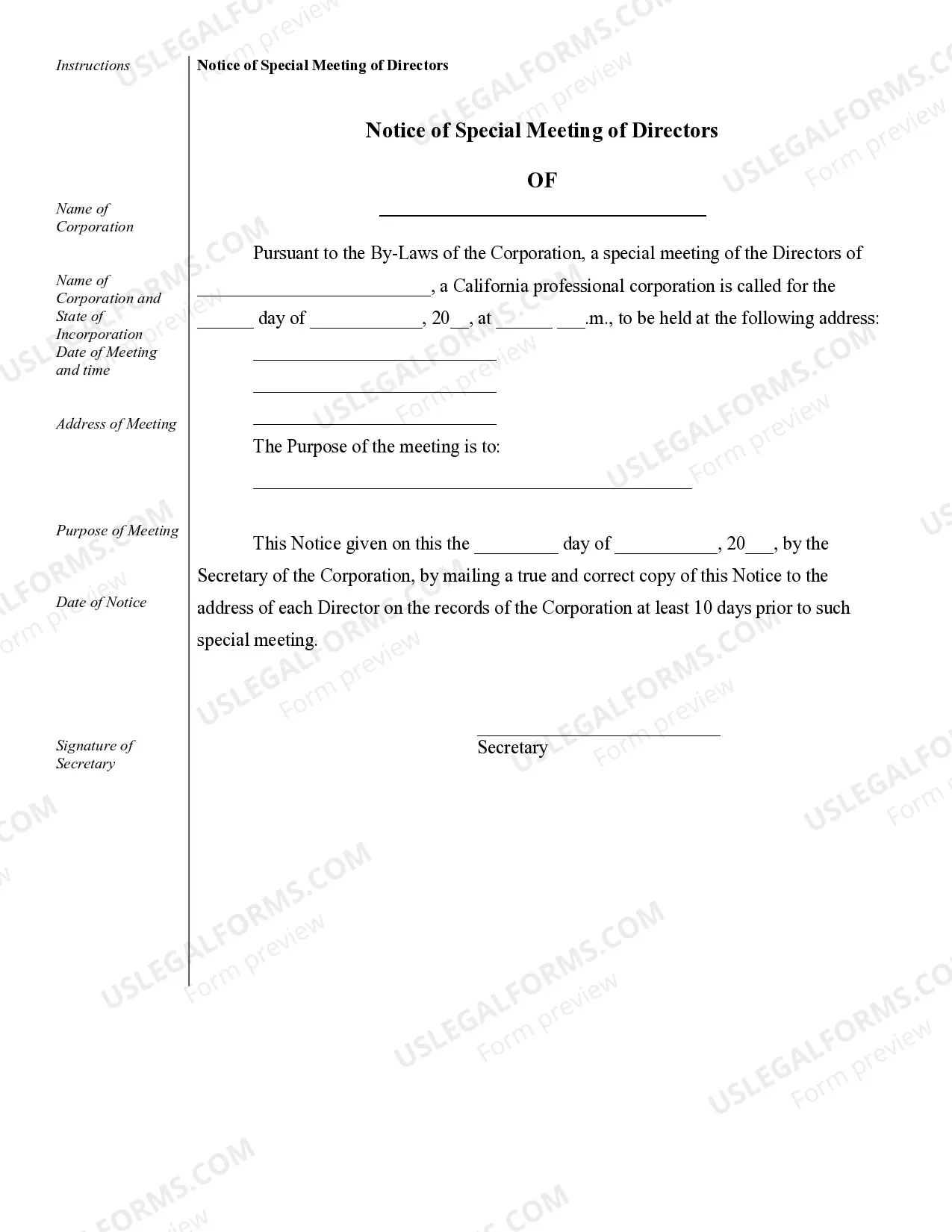

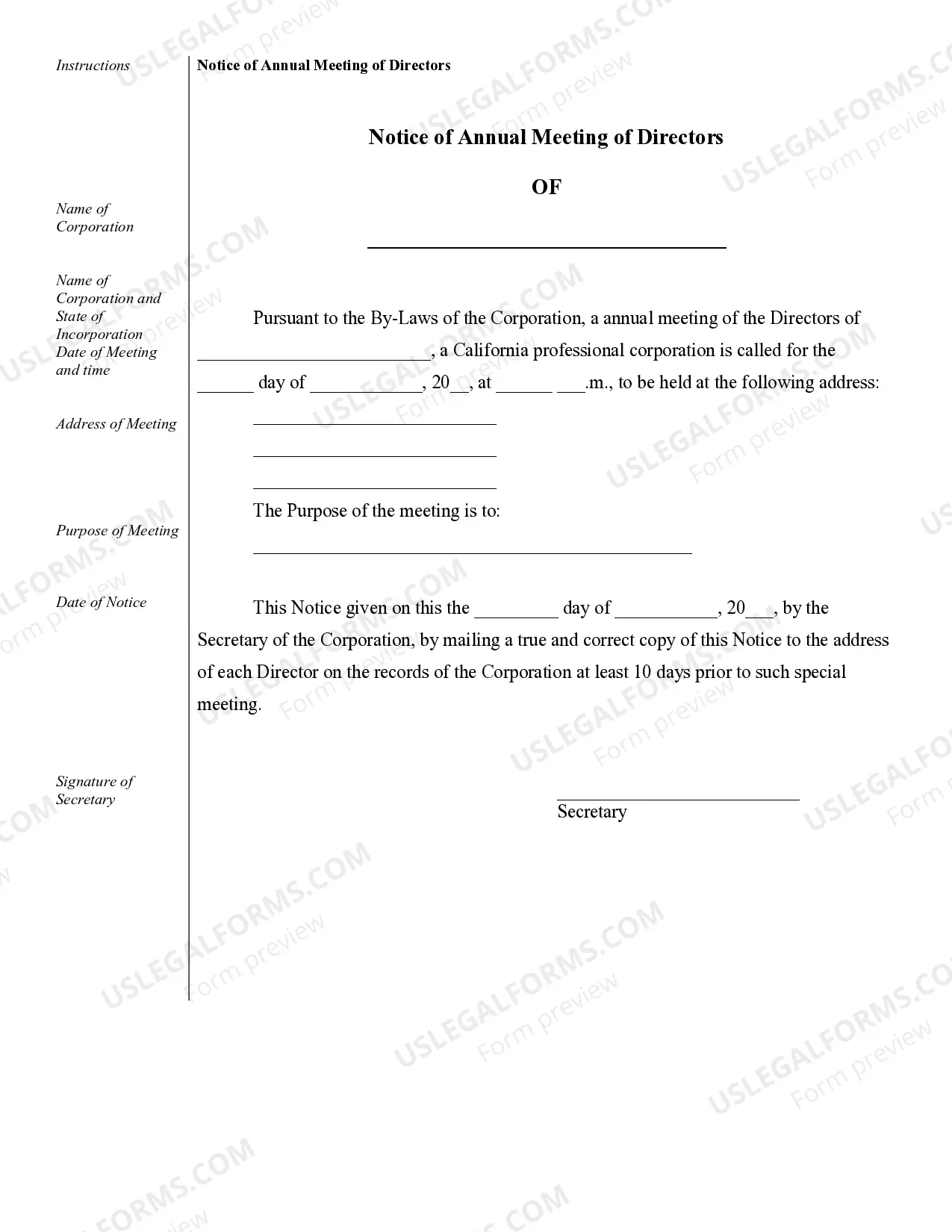

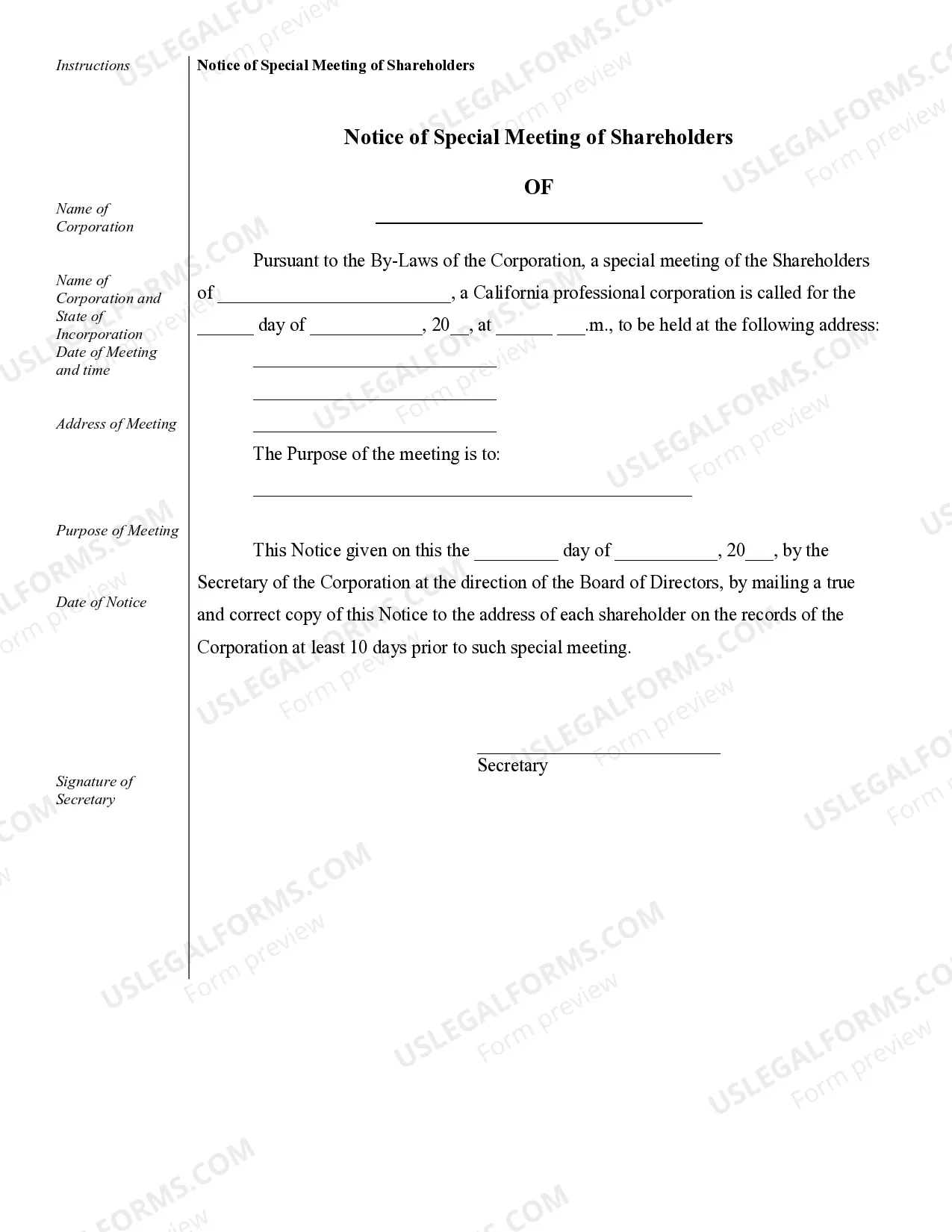

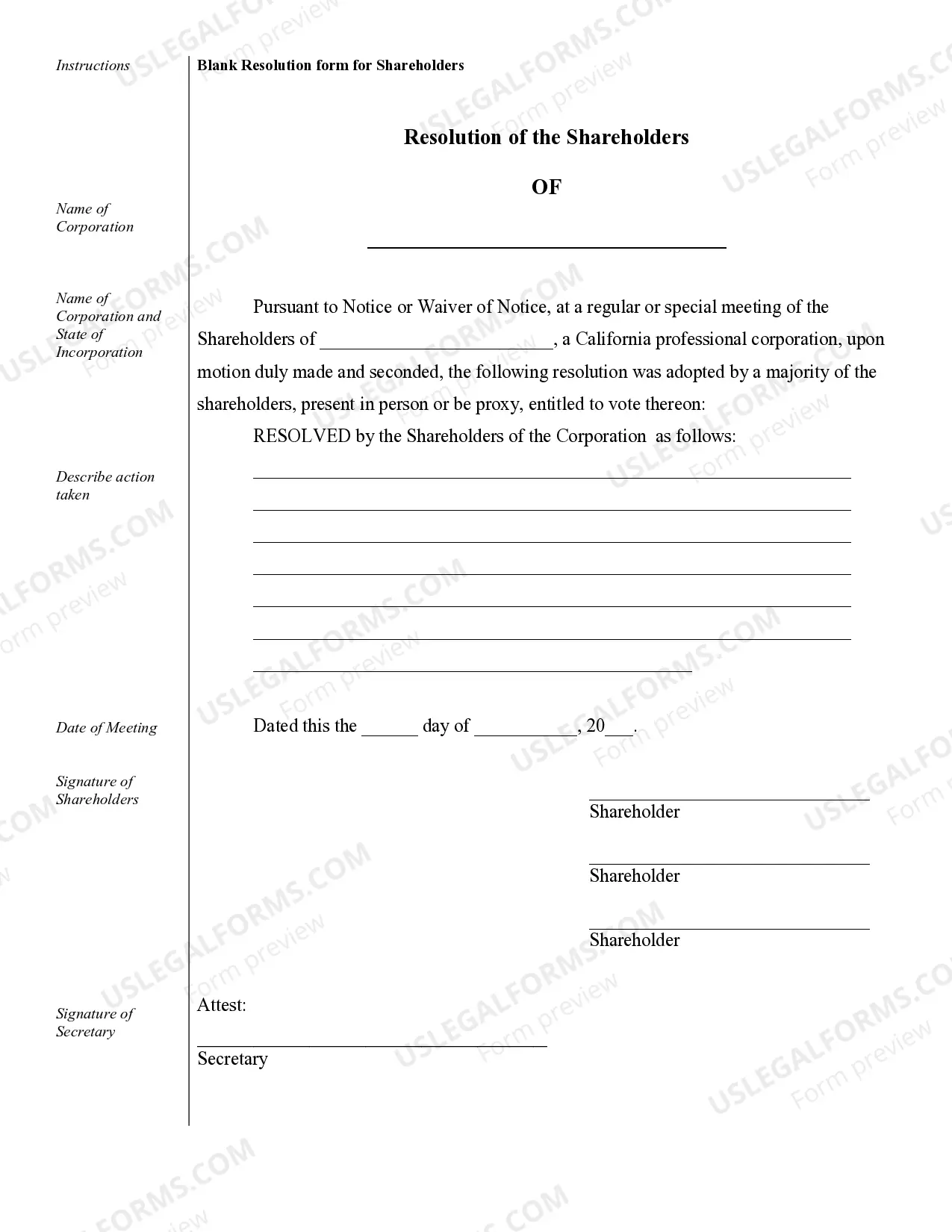

Elk Grove Sample Corporate Records for a California Professional Corporation are essential documents that outline the various administrative, legal, and financial activities of a professional corporation based in Elk Grove, California. These records function as a historical and legal reference for the corporation and assist in ensuring compliance with state laws and regulations. Some crucial Elk Grove Sample Corporate Records for a California Professional Corporation may include: 1. Articles of Incorporation: A foundational document that officially establishes the corporation, including its name, purpose, registered agent, and initial directors. 2. Bylaws: A set of rules and regulations that govern the internal operations of the corporation, including procedures for director and shareholder meetings, appointment of officers, voting rights, and other corporate governance matters. 3. Shareholder Agreements: An agreement among the shareholders of the corporation that outlines their rights, obligations, and restrictions related to stock ownership and transfer, dividend distribution, and decision-making processes. 4. Meeting Minutes: A comprehensive record of all meetings conducted by the board of directors and shareholders, recording the topics discussed, decisions made, and actions taken. These minutes provide evidence of compliance and corporate decision-making processes. 5. Stock Certificates: Documentation that verifies ownership of shares in the corporation, including details such as shareholder name, stock class, and number of shares held. 6. Financial Statements: Documents that present the corporation's financial position, including its income, expenses, assets, and liabilities. These statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial health. 7. Annual Reports: An annual filing required by the California Secretary of State that provides an update on the corporation's basic information, such as its business address, officers, and directors. 8. Tax Filings: Various tax-related documents, including federal and state tax returns, payroll tax filings, and other relevant forms that report the corporation's financial activities and tax obligations. 9. Contracts and Agreements: Copies of any legal contracts or agreements entered into by the corporation, such as client agreements, vendor contracts, or lease agreements. 10. Licenses and permits: Documentation demonstrating that the corporation holds the necessary licenses and permits required to conduct its professional activities legally. These Elk Grove Sample Corporate Records for a California Professional Corporation ensure transparency, accountability, and legal compliance while providing an organized record of the corporation's activities. Retaining these records is vital not only for ongoing operations but also for potential audits, litigation, or future transactions involving the corporation.Elk Grove Sample Corporate Records for a California Professional Corporation are essential documents that outline the various administrative, legal, and financial activities of a professional corporation based in Elk Grove, California. These records function as a historical and legal reference for the corporation and assist in ensuring compliance with state laws and regulations. Some crucial Elk Grove Sample Corporate Records for a California Professional Corporation may include: 1. Articles of Incorporation: A foundational document that officially establishes the corporation, including its name, purpose, registered agent, and initial directors. 2. Bylaws: A set of rules and regulations that govern the internal operations of the corporation, including procedures for director and shareholder meetings, appointment of officers, voting rights, and other corporate governance matters. 3. Shareholder Agreements: An agreement among the shareholders of the corporation that outlines their rights, obligations, and restrictions related to stock ownership and transfer, dividend distribution, and decision-making processes. 4. Meeting Minutes: A comprehensive record of all meetings conducted by the board of directors and shareholders, recording the topics discussed, decisions made, and actions taken. These minutes provide evidence of compliance and corporate decision-making processes. 5. Stock Certificates: Documentation that verifies ownership of shares in the corporation, including details such as shareholder name, stock class, and number of shares held. 6. Financial Statements: Documents that present the corporation's financial position, including its income, expenses, assets, and liabilities. These statements, including balance sheets, income statements, and cash flow statements, provide an overview of the corporation's financial health. 7. Annual Reports: An annual filing required by the California Secretary of State that provides an update on the corporation's basic information, such as its business address, officers, and directors. 8. Tax Filings: Various tax-related documents, including federal and state tax returns, payroll tax filings, and other relevant forms that report the corporation's financial activities and tax obligations. 9. Contracts and Agreements: Copies of any legal contracts or agreements entered into by the corporation, such as client agreements, vendor contracts, or lease agreements. 10. Licenses and permits: Documentation demonstrating that the corporation holds the necessary licenses and permits required to conduct its professional activities legally. These Elk Grove Sample Corporate Records for a California Professional Corporation ensure transparency, accountability, and legal compliance while providing an organized record of the corporation's activities. Retaining these records is vital not only for ongoing operations but also for potential audits, litigation, or future transactions involving the corporation.