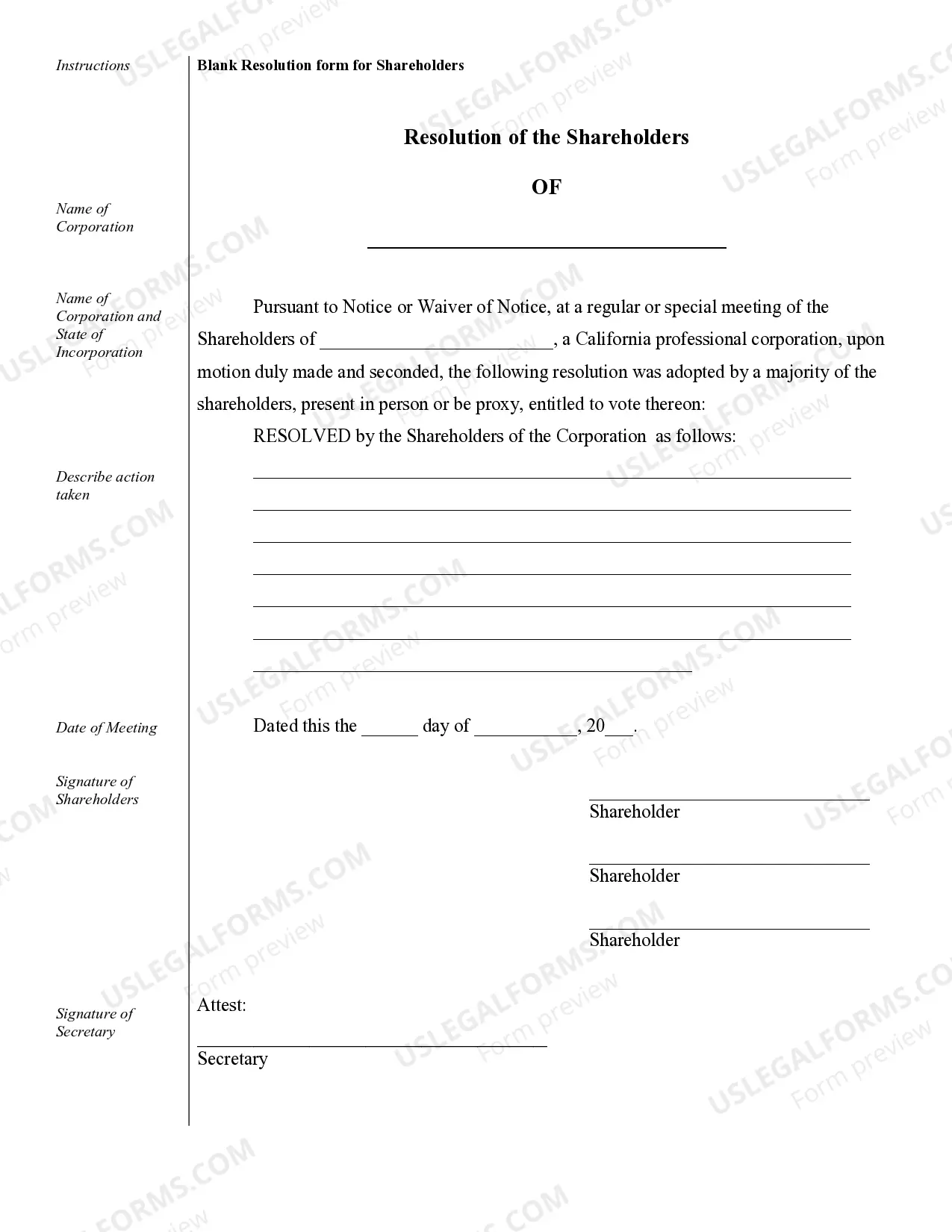

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

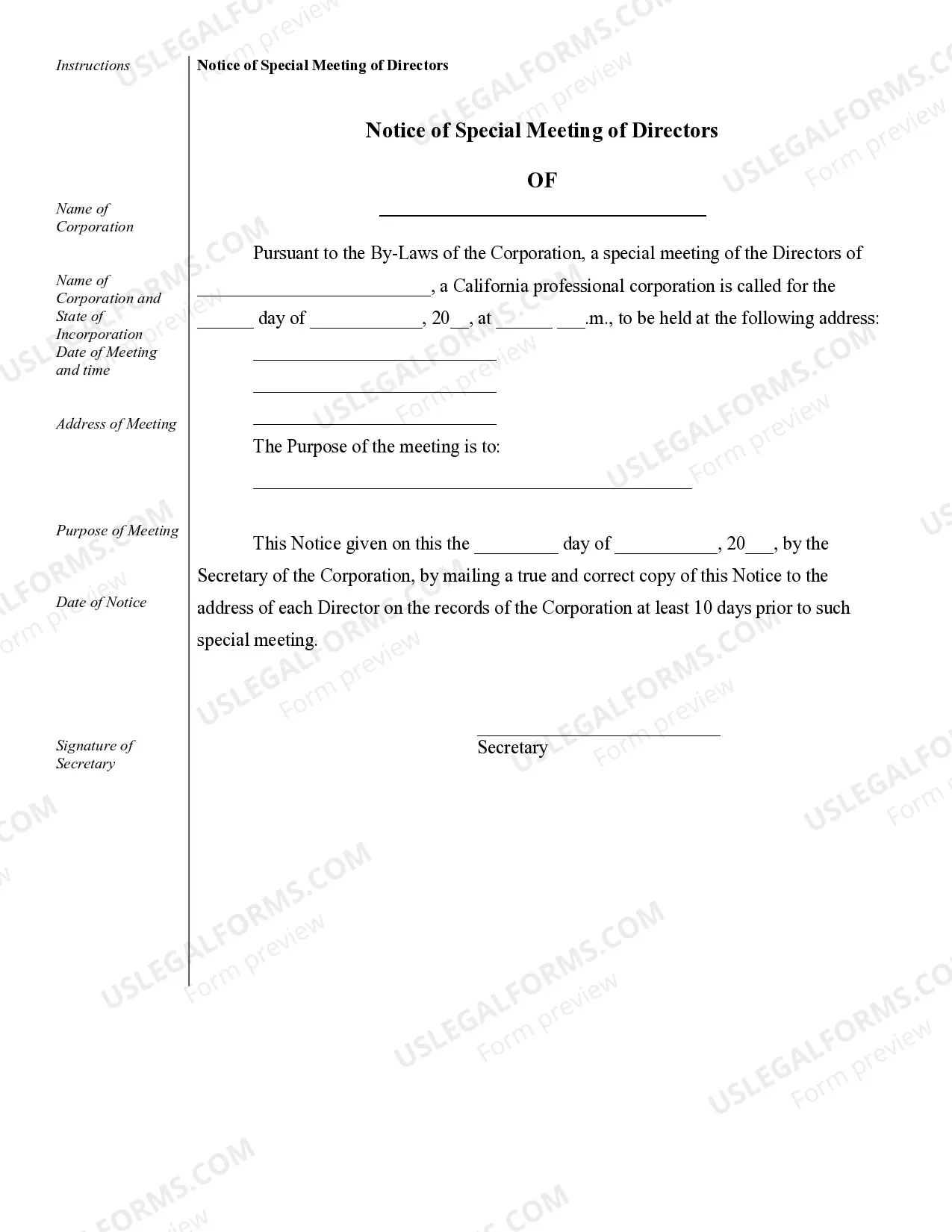

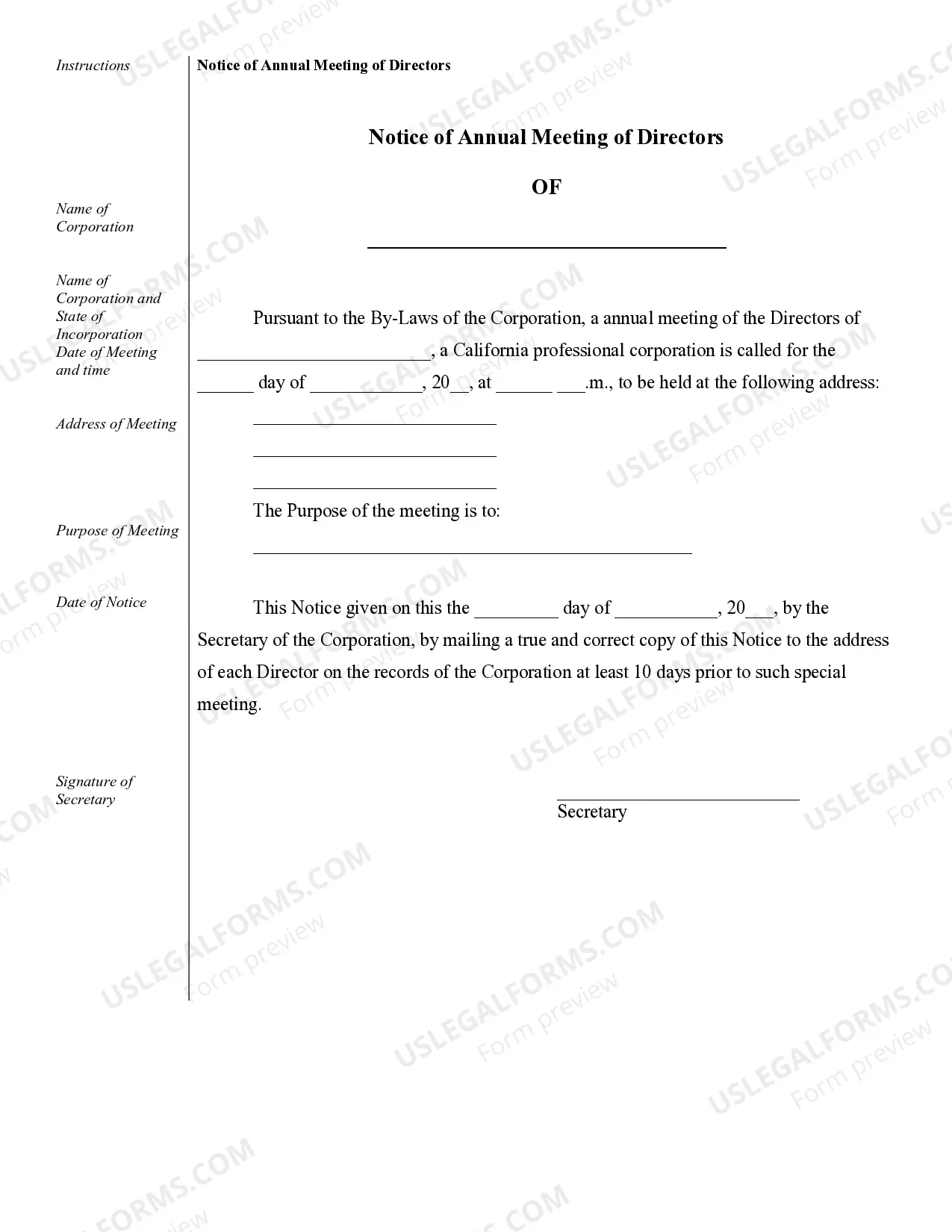

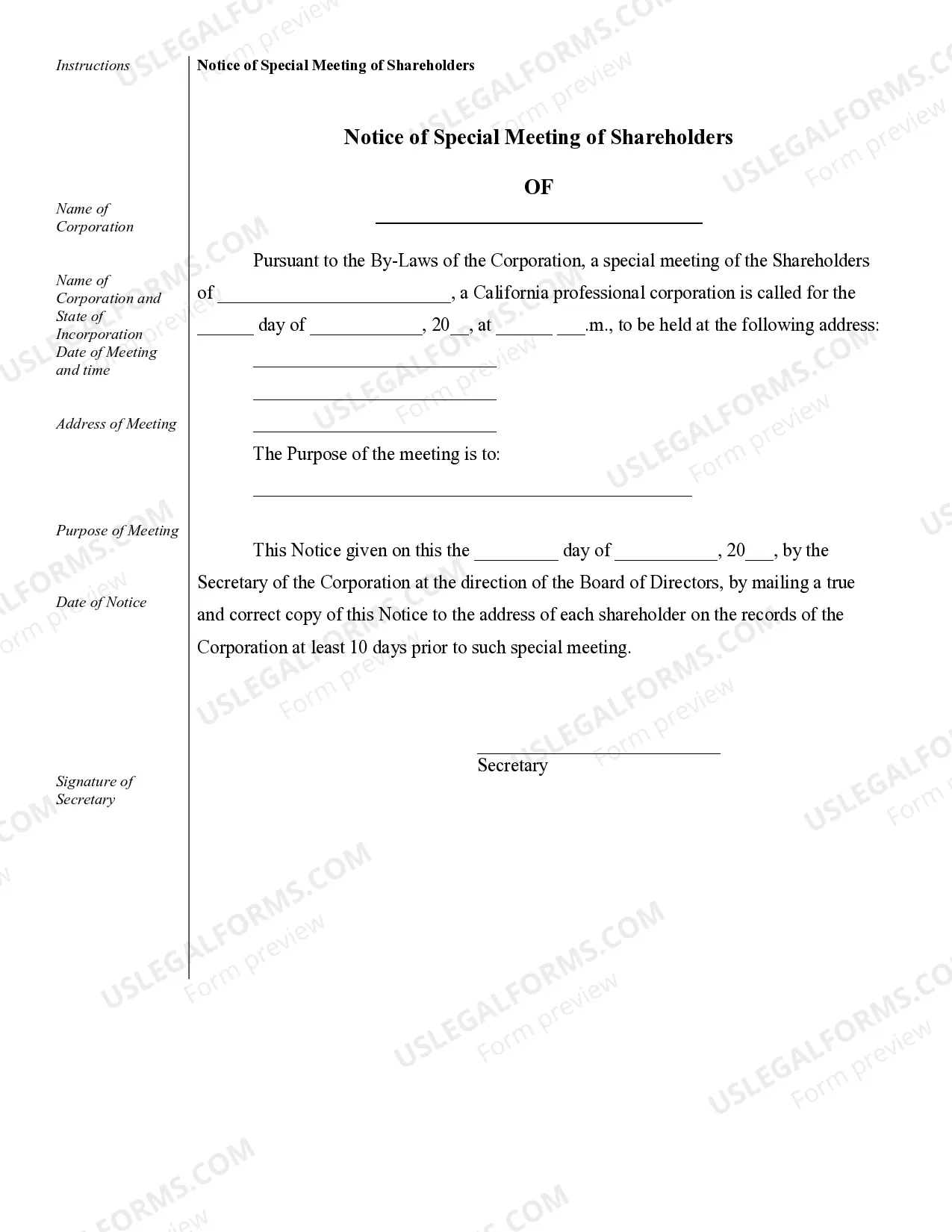

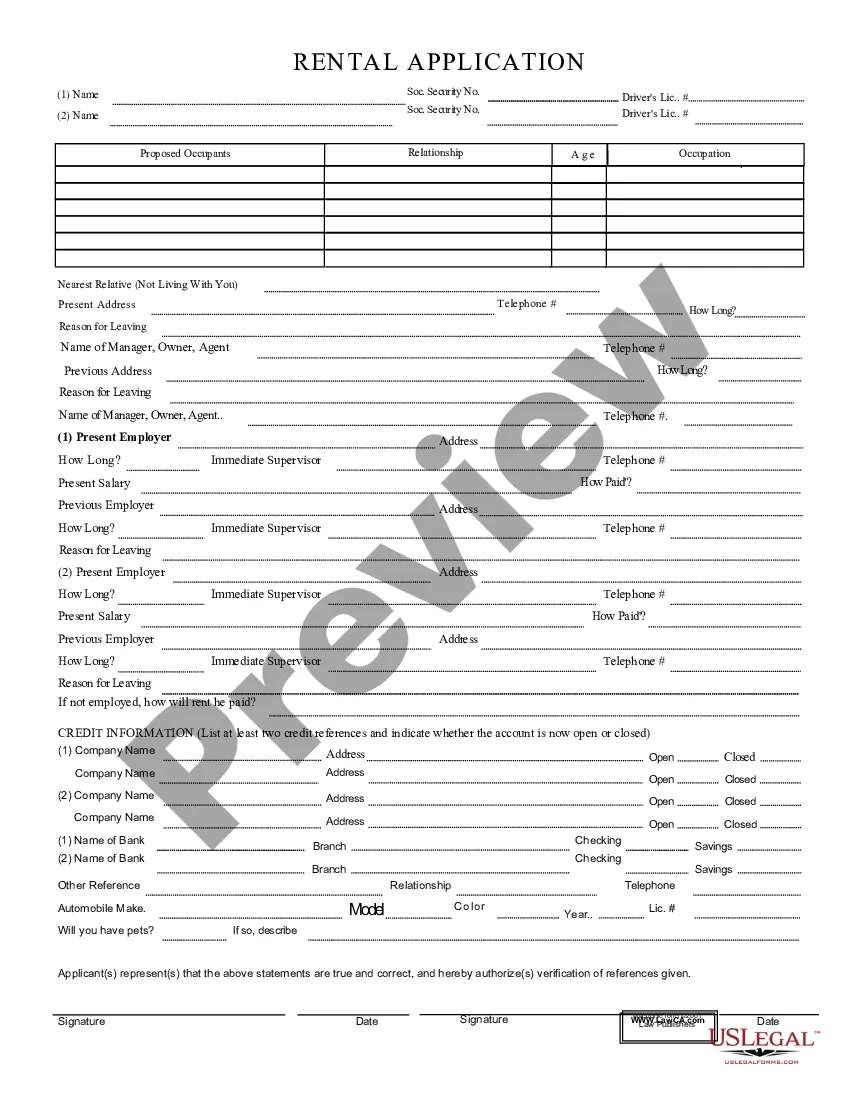

El Monte Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive overview of the corporation's operations, financial activities, and legal compliance. These records serve as a vital resource for both internal management and external stakeholders, such as shareholders, potential investors, and regulatory authorities. Below, we will discuss various types of El Monte Sample Corporate Records for a California Professional Corporation that are crucial for maintaining transparency and ensuring legal compliance: 1. Articles of Incorporation: These documents establish the legal existence of the corporation and contain vital information such as the corporation's name, purpose, shares of stock, registered agent, and initial directors. 2. Bylaws: This set of rules and regulations provides a framework for governing the corporation's internal affairs, including matters relating to shareholders, directors, officers, and meetings. Bylaws outline the corporation's decision-making process, voting procedures, and other essential provisions. 3. Meeting Minutes: Detailed records of board of directors and shareholders' meetings, documenting discussions, decisions, and resolutions taken during these sessions. Meeting minutes provide a historical account of important corporate actions, approvals, and changes in policies. 4. Stock Ledger: A record of all shares issued by the corporation, indicating the name of the shareholder, date of issuance, class of shares, certificate number, and any transfers or cancellations. This ledger helps track ownership and facilitates the distribution of dividends or voting rights. 5. Financial Statements: These statements include the balance sheet, income statement, and cash flow statement, providing a snapshot of the corporation's financial health. They are crucial for assessing profitability, liquidity, and solvency, and are often required by lenders, investors, and regulatory agencies. 6. Annual Reports: These reports summarize the corporation's activities, financial performance, and accomplishments during the fiscal year. They typically include management's discussion and analysis, audited financial statements, and other relevant disclosures. Annual reports are usually distributed to shareholders and filed with regulatory authorities. 7. Stockholder Records: These records maintain up-to-date information about each stockholder, including name, address, number of shares owned, and contact details. They are crucial for communication, voting, and issuing dividends or corporate notices. 8. Tax Returns: Complete tax records, including federal, state, and local tax returns, assist in fulfilling tax obligations. These records also help during audits and ensure compliance with tax laws and regulations. 9. Legal and Licensing Documents: Any licenses, permits, or certifications required for the professional corporation's operations should be recorded and well-maintained. This includes professional licenses of practitioners within the corporation. 10. Contracts and Agreements: Records of all contracts entered into by the corporation, such as leases, agreements with vendors, clients, or partners, are essential to ensure legal protection and accountability. Properly maintaining El Monte Sample Corporate Records for a California Professional Corporation not only fulfills legal obligations but also reinforces transparency, accountability, and trust among stakeholders. It is vital for corporations to maintain organized, accurate, and readily accessible records to facilitate effective corporate governance and make informed business decisions.El Monte Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive overview of the corporation's operations, financial activities, and legal compliance. These records serve as a vital resource for both internal management and external stakeholders, such as shareholders, potential investors, and regulatory authorities. Below, we will discuss various types of El Monte Sample Corporate Records for a California Professional Corporation that are crucial for maintaining transparency and ensuring legal compliance: 1. Articles of Incorporation: These documents establish the legal existence of the corporation and contain vital information such as the corporation's name, purpose, shares of stock, registered agent, and initial directors. 2. Bylaws: This set of rules and regulations provides a framework for governing the corporation's internal affairs, including matters relating to shareholders, directors, officers, and meetings. Bylaws outline the corporation's decision-making process, voting procedures, and other essential provisions. 3. Meeting Minutes: Detailed records of board of directors and shareholders' meetings, documenting discussions, decisions, and resolutions taken during these sessions. Meeting minutes provide a historical account of important corporate actions, approvals, and changes in policies. 4. Stock Ledger: A record of all shares issued by the corporation, indicating the name of the shareholder, date of issuance, class of shares, certificate number, and any transfers or cancellations. This ledger helps track ownership and facilitates the distribution of dividends or voting rights. 5. Financial Statements: These statements include the balance sheet, income statement, and cash flow statement, providing a snapshot of the corporation's financial health. They are crucial for assessing profitability, liquidity, and solvency, and are often required by lenders, investors, and regulatory agencies. 6. Annual Reports: These reports summarize the corporation's activities, financial performance, and accomplishments during the fiscal year. They typically include management's discussion and analysis, audited financial statements, and other relevant disclosures. Annual reports are usually distributed to shareholders and filed with regulatory authorities. 7. Stockholder Records: These records maintain up-to-date information about each stockholder, including name, address, number of shares owned, and contact details. They are crucial for communication, voting, and issuing dividends or corporate notices. 8. Tax Returns: Complete tax records, including federal, state, and local tax returns, assist in fulfilling tax obligations. These records also help during audits and ensure compliance with tax laws and regulations. 9. Legal and Licensing Documents: Any licenses, permits, or certifications required for the professional corporation's operations should be recorded and well-maintained. This includes professional licenses of practitioners within the corporation. 10. Contracts and Agreements: Records of all contracts entered into by the corporation, such as leases, agreements with vendors, clients, or partners, are essential to ensure legal protection and accountability. Properly maintaining El Monte Sample Corporate Records for a California Professional Corporation not only fulfills legal obligations but also reinforces transparency, accountability, and trust among stakeholders. It is vital for corporations to maintain organized, accurate, and readily accessible records to facilitate effective corporate governance and make informed business decisions.