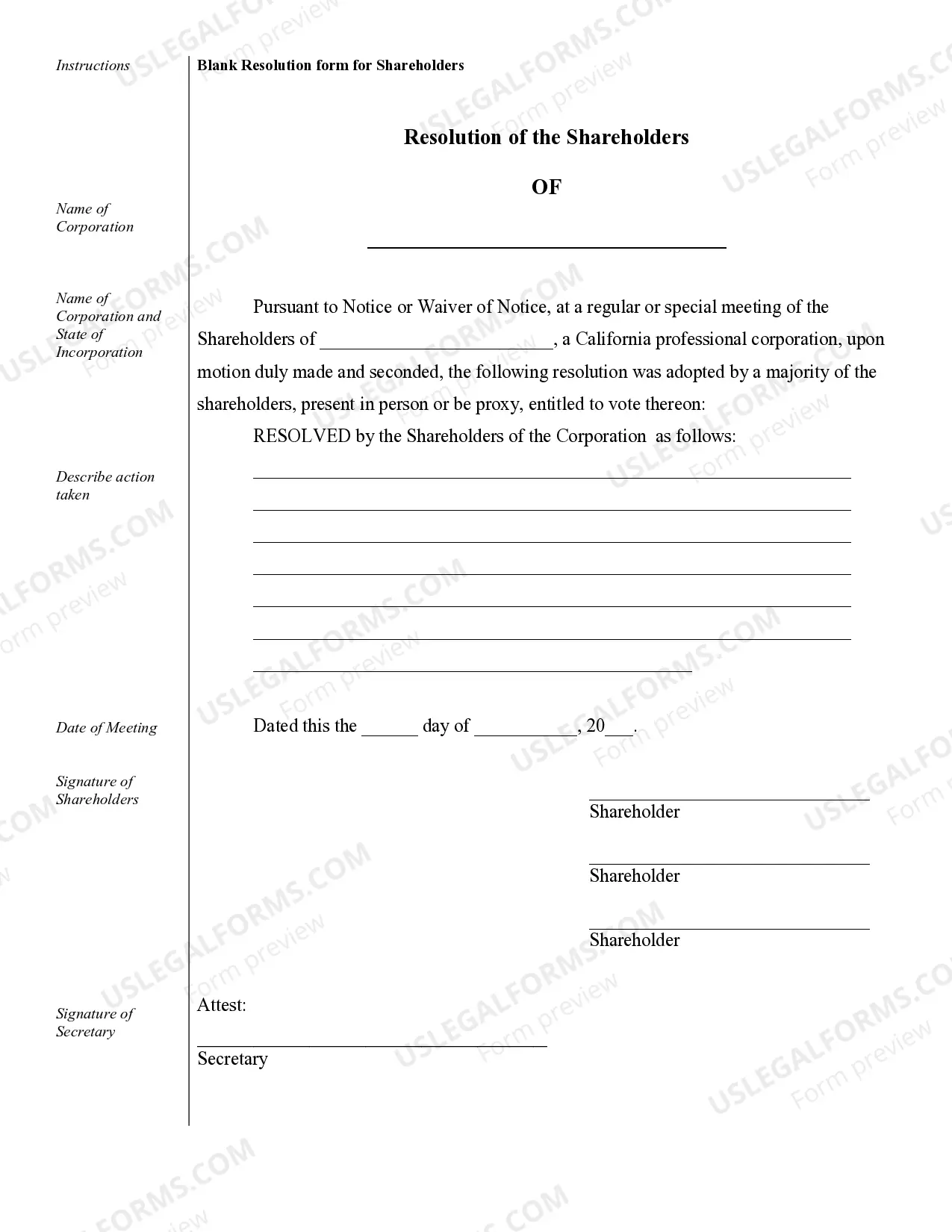

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

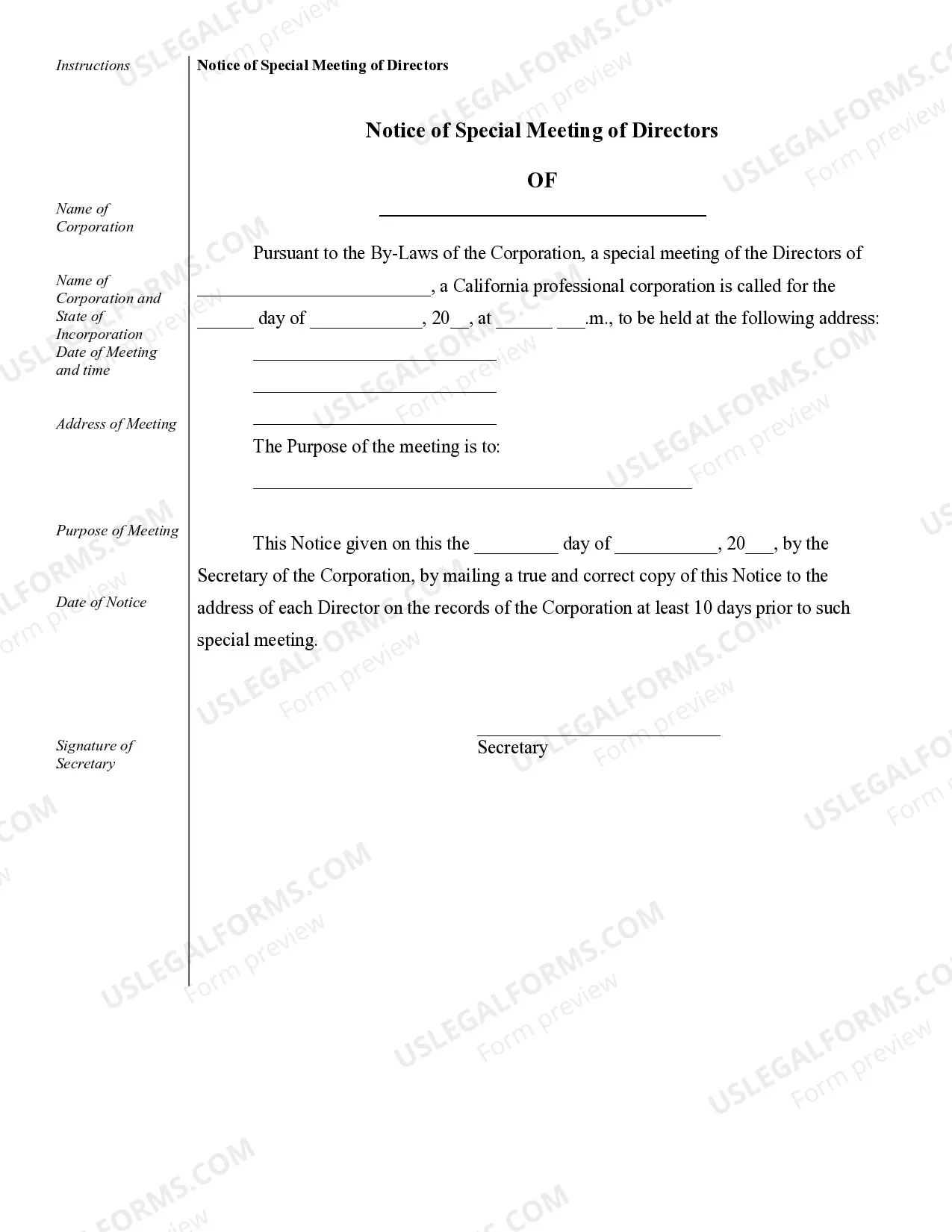

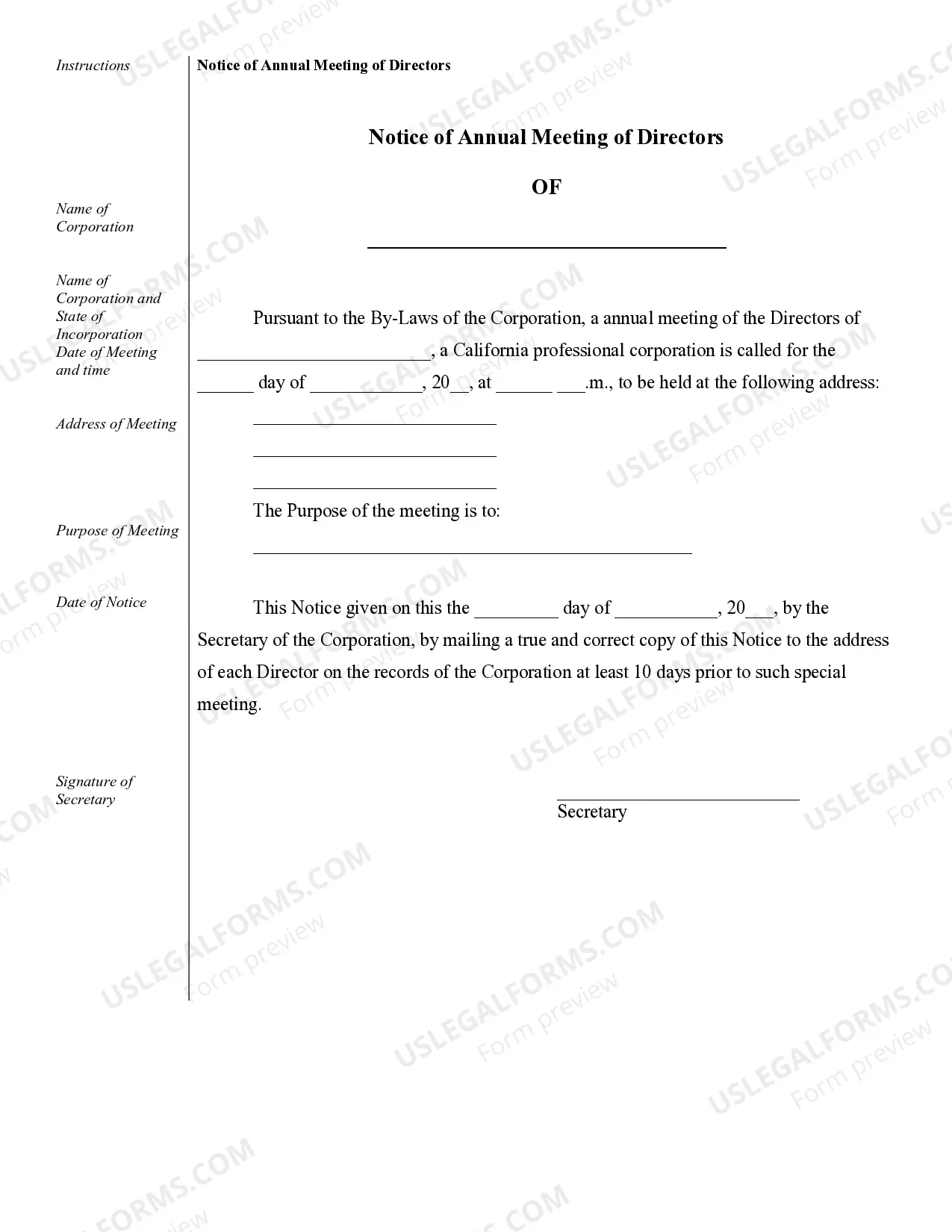

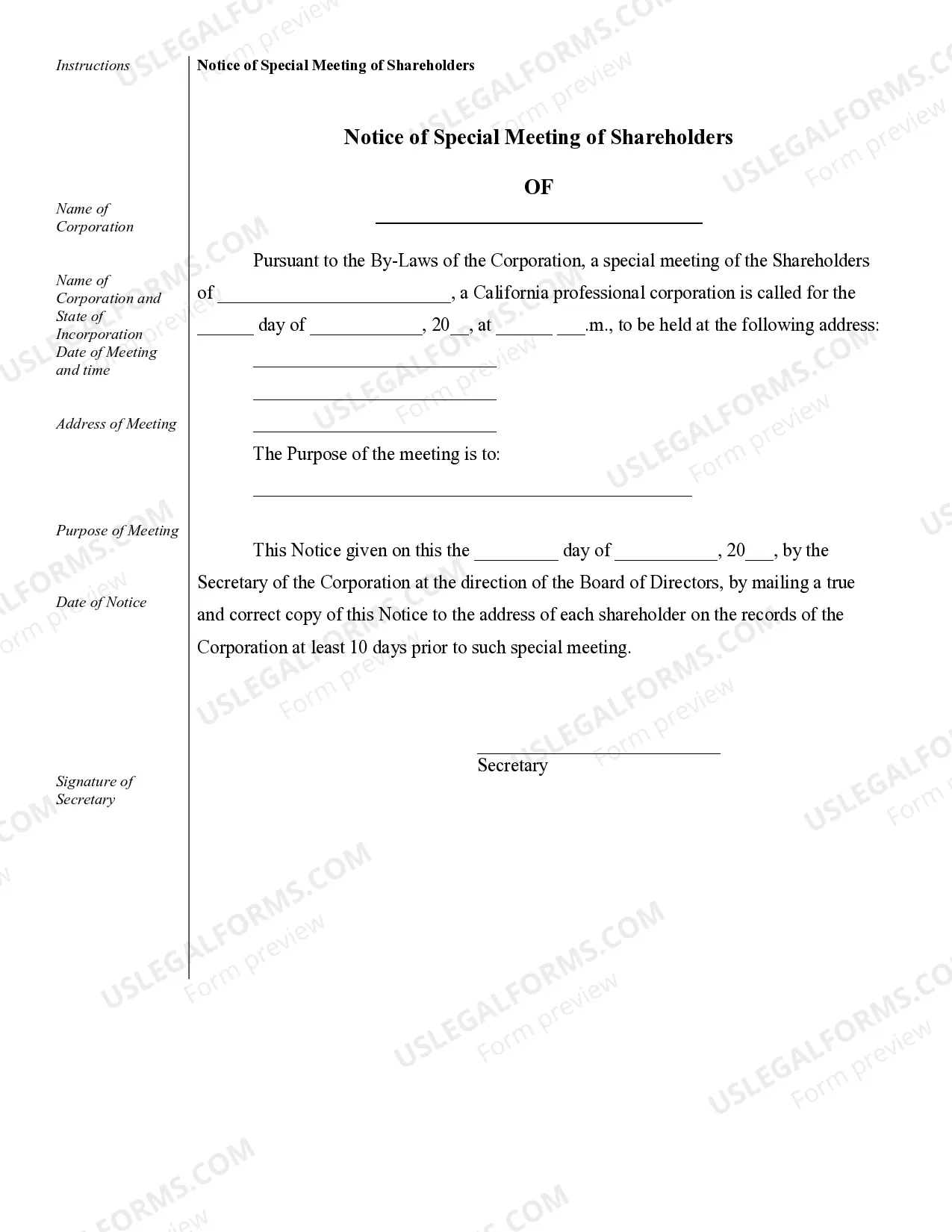

Escondido Sample Corporate Records for a California Professional Corporation are essential documents that serve as evidence and provide a comprehensive record of the organization's activities, decisions, and responsibilities. These records help maintain the legality and transparency of professional corporations operating in Escondido, California. By keeping well-organized corporate records, businesses can demonstrate compliance with state regulations and ensure proper corporate governance practices. Here are some key types of Escondido Sample Corporate Records specific to California Professional Corporations: 1. Articles of Incorporation: This vital document establishes the existence and structure of the professional corporation. It includes information such as the corporation's name, purpose, stock structure, and the names of initial directors and officers. 2. Bylaws: These are the guidelines and rules governing how the corporation will operate. Bylaws typically include information about shareholder meetings, director responsibilities, voting procedures, and other corporate formalities. 3. Shareholder Agreements: In cases where there are multiple shareholders, a shareholder agreement outlines the rights, responsibilities, and obligations of each shareholder within the organization. This agreement may cover topics such as share transfers, dispute resolution mechanisms, and restrictions on shareholder actions. 4. Meeting Minutes: Detailed minutes of meetings held by the board of directors and shareholders capture the discussions, decisions, and resolutions taken during these meetings. These minutes should accurately reflect the deliberations and actions to ensure legal compliance. 5. Stock Certificates: Stock certificates are issued to shareholders as evidence of ownership in the professional corporation. These certificates should include relevant information, such as the shareholder's name, certificate number, number of shares owned, and class of shares. 6. Financial Statements: Accurate financial records, including balance sheets, income statements, and cash flow statements, help track the financial health of the professional corporation. This information is vital for tax compliance, securing loans, attracting investors, and making informed business decisions. 7. Annual Reports and Statements of Information: California Professional Corporations are required to file annual reports with the Secretary of State. These reports provide updates on the corporation's activities, including identifying information about directors, officers, and shareholders. 8. Employee Records: Records related to employee contracts, payroll, benefits, and personnel policies are essential for maintaining a professional and compliant work environment. These records also help ensure compliance with employment laws and regulations. 9. Licenses and Permits: Professional corporations may require specific licenses or permits operating legally in Escondido. Keeping records of these licenses and permits, as well as any renewals, helps demonstrate legal compliance. It is crucial for a California Professional Corporation in Escondido to maintain well-organized sample corporate records. These records can be used as references to ensure compliance with local laws, facilitate audits, attract potential investors, and enhance overall corporate transparency.Escondido Sample Corporate Records for a California Professional Corporation are essential documents that serve as evidence and provide a comprehensive record of the organization's activities, decisions, and responsibilities. These records help maintain the legality and transparency of professional corporations operating in Escondido, California. By keeping well-organized corporate records, businesses can demonstrate compliance with state regulations and ensure proper corporate governance practices. Here are some key types of Escondido Sample Corporate Records specific to California Professional Corporations: 1. Articles of Incorporation: This vital document establishes the existence and structure of the professional corporation. It includes information such as the corporation's name, purpose, stock structure, and the names of initial directors and officers. 2. Bylaws: These are the guidelines and rules governing how the corporation will operate. Bylaws typically include information about shareholder meetings, director responsibilities, voting procedures, and other corporate formalities. 3. Shareholder Agreements: In cases where there are multiple shareholders, a shareholder agreement outlines the rights, responsibilities, and obligations of each shareholder within the organization. This agreement may cover topics such as share transfers, dispute resolution mechanisms, and restrictions on shareholder actions. 4. Meeting Minutes: Detailed minutes of meetings held by the board of directors and shareholders capture the discussions, decisions, and resolutions taken during these meetings. These minutes should accurately reflect the deliberations and actions to ensure legal compliance. 5. Stock Certificates: Stock certificates are issued to shareholders as evidence of ownership in the professional corporation. These certificates should include relevant information, such as the shareholder's name, certificate number, number of shares owned, and class of shares. 6. Financial Statements: Accurate financial records, including balance sheets, income statements, and cash flow statements, help track the financial health of the professional corporation. This information is vital for tax compliance, securing loans, attracting investors, and making informed business decisions. 7. Annual Reports and Statements of Information: California Professional Corporations are required to file annual reports with the Secretary of State. These reports provide updates on the corporation's activities, including identifying information about directors, officers, and shareholders. 8. Employee Records: Records related to employee contracts, payroll, benefits, and personnel policies are essential for maintaining a professional and compliant work environment. These records also help ensure compliance with employment laws and regulations. 9. Licenses and Permits: Professional corporations may require specific licenses or permits operating legally in Escondido. Keeping records of these licenses and permits, as well as any renewals, helps demonstrate legal compliance. It is crucial for a California Professional Corporation in Escondido to maintain well-organized sample corporate records. These records can be used as references to ensure compliance with local laws, facilitate audits, attract potential investors, and enhance overall corporate transparency.