Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

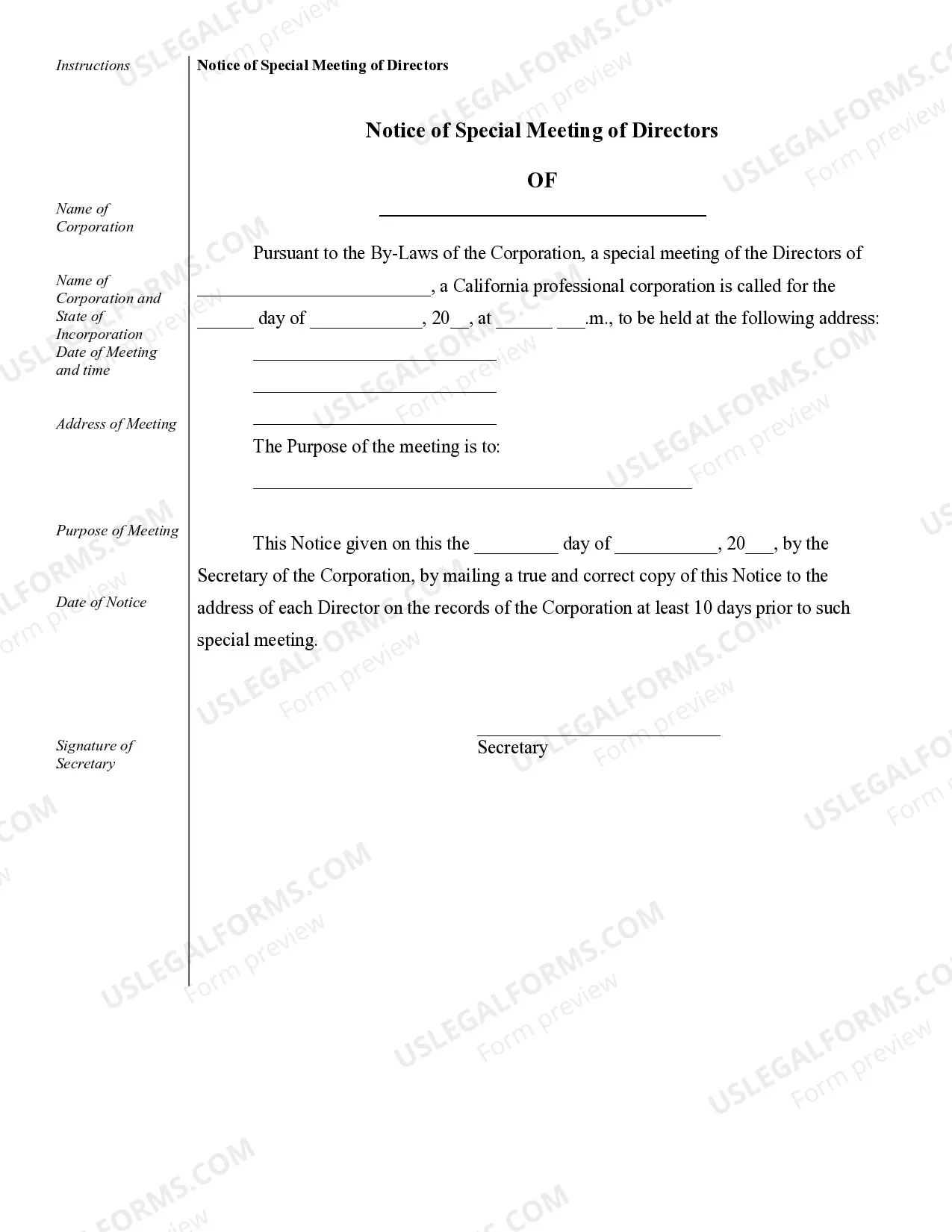

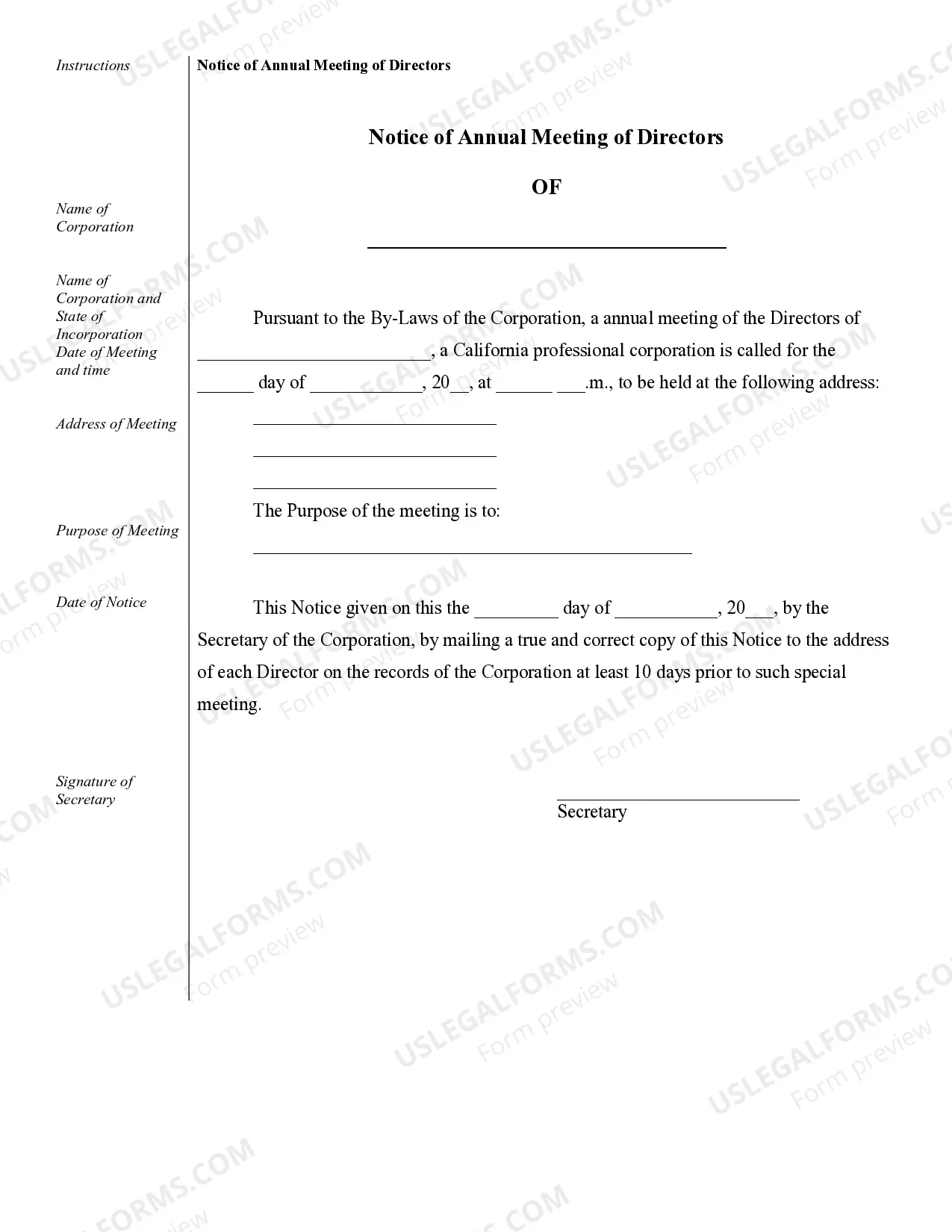

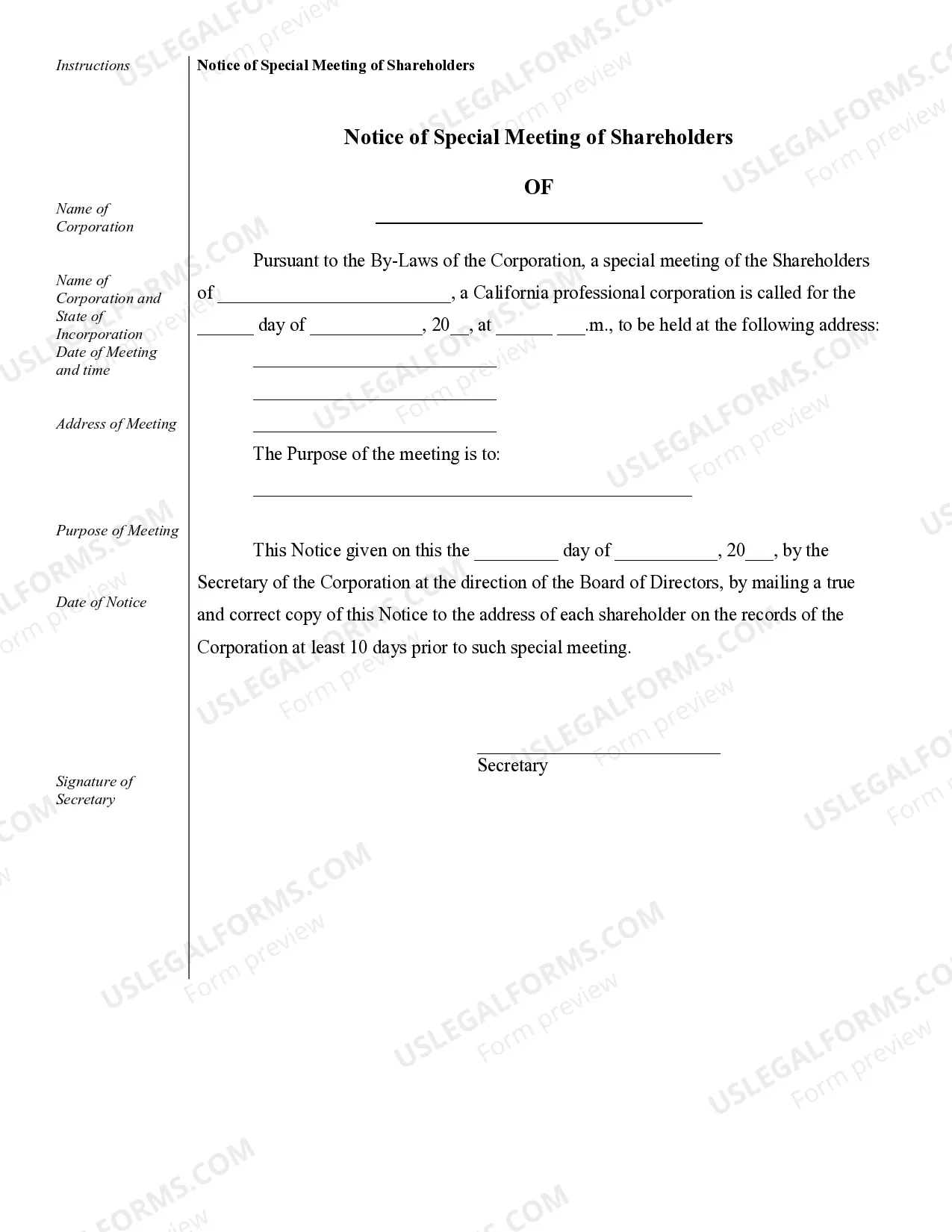

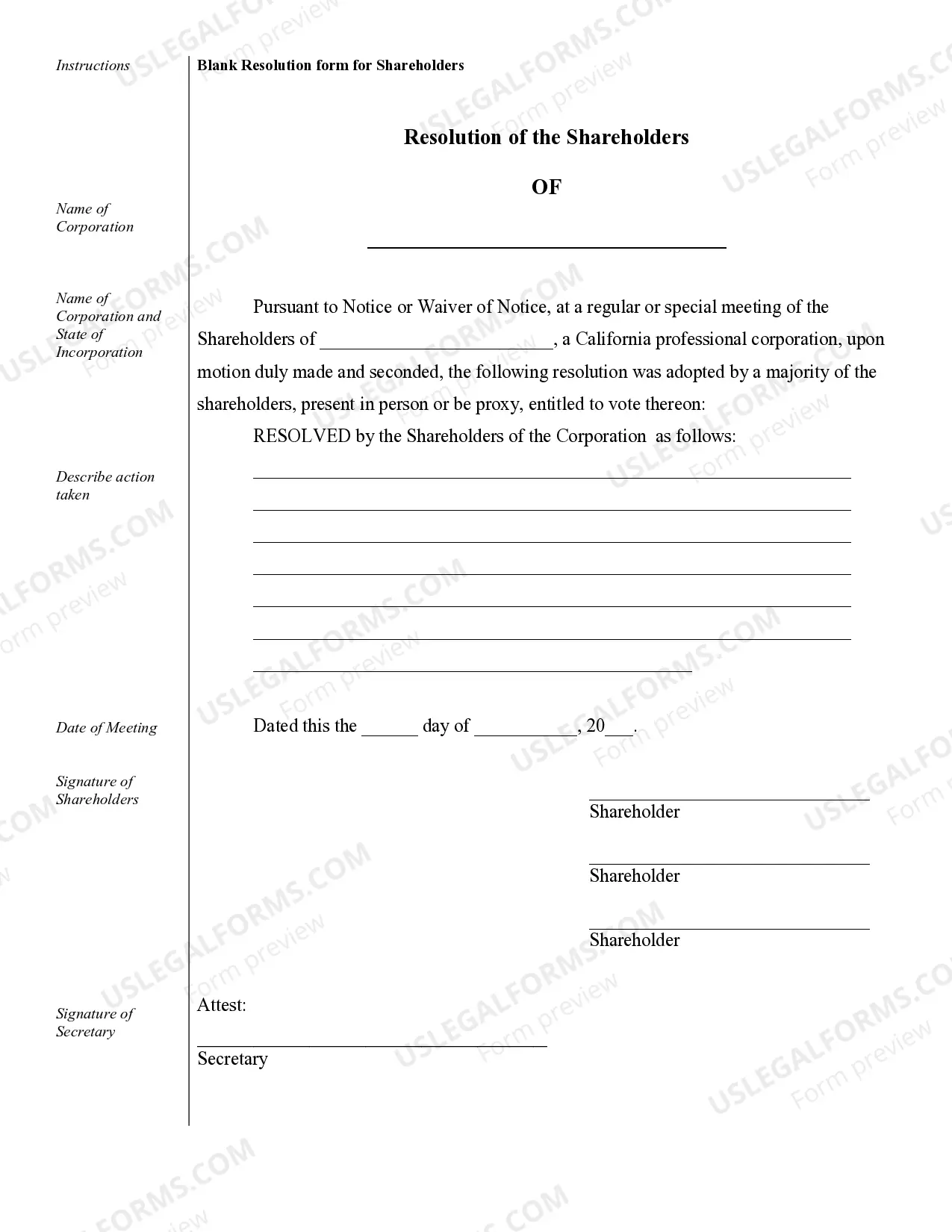

Modesto Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive view of the company's operations, financial status, and compliance with state regulations. These records serve as an official record of the corporation's activities and are often required by law. One essential type of Modesto Sample Corporate Record for a California Professional Corporation is the Articles of Incorporation. This document is filed with the California Secretary of State and includes vital information about the corporation, such as its name, purpose, registered agent, and the number of authorized shares. Another crucial record is the Bylaws, which outlines the internal rules and regulations that govern the corporation's operations. It specifies details about the board of directors, their roles and responsibilities, shareholder meetings, and voting procedures. The Stock Ledger is yet another important document that tracks the issuance and ownership of the corporation's shares. It provides a record of shareholders' names, addresses, the number of shares they hold, and any changes in ownership. The Minutes of Meetings document all the official discussions, decisions, and actions of the board of directors and shareholders during meetings. These minutes should include topics discussed, voting results, and approvals or disapproval of resolutions or policies. For financial records, a California Professional Corporation should maintain its accounting records, including balance sheets, income statements, cash flow statements, and general ledgers. These records help assess the corporation's financial health and ensure compliance with accounting standards. Additionally, businesses often maintain a record of contracts, including employment agreements, vendor contracts, and leases. These records safeguard the corporation's legal interests and provide proof of agreements. Moreover, Corporate Tax Returns, filed annually with the Internal Revenue Service (IRS), are vital records that exhibit the corporation's compliance with tax laws. Bank statements, transaction records, and payroll documents may also be required in this context. Overall, Modesto Sample Corporate Records for a California Professional Corporation encompass Articles of Incorporation, Bylaws, Stock Ledger, Minutes of Meetings, financial records, contract records, tax returns, and other relevant documents. Proper maintenance of these records ensures transparency, legal compliance, and efficient corporate governance.Modesto Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive view of the company's operations, financial status, and compliance with state regulations. These records serve as an official record of the corporation's activities and are often required by law. One essential type of Modesto Sample Corporate Record for a California Professional Corporation is the Articles of Incorporation. This document is filed with the California Secretary of State and includes vital information about the corporation, such as its name, purpose, registered agent, and the number of authorized shares. Another crucial record is the Bylaws, which outlines the internal rules and regulations that govern the corporation's operations. It specifies details about the board of directors, their roles and responsibilities, shareholder meetings, and voting procedures. The Stock Ledger is yet another important document that tracks the issuance and ownership of the corporation's shares. It provides a record of shareholders' names, addresses, the number of shares they hold, and any changes in ownership. The Minutes of Meetings document all the official discussions, decisions, and actions of the board of directors and shareholders during meetings. These minutes should include topics discussed, voting results, and approvals or disapproval of resolutions or policies. For financial records, a California Professional Corporation should maintain its accounting records, including balance sheets, income statements, cash flow statements, and general ledgers. These records help assess the corporation's financial health and ensure compliance with accounting standards. Additionally, businesses often maintain a record of contracts, including employment agreements, vendor contracts, and leases. These records safeguard the corporation's legal interests and provide proof of agreements. Moreover, Corporate Tax Returns, filed annually with the Internal Revenue Service (IRS), are vital records that exhibit the corporation's compliance with tax laws. Bank statements, transaction records, and payroll documents may also be required in this context. Overall, Modesto Sample Corporate Records for a California Professional Corporation encompass Articles of Incorporation, Bylaws, Stock Ledger, Minutes of Meetings, financial records, contract records, tax returns, and other relevant documents. Proper maintenance of these records ensures transparency, legal compliance, and efficient corporate governance.