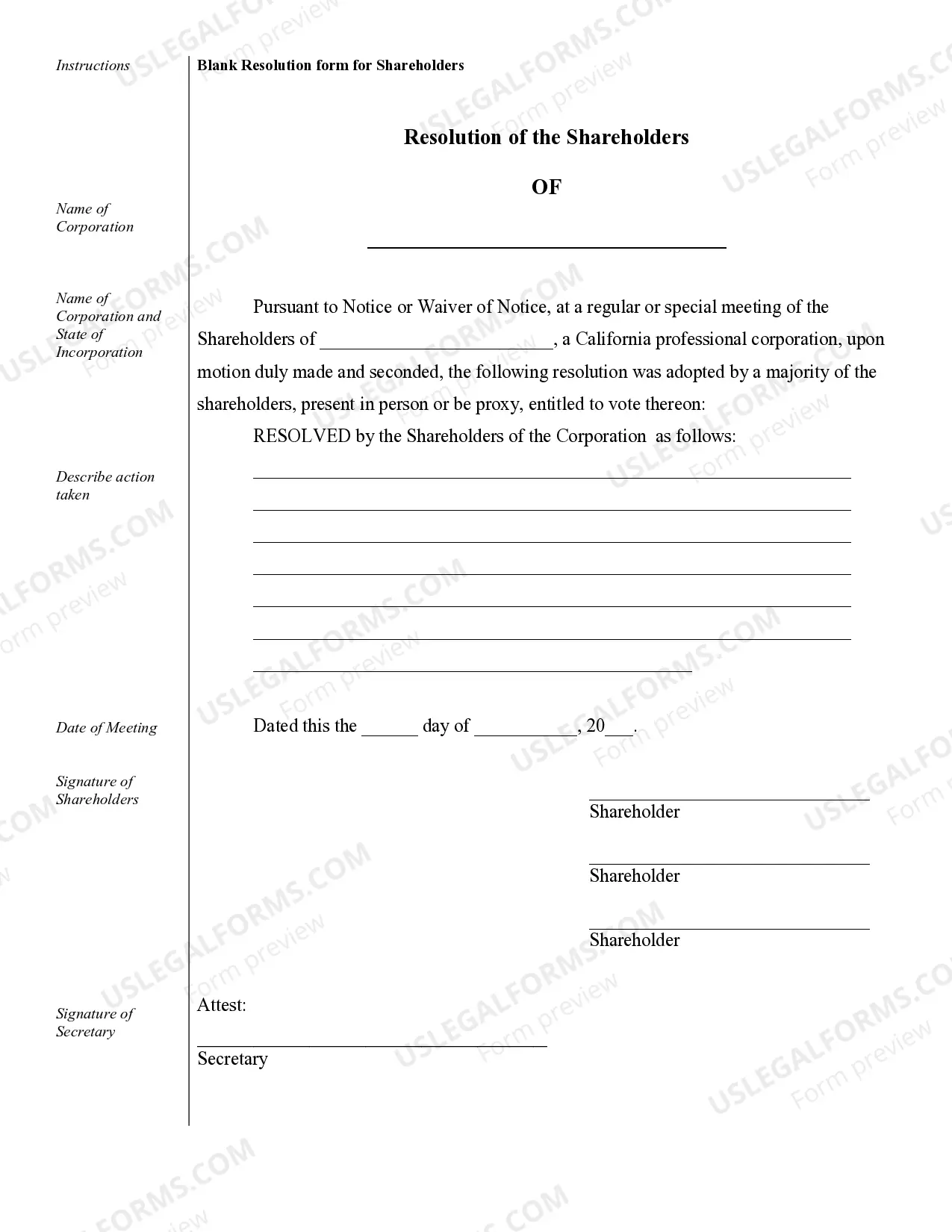

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

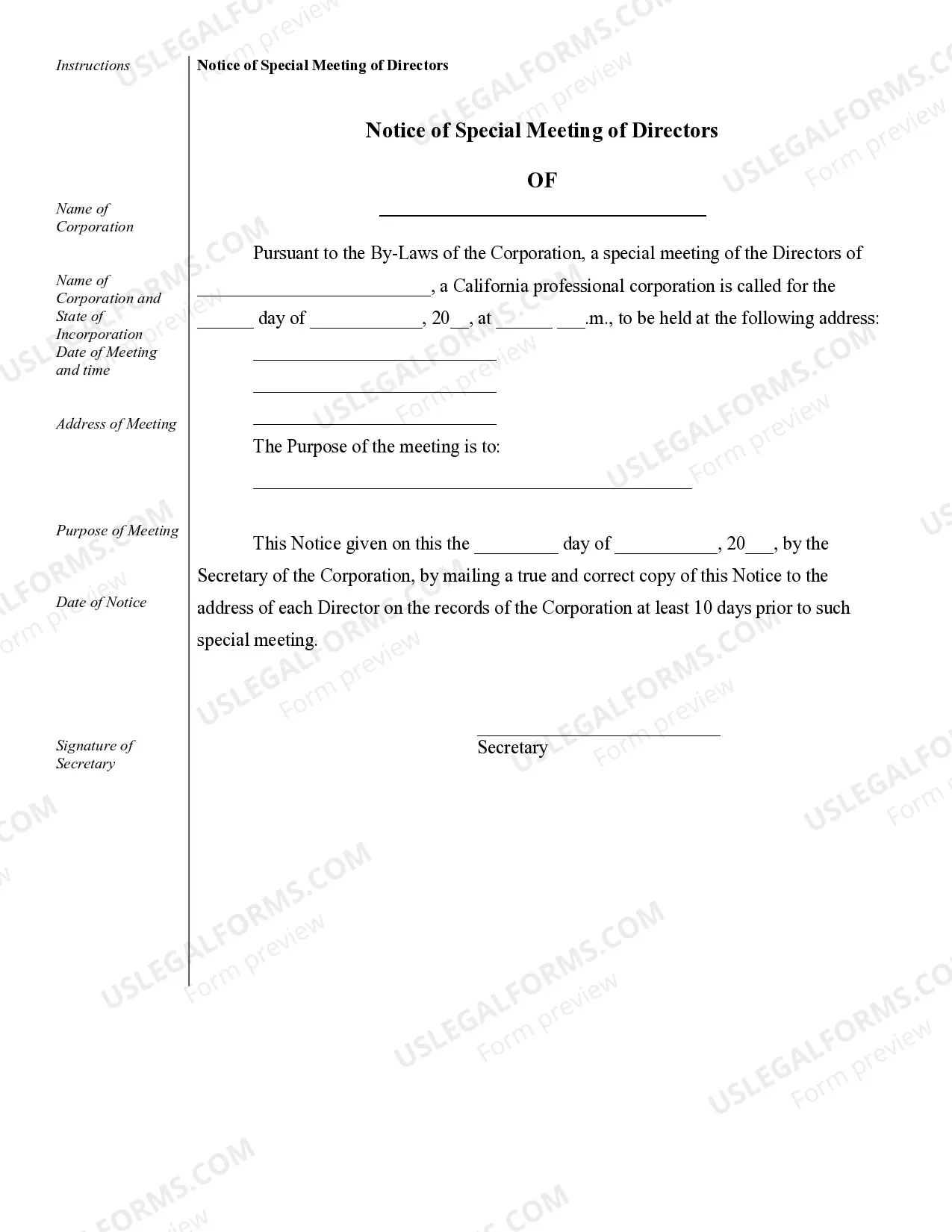

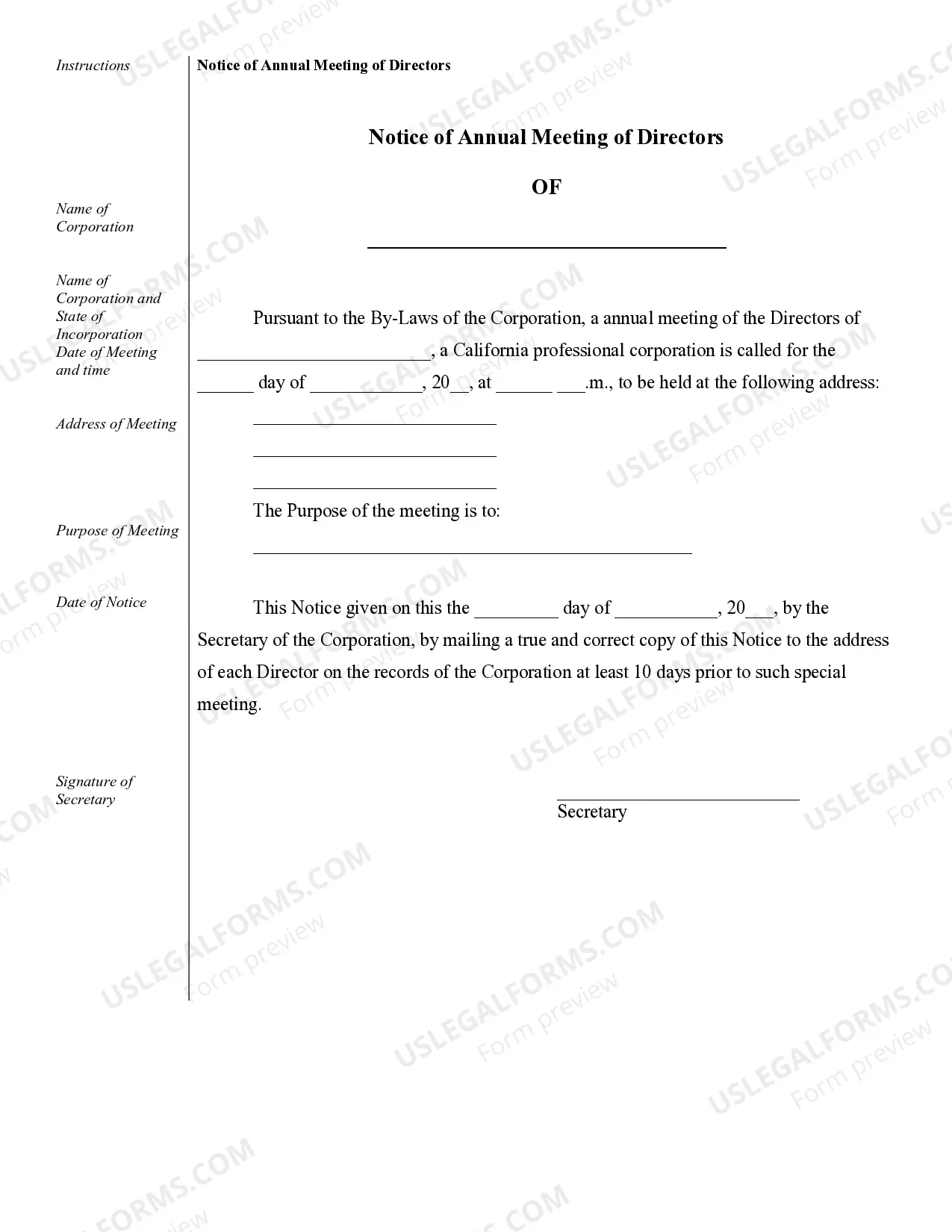

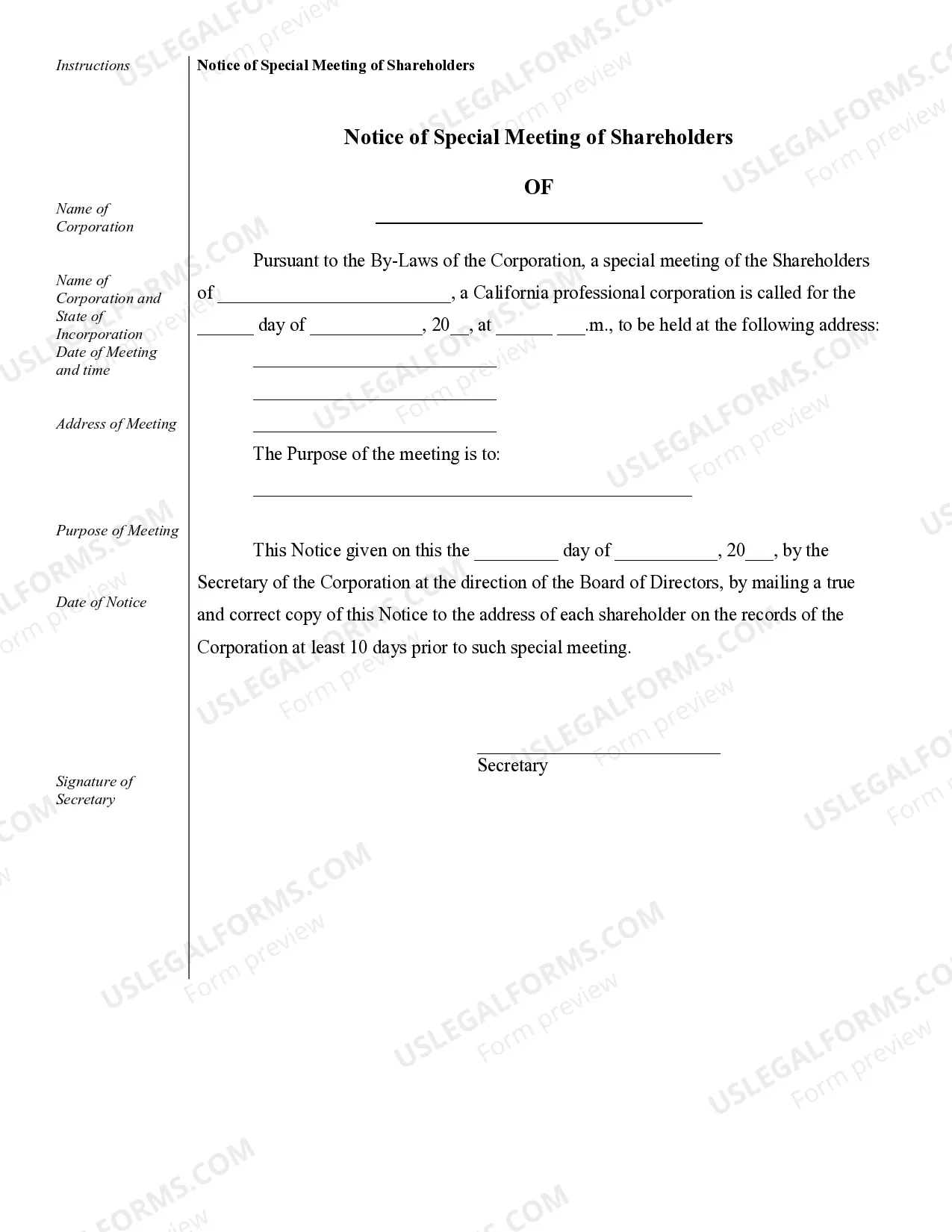

Murrieta Sample Corporate Records for a California Professional Corporation are essential documents that help maintain compliance and organize vital information for the successful operation of a professional corporation in California. These records provide an accurate and comprehensive record of the company's activities, financial transactions, and corporate governance. They serve as a crucial reference point for auditors, government agencies, shareholders, and potential investors. Below are some key types of Murrieta Sample Corporate Records relevant to the operation of a California Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation officially establish the legal entity of the professional corporation. They contain essential information such as the corporation's name, purpose, registered agent, authorized shares, and initial directors. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations of the professional corporation. They outline procedures for meetings, voting rights, officer roles, and other corporate governance matters. 3. Shareholder Agreements: Shareholder agreements are contracts among the corporation and its shareholders that define ownership rights, restrictions on the transfer of shares, dividend policies, dispute resolution mechanisms, and other matters relevant to the relationship between shareholders and the corporation. 4. Meeting Minutes: Meeting minutes document the proceedings and decisions made during board of directors and shareholders' meetings. They provide a chronological record of discussions, resolutions, votes, and actions taken by the corporation's leadership. 5. Annual Reports: Professional corporations are required to file annual reports with the California Secretary of State. These reports include information such as the corporation's address, registered agent details, names of directors/officers, and an update on the corporation's status. 6. Financial Statements: Financial statements, including income statements, balance sheets, and cash flow statements, are crucial for monitoring the corporation's financial health. These records provide a snapshot of the company's financial position, performance, and cash flow over a specific period. 7. Stock Ledger: The stock ledger tracks the ownership information of the professional corporation's shares. It maintains a record of each shareholder's name, address, number of shares owned, issuance dates, and any transfers or changes in ownership. 8. Contracts and Agreements: Corporate records may also include copies of contracts and agreements entered into by the professional corporation, such as client contracts, vendor agreements, employment contracts, and lease agreements. Maintaining accurate and up-to-date Murrieta Sample Corporate Records for a California Professional Corporation is crucial for legal compliance, transparency, and efficient corporate governance. These records serve as a valuable resource for internal decision-making and external inquiries, ensuring the company's smooth operations and facilitating business growth.Murrieta Sample Corporate Records for a California Professional Corporation are essential documents that help maintain compliance and organize vital information for the successful operation of a professional corporation in California. These records provide an accurate and comprehensive record of the company's activities, financial transactions, and corporate governance. They serve as a crucial reference point for auditors, government agencies, shareholders, and potential investors. Below are some key types of Murrieta Sample Corporate Records relevant to the operation of a California Professional Corporation: 1. Articles of Incorporation: The Articles of Incorporation officially establish the legal entity of the professional corporation. They contain essential information such as the corporation's name, purpose, registered agent, authorized shares, and initial directors. 2. Bylaws: Bylaws are a set of rules and regulations that govern the internal operations of the professional corporation. They outline procedures for meetings, voting rights, officer roles, and other corporate governance matters. 3. Shareholder Agreements: Shareholder agreements are contracts among the corporation and its shareholders that define ownership rights, restrictions on the transfer of shares, dividend policies, dispute resolution mechanisms, and other matters relevant to the relationship between shareholders and the corporation. 4. Meeting Minutes: Meeting minutes document the proceedings and decisions made during board of directors and shareholders' meetings. They provide a chronological record of discussions, resolutions, votes, and actions taken by the corporation's leadership. 5. Annual Reports: Professional corporations are required to file annual reports with the California Secretary of State. These reports include information such as the corporation's address, registered agent details, names of directors/officers, and an update on the corporation's status. 6. Financial Statements: Financial statements, including income statements, balance sheets, and cash flow statements, are crucial for monitoring the corporation's financial health. These records provide a snapshot of the company's financial position, performance, and cash flow over a specific period. 7. Stock Ledger: The stock ledger tracks the ownership information of the professional corporation's shares. It maintains a record of each shareholder's name, address, number of shares owned, issuance dates, and any transfers or changes in ownership. 8. Contracts and Agreements: Corporate records may also include copies of contracts and agreements entered into by the professional corporation, such as client contracts, vendor agreements, employment contracts, and lease agreements. Maintaining accurate and up-to-date Murrieta Sample Corporate Records for a California Professional Corporation is crucial for legal compliance, transparency, and efficient corporate governance. These records serve as a valuable resource for internal decision-making and external inquiries, ensuring the company's smooth operations and facilitating business growth.