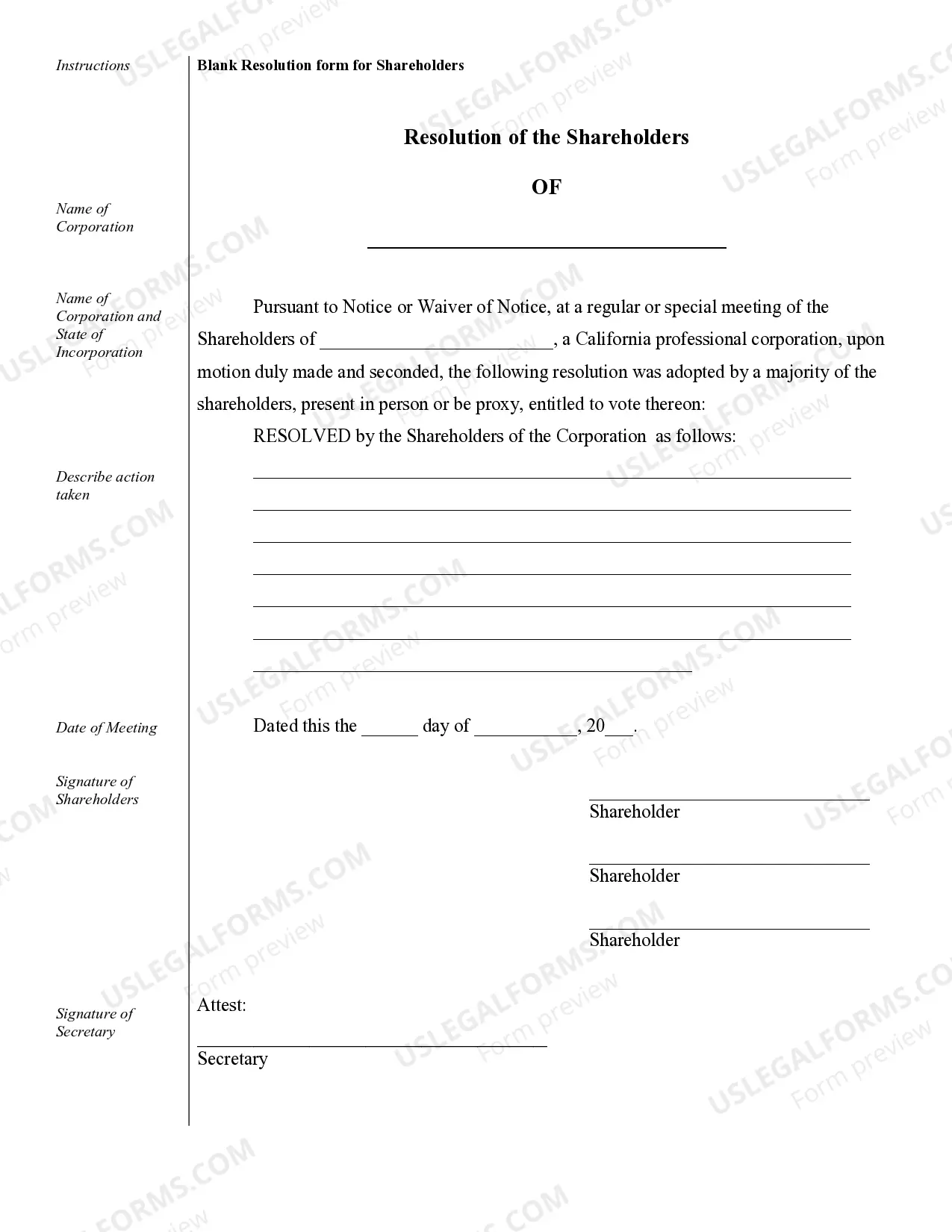

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

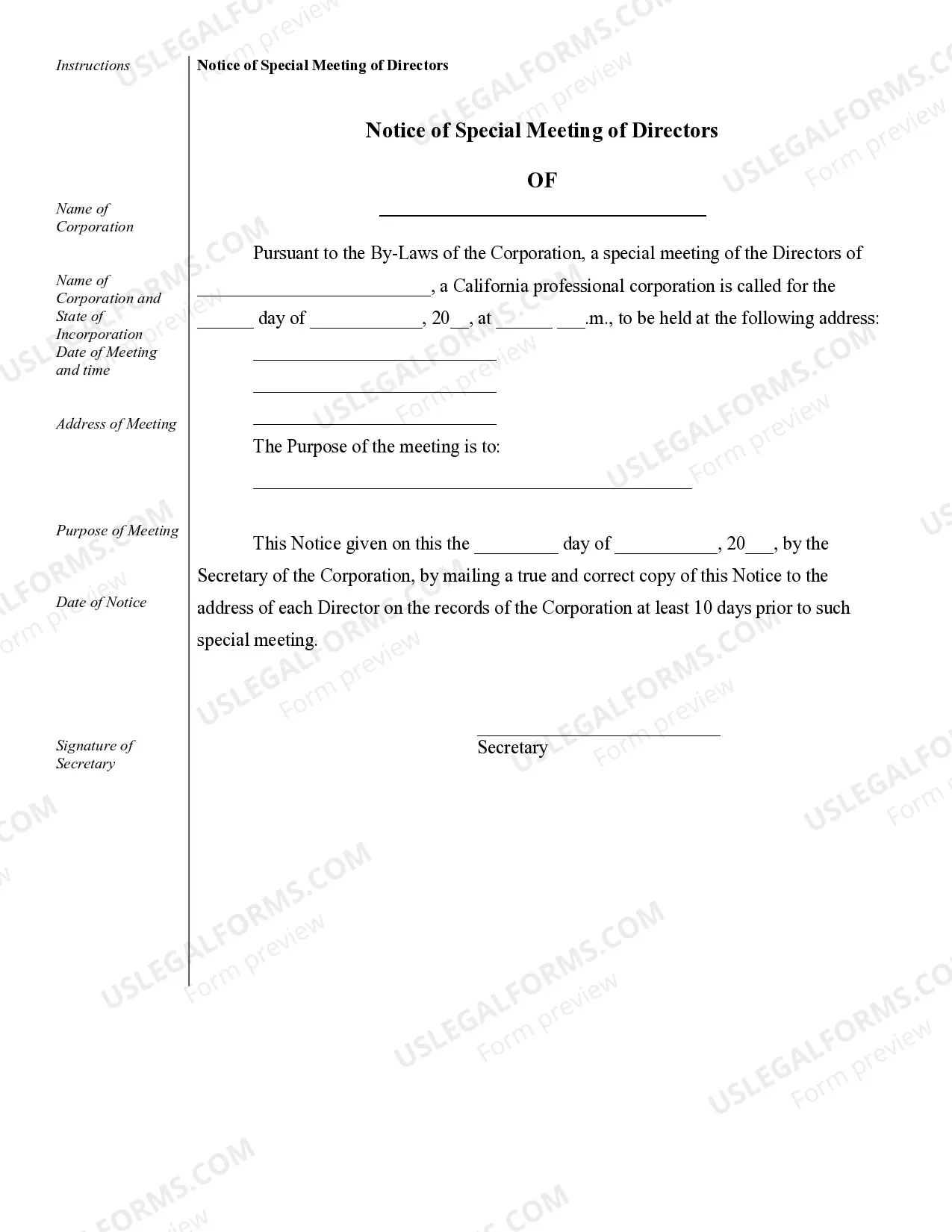

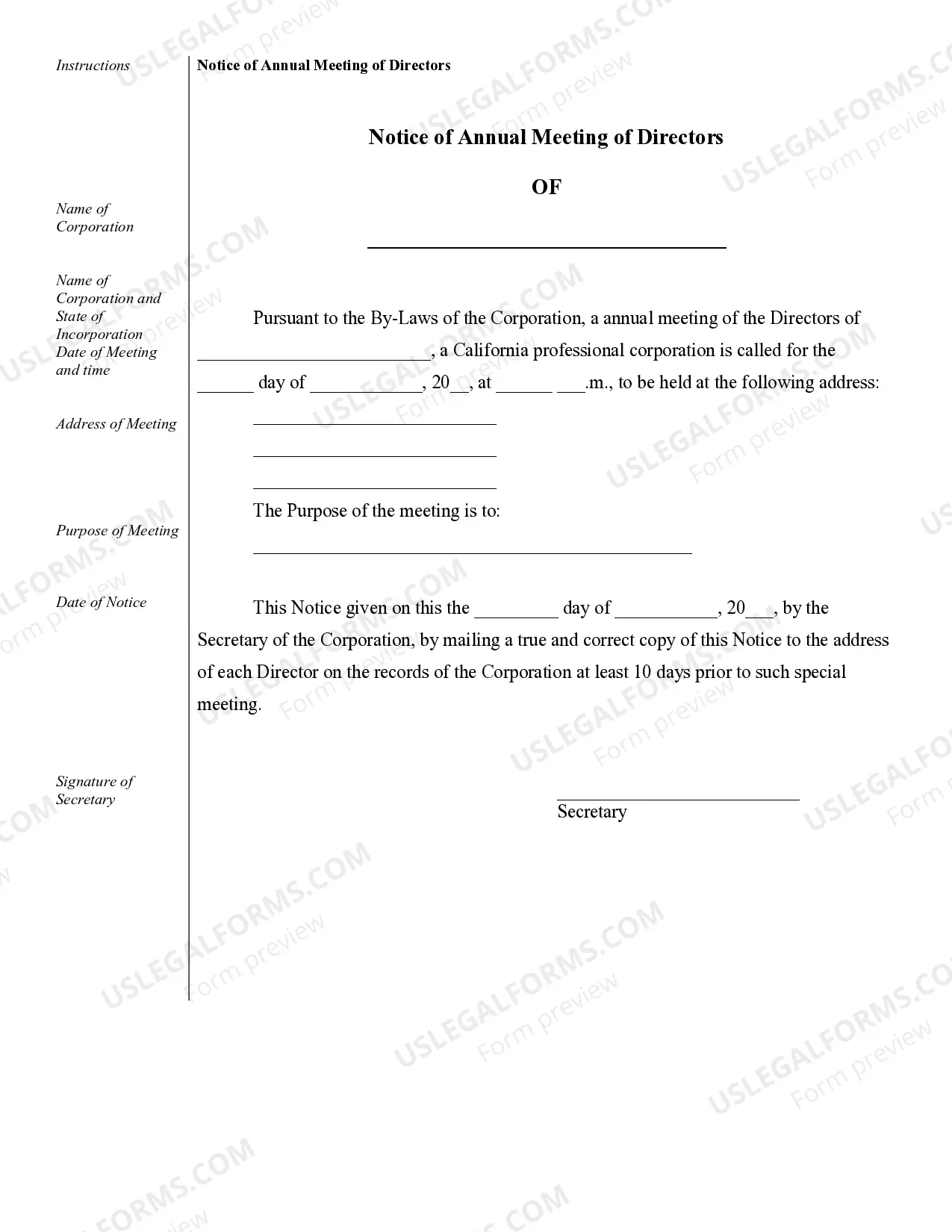

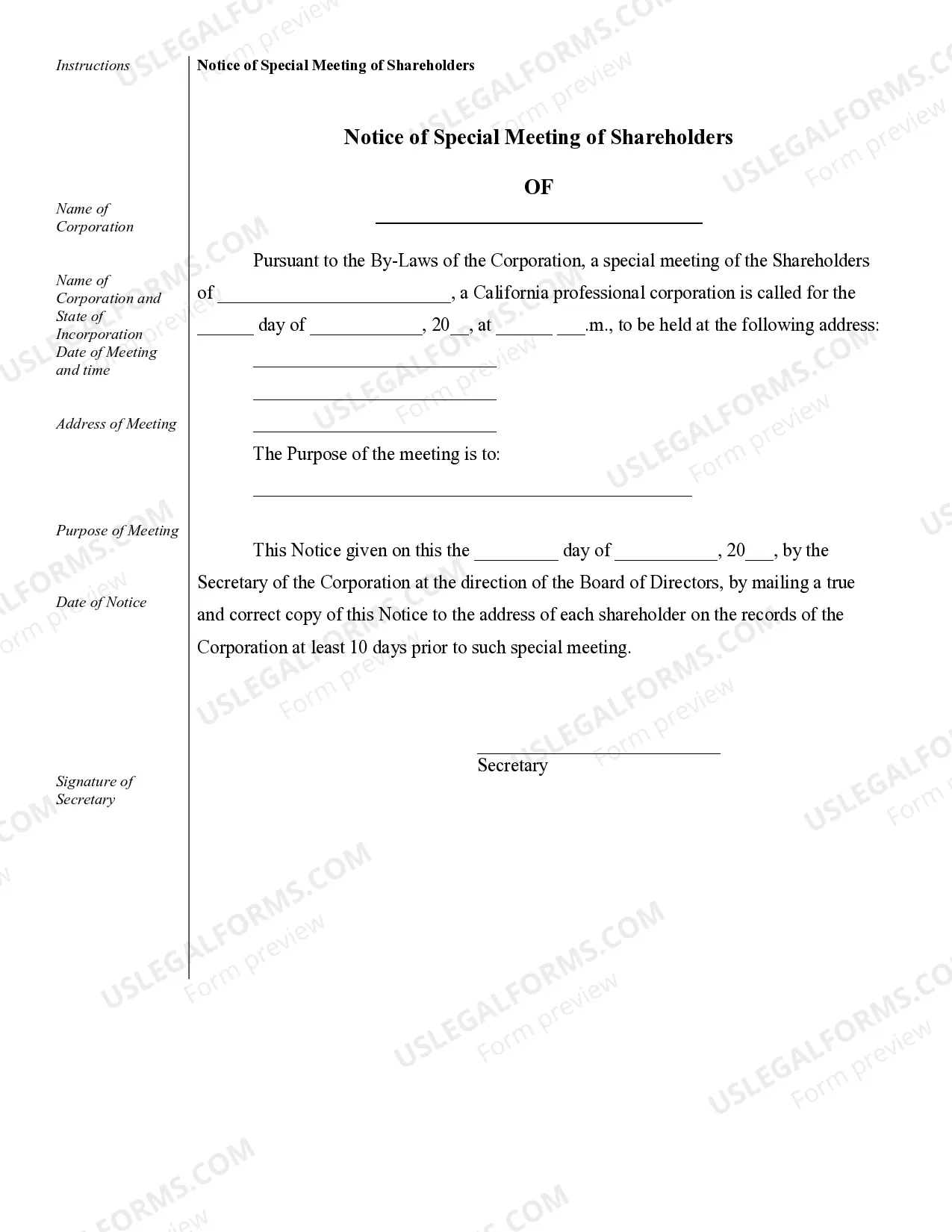

Norwalk Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive and organized record of a corporation's activities and financial transactions. These records act as proof of compliance with legal requirements and facilitate transparency within the organization. Here are some of the key types of Norwalk Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: This document establishes the existence of the corporation and includes information such as the corporation's name, purpose, registered agent, and shares of stock. It is filed with the California Secretary of State. 2. Bylaws: The bylaws outline the internal rules and regulations governing the corporation's operations, including the roles and responsibilities of its directors, officers, and shareholders. 3. Minutes of Meetings: These records document the discussions, decisions, and actions taken during meetings of the board of directors, committees, and shareholders. They include details such as attendees, topics discussed, and voting outcomes. 4. Shareholder and Director Resolutions: Resolutions record the official decisions made by the board of directors or shareholders. They cover various matters, such as amendments to the bylaws, appointment of officers, or approval of major business transactions. 5. Stock Ledger: The stock ledger maintains a record of the corporation's stock ownership, including information on shareholders, stock certificates, the number of shares owned, and any transfers or issuance of stock. 6. Annual Reports: An annual report is a comprehensive document that provides a summary of the corporation's financial performance, operations, and future plans. It is often filed with the Secretary of State and may also be shared with shareholders and other stakeholders. 7. Financial Statements: These records include the corporation's balance sheet, income statement, and cash flow statement. They provide an overview of its financial position, profitability, and liquidity, ensuring transparency and accountability. 8. Tax Returns: The corporation's tax returns, including federal and state filings, should be maintained as part of the corporate records. These documents demonstrate compliance with tax regulations and obligations. 9. Corporate Contracts and Agreements: Copies of contracts, agreements, or other legal documents entered into by the corporation should be included in the records. These may include vendor contracts, lease agreements, or partnership agreements. 10. Licenses and Permits: Any licenses, permits, or certificates required for the corporation's operation should be kept with the records, serving as evidence of compliance with regulatory requirements. It is important for a California Professional Corporation to maintain accurate and up-to-date Norwalk Sample Corporate Records. These documentation practices ensure legal compliance, facilitate efficient corporate governance, and protect the corporation's interests in various contexts such as audits, legal disputes, and potential mergers or acquisitions.Norwalk Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive and organized record of a corporation's activities and financial transactions. These records act as proof of compliance with legal requirements and facilitate transparency within the organization. Here are some of the key types of Norwalk Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: This document establishes the existence of the corporation and includes information such as the corporation's name, purpose, registered agent, and shares of stock. It is filed with the California Secretary of State. 2. Bylaws: The bylaws outline the internal rules and regulations governing the corporation's operations, including the roles and responsibilities of its directors, officers, and shareholders. 3. Minutes of Meetings: These records document the discussions, decisions, and actions taken during meetings of the board of directors, committees, and shareholders. They include details such as attendees, topics discussed, and voting outcomes. 4. Shareholder and Director Resolutions: Resolutions record the official decisions made by the board of directors or shareholders. They cover various matters, such as amendments to the bylaws, appointment of officers, or approval of major business transactions. 5. Stock Ledger: The stock ledger maintains a record of the corporation's stock ownership, including information on shareholders, stock certificates, the number of shares owned, and any transfers or issuance of stock. 6. Annual Reports: An annual report is a comprehensive document that provides a summary of the corporation's financial performance, operations, and future plans. It is often filed with the Secretary of State and may also be shared with shareholders and other stakeholders. 7. Financial Statements: These records include the corporation's balance sheet, income statement, and cash flow statement. They provide an overview of its financial position, profitability, and liquidity, ensuring transparency and accountability. 8. Tax Returns: The corporation's tax returns, including federal and state filings, should be maintained as part of the corporate records. These documents demonstrate compliance with tax regulations and obligations. 9. Corporate Contracts and Agreements: Copies of contracts, agreements, or other legal documents entered into by the corporation should be included in the records. These may include vendor contracts, lease agreements, or partnership agreements. 10. Licenses and Permits: Any licenses, permits, or certificates required for the corporation's operation should be kept with the records, serving as evidence of compliance with regulatory requirements. It is important for a California Professional Corporation to maintain accurate and up-to-date Norwalk Sample Corporate Records. These documentation practices ensure legal compliance, facilitate efficient corporate governance, and protect the corporation's interests in various contexts such as audits, legal disputes, and potential mergers or acquisitions.