Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

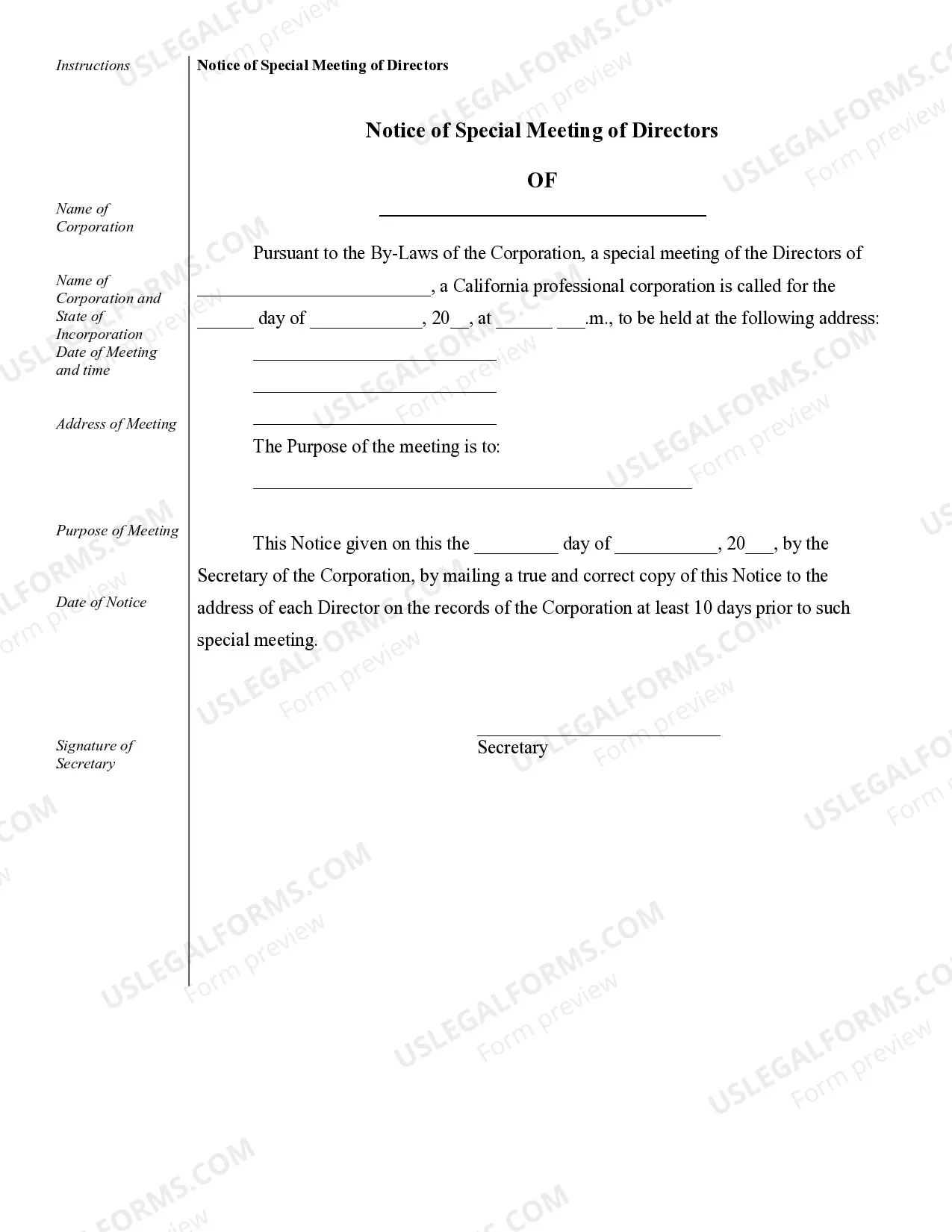

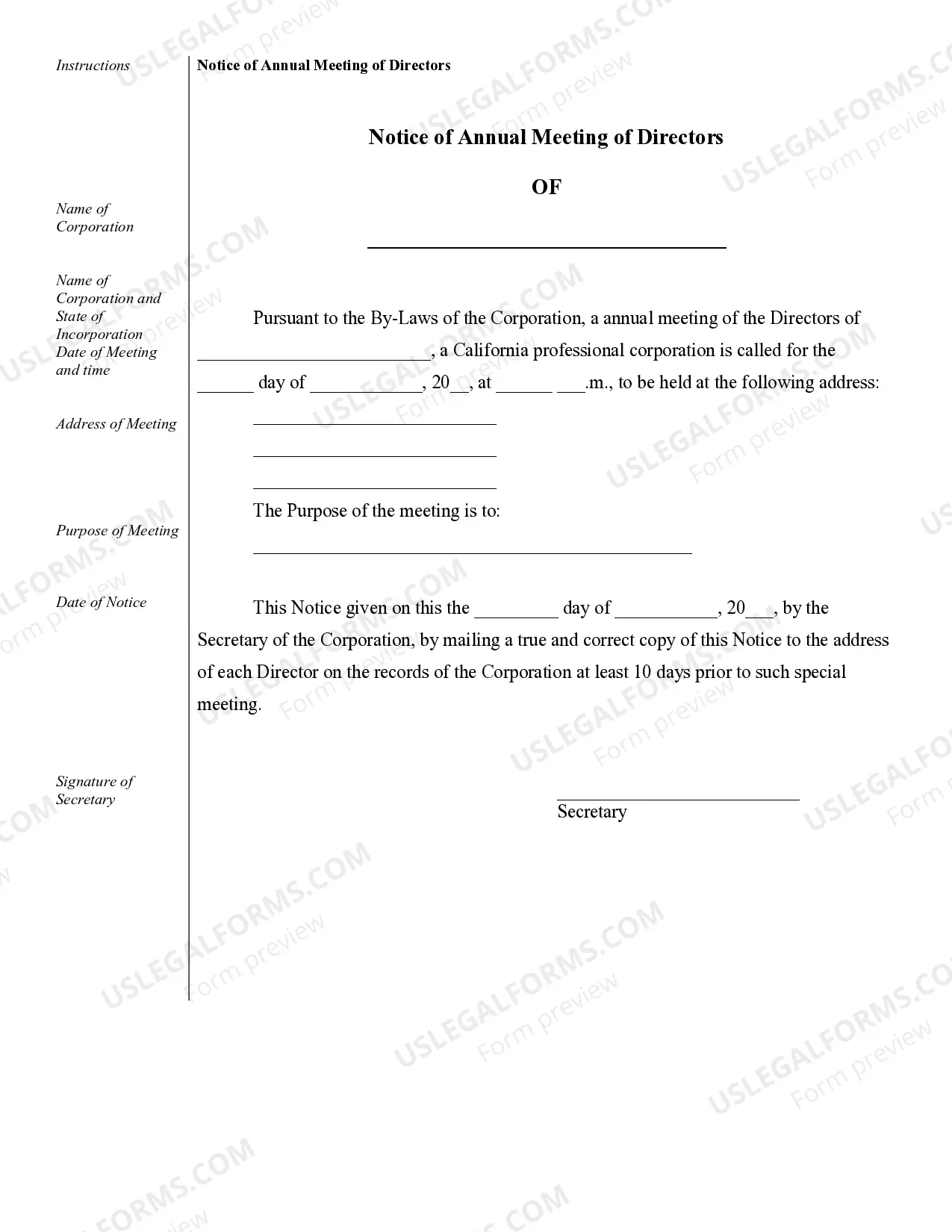

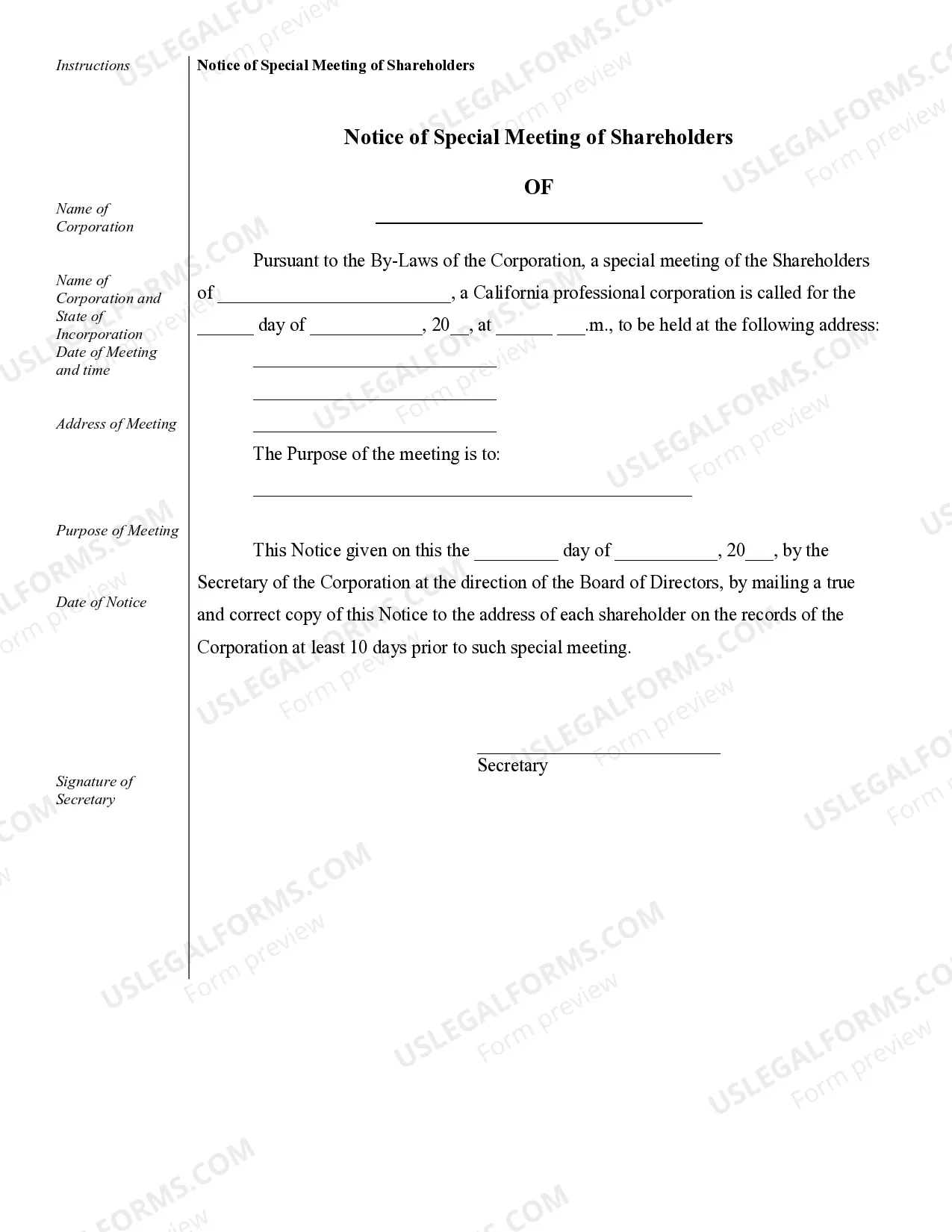

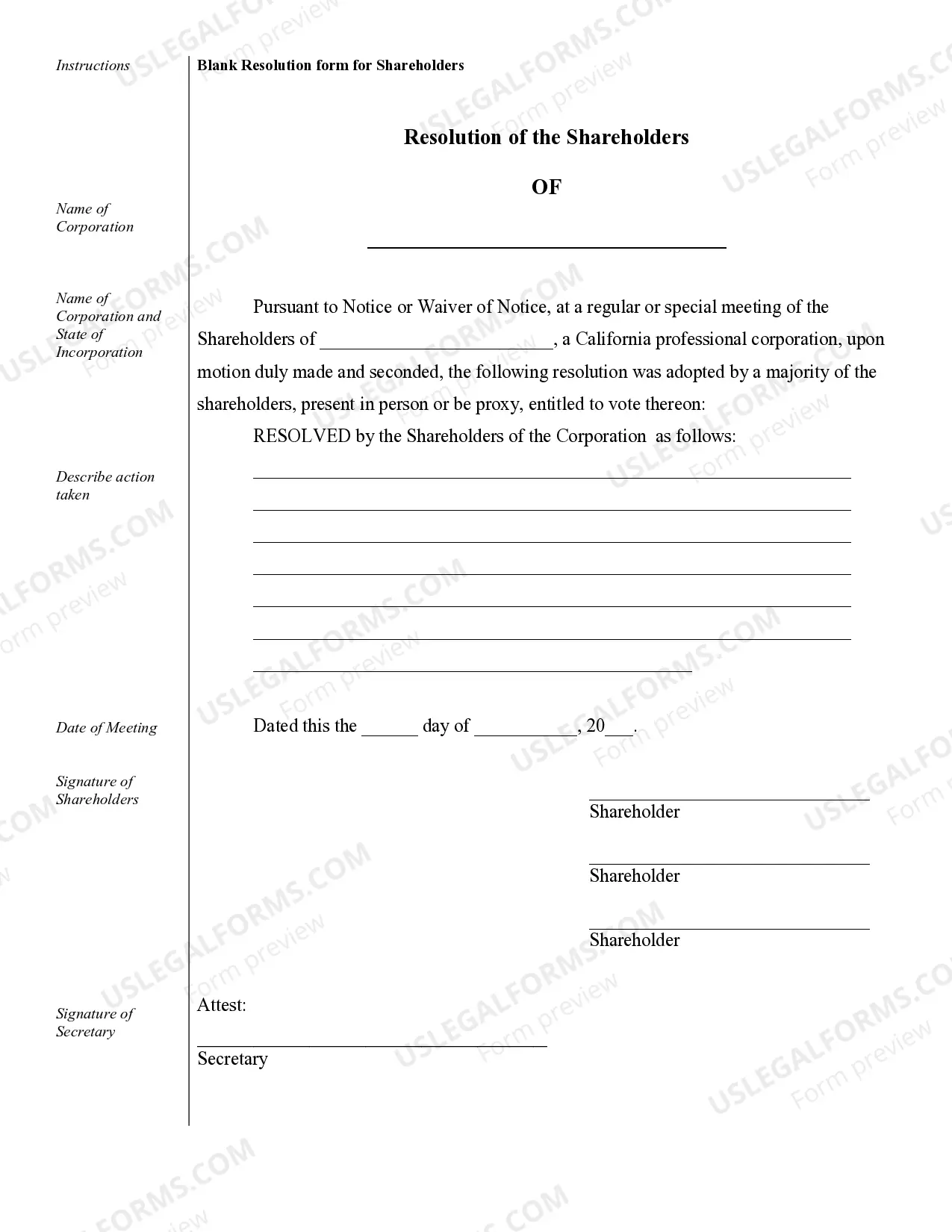

Palmdale Sample Corporate Records for a California Professional Corporation serve as vital documentation in maintaining the legal and financial aspects of your company. These records are essential for demonstrating compliance with state regulations, tracking business activities, and safeguarding the rights and responsibilities of shareholders and directors. Each record type holds a specific purpose and contributes to the overall transparency and integrity of the corporation. 1. Articles of Incorporation: The Articles of Incorporation represent a foundational document for any California Professional Corporation. It includes crucial details about the business, such as the corporation's name, purpose, board structure, and stock information. Filing the Articles with the California Secretary of State initiates the formal existence of the corporation. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the California Professional Corporation's operations. They typically cover key topics such as shareholder voting rights, director responsibilities, meeting procedures, and the overall decision-making process. Bylaws provide clarity and guidance for directors, officers, and shareholders, ensuring smooth corporate governance. 3. Shareholder Register: This register documents the ownership details of each shareholder in the corporation. It includes important information like the names, addresses, and stock holdings of the shareholders. Maintaining an accurate shareholder register is crucial for communication, voting, and distributing dividends within the corporation. 4. Meeting Minutes: Meeting minutes serve as official records documenting the discussions, decisions, and actions taken during shareholder and director meetings. These minutes capture various company matters, such as board elections, approval of financial statements, appointment of officers, and major business decisions. They provide an in-depth historical account of corporate activities and uphold transparency. 5. Financial Statements: California Professional Corporations are required to maintain financial statements, including balance sheets, income statements, and cash flow statements. These records provide a clear snapshot of the corporation's financial health, ensuring compliance with state regulations, and assisting with tax filings. 6. Stock Ledger: The stock ledger is a ledger book or an electronic record that tracks the issuance and transfer of company stocks. It maintains information about the initial issuance of shares, subsequent transfers, and relevant stock certificates. The stock ledger helps monitor ownership changes and simplifies tracking for future references. It is essential to note that these sample corporate records may vary depending on the specific needs of your California Professional Corporation. Consulting with legal and financial professionals is advisable to ensure compliance with state laws and proper documentation of corporate activities.