Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

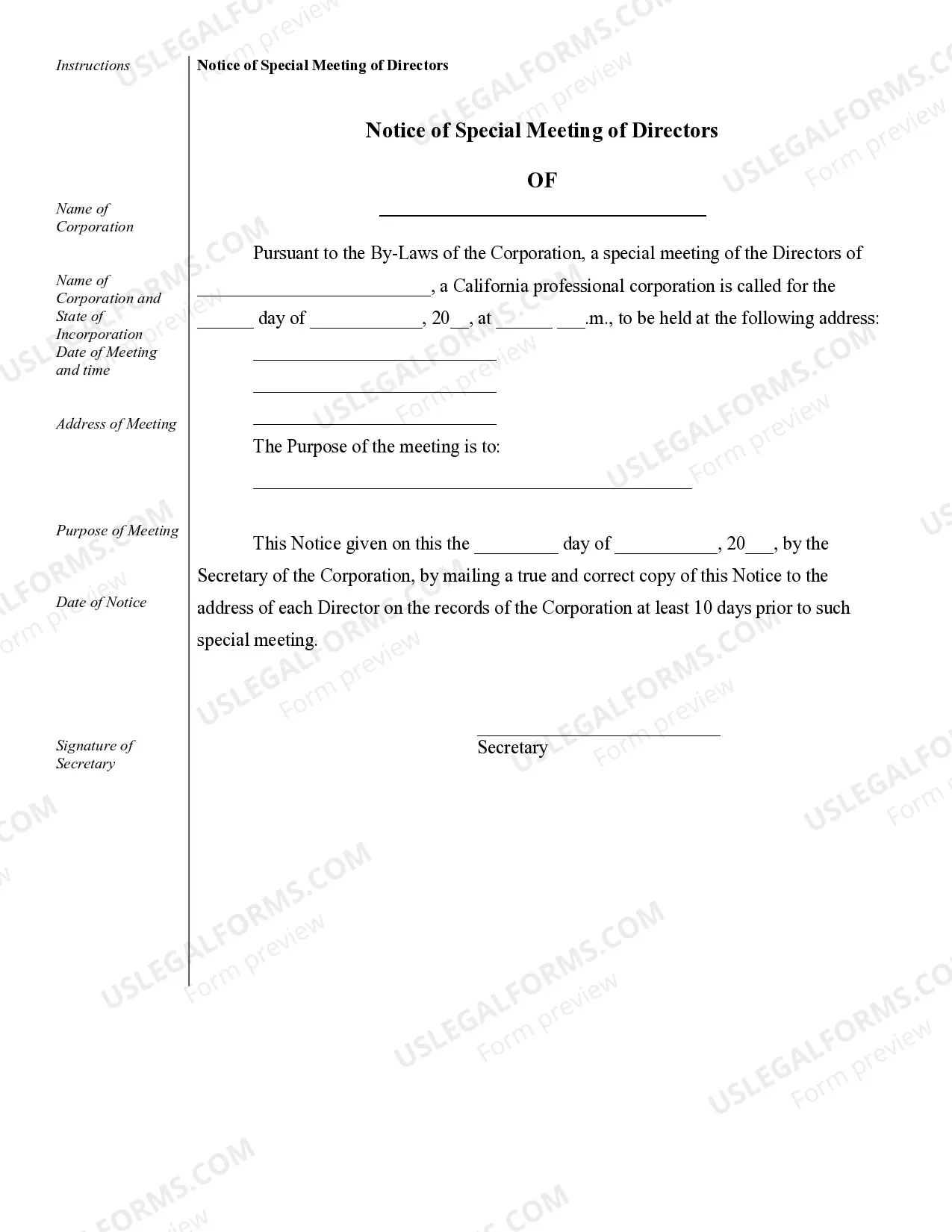

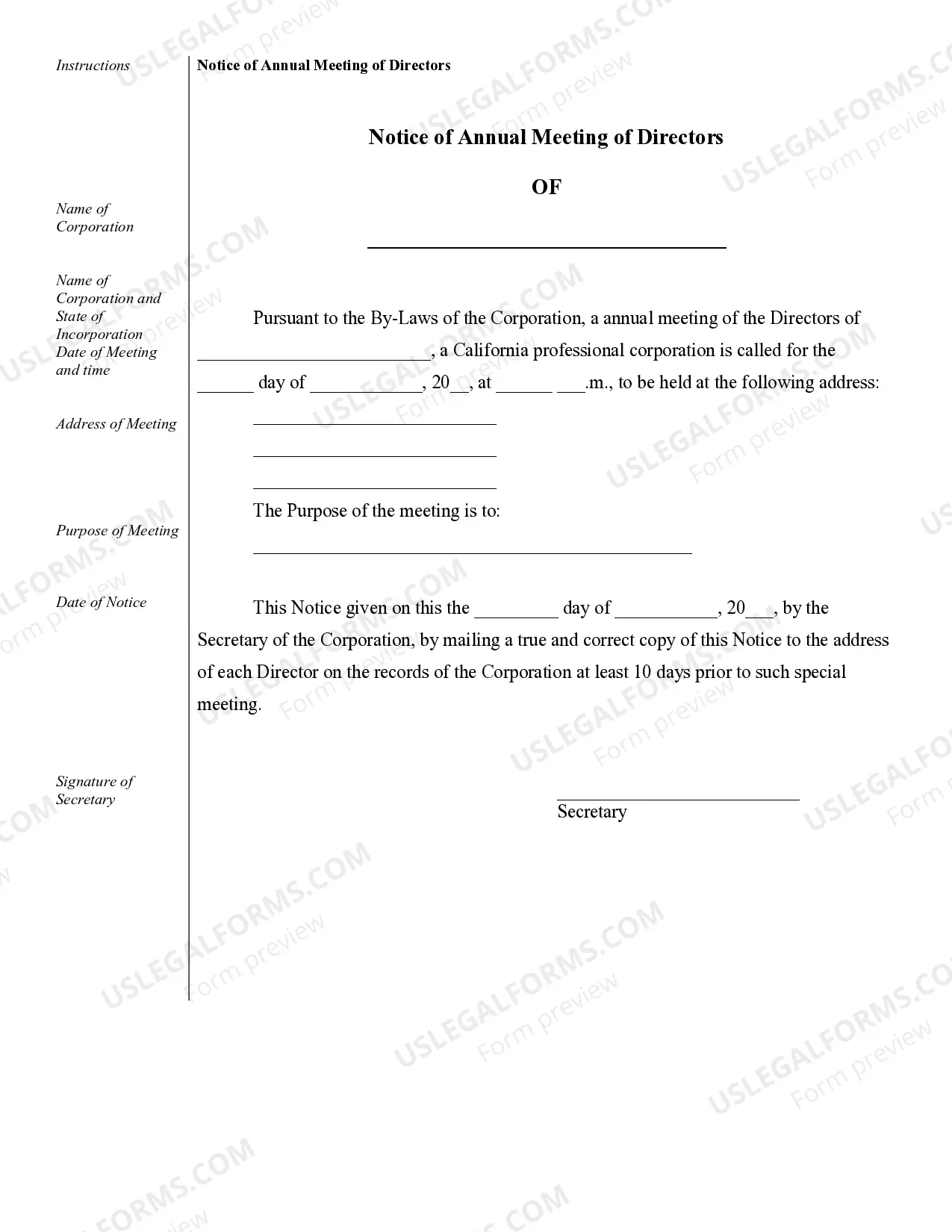

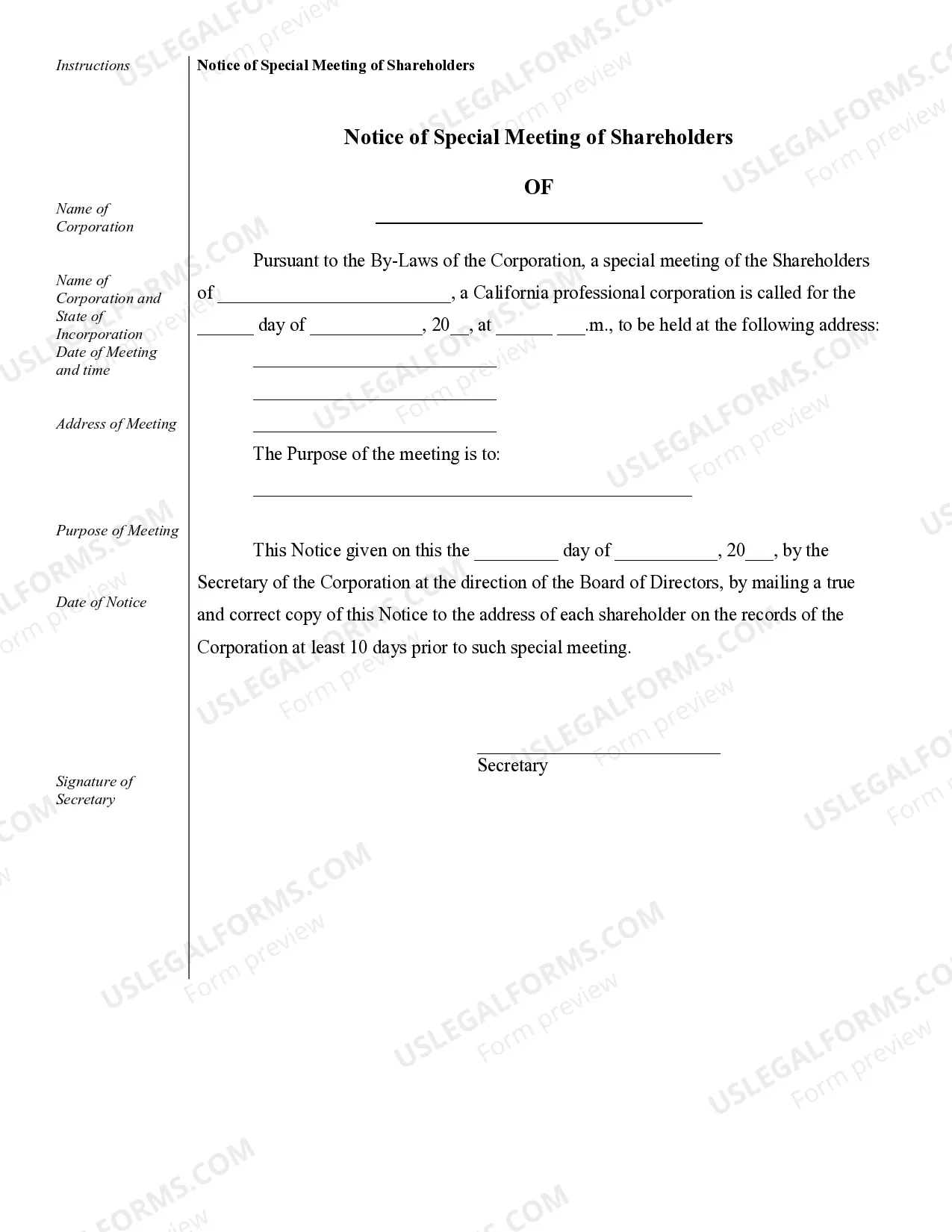

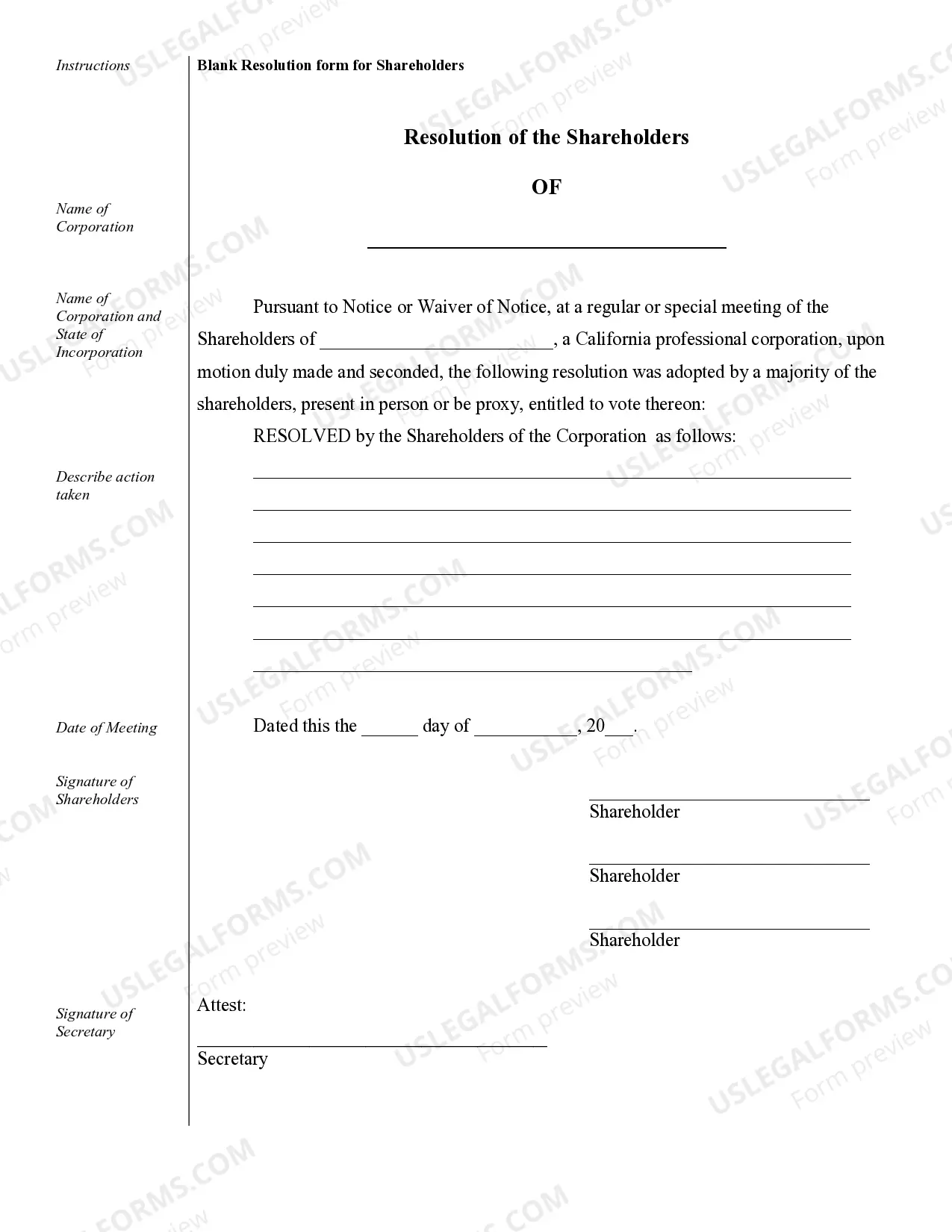

Rancho Cucamonga Sample Corporate Records for a California Professional Corporation When it comes to running a California Professional Corporation in Rancho Cucamonga, maintaining accurate and up-to-date corporate records is essential. These records serve as a legal documentation of the company's formation, structure, and ongoing compliance with state laws and regulations. The sample corporate records provided here offer an insight into the various types of documents that a professional corporation based in Rancho Cucamonga should maintain. 1. Articles of Incorporation: This is the foundational document that establishes a California Professional Corporation. It contains important information such as the corporate name, purpose, duration, and the names and addresses of directors and officers. 2. Bylaws: The bylaws lay down the rules and regulations for the internal operations of the professional corporation. They cover topics like board meetings, voting procedures, officer roles and responsibilities, and other governance practices. 3. Shareholder Agreements: In cases where there are multiple shareholders in the corporation, having shareholder agreements is crucial. These contracts outline the rights, responsibilities, and expectations of each shareholder, including matters related to stock ownership, dividends, buy-sell provisions, and dispute resolution mechanisms. 4. Board of Directors Meeting Minutes: These records detail the discussions, decisions, and actions taken during board meetings. Meeting minutes should accurately reflect the date, time, location, attendees, and topics covered, including any official resolutions or approvals. 5. Shareholder Meeting Minutes: Similar to board of directors meeting minutes, these records document the proceedings of shareholder meetings. They include information on the meeting agenda, resolutions adopted, voting results, and any other discussions of importance to shareholders. 6. Stock Ledger: The stock ledger is a comprehensive record of all shares that have been issued by the professional corporation. It contains details such as the shareholder's name, address, number of shares owned, and dates of issuance, transfer, or cancellation. 7. Annual Reports: California Professional Corporations are required to file annual reports with the California Secretary of State. These reports provide updates on the corporation's business activities, ownership changes, and contact information. They are essential for maintaining good standing and legal compliance. 8. Financial Statements: Accurate financial records, including balance sheets, income statements, and cash flow statements, must be maintained by a professional corporation. These documents reflect the company's financial health, performance, and compliance with accounting standards. 9. Employee Records: This includes documentation related to employee hiring, contracts, salaries, benefits, and any disciplinary actions. Properly maintaining employee records is not only crucial for legal compliance but also for efficient business operations. 10. Contracts and Legal Agreements: Professional corporations often enter into various contracts and agreements, such as client contracts, leases, vendor agreements, or partnership agreements. Keeping copies of these documents in the corporate record helps ensure accountability and proper communication. By keeping these Rancho Cucamonga Sample Corporate Records for a California Professional Corporation organized and up-to-date, companies can demonstrate transparency, comply with legal obligations, and effectively manage their operations. It is crucial to consult with legal professionals or corporate service providers to ensure that the specific requirements of a professional corporation are met and that records are properly managed.Rancho Cucamonga Sample Corporate Records for a California Professional Corporation When it comes to running a California Professional Corporation in Rancho Cucamonga, maintaining accurate and up-to-date corporate records is essential. These records serve as a legal documentation of the company's formation, structure, and ongoing compliance with state laws and regulations. The sample corporate records provided here offer an insight into the various types of documents that a professional corporation based in Rancho Cucamonga should maintain. 1. Articles of Incorporation: This is the foundational document that establishes a California Professional Corporation. It contains important information such as the corporate name, purpose, duration, and the names and addresses of directors and officers. 2. Bylaws: The bylaws lay down the rules and regulations for the internal operations of the professional corporation. They cover topics like board meetings, voting procedures, officer roles and responsibilities, and other governance practices. 3. Shareholder Agreements: In cases where there are multiple shareholders in the corporation, having shareholder agreements is crucial. These contracts outline the rights, responsibilities, and expectations of each shareholder, including matters related to stock ownership, dividends, buy-sell provisions, and dispute resolution mechanisms. 4. Board of Directors Meeting Minutes: These records detail the discussions, decisions, and actions taken during board meetings. Meeting minutes should accurately reflect the date, time, location, attendees, and topics covered, including any official resolutions or approvals. 5. Shareholder Meeting Minutes: Similar to board of directors meeting minutes, these records document the proceedings of shareholder meetings. They include information on the meeting agenda, resolutions adopted, voting results, and any other discussions of importance to shareholders. 6. Stock Ledger: The stock ledger is a comprehensive record of all shares that have been issued by the professional corporation. It contains details such as the shareholder's name, address, number of shares owned, and dates of issuance, transfer, or cancellation. 7. Annual Reports: California Professional Corporations are required to file annual reports with the California Secretary of State. These reports provide updates on the corporation's business activities, ownership changes, and contact information. They are essential for maintaining good standing and legal compliance. 8. Financial Statements: Accurate financial records, including balance sheets, income statements, and cash flow statements, must be maintained by a professional corporation. These documents reflect the company's financial health, performance, and compliance with accounting standards. 9. Employee Records: This includes documentation related to employee hiring, contracts, salaries, benefits, and any disciplinary actions. Properly maintaining employee records is not only crucial for legal compliance but also for efficient business operations. 10. Contracts and Legal Agreements: Professional corporations often enter into various contracts and agreements, such as client contracts, leases, vendor agreements, or partnership agreements. Keeping copies of these documents in the corporate record helps ensure accountability and proper communication. By keeping these Rancho Cucamonga Sample Corporate Records for a California Professional Corporation organized and up-to-date, companies can demonstrate transparency, comply with legal obligations, and effectively manage their operations. It is crucial to consult with legal professionals or corporate service providers to ensure that the specific requirements of a professional corporation are met and that records are properly managed.