Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

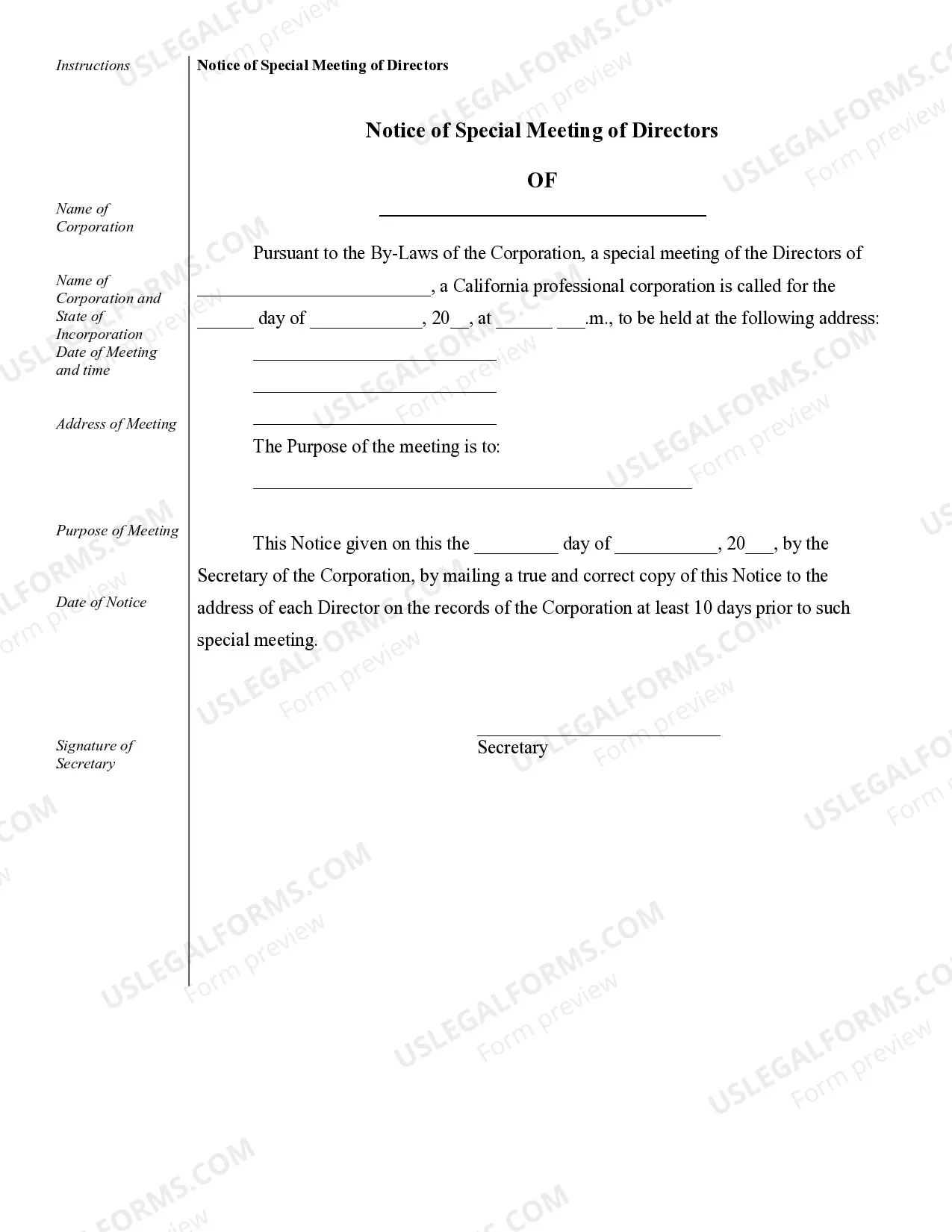

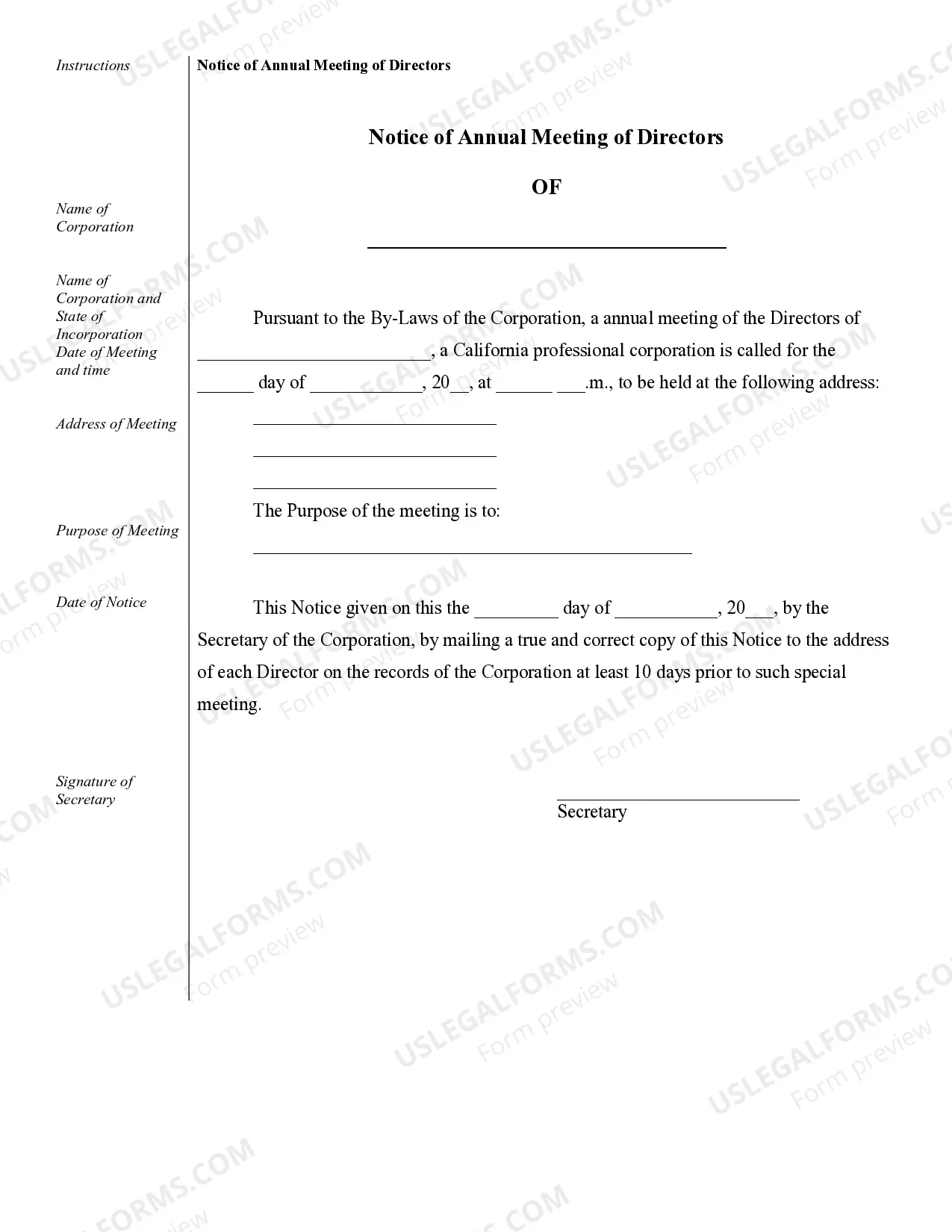

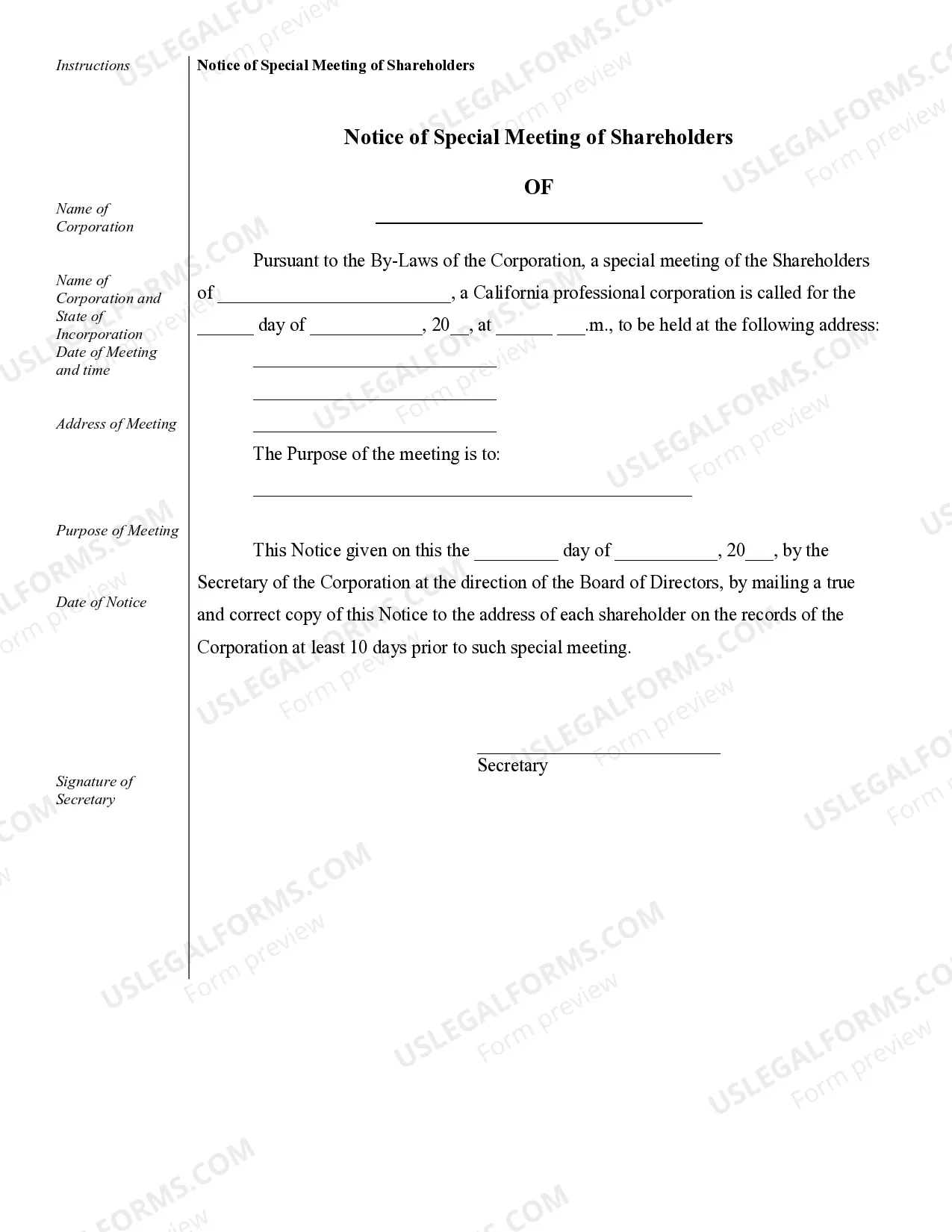

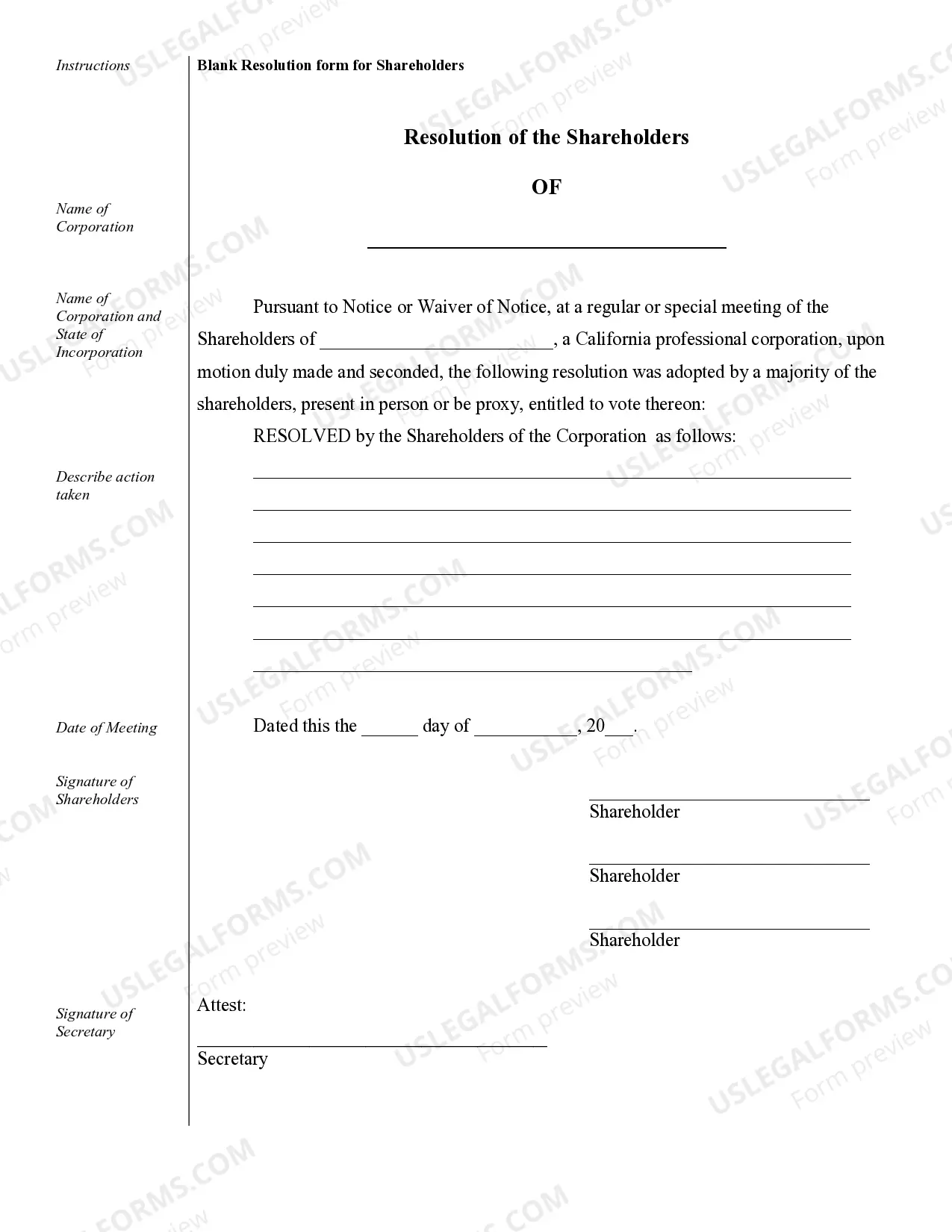

Rialto Sample Corporate Records for a California Professional Corporation are comprehensive documents that serve as a record of the essential information and activities of a professional corporation registered in California. These records are crucial for maintaining transparency, complying with legal obligations, and preserving corporate history. Below are some types of Rialto Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: These documents establish the professional corporation as a legal entity and include information such as the company's name, purpose, duration, address, and the names and addresses of the initial directors and officers. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations. They cover details such as the roles and responsibilities of directors and officers, meeting procedures, voting rights, and amendment procedures. 3. Organizational Meeting Minutes: These records document the discussions and decisions made at the initial meeting of the corporation's directors and shareholders. They typically cover the appointment of officers, adoption of bylaws, issuance of shares, and any other important matters. 4. Shareholder Meeting Minutes: These minutes capture the proceedings and outcomes of annual or special shareholder meetings. They include details like election of directors, financial reports, dividend declarations, stock issuance or transfers, and major corporate decisions requiring shareholder approval. 5. Director Meeting Minutes: Director meeting minutes record the discussions and resolutions made during board meetings. They outline important decisions regarding corporate policies, financial matters, strategic initiatives, officer appointments, and more. 6. Stock Ledger: The stock ledger maintains a record of all share issuance, transfers, and ownership details for the corporation's stockholders. It includes information like shareholder names, addresses, date of stock issuance or transfer, certificate numbers, and the number of shares held. 7. Financial Statements: These reports provide a snapshot of the corporation's financial health and performance. They include balance sheets, income statements, cash flow statements, and notes to financial statements. Financial statements may be audited, reviewed, or compiled, depending on the corporation's requirements. 8. Contracts and Agreements: These documents encompass various corporate agreements, such as client contracts, vendor agreements, employment contracts, and lease agreements. They outline the terms, conditions, and obligations of each party involved in the agreement. 9. Licenses and Permits: Records related to licenses and permits obtained by the professional corporation, such as professional licenses, business permits, and industry-specific certifications. 10. Tax Filings: Records pertaining to the corporation's tax returns, including federal, state, and local tax filings. This may include income tax returns, payroll tax returns, sales tax returns, and other relevant tax documents. By maintaining accurate and up-to-date Rialto Sample Corporate Records for a California Professional Corporation, businesses can ensure compliance with legal obligations, facilitate financial transparency, and effectively manage corporate affairs.Rialto Sample Corporate Records for a California Professional Corporation are comprehensive documents that serve as a record of the essential information and activities of a professional corporation registered in California. These records are crucial for maintaining transparency, complying with legal obligations, and preserving corporate history. Below are some types of Rialto Sample Corporate Records for a California Professional Corporation: 1. Articles of Incorporation: These documents establish the professional corporation as a legal entity and include information such as the company's name, purpose, duration, address, and the names and addresses of the initial directors and officers. 2. Bylaws: Bylaws outline the internal rules and regulations that govern the corporation's operations. They cover details such as the roles and responsibilities of directors and officers, meeting procedures, voting rights, and amendment procedures. 3. Organizational Meeting Minutes: These records document the discussions and decisions made at the initial meeting of the corporation's directors and shareholders. They typically cover the appointment of officers, adoption of bylaws, issuance of shares, and any other important matters. 4. Shareholder Meeting Minutes: These minutes capture the proceedings and outcomes of annual or special shareholder meetings. They include details like election of directors, financial reports, dividend declarations, stock issuance or transfers, and major corporate decisions requiring shareholder approval. 5. Director Meeting Minutes: Director meeting minutes record the discussions and resolutions made during board meetings. They outline important decisions regarding corporate policies, financial matters, strategic initiatives, officer appointments, and more. 6. Stock Ledger: The stock ledger maintains a record of all share issuance, transfers, and ownership details for the corporation's stockholders. It includes information like shareholder names, addresses, date of stock issuance or transfer, certificate numbers, and the number of shares held. 7. Financial Statements: These reports provide a snapshot of the corporation's financial health and performance. They include balance sheets, income statements, cash flow statements, and notes to financial statements. Financial statements may be audited, reviewed, or compiled, depending on the corporation's requirements. 8. Contracts and Agreements: These documents encompass various corporate agreements, such as client contracts, vendor agreements, employment contracts, and lease agreements. They outline the terms, conditions, and obligations of each party involved in the agreement. 9. Licenses and Permits: Records related to licenses and permits obtained by the professional corporation, such as professional licenses, business permits, and industry-specific certifications. 10. Tax Filings: Records pertaining to the corporation's tax returns, including federal, state, and local tax filings. This may include income tax returns, payroll tax returns, sales tax returns, and other relevant tax documents. By maintaining accurate and up-to-date Rialto Sample Corporate Records for a California Professional Corporation, businesses can ensure compliance with legal obligations, facilitate financial transparency, and effectively manage corporate affairs.