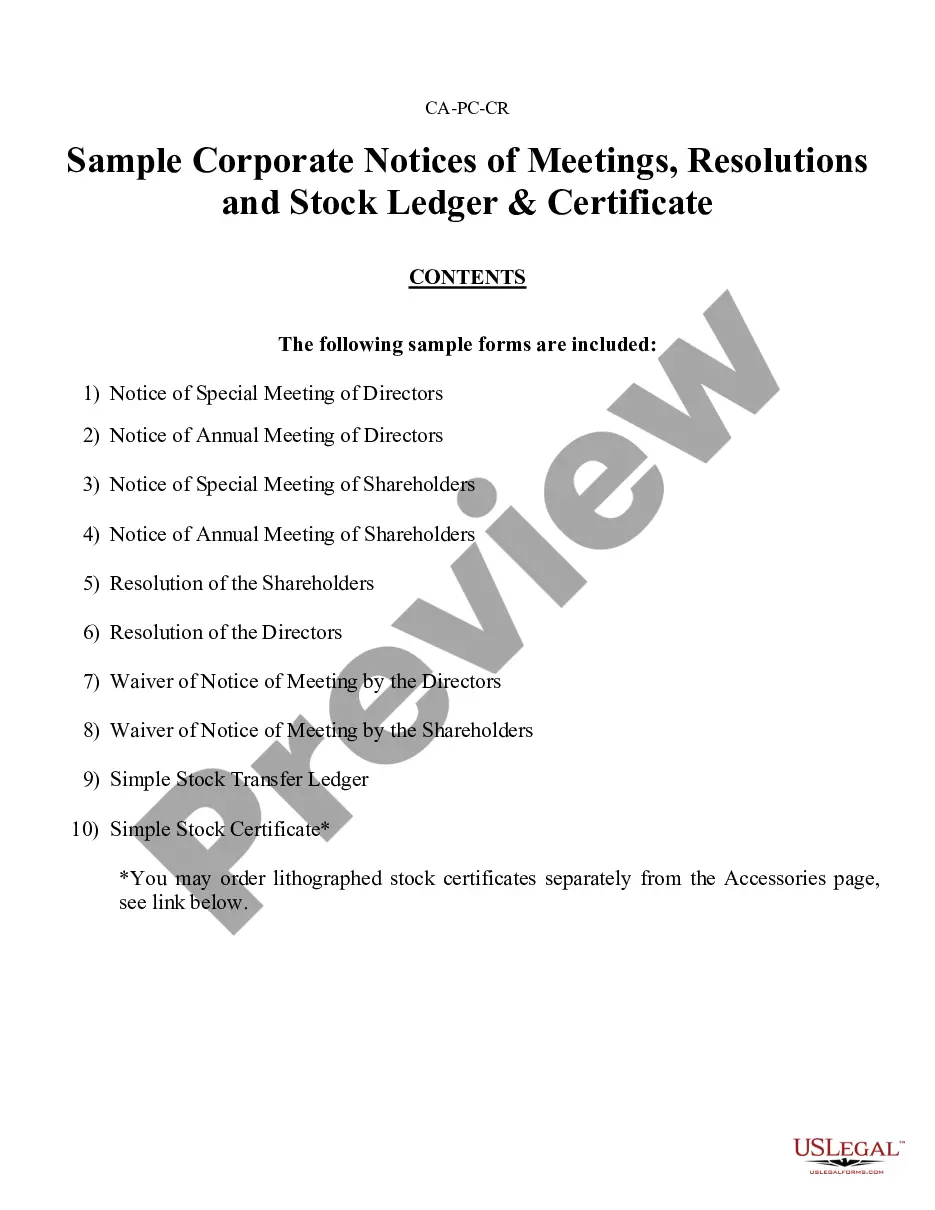

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

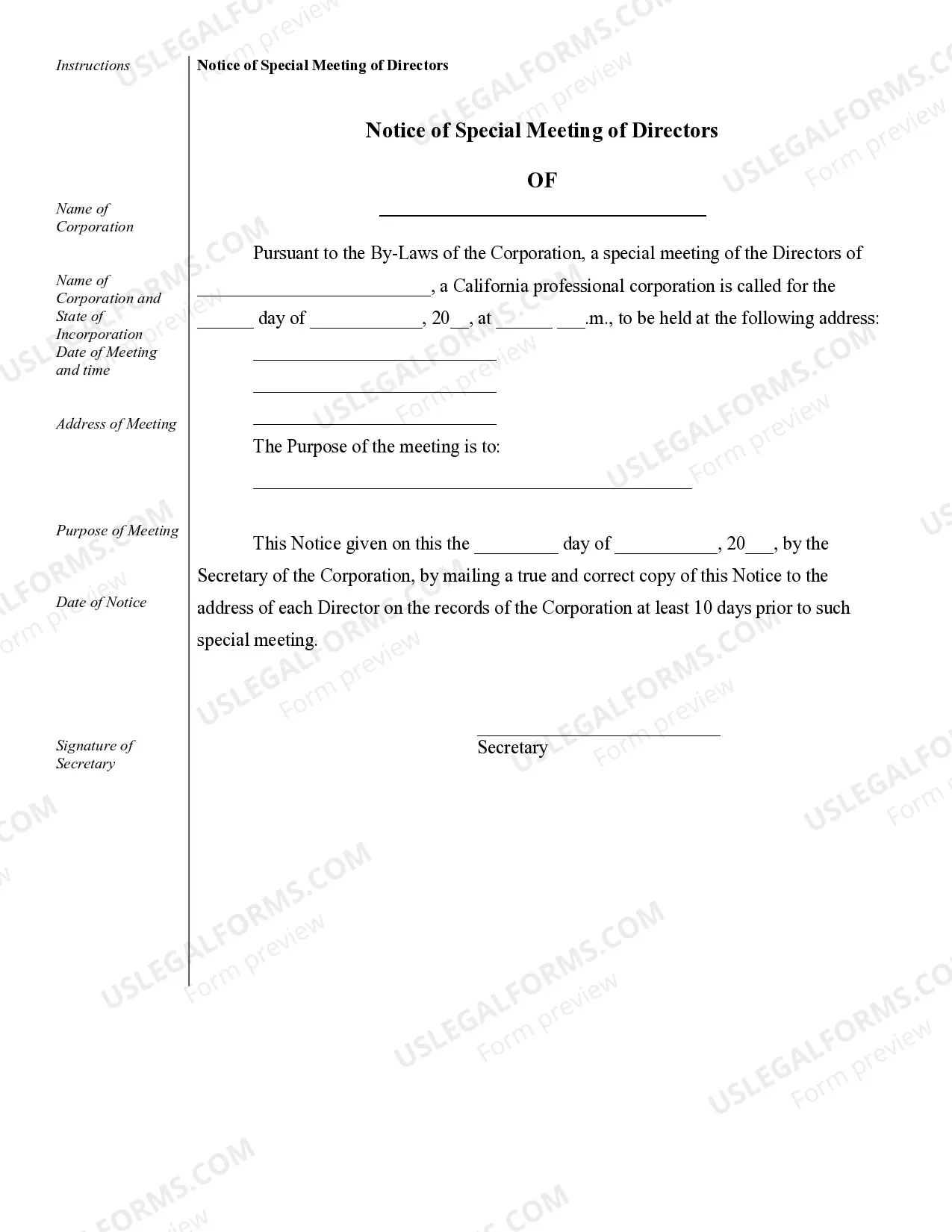

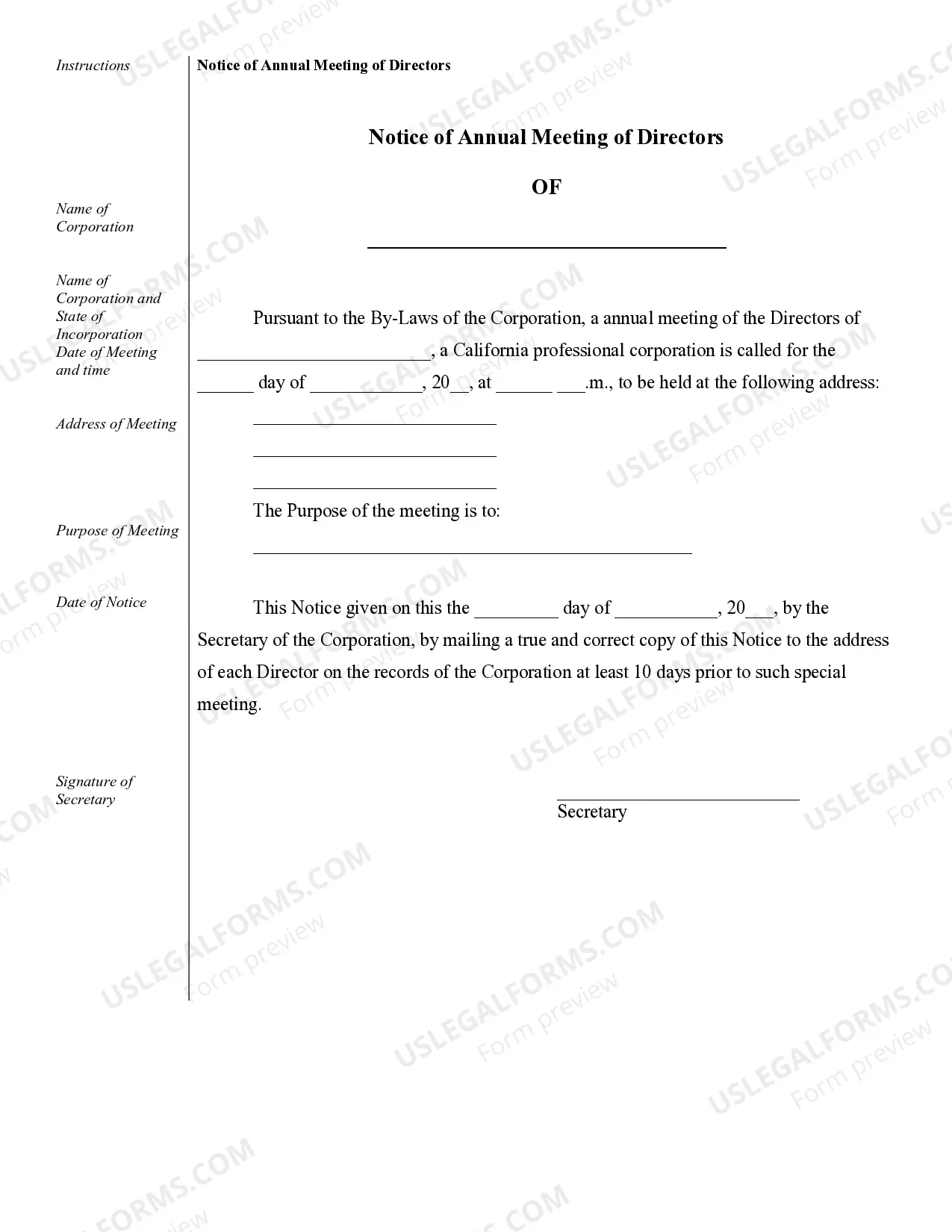

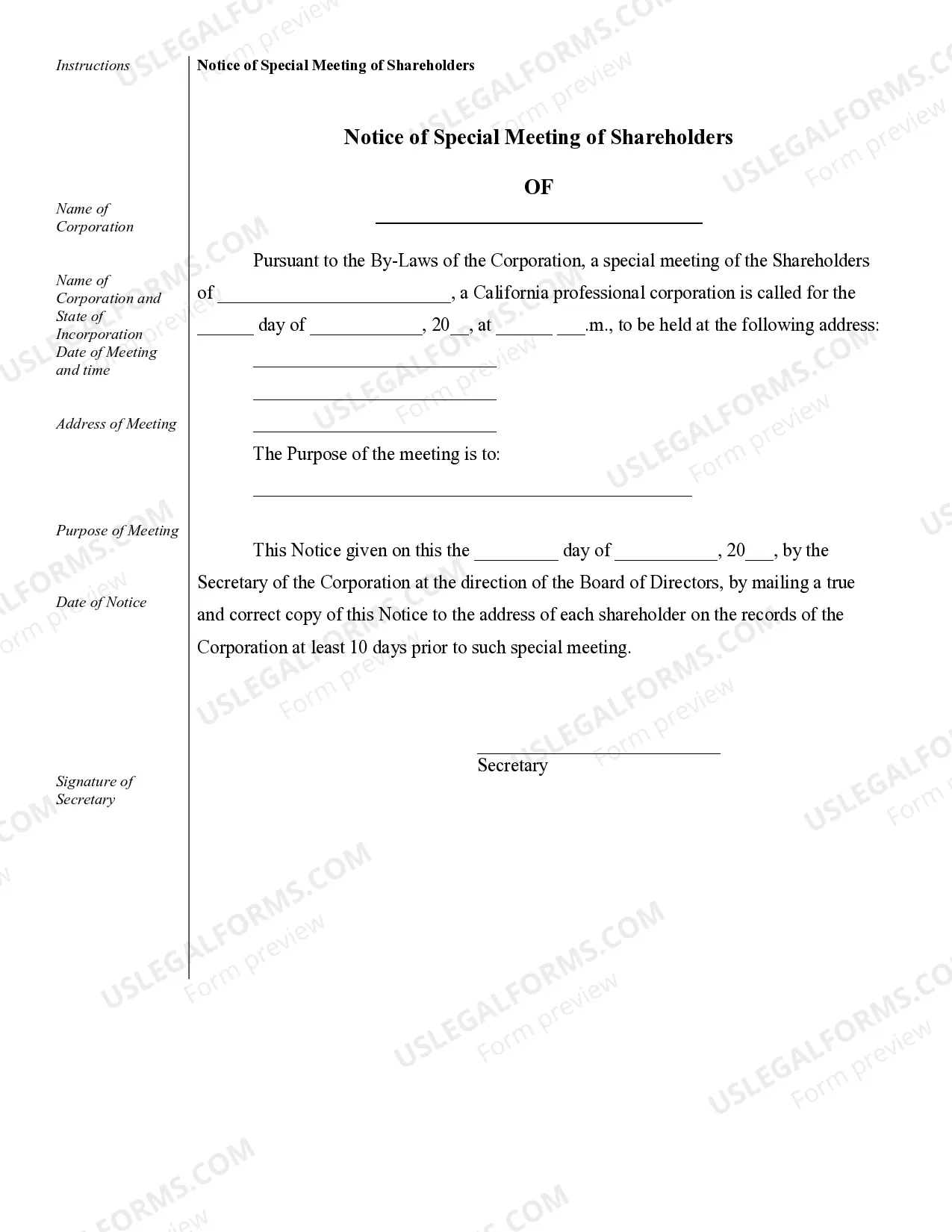

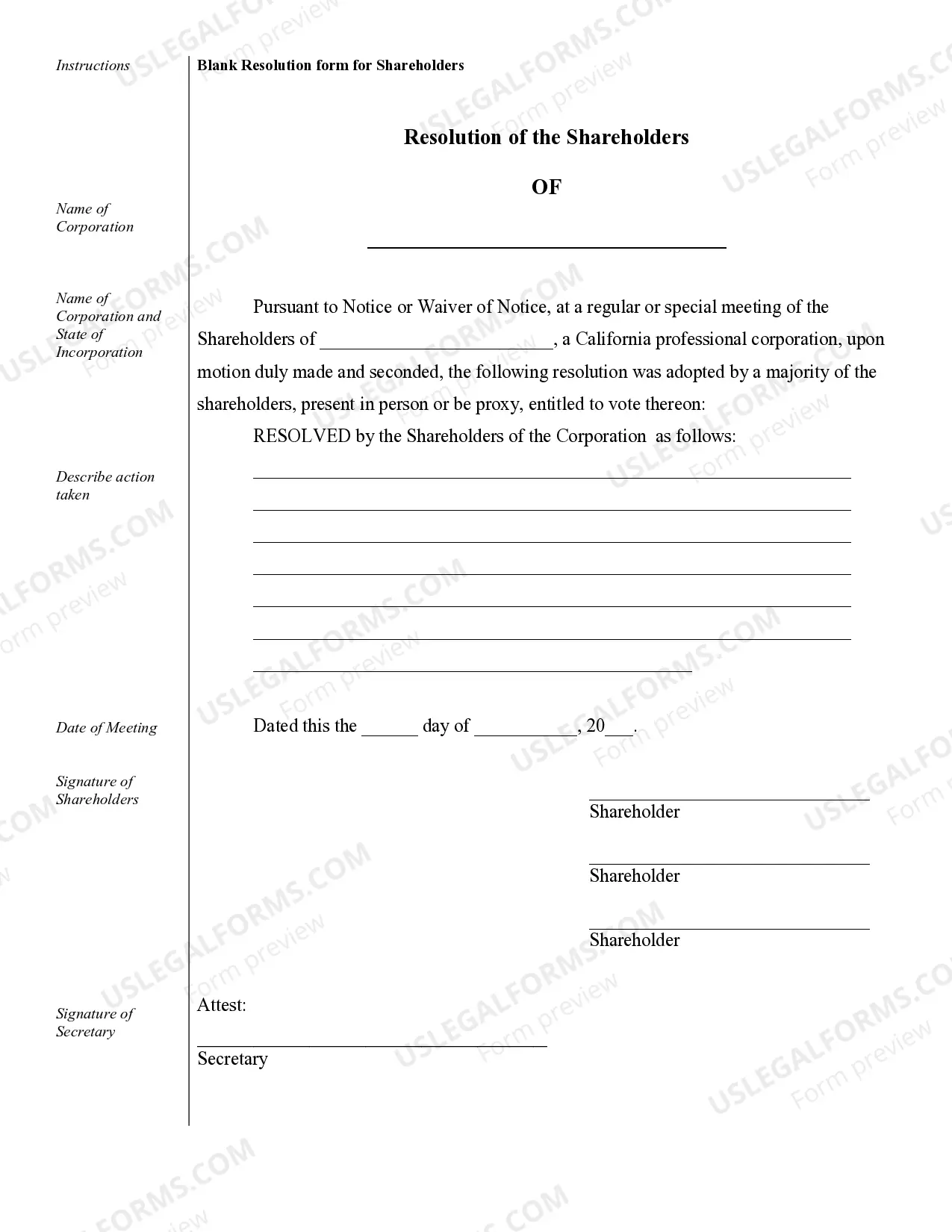

Riverside Sample Corporate Records for a California Professional Corporation are essential documents that provide detailed information about the company's formation, structure, and operations. These records serve as official evidence of the corporation's existence and compliance with state regulations. They also establish the corporation's identity, ownership, and various transactions throughout its lifespan. Below are various types of Riverside Sample Corporate Records commonly maintained by a California Professional Corporation: 1. Articles of Incorporation: This is the foundational document that establishes the corporation and includes information such as the corporation's name, purpose, registered agent, shareholders, and capital structure. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder and board meetings, officer roles and responsibilities, voting rights, and procedures for stock issuance. 3. Stock Ledger: This record tracks the issuance and ownership of the corporation's stock, including details such as the shareholder's name, contact information, number of shares, and dates of issuance or transfer. 4. Meeting Minutes: These are detailed records of the proceedings held during shareholder and board of directors' meetings. Meeting minutes include discussions, resolutions, voting results, and any major decisions or actions taken. 5. Shareholder Agreements: These documents outline the rights and obligations of shareholders, including voting rights, restrictions on stock transfers, dividend distributions, and procedures for dispute resolution. 6. Financial Statements: Statements such as balance sheets, income statements, and cash flow statements provide an overview of the corporation's financial position, performance, and cash flow. 7. Contracts and Agreements: This category encompasses various legal agreements, including contracts with clients, suppliers, employees, and any other relevant party. It also includes leases, licenses, and loan agreements. 8. Annual Reports: California Professional Corporations are required to file an annual report with the California Secretary of State, providing updated information about the company's officers, directors, and the registered agent's address. 9. Tax Filings: These records include federal and state tax returns, payroll tax filings, and any other relevant tax documents. 10. Licenses and Permits: If applicable, the corporation maintains licenses and permits granted by government authorities to operate within specific industries or geographical areas. It is important to note that the specific records maintained may vary depending on the corporation's size, industry, and specific legal requirements. However, these Riverside Sample Corporate Records provide a comprehensive overview of the key documents typically associated with a California Professional Corporation.Riverside Sample Corporate Records for a California Professional Corporation are essential documents that provide detailed information about the company's formation, structure, and operations. These records serve as official evidence of the corporation's existence and compliance with state regulations. They also establish the corporation's identity, ownership, and various transactions throughout its lifespan. Below are various types of Riverside Sample Corporate Records commonly maintained by a California Professional Corporation: 1. Articles of Incorporation: This is the foundational document that establishes the corporation and includes information such as the corporation's name, purpose, registered agent, shareholders, and capital structure. 2. Bylaws: These are the internal rules and regulations that govern the corporation's operations, including procedures for shareholder and board meetings, officer roles and responsibilities, voting rights, and procedures for stock issuance. 3. Stock Ledger: This record tracks the issuance and ownership of the corporation's stock, including details such as the shareholder's name, contact information, number of shares, and dates of issuance or transfer. 4. Meeting Minutes: These are detailed records of the proceedings held during shareholder and board of directors' meetings. Meeting minutes include discussions, resolutions, voting results, and any major decisions or actions taken. 5. Shareholder Agreements: These documents outline the rights and obligations of shareholders, including voting rights, restrictions on stock transfers, dividend distributions, and procedures for dispute resolution. 6. Financial Statements: Statements such as balance sheets, income statements, and cash flow statements provide an overview of the corporation's financial position, performance, and cash flow. 7. Contracts and Agreements: This category encompasses various legal agreements, including contracts with clients, suppliers, employees, and any other relevant party. It also includes leases, licenses, and loan agreements. 8. Annual Reports: California Professional Corporations are required to file an annual report with the California Secretary of State, providing updated information about the company's officers, directors, and the registered agent's address. 9. Tax Filings: These records include federal and state tax returns, payroll tax filings, and any other relevant tax documents. 10. Licenses and Permits: If applicable, the corporation maintains licenses and permits granted by government authorities to operate within specific industries or geographical areas. It is important to note that the specific records maintained may vary depending on the corporation's size, industry, and specific legal requirements. However, these Riverside Sample Corporate Records provide a comprehensive overview of the key documents typically associated with a California Professional Corporation.