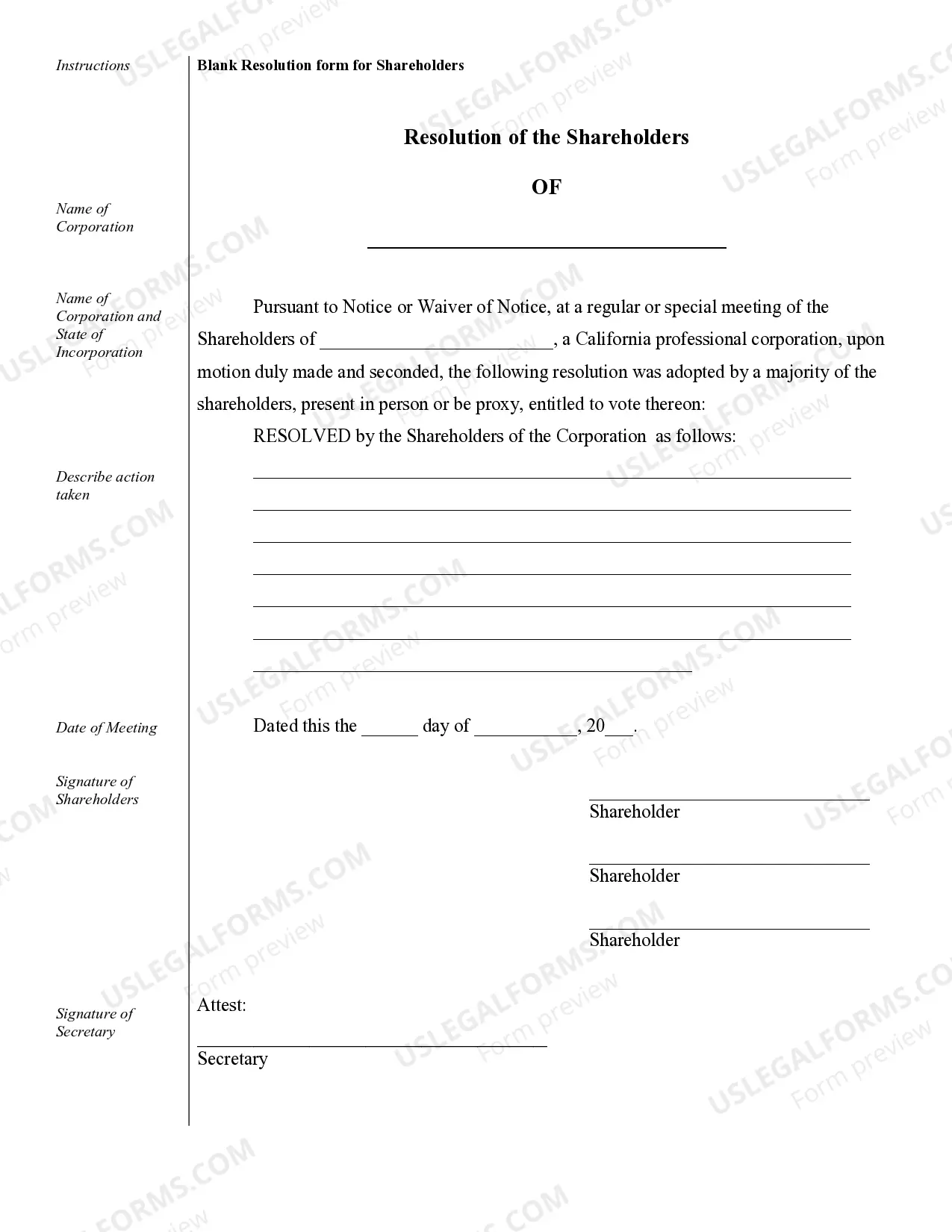

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

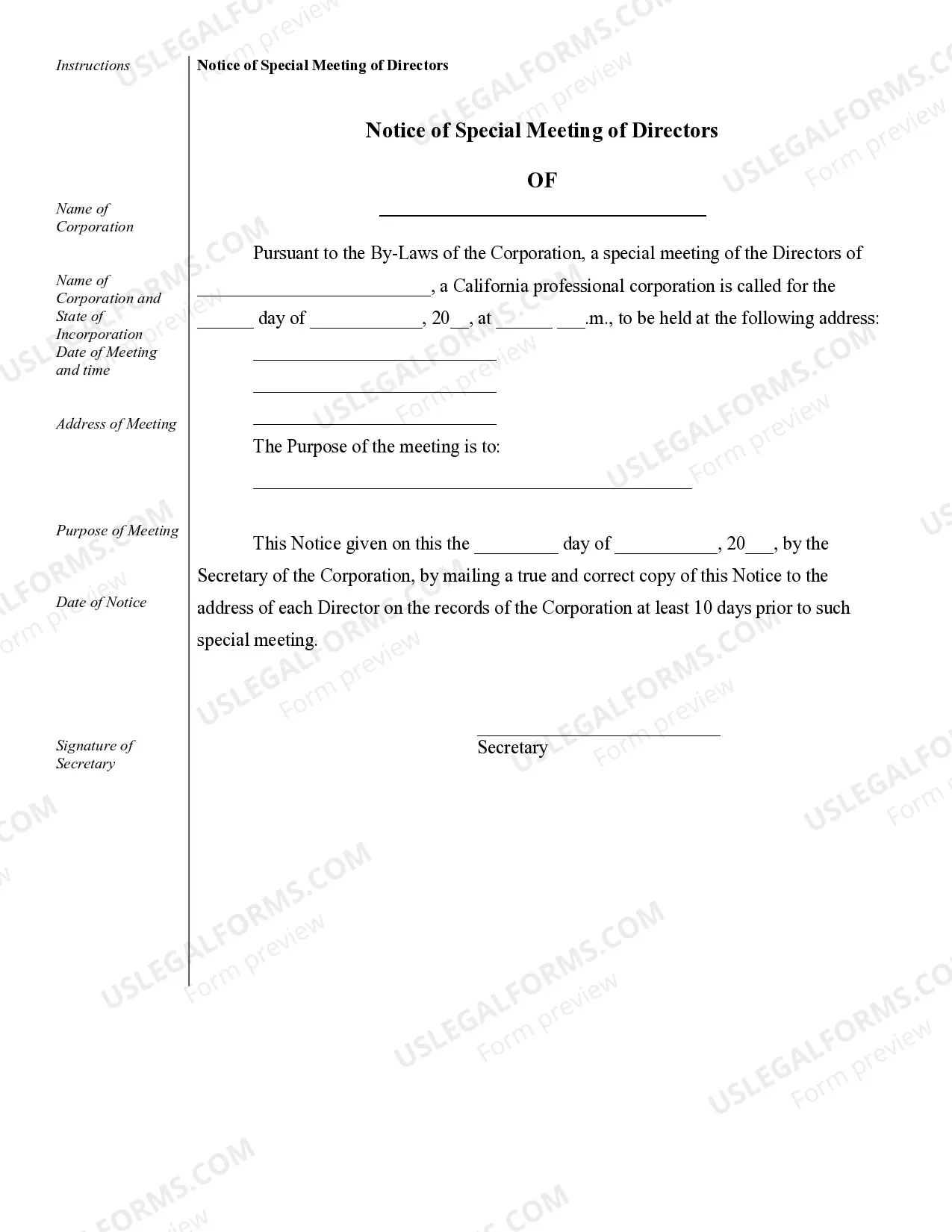

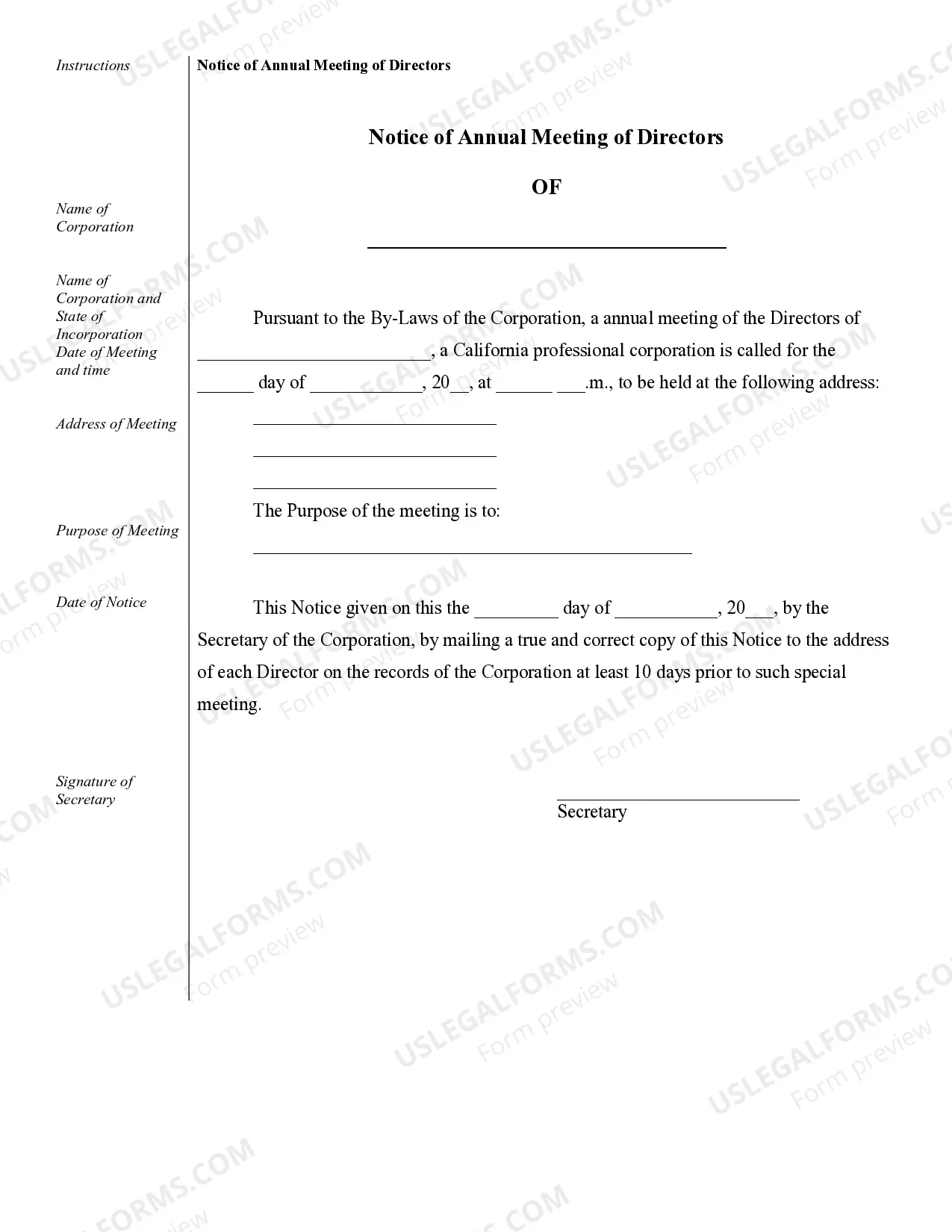

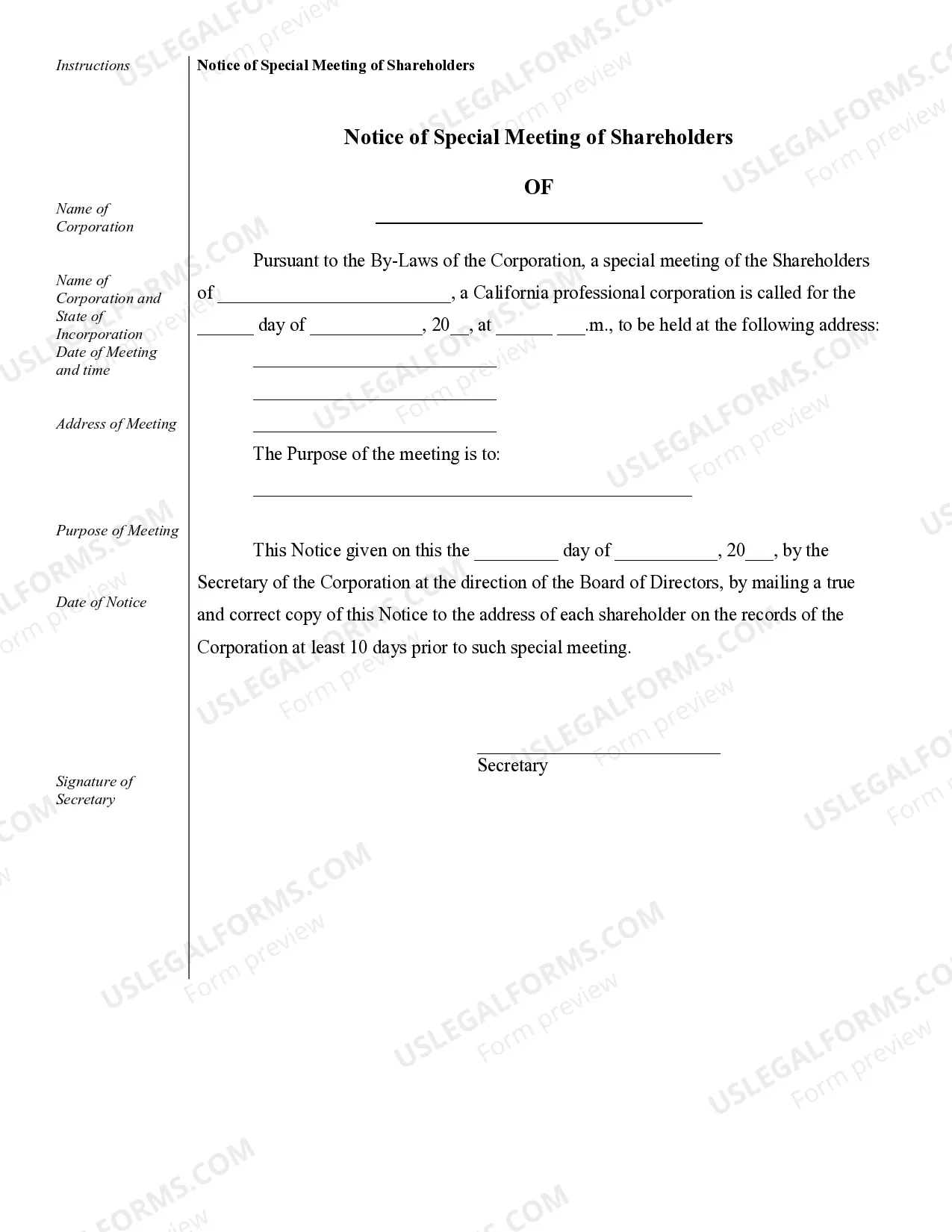

Salinas Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive overview and history of a professional corporation operating in the state of California. These records serve as a detailed reference for both the corporation's management and regulatory authorities. The various types of Salinas Sample Corporate Records for a California Professional Corporation include: 1. Articles of Incorporation: This is a foundational document filed with the California Secretary of State that establishes the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, and initial officers and directors. 2. Bylaws: These are rules and regulations created by the corporation to outline its internal management and governance structure. Bylaws typically cover topics such as the roles and responsibilities of directors and officers, procedures for holding meetings, voting rights, and any other specific corporate policies. 3. Shareholder Agreements: These agreements govern the rights and obligations of shareholders within the corporation. It covers matters such as the transfer of shares, restrictions on share transfers, dividend distribution, and procedures for resolving shareholder disputes. 4. Stock Certificates: These documents serve as evidence of ownership for shareholders in a professional corporation. They typically include details such as the shareholder's name, the number and class of shares owned, and any special rights or restrictions associated with the shares. 5. Meeting Minutes: These are detailed records of the discussions, decisions, and resolutions passed during board of directors' and shareholder meetings. Meeting minutes reflect the corporation's official actions, including approvals of important corporate matters such as mergers, acquisitions, financial statements, and officer appointments. 6. Annual Reports: California law requires professional corporations to file annual reports with the Secretary of State. These reports provide an update on the corporation's current officers, directors, and shareholders, as well as its financial information. They also include any amendments to the Articles of Incorporation or changes in the corporation's registered agent. 7. Financial Statements: These documents provide a snapshot of the financial health of the professional corporation. They include the income statement, balance sheet, and cash flow statement that provide an overview of the corporation's revenues, expenses, assets, and liabilities. 8. Employment Contracts: These agreements outline the terms and conditions of employment for key employees, such as officers and directors. They typically cover compensation, benefits, working hours, job responsibilities, and termination clauses. It is important for a California Professional Corporation to maintain accurate and up-to-date corporate records in order to comply with legal and regulatory requirements. These records not only provide a historical record of the corporation's activities but also serve as a valuable resource in ensuring proper corporate governance and decision-making.Salinas Sample Corporate Records for a California Professional Corporation are essential documents that provide a comprehensive overview and history of a professional corporation operating in the state of California. These records serve as a detailed reference for both the corporation's management and regulatory authorities. The various types of Salinas Sample Corporate Records for a California Professional Corporation include: 1. Articles of Incorporation: This is a foundational document filed with the California Secretary of State that establishes the existence of the professional corporation. It includes information such as the corporation's name, purpose, registered agent, and initial officers and directors. 2. Bylaws: These are rules and regulations created by the corporation to outline its internal management and governance structure. Bylaws typically cover topics such as the roles and responsibilities of directors and officers, procedures for holding meetings, voting rights, and any other specific corporate policies. 3. Shareholder Agreements: These agreements govern the rights and obligations of shareholders within the corporation. It covers matters such as the transfer of shares, restrictions on share transfers, dividend distribution, and procedures for resolving shareholder disputes. 4. Stock Certificates: These documents serve as evidence of ownership for shareholders in a professional corporation. They typically include details such as the shareholder's name, the number and class of shares owned, and any special rights or restrictions associated with the shares. 5. Meeting Minutes: These are detailed records of the discussions, decisions, and resolutions passed during board of directors' and shareholder meetings. Meeting minutes reflect the corporation's official actions, including approvals of important corporate matters such as mergers, acquisitions, financial statements, and officer appointments. 6. Annual Reports: California law requires professional corporations to file annual reports with the Secretary of State. These reports provide an update on the corporation's current officers, directors, and shareholders, as well as its financial information. They also include any amendments to the Articles of Incorporation or changes in the corporation's registered agent. 7. Financial Statements: These documents provide a snapshot of the financial health of the professional corporation. They include the income statement, balance sheet, and cash flow statement that provide an overview of the corporation's revenues, expenses, assets, and liabilities. 8. Employment Contracts: These agreements outline the terms and conditions of employment for key employees, such as officers and directors. They typically cover compensation, benefits, working hours, job responsibilities, and termination clauses. It is important for a California Professional Corporation to maintain accurate and up-to-date corporate records in order to comply with legal and regulatory requirements. These records not only provide a historical record of the corporation's activities but also serve as a valuable resource in ensuring proper corporate governance and decision-making.