Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

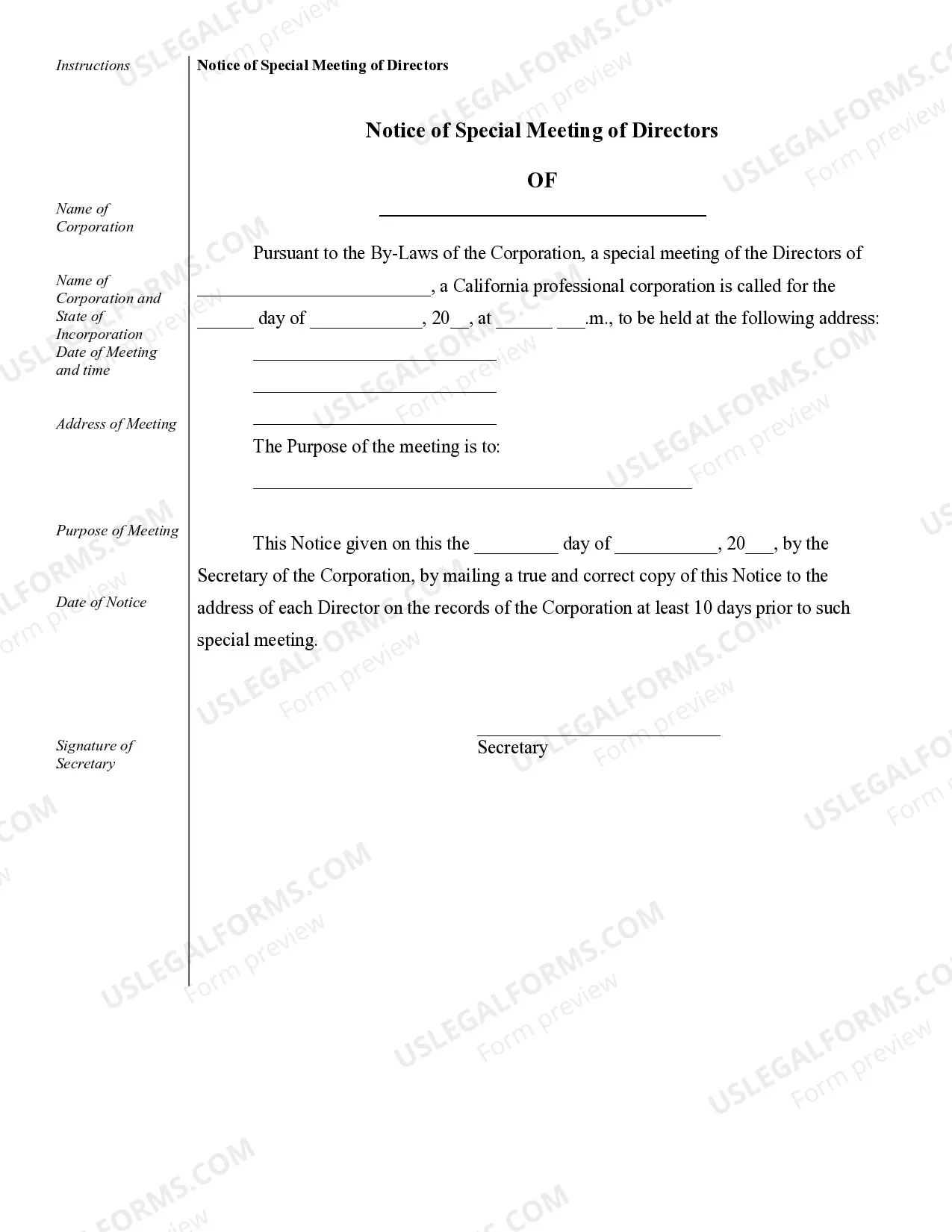

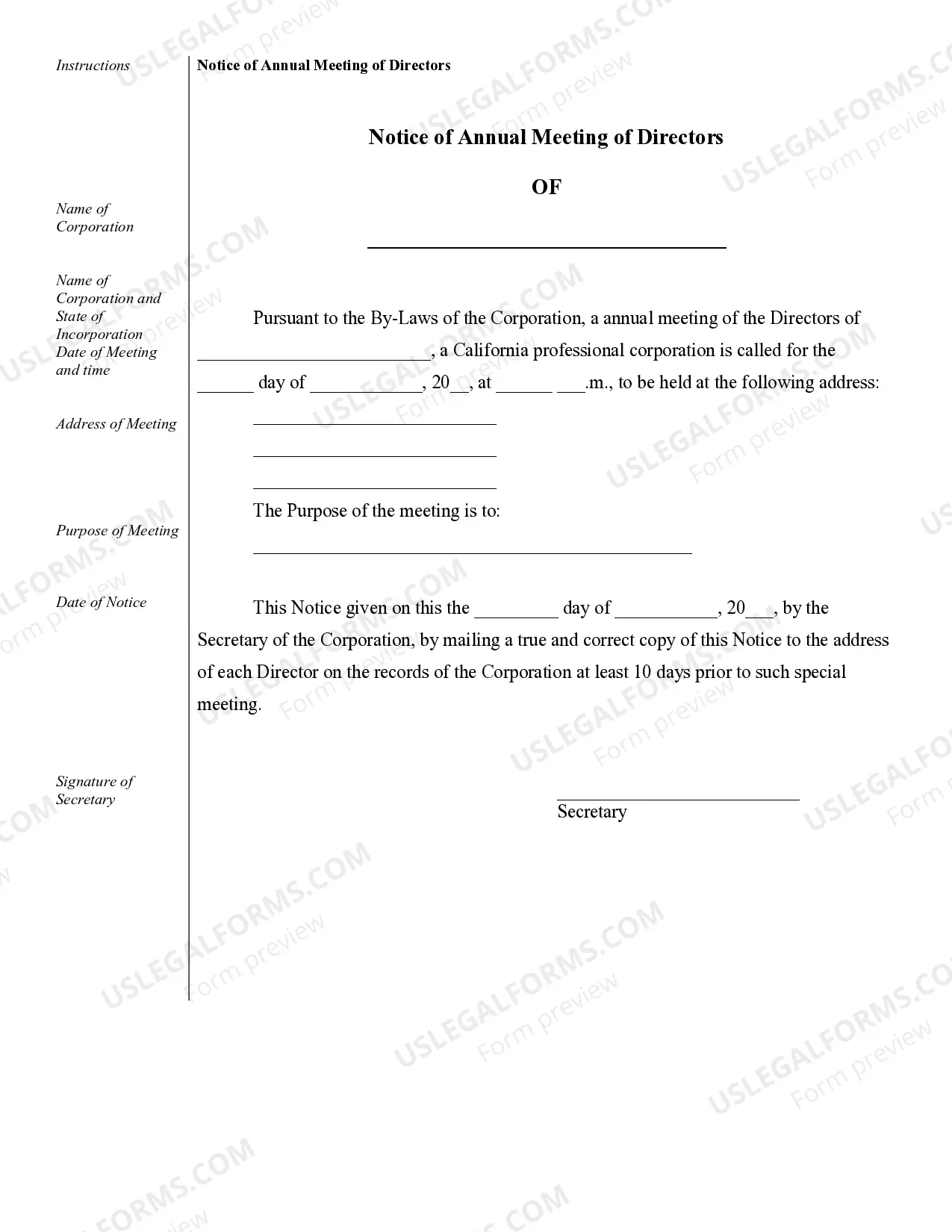

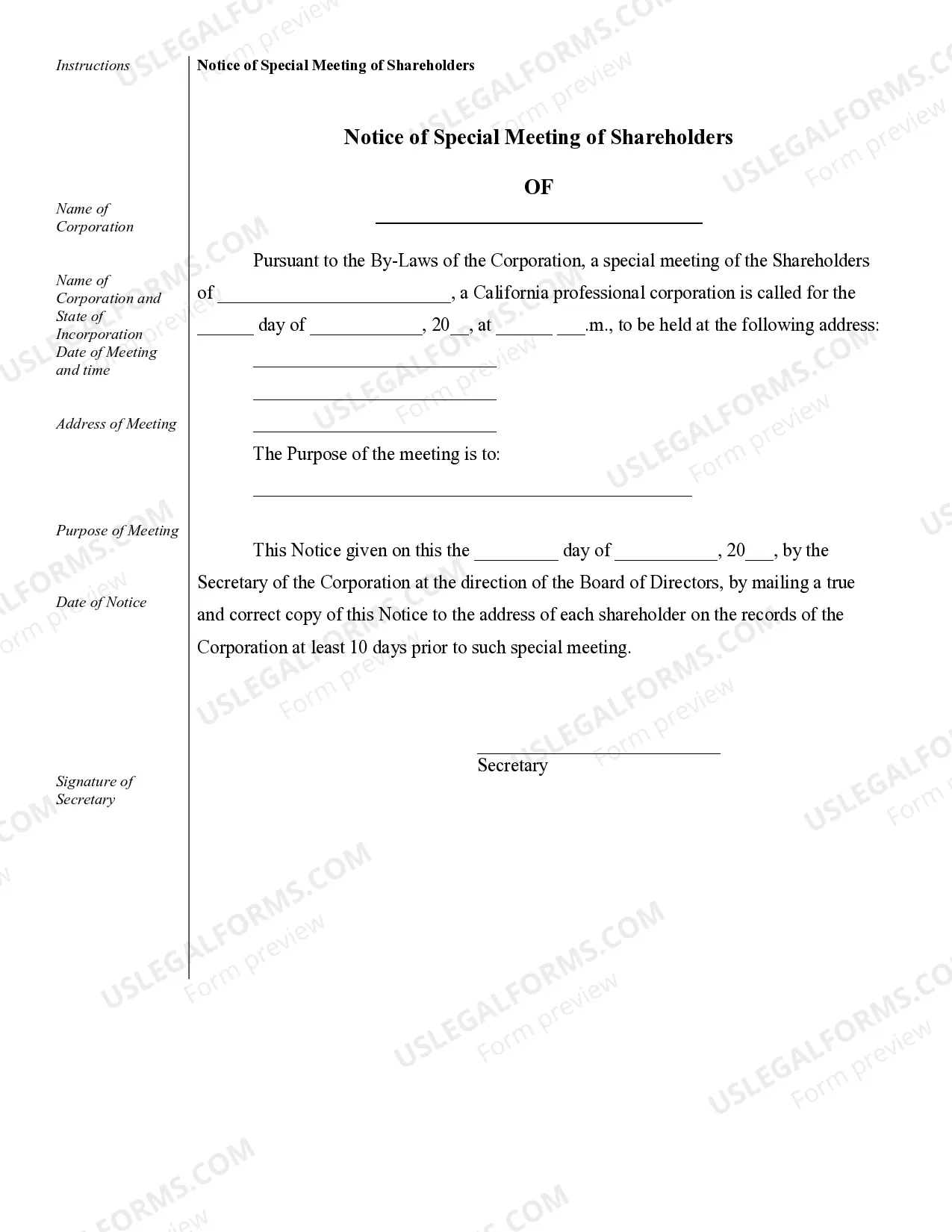

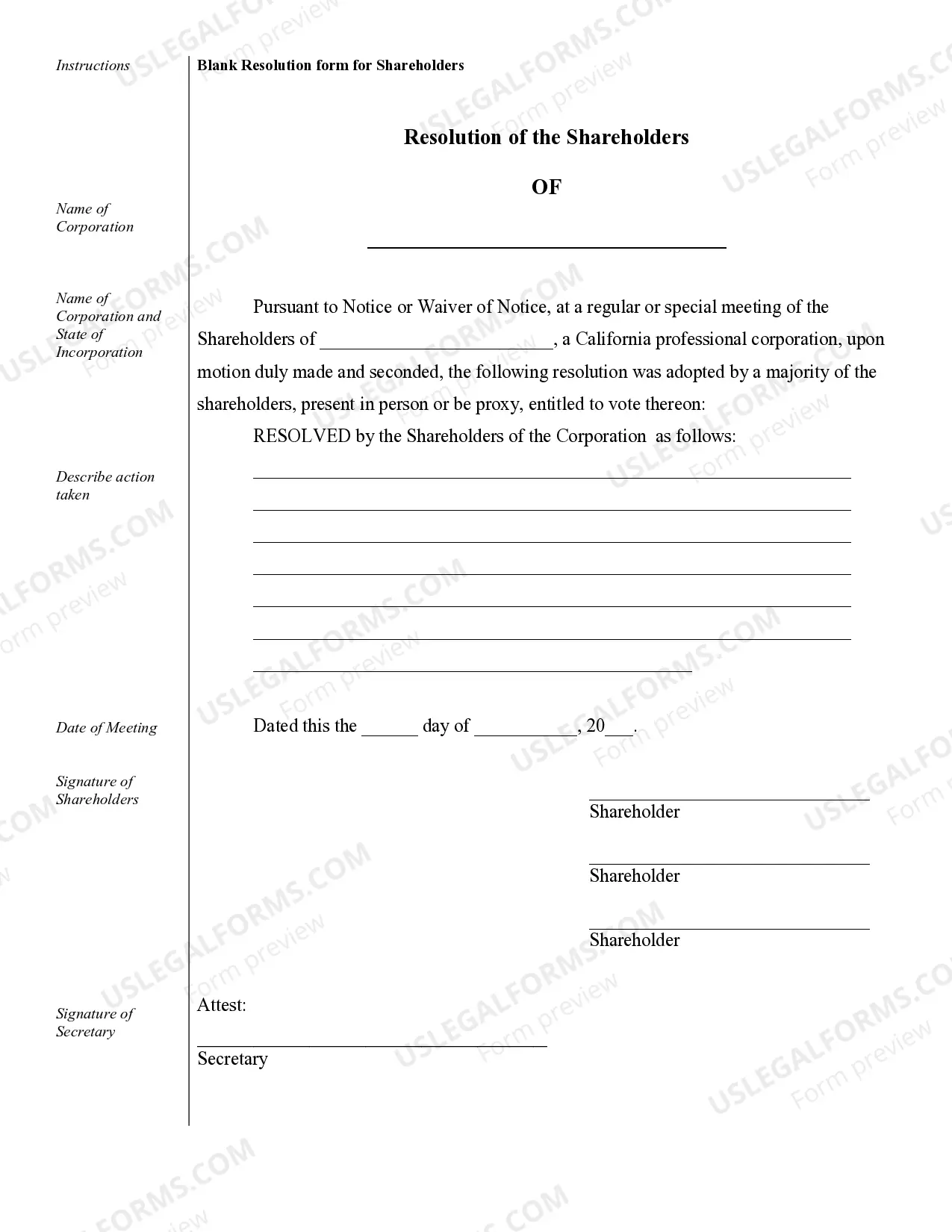

San Bernardino Sample Corporate Records for a California Professional Corporation play a vital role in maintaining the legal and financial transparency of the company. These records serve as a documented history of the corporation's activities and are necessary for compliance with state laws, regulations, and filing requirements. They provide an accurate representation of the corporation's operations, governance, and ownership structure. In the event of legal disputes, audits, or potential mergers and acquisitions, these records act as evidence and support the corporation's integrity and credibility. Some key types of San Bernardino Sample Corporate Records for a California Professional Corporation include: 1. Articles of Incorporation: This document establishes the corporation as a legal entity and includes information such as the corporation's name, purpose, registered agent, and initial director(s). 2. Bylaws: The bylaws outline the internal rules and procedures that govern the corporation's operations, including guidelines on meetings, voting procedures, and roles and responsibilities of directors and officers. 3. Shareholder Agreements: These agreements document the rights and obligations of the corporation's shareholders, including their ownership percentages, dividend distribution policies, and procedures for buying and selling shares. 4. Stock Certificates and Ledger: Stock certificates represent ownership of shares in the corporation and are often issued to shareholders. The stock ledger maintains records of all issued and outstanding shares, including the names and contact information of shareholders. 5. Meeting Minutes: These records document the proceedings and resolutions of board of directors' and shareholder meetings, ensuring transparency and compliance with legal formalities. They typically include attendance, voting results, and discussions on important matters affecting the corporation. 6. Financial Statements: These are comprehensive reports detailing the corporation's financial performance, including income statements, balance sheets, and cash flow statements. They provide an overview of the corporation's financial health and are essential for tax filings, audits, and potential investors or lenders. 7. Annual Reports: A requirement for every California Professional Corporation, annual reports summarize the corporation's financial status, significant events, and future plans. They are filed with the California Secretary of State to maintain the corporation's active status. 8. Board Resolutions: These records document significant decisions and actions approved by the board of directors, such as appointment or removal of officers, changes to financial policies, and approval of major contracts or loans. 9. Contracts and Agreements: Any legally binding agreements entered into by the corporation, such as employment contracts, client contracts, or vendor agreements, should be maintained with the corporate records. 10. Tax Returns and Filings: San Bernardino Sample Corporate Records for a California Professional Corporation should include copies of federal and state tax returns, quarterly payroll tax filings, and any other tax-related documents. Keeping an organized and up-to-date set of San Bernardino Sample Corporate Records for a California Professional Corporation is crucial for legal compliance, effective corporate governance, and maintaining the corporation's reputation. These records help ensure transparency, accountability, and proper management of the corporation's affairs, thereby safeguarding the corporation's interests and those of its shareholders.San Bernardino Sample Corporate Records for a California Professional Corporation play a vital role in maintaining the legal and financial transparency of the company. These records serve as a documented history of the corporation's activities and are necessary for compliance with state laws, regulations, and filing requirements. They provide an accurate representation of the corporation's operations, governance, and ownership structure. In the event of legal disputes, audits, or potential mergers and acquisitions, these records act as evidence and support the corporation's integrity and credibility. Some key types of San Bernardino Sample Corporate Records for a California Professional Corporation include: 1. Articles of Incorporation: This document establishes the corporation as a legal entity and includes information such as the corporation's name, purpose, registered agent, and initial director(s). 2. Bylaws: The bylaws outline the internal rules and procedures that govern the corporation's operations, including guidelines on meetings, voting procedures, and roles and responsibilities of directors and officers. 3. Shareholder Agreements: These agreements document the rights and obligations of the corporation's shareholders, including their ownership percentages, dividend distribution policies, and procedures for buying and selling shares. 4. Stock Certificates and Ledger: Stock certificates represent ownership of shares in the corporation and are often issued to shareholders. The stock ledger maintains records of all issued and outstanding shares, including the names and contact information of shareholders. 5. Meeting Minutes: These records document the proceedings and resolutions of board of directors' and shareholder meetings, ensuring transparency and compliance with legal formalities. They typically include attendance, voting results, and discussions on important matters affecting the corporation. 6. Financial Statements: These are comprehensive reports detailing the corporation's financial performance, including income statements, balance sheets, and cash flow statements. They provide an overview of the corporation's financial health and are essential for tax filings, audits, and potential investors or lenders. 7. Annual Reports: A requirement for every California Professional Corporation, annual reports summarize the corporation's financial status, significant events, and future plans. They are filed with the California Secretary of State to maintain the corporation's active status. 8. Board Resolutions: These records document significant decisions and actions approved by the board of directors, such as appointment or removal of officers, changes to financial policies, and approval of major contracts or loans. 9. Contracts and Agreements: Any legally binding agreements entered into by the corporation, such as employment contracts, client contracts, or vendor agreements, should be maintained with the corporate records. 10. Tax Returns and Filings: San Bernardino Sample Corporate Records for a California Professional Corporation should include copies of federal and state tax returns, quarterly payroll tax filings, and any other tax-related documents. Keeping an organized and up-to-date set of San Bernardino Sample Corporate Records for a California Professional Corporation is crucial for legal compliance, effective corporate governance, and maintaining the corporation's reputation. These records help ensure transparency, accountability, and proper management of the corporation's affairs, thereby safeguarding the corporation's interests and those of its shareholders.