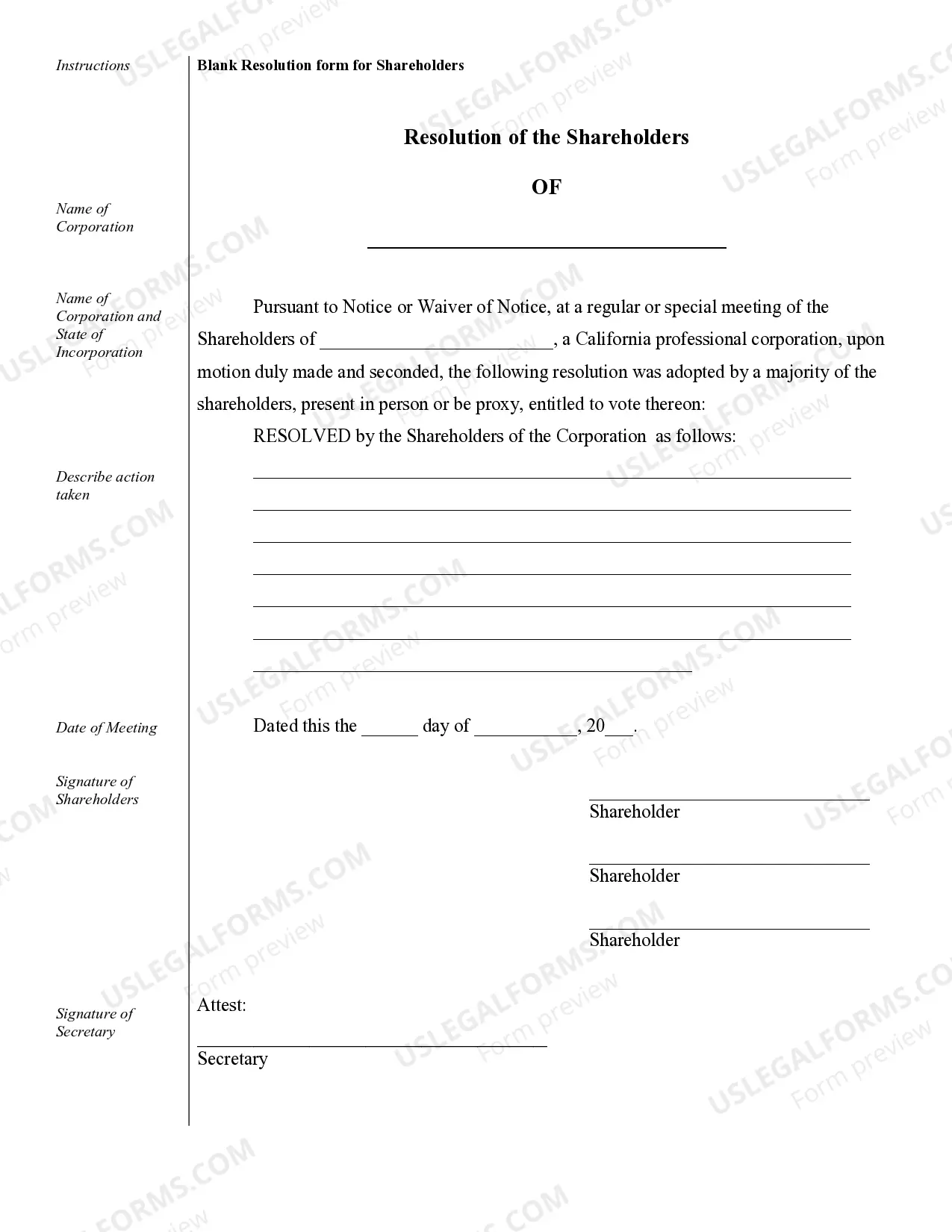

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

San Diego Sample Corporate Records for a California Professional Corporation

Description

How to fill out Sample Corporate Records For A California Professional Corporation?

Regardless of one's social or occupational position, navigating legal documents is an unfortunate requirement in today's society.

Frequently, it is nearly unfeasible for individuals without any legal training to generate such paperwork from scratch, mainly due to the complicated terminology and legal nuances it entails.

This is where US Legal Forms can be a game changer. Our service provides an extensive collection with over 85,000 ready-to-utilize state-specific documents suitable for nearly any legal situation.

Click Buy Now and select the subscription option that fits you best.

Once you have entered your details or created a new account, choose your method of payment and proceed to download the San Diego Sample Corporate Records for a California Professional Corporation after the transaction is completed.

- If you need the San Diego Sample Corporate Records for a California Professional Corporation or any other document applicable in your state or county, US Legal Forms has you covered.

- For current subscribers, you can proceed to Log In to access the relevant form.

- However, if you are unfamiliar with our repository, please follow these steps before acquiring the San Diego Sample Corporate Records for a California Professional Corporation.

- Ensure that the template you select is appropriate for your locale since the laws of one state or county may not be applicable to another.

- Examine the form and review a brief summary (if available) of the situations the document can address.

- If the template you selected does not meet your requirements, you can start anew and search for the desired form.

Form popularity

FAQ

When you file incorporation documents in California, you start by selecting a unique name for your corporation, ensuring it complies with state naming rules. Next, you must prepare and file your Articles of Incorporation with the California Secretary of State, which requires basic information about your entity. Additionally, obtaining an Employer Identification Number (EIN) from the IRS is essential for tax purposes. Using USLegalForms for your San Diego Sample Corporate Records for a California Professional Corporation can simplify this process, providing you with the necessary forms and guidance tailored for your specific needs.

Yes, all corporations in California are required to file a statement of information. This document provides crucial details about the corporation, such as addresses and officers. Having up-to-date San Diego Sample Corporate Records for a California Professional Corporation can simplify this process and ensure compliance with state regulations.

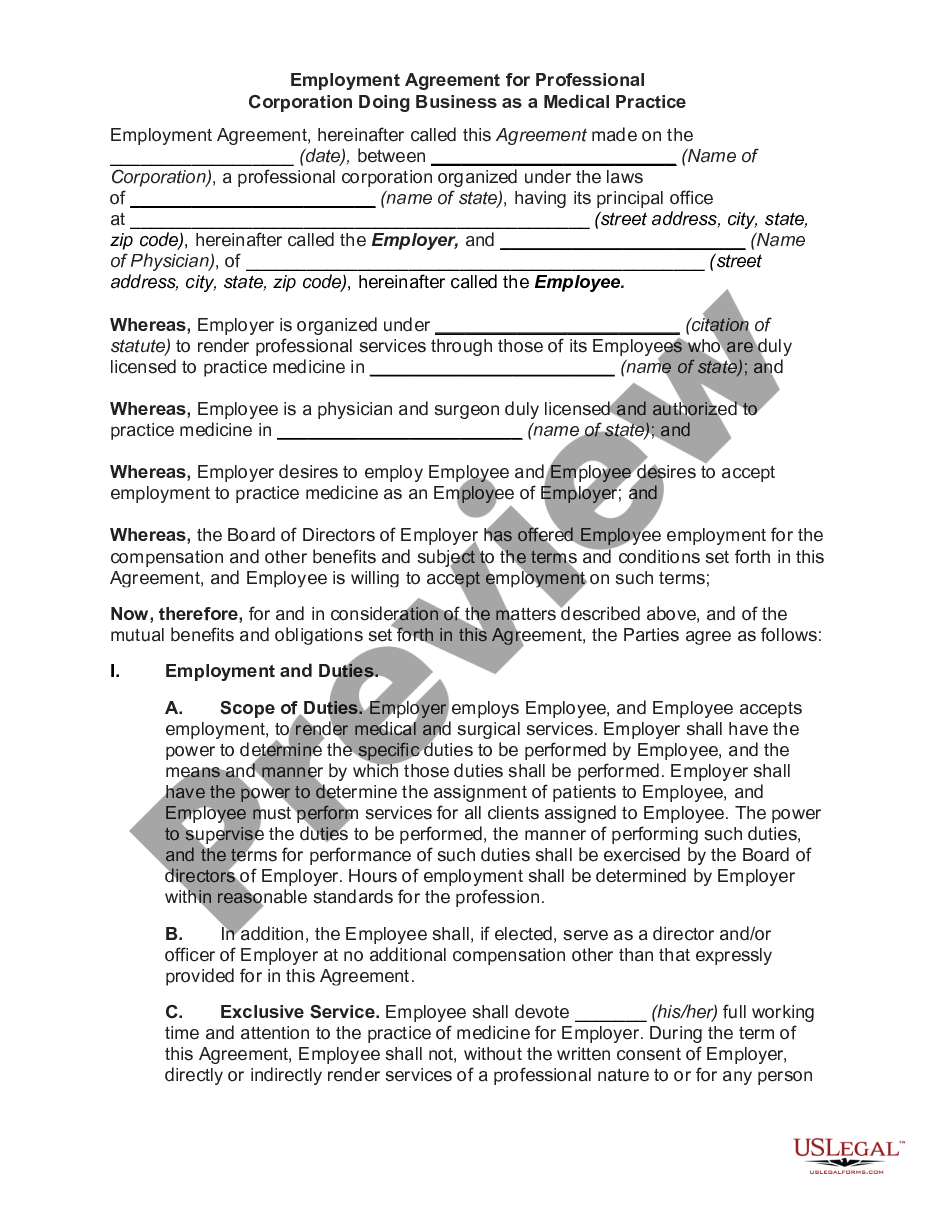

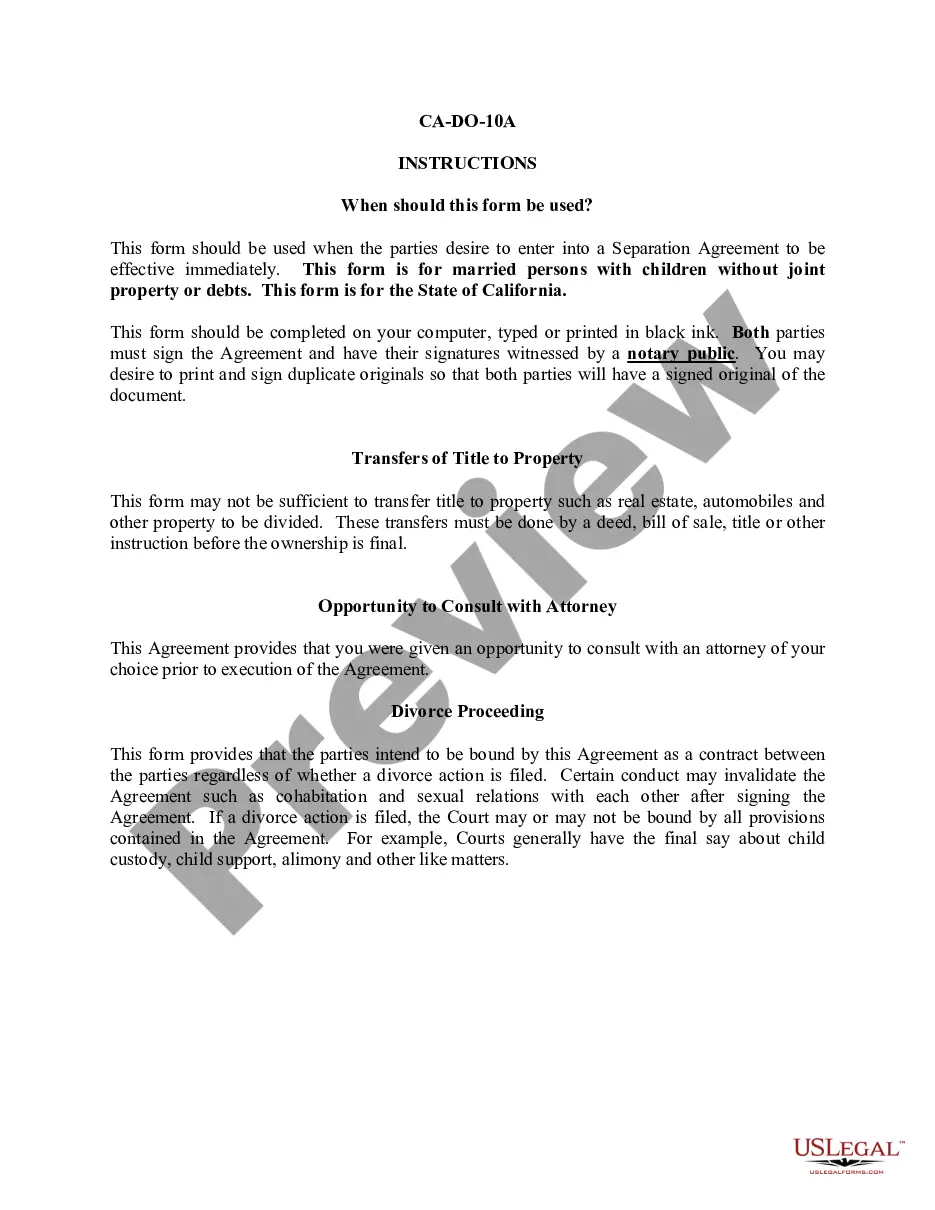

In California, a standard corporation serves a broad range of business purposes, while a professional corporation is specifically designed for licensed professions, such as law or medicine. Professional corporations limit ownership to licensed professionals in the field. If you are looking to set up a California professional corporation, you will likely need a specific type of San Diego Sample Corporate Records for a California Professional Corporation to meet regulatory requirements.

In California, a professional corporation is a specific business entity formed by licensed professionals like doctors, lawyers, or accountants. This type of corporation provides limited liability protection for its owners while allowing them to offer professional services. To review San Diego Sample Corporate Records for a California Professional Corporation, you will see that certain requirements must be met during the formation process, ensuring adherence to the law.

Looking up a corporation in California is straightforward. You can use the California Secretary of State's online business search tool to find detailed information on any corporation registered in the state. This resource easily provides you with San Diego Sample Corporate Records for a California Professional Corporation, including status, filing history, and address information, helping you stay informed.

To obtain a copy of your articles of incorporation in California, visit the California Secretary of State's website. You can access these documents online, ensuring you find the relevant San Diego Sample Corporate Records for a California Professional Corporation. If you prefer, you can also request certified copies through their office, either by mail or in person, including providing any necessary information about your corporation.

The most important document required to form a corporation is the Articles of Incorporation. This legal document establishes your corporation's existence and outlines essential details such as its name, address, and purpose. Having accurate and complete Articles of Incorporation is vital for keeping your San Diego Sample Corporate Records for a California Professional Corporation in order. Make sure to consult resources like USLegalForms for templates and guidance.

To form a California professional corporation, start by choosing a unique name that complies with state regulations. Next, file Articles of Incorporation with the California Secretary of State, ensuring you include the necessary information. After that, obtain all required licenses and permits for your specific profession. Finally, keep your San Diego Sample Corporate Records for a California Professional Corporation organized to maintain compliance and professionalism.