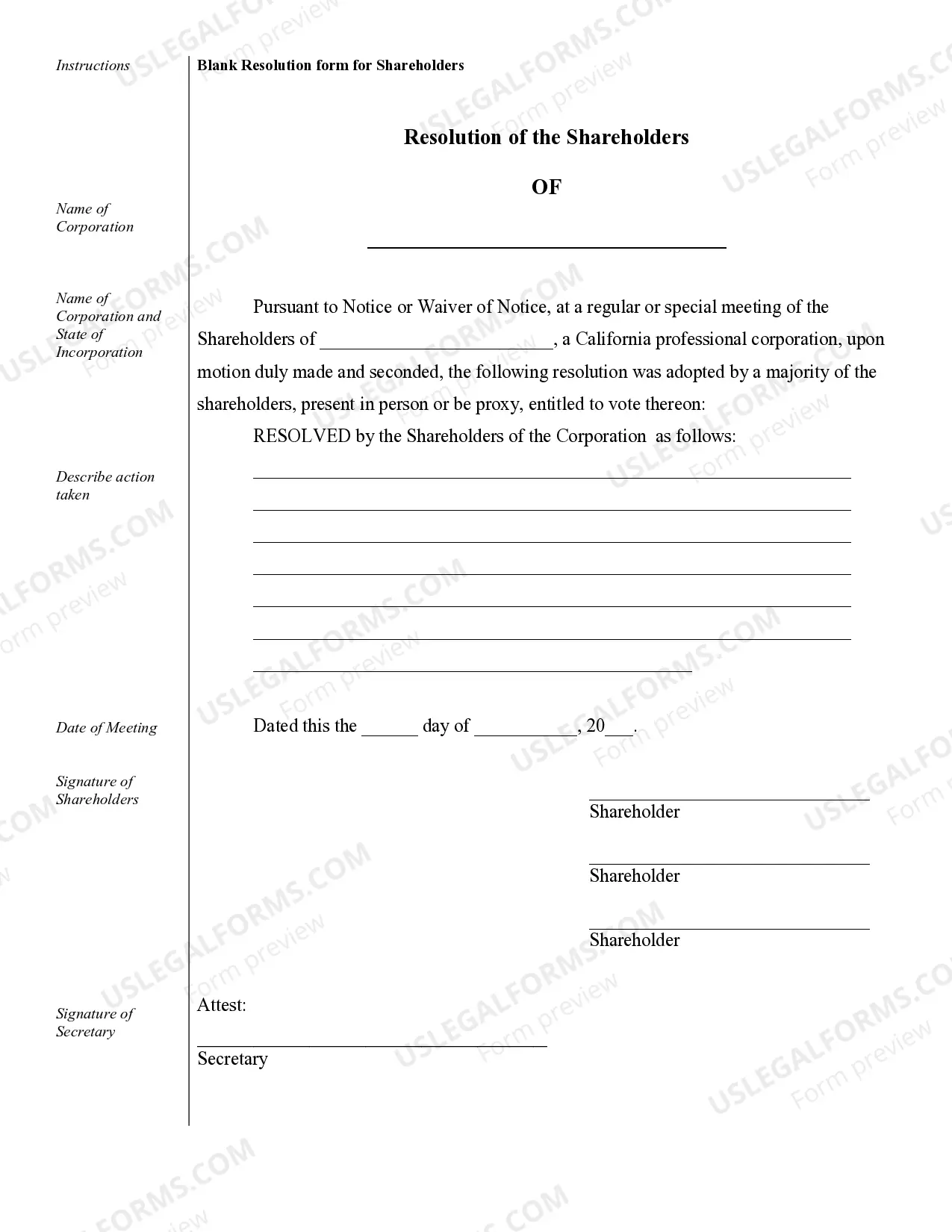

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

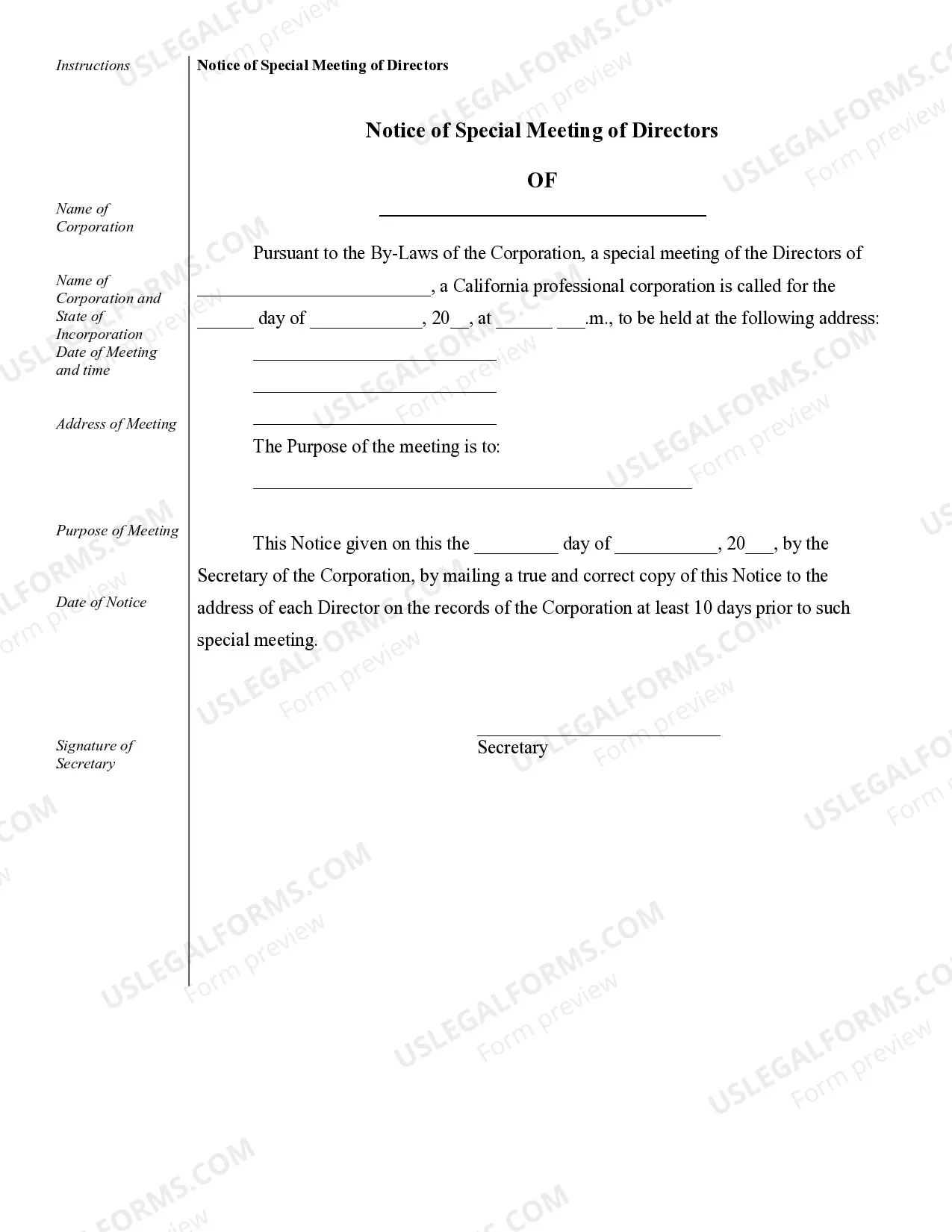

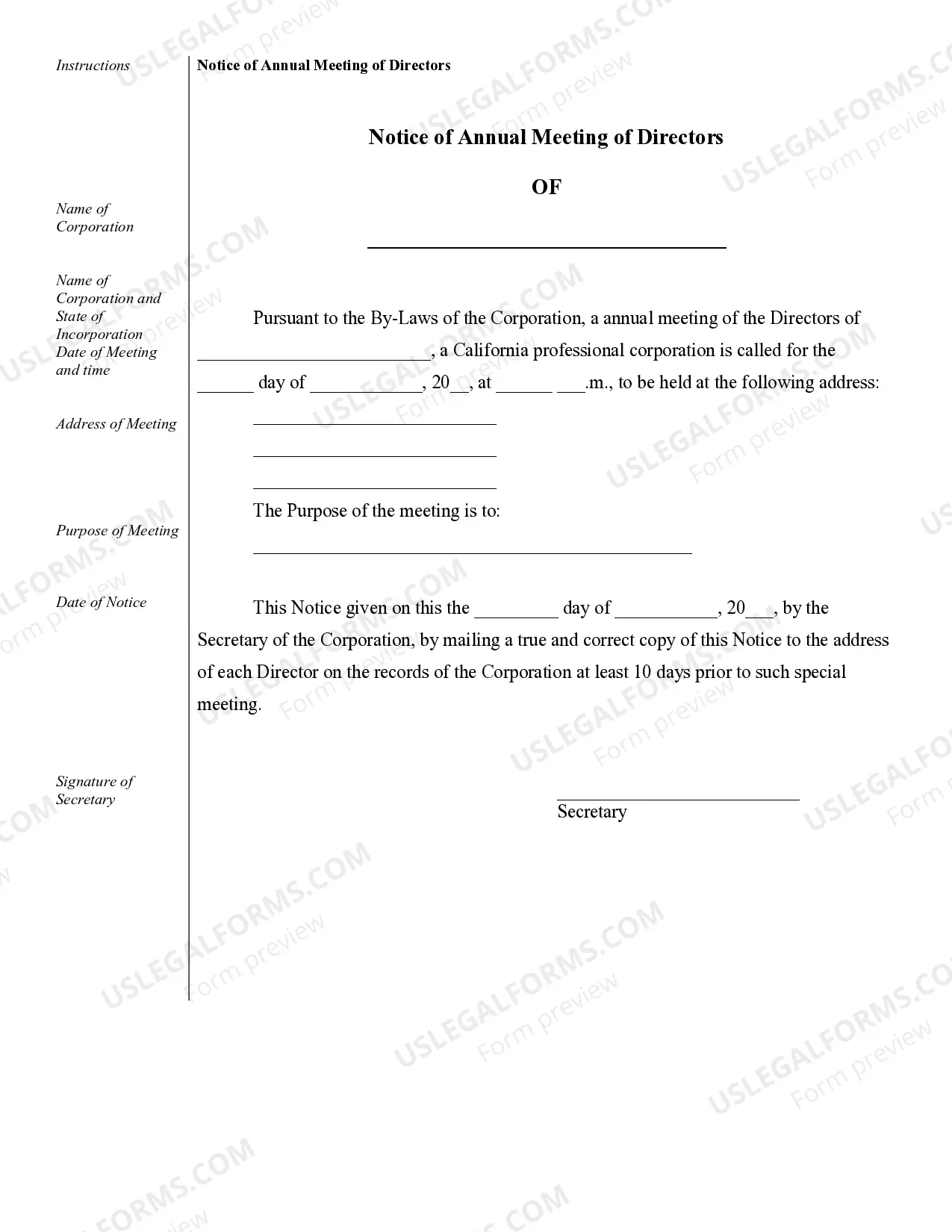

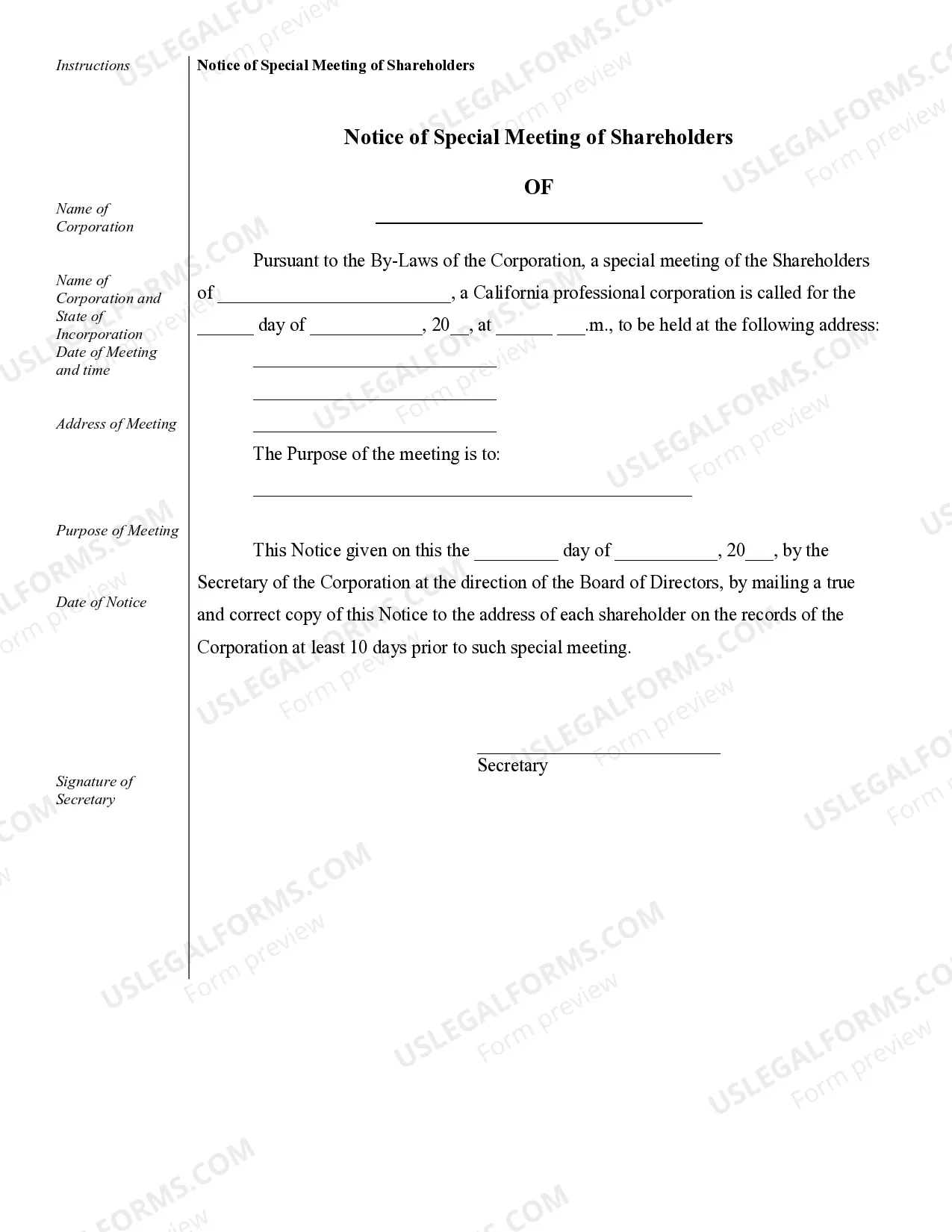

Simi Valley Sample Corporate Records for a California Professional Corporation are documentation files that hold information and evidence of the organization's activities and transactions. These records are crucial for legal compliance, transparency, and maintaining accurate financial records. The key purpose of Simi Valley Sample Corporate Records is to provide a comprehensive overview of the Professional Corporation's structure, operations, and history. By documenting critical business activities and decisions, these records help in safeguarding the corporation's interests and ensuring responsible corporate governance. Specific types of Simi Valley Sample Corporate Records for a California Professional Corporation may include, but are not limited to: 1. Articles of Incorporation: This document outlines the founding details of the Professional Corporation, including its legal name, purpose, registered agent, and the initial directors or officers. 2. Bylaws: The bylaws establish the internal rules and regulations that govern the Professional Corporation's operations, including processes related to meetings, voting procedures, and board responsibilities. 3. Meeting Minutes: Detailed records of board meetings, special meetings, or annual general meetings. These minutes serve as official documentation of discussions, decisions, and actions taken during these gatherings. 4. Shareholder Records: Records of ownership, detailing the individual shareholders, their percentage of ownership, and any changes in ownership over time. 5. Financial Statements: Comprehensive financial reports that summarize the corporation's financial health, including income statements, balance sheets, and cash flow statements. 6. Annual Reports: Summaries of the Professional Corporation's achievements, financial performance, and activities over the past year, typically shared with shareholders and the regulatory bodies. 7. Tax Returns and Filings: Documentation related to the Professional Corporation's tax obligations, including federal, state, and local tax returns and related correspondence. 8. Licenses and Permits: Copies of licenses and permits obtained by the Professional Corporation to operate legally, such as state professional licenses or specialized permits regarding specific activities. 9. Contracts and Agreements: Copies of contracts entered into by the Professional Corporation, including client agreements, vendor contracts, leases, and partnership agreements. 10. Stock Certificates: Physical or electronic certificates issued to shareholders as evidence of their ownership in the Professional Corporation. 11. Intellectual Property Records: Documentation related to trademarks, copyrights, patents, or any other intellectual property owned or licensed by the corporation. By maintaining organized and up-to-date Simi Valley Sample Corporate Records, a California Professional Corporation can demonstrate compliance with legal requirements, protect shareholders' interests, facilitate financial audits, and effectively manage its operations.Simi Valley Sample Corporate Records for a California Professional Corporation are documentation files that hold information and evidence of the organization's activities and transactions. These records are crucial for legal compliance, transparency, and maintaining accurate financial records. The key purpose of Simi Valley Sample Corporate Records is to provide a comprehensive overview of the Professional Corporation's structure, operations, and history. By documenting critical business activities and decisions, these records help in safeguarding the corporation's interests and ensuring responsible corporate governance. Specific types of Simi Valley Sample Corporate Records for a California Professional Corporation may include, but are not limited to: 1. Articles of Incorporation: This document outlines the founding details of the Professional Corporation, including its legal name, purpose, registered agent, and the initial directors or officers. 2. Bylaws: The bylaws establish the internal rules and regulations that govern the Professional Corporation's operations, including processes related to meetings, voting procedures, and board responsibilities. 3. Meeting Minutes: Detailed records of board meetings, special meetings, or annual general meetings. These minutes serve as official documentation of discussions, decisions, and actions taken during these gatherings. 4. Shareholder Records: Records of ownership, detailing the individual shareholders, their percentage of ownership, and any changes in ownership over time. 5. Financial Statements: Comprehensive financial reports that summarize the corporation's financial health, including income statements, balance sheets, and cash flow statements. 6. Annual Reports: Summaries of the Professional Corporation's achievements, financial performance, and activities over the past year, typically shared with shareholders and the regulatory bodies. 7. Tax Returns and Filings: Documentation related to the Professional Corporation's tax obligations, including federal, state, and local tax returns and related correspondence. 8. Licenses and Permits: Copies of licenses and permits obtained by the Professional Corporation to operate legally, such as state professional licenses or specialized permits regarding specific activities. 9. Contracts and Agreements: Copies of contracts entered into by the Professional Corporation, including client agreements, vendor contracts, leases, and partnership agreements. 10. Stock Certificates: Physical or electronic certificates issued to shareholders as evidence of their ownership in the Professional Corporation. 11. Intellectual Property Records: Documentation related to trademarks, copyrights, patents, or any other intellectual property owned or licensed by the corporation. By maintaining organized and up-to-date Simi Valley Sample Corporate Records, a California Professional Corporation can demonstrate compliance with legal requirements, protect shareholders' interests, facilitate financial audits, and effectively manage its operations.