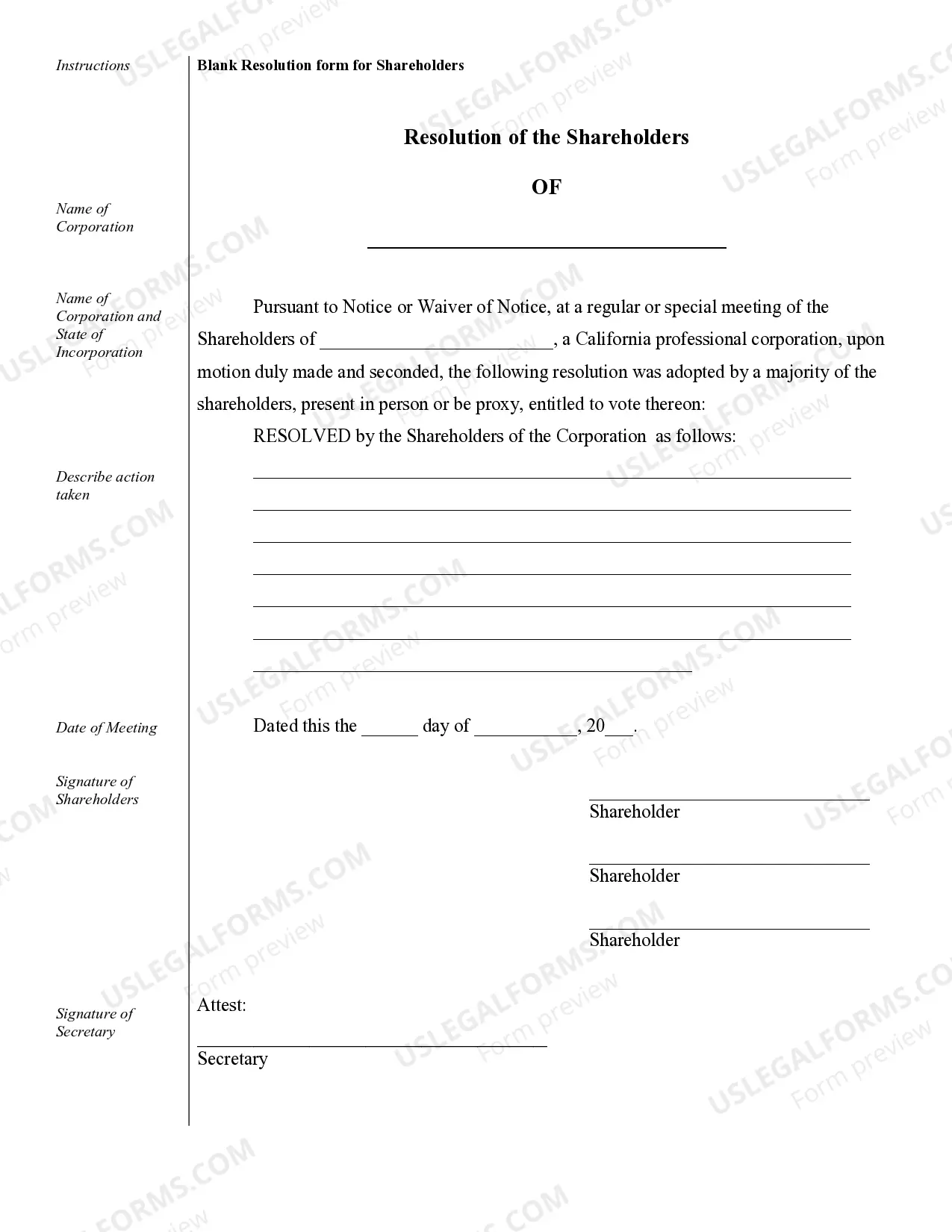

Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

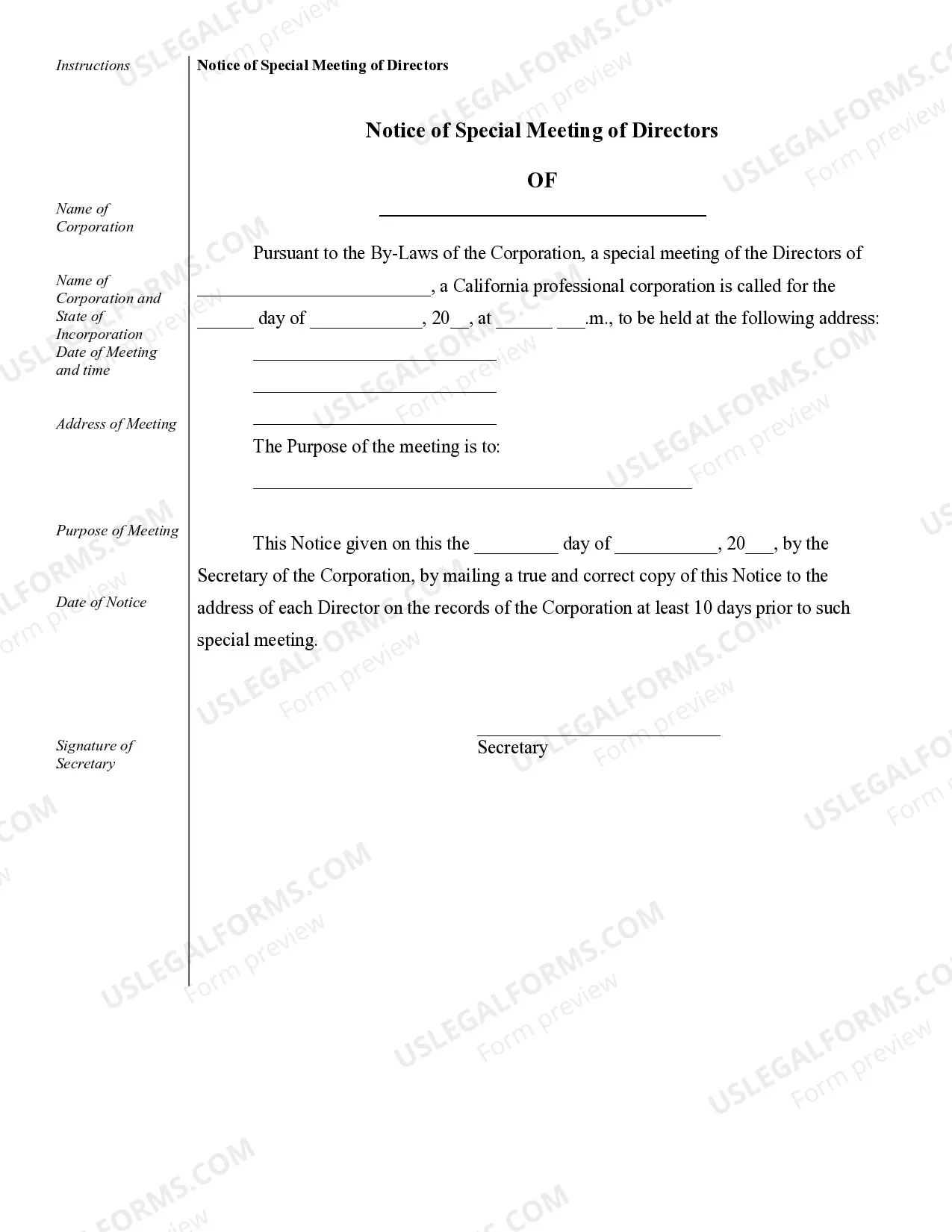

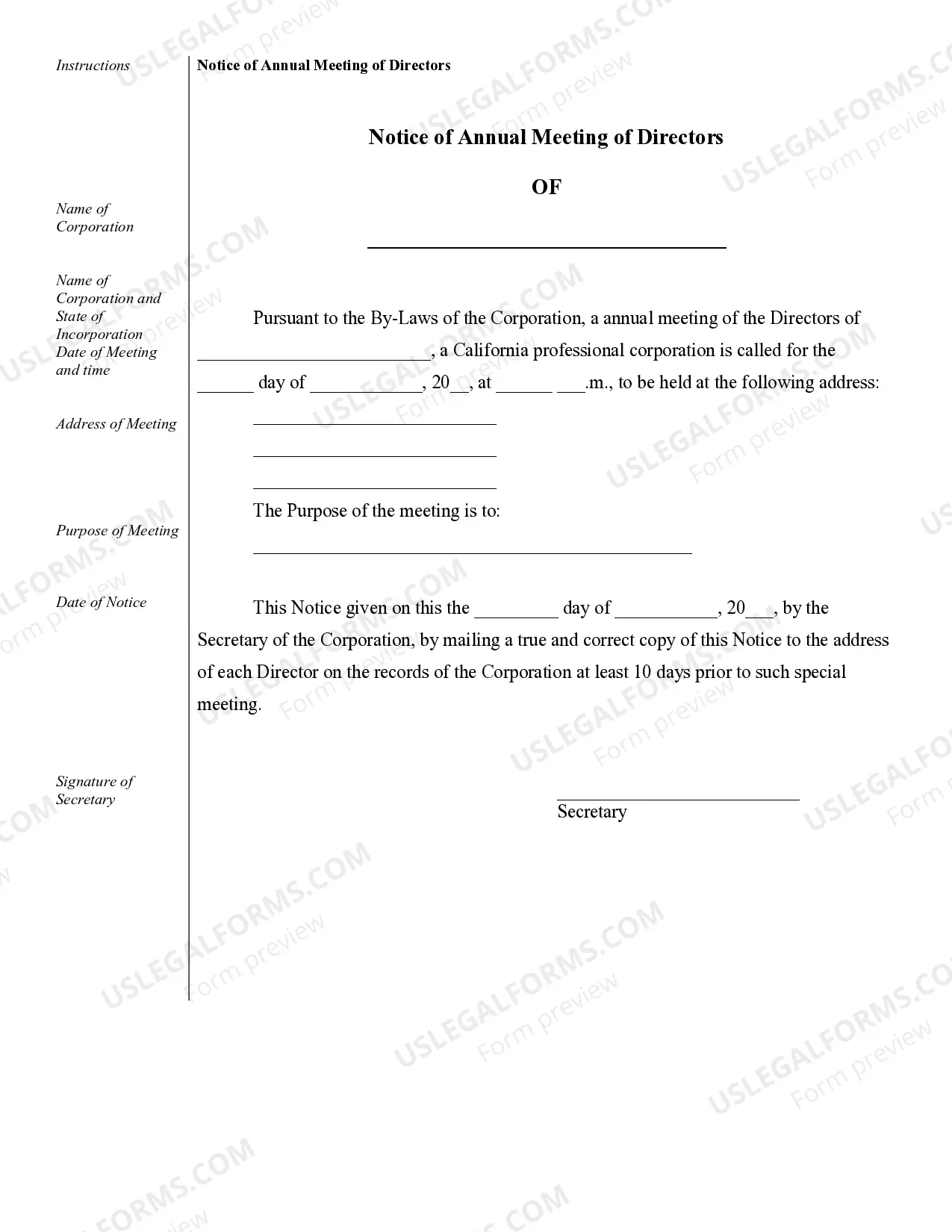

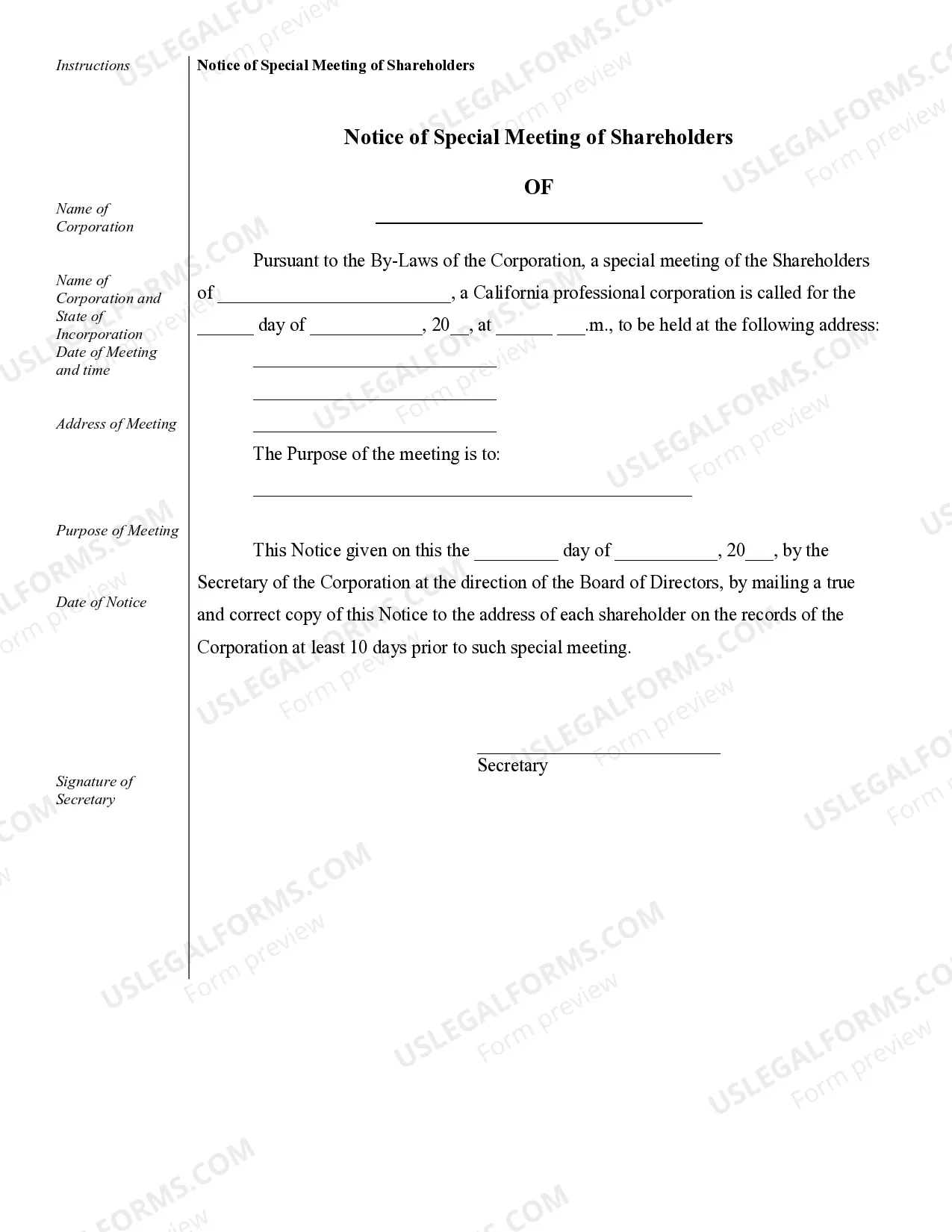

Sunnyvale Sample Corporate Records for a California Professional Corporation are essential for maintaining thorough and accurate records of a professional corporation's activities and operations. These records serve as a comprehensive documentation of the company's legal and financial history, and are often required by law for compliance purposes. Some key documents typically included in Sunnyvale Sample Corporate Records for a California Professional Corporation are: 1. Articles of Incorporation: This is the initial document that establishes the existence of the professional corporation. It includes important details such as the corporation's name, purpose, registered agent, and the number of shares authorized. 2. Bylaws: The bylaws outline the internal rules and regulations for the corporation's governance. This document covers various aspects such as board meetings, shareholder rights, officer roles, voting procedures, and other essential operational guidelines. 3. Meeting Minutes: These records provide a detailed account of discussions, decisions, and actions taken during board meetings, shareholder meetings, and any other official company gatherings. Meeting minutes reflect the corporation's decision-making processes and are crucial for legal compliance and documentation. 4. Shareholder Agreements: In case the professional corporation has multiple shareholders, the shareholder agreements outline the rights and responsibilities of each shareholder. It covers topics such as share allocation, voting rights, profit sharing, dispute resolution mechanisms, and restrictions on share transfers. 5. Stock Ledger: The stock ledger is a record book that meticulously documents the issuance, transfer, and ownership of company shares. It maintains an accurate record of all shareholders, their shareholdings, and any changes made over time. 6. Financial Statements: These include the corporation's balance sheet, income statement, and cash flow statement. Financial statements provide a comprehensive overview of the company's financial health, its assets and liabilities, revenue, expenses, and net income. 7. Annual Reports: California law mandates that professional corporations file an annual report with the Secretary of State. These reports summarize the corporation's activities, financial status, and any significant changes that occurred during the year. Other notable documents that may be included in Sunnyvale Sample Corporate Records for a California Professional Corporation, depending on the specific needs and activities of the organization, are stock certificates, employment agreements, client contracts, licenses, permits, and any applicable government filings. By maintaining accurate and up-to-date Sunnyvale Sample Corporate Records for a California Professional Corporation, companies can ensure legal compliance, minimize legal risks, and provide transparency to shareholders, regulators, and other stakeholders. These records serve as a historical account of the corporation's progress and are essential for demonstrating corporate accountability and maintaining the integrity of the professional corporation.Sunnyvale Sample Corporate Records for a California Professional Corporation are essential for maintaining thorough and accurate records of a professional corporation's activities and operations. These records serve as a comprehensive documentation of the company's legal and financial history, and are often required by law for compliance purposes. Some key documents typically included in Sunnyvale Sample Corporate Records for a California Professional Corporation are: 1. Articles of Incorporation: This is the initial document that establishes the existence of the professional corporation. It includes important details such as the corporation's name, purpose, registered agent, and the number of shares authorized. 2. Bylaws: The bylaws outline the internal rules and regulations for the corporation's governance. This document covers various aspects such as board meetings, shareholder rights, officer roles, voting procedures, and other essential operational guidelines. 3. Meeting Minutes: These records provide a detailed account of discussions, decisions, and actions taken during board meetings, shareholder meetings, and any other official company gatherings. Meeting minutes reflect the corporation's decision-making processes and are crucial for legal compliance and documentation. 4. Shareholder Agreements: In case the professional corporation has multiple shareholders, the shareholder agreements outline the rights and responsibilities of each shareholder. It covers topics such as share allocation, voting rights, profit sharing, dispute resolution mechanisms, and restrictions on share transfers. 5. Stock Ledger: The stock ledger is a record book that meticulously documents the issuance, transfer, and ownership of company shares. It maintains an accurate record of all shareholders, their shareholdings, and any changes made over time. 6. Financial Statements: These include the corporation's balance sheet, income statement, and cash flow statement. Financial statements provide a comprehensive overview of the company's financial health, its assets and liabilities, revenue, expenses, and net income. 7. Annual Reports: California law mandates that professional corporations file an annual report with the Secretary of State. These reports summarize the corporation's activities, financial status, and any significant changes that occurred during the year. Other notable documents that may be included in Sunnyvale Sample Corporate Records for a California Professional Corporation, depending on the specific needs and activities of the organization, are stock certificates, employment agreements, client contracts, licenses, permits, and any applicable government filings. By maintaining accurate and up-to-date Sunnyvale Sample Corporate Records for a California Professional Corporation, companies can ensure legal compliance, minimize legal risks, and provide transparency to shareholders, regulators, and other stakeholders. These records serve as a historical account of the corporation's progress and are essential for demonstrating corporate accountability and maintaining the integrity of the professional corporation.