Sample Corporate Notices of Meetings, Resolutions, Simple Stock Ledger & Certificate.

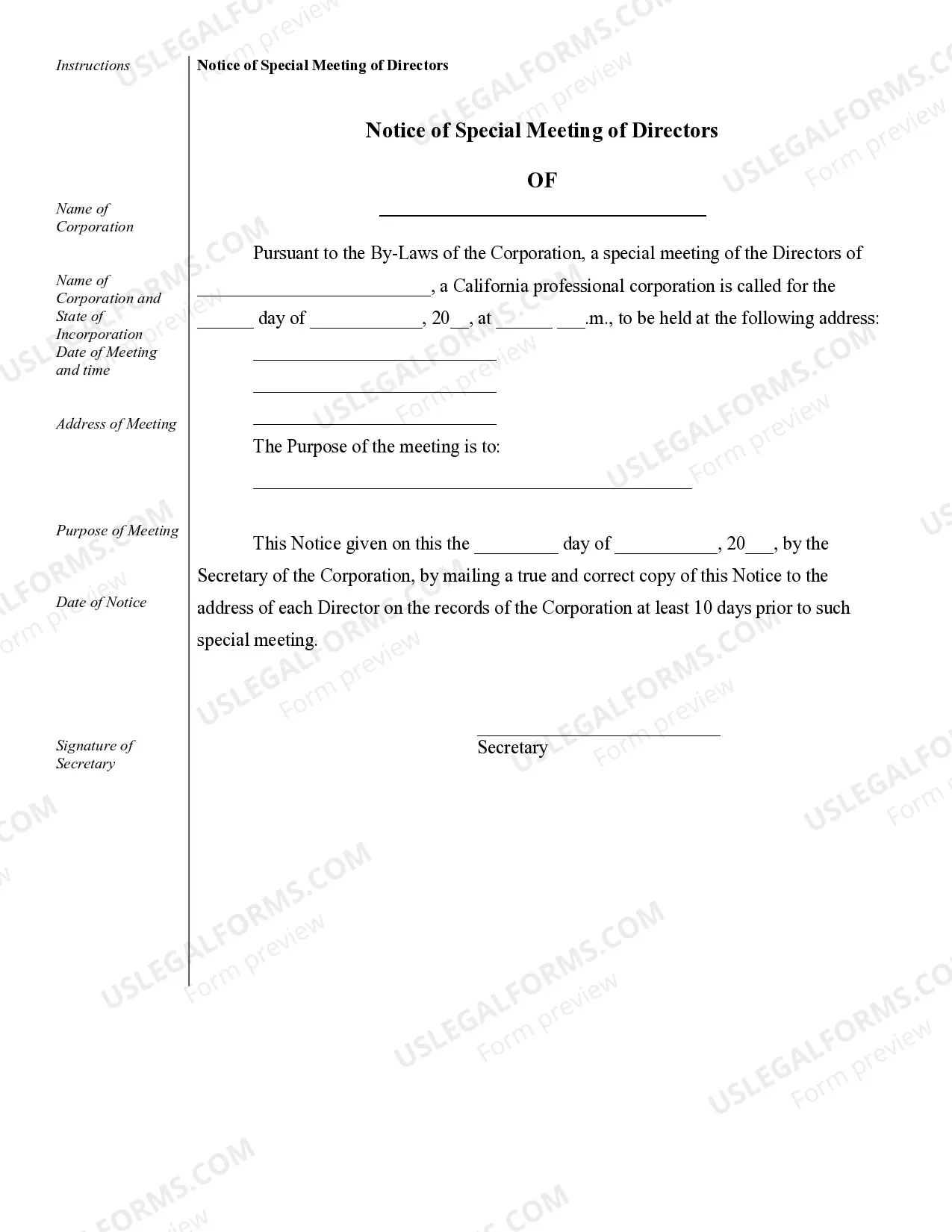

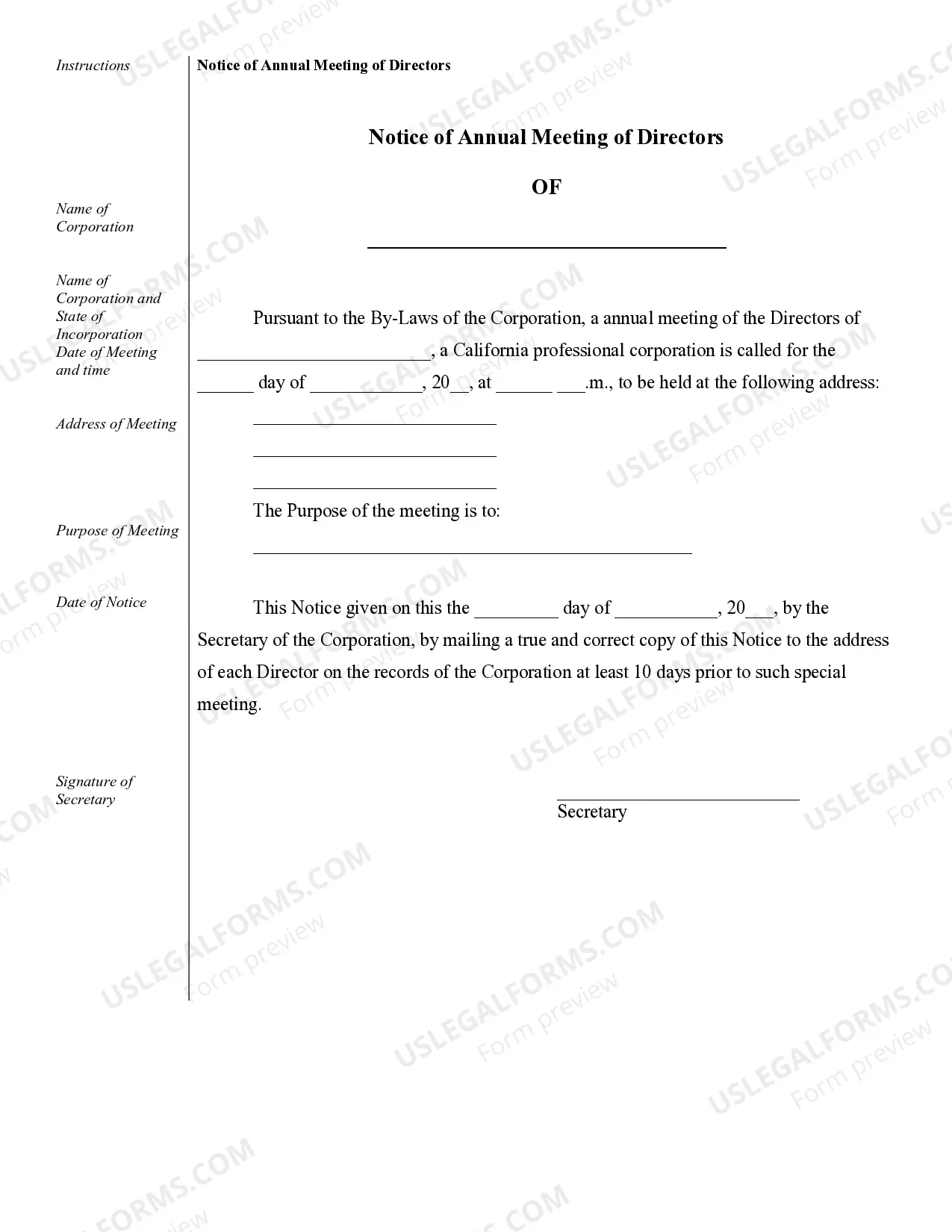

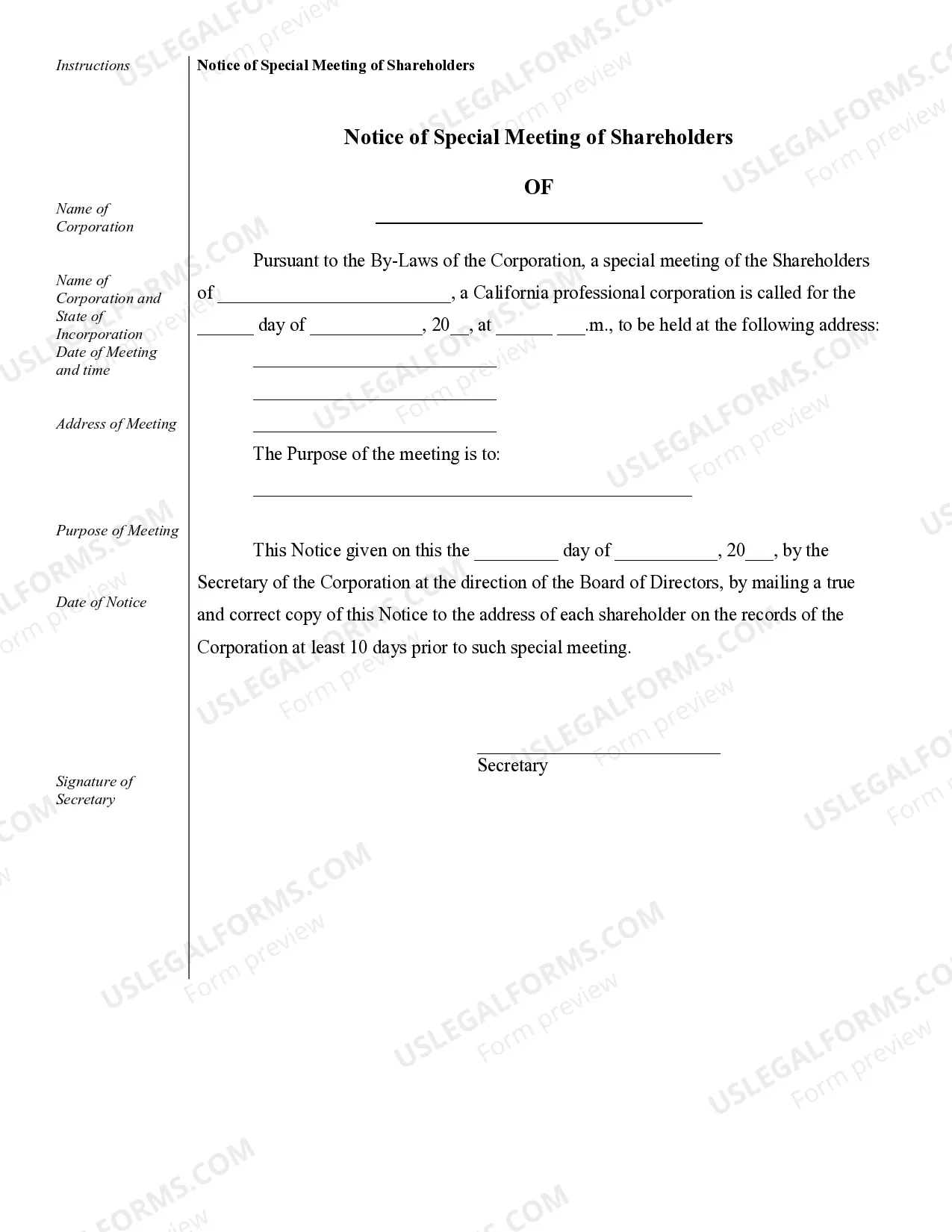

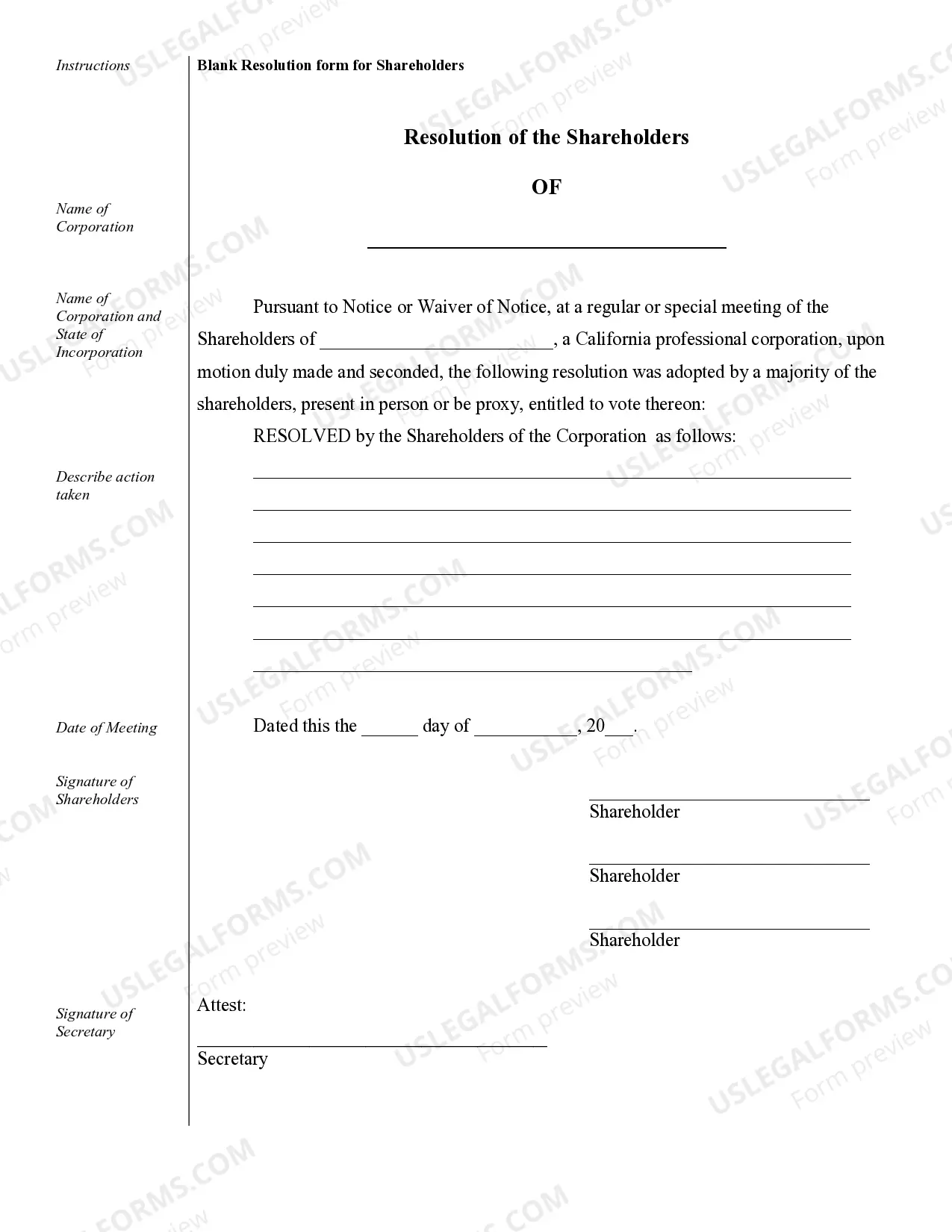

Vallejo Sample Corporate Records for a California Professional Corporation Vallejo Sample Corporate Records for a California Professional Corporation encompass a range of essential documents that are crucial for maintaining accurate and up-to-date records for a professional corporation registered in the state of California. These records provide legal evidence of the corporation's formation, activities, and compliance with various state regulations. Among the primary types of Vallejo Sample Corporate Records for a California Professional Corporation are: 1. Articles of Incorporation: This document serves as the foundation of a professional corporation. It includes important information such as the corporation's name, purpose, duration, shareholder details, and registered agent. 2. Corporate Bylaws: Bylaws outline the internal rules and regulations that govern how a professional corporation is managed and operated. They cover topics such as shareholder meetings, the appointment of directors, voting protocols, and the corporation's decision-making processes. 3. Meeting Minutes: Meeting minutes provide a detailed account of discussions and decisions made during board of directors and shareholder meetings. These records help ensure transparency and documentation of the corporation's important actions, including the election of officers, approval of key resolutions, and major business decisions. 4. Shareholder Records: Shareholder records identify the individuals who own shares in the professional corporation. These records typically include the names, addresses, and share allocations of each shareholder. They are essential for establishing ownership and ensuring compliance with state regulations. 5. Stock Ledger: The stock ledger records all transactions related to the corporation's shares. It includes information on the issuance, transfer, cancellation, and ownership changes in the corporation's stock. This ledger helps maintain an accurate record of the corporation's share capital and ownership structure. 6. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide a comprehensive view of the professional corporation's financial health and performance. These records are crucial for tax compliance, auditing purposes, and decision-making. 7. Business Licenses and Permits: Professional corporations often require various licenses and permits operating legally in California. Records relating to these licenses, such as applications, approvals, and renewals, demonstrate the corporation's compliance with regulatory requirements. Vallejo Sample Corporate Records for a California Professional Corporation are valuable resources for maintaining legal compliance, facilitating corporate governance, and showcasing the corporation's transparency and professionalism. Keeping these records organized and easily accessible ensures a smooth operation and builds trust among stakeholders.Vallejo Sample Corporate Records for a California Professional Corporation Vallejo Sample Corporate Records for a California Professional Corporation encompass a range of essential documents that are crucial for maintaining accurate and up-to-date records for a professional corporation registered in the state of California. These records provide legal evidence of the corporation's formation, activities, and compliance with various state regulations. Among the primary types of Vallejo Sample Corporate Records for a California Professional Corporation are: 1. Articles of Incorporation: This document serves as the foundation of a professional corporation. It includes important information such as the corporation's name, purpose, duration, shareholder details, and registered agent. 2. Corporate Bylaws: Bylaws outline the internal rules and regulations that govern how a professional corporation is managed and operated. They cover topics such as shareholder meetings, the appointment of directors, voting protocols, and the corporation's decision-making processes. 3. Meeting Minutes: Meeting minutes provide a detailed account of discussions and decisions made during board of directors and shareholder meetings. These records help ensure transparency and documentation of the corporation's important actions, including the election of officers, approval of key resolutions, and major business decisions. 4. Shareholder Records: Shareholder records identify the individuals who own shares in the professional corporation. These records typically include the names, addresses, and share allocations of each shareholder. They are essential for establishing ownership and ensuring compliance with state regulations. 5. Stock Ledger: The stock ledger records all transactions related to the corporation's shares. It includes information on the issuance, transfer, cancellation, and ownership changes in the corporation's stock. This ledger helps maintain an accurate record of the corporation's share capital and ownership structure. 6. Financial Statements: Financial statements, such as balance sheets, income statements, and cash flow statements, provide a comprehensive view of the professional corporation's financial health and performance. These records are crucial for tax compliance, auditing purposes, and decision-making. 7. Business Licenses and Permits: Professional corporations often require various licenses and permits operating legally in California. Records relating to these licenses, such as applications, approvals, and renewals, demonstrate the corporation's compliance with regulatory requirements. Vallejo Sample Corporate Records for a California Professional Corporation are valuable resources for maintaining legal compliance, facilitating corporate governance, and showcasing the corporation's transparency and professionalism. Keeping these records organized and easily accessible ensures a smooth operation and builds trust among stakeholders.